Why KOREA

Finding Business Opportunities in KoreaInvest KOREA is a platform for attracting foreign investment.

We support your entry into Korea.

Site Information

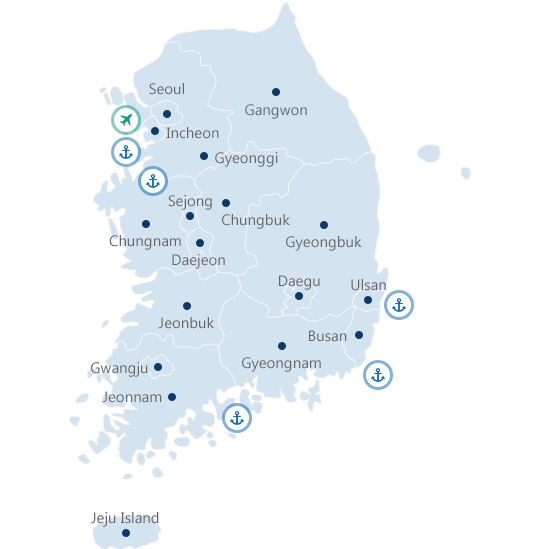

Local governments and FEZ in Korea offer their own specialized investment environment and services.

Seoul, the capital of Korea, is rising rapidly as the Northeast Asia’s business hub. It is geographically situated between Asia’s two largest economic powers including China and Japan. Although making up 0.6 percent of Korean territory, Seoul generates 21 percent of the national GDP and serves as a financial hub in which more than 50 percent of finance is concentrated.

Only 28 kilometers away from Seoul, Incheon has led the economic development of Korea by expanding the Incheon Port, opening the Incheon International Airport in March, 2001, building various industrial, logistics, tourism and leisure complexes and new types of residential facilities, developing Songdo International City, Cheongna and Yeongjong districts, establishing the Free Economic Zone Authority in October, 2003 and hosting the 2014 Asian Games.

As the center of Northeast Asia, Gyeonggi Province offers a favorable investment environment for promoting business activities in China and other countries. The province also provides excellent transport infrastructure and customized support services to encourage investment to enable the companies to efficiently and successfully pursue their business activities.

The expressways, Yangyang International Airport and Donghae Port located in Gangwon Province provide easier access to Seoul and other metropolitan cities in Korea. The province helps corporations to capitalize on the professional human resources cultivated by some 140 educational institutions. As the host for the Pyeongchang Winter Olympics 2018, it is considered the Mecca of Korean tourism and leisure industry.

South Chungcheong Province, located at the center of Korea, can reach any regions in Korea within two hours. The province boasts its optimal investment environment with abundant human resources, perfect social overhead capital, reasonably priced land, the cheapest and most stable electricity supply and enough industrial water.

Daejeon has the advantage of being adjacent to the recently developing Multifunctional Administrative City of Sejong and having an easy access to transportation infrastructure. While the city is transforming into a science city with the establishment of Daedeok Research Complex, it is playing its role as an administrative city with the Government Complex Daejeon.

Sejong was built to balance the national development and enhance the national competitiveness by resolving the adverse effects caused by the excessive concentration in Seoul. With the international science business belt project, the city is attracting scholars around the world. It is also becoming the pivot of the national growth network by converging science and business.

North Chungcheong Province boasts its well-established transport infrastructure including Cheongju International Airport, KTX Osong Station and grid highways. The province is also known for its best IT and BT industry, industrial complexes in Osong and Ochang, excellent infrastructure, optimal industrial sites and skilled workers.

North Gyeongsang Province has driven the Korean economy as the hub of the global electronic and textile industry. It has abundant human resources in research and development. It is also home to 47 universities, the second largest following Seoul. The province is the perfect place for investment with its well-established transportation network including expressways, railways and airports, abundant land for industrial use, talented industrial human resources and business strategies.

Jeonbuk State boasts its clean environment, prosperous history and culture and unique traditional food, fashion and music. Its on-going projects including Saemangeum Project and New Gunjang Port make the province play a central role in Korea’s trade with China. It is diversifying its businesses from paper and textile to automobile and shipbuilding. Since 2007, it has been developing new growth engines such as components and materials, food and renewable energy.

Daegu City is renowned for its cutting edge industry based on its well-established industrial infrastructure. The city has been actively engaged in various national projects, such as designation of special R&D zone, development of knowledge-creation free economic zone and establishment of national science industrial complex, technopolis, comprehensive cutting edge medical complex and robotic industry cluster, and regional development project.

The justice of Gwangju will now create abundance. It is taking another leap towards more open and embracing city and economic ecosystem where anyone with great technology can succeed. While the competitiveness of automobile, electronics, photonics and mold & die industries are reinforced through convergence and integration with new technologies, new businesses of energy industry and cultural contents industry are developed as growth engines in the era of the Fourth Industrial Revolution.

Northeast Asia is expected to play a pivotal role in the global trade and logistics in the 21st Century. At the center of Northeast Asia lies South Jeolla Province boasting a business-friendly environment including the designation of Daebul Free Economic Zone and Gwangyang Bay Area Free Economic Zone. It is serving as a gateway to China by helping local companies expand their businesses to the Pacific region.

South Gyeongsang Province has a massive consumer market of 15 million people with its advantage of being adjacent to the Southeastern industrial cluster, Busan Metropolitan City, Gwangyang-Jinju metropolitan area and Daegu-Pohang metropolitan area. Also, the province is well-known for its largest industrial complex for transportation equipment and cutting-edge defense industry with the well-established R&D infrastructure including national research institutes, universities and corporate research institutes.

Ulsan Metropolitan City is Korea’s largest industrial city, accounting for 12% of mining and manufacturing production (as of 2019, 2nd in the nation) in Korea, with exports amount USD 74.3 billion (as of 2021, 3rd in the nation), and KRW 60.2 million per capita GRDP (as of 2020, No.1 in the nation).

Busan, one of the biggest maritime cities in North East Asia, is Korea’s second most populous city after Seoul, with a population of approximately 3.5 million. The city handles nearly 90% of the total container shipping capacity in Korea as a geopolitical gateway that links between two large regional trade blocs, economic communities in North and South Asia by forming logistics networks with 530 ports in 150 counties worldwide.

The volcanic island Jeju and lava caves are recognized all around the world as they have been listed on the UNESCO World Heritage Site. The Korean government designated Jeju as the Free International City in 2002. In 2006, the government designated the island as the special self-governing province so to allow Jeju to exercise all administrative authority except for defense, diplomacy and jurisdiction.