Introduction of Companies

- Home

- Jeju Life

- Local Businesses

“FBH produces and sells fruit cups under an official license for the global beverage brand, Sunkist. We are also the sole Korean vendor1supplying products to Walmart, Costco, and Kroger. To develop home-grown fruit products that are differentiated from existing global brands, we have engaged in R&D projects with Seoul National University and Sookmyung Women’s University under commercialization and technology transfer contracts. This year, we signed a memorandum of understanding (MOU) with the Jeju Provincial Government (JPG) to build a plant in Jeju for developing Jeju citrus products. Looking ahead, our ultimate goal is to launch products made from other locally-grown Jeju produce, such as carrots and buckwheat. Watch us as Jeju takes to the global stage with FBH.”

Oh Seung-seok, CEO, FBH

1. Vendors act as crucial intermediaries between suppliers, who produce products and services, and retailers, who sell them to consumers. They receive products from manufacturers and distributors to store, transport, and sometimes even market them.

|

FBH’s non-commodity citrus product development project |

In March, the Jeju Provincial Government and FBH signed an MOU to construct a citrus processing plant. As part of a project focused on developing products made from non-commodity citrus, FBH committed to investing KRW 40 billion in the facility by 2026. The provincial government has promised administrative support within the relevant legal framework. Located in Seongeup-ri, Pyoseon-myeon in Seogwipo-si, Jeju, on a 49,587㎡ site, the plant will begin pilot operations after the completion of its first production line in September 2025. The company plans to launch products such as citrus cups, canned citrus, and others in 2026.

The flagship product of Sunkist, a global food and beverage brand.

Q What can you tell me about the history of FBH, an official Sunkist partner?

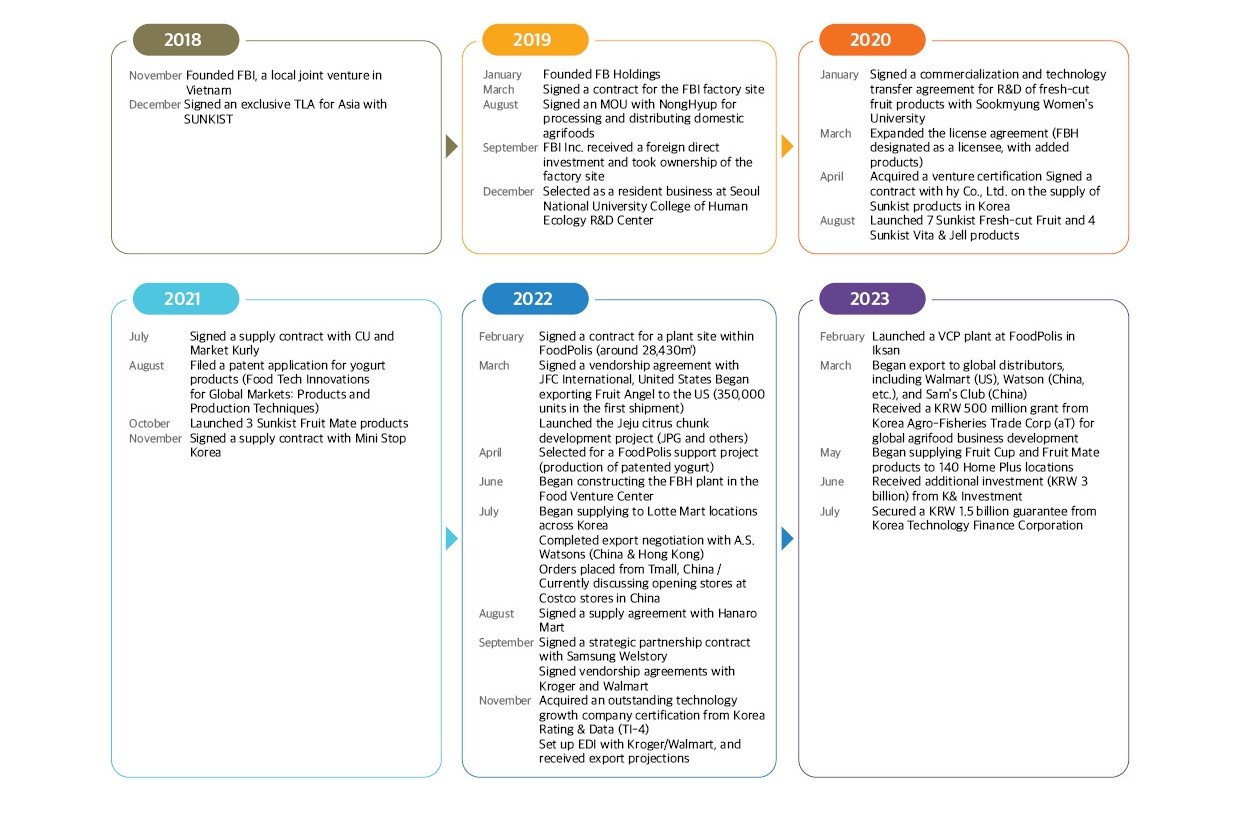

After founding a joint venture (FBI) in Vietnam in 2018, I established FBH in Korea in 2019 following a trademark license agreement with Sunkist headquarters in the United States. Initially, our plan was to expand our distribution chain from the Vietnamese firm. However, the pandemic halted our overseas projects, necessitating the relocation of the entire business to Korea. During this transition, the trademark license contract was modified, designating FBH as the licensee. Since then, we have been the de-facto manufacturer/distributor, supplying products to various distribution chains.

Q Why did you choose Jeju citrus in particular for your product development project after signing an investment agreement with Jeju?

When we entered the overseas market, we evaluated various domestic fruits to identify those that could compete internationally on price and quality. We ruled out tropical fruits like mangoes and pineapples due to Korea’s less favorable natural conditions for these crops. Instead, we focused on Jeju citrus. Currently, China is the world's No. 1 citrus producer, processing and exporting over 260,000 tons annually, with more than half going to the United States. We identified a significant sales opportunity here; although production costs are similar to those in China, Jeju citrus benefits from a substantial tariff advantage. A 28% tariff is levied on Chinese citrus imports, while Jeju citrus enjoys duty-free status under a free trade agreement, offering a competitive price edge. This advantage extends to the domestic market as well―while Chinese imports face a 45% tariff, Jeju citrus is tariff-free, allowing us to potentially dominate the domestic market. Based on these factors, we decided that processed Jeju citrus products could be highly competitive. For the past three years, we have been conducting thorough research and analysis on Jeju citrus. Our ultimate goal is to market these products across Asia and to major global retailers such as Walmart, Kroger, and Costco.

|

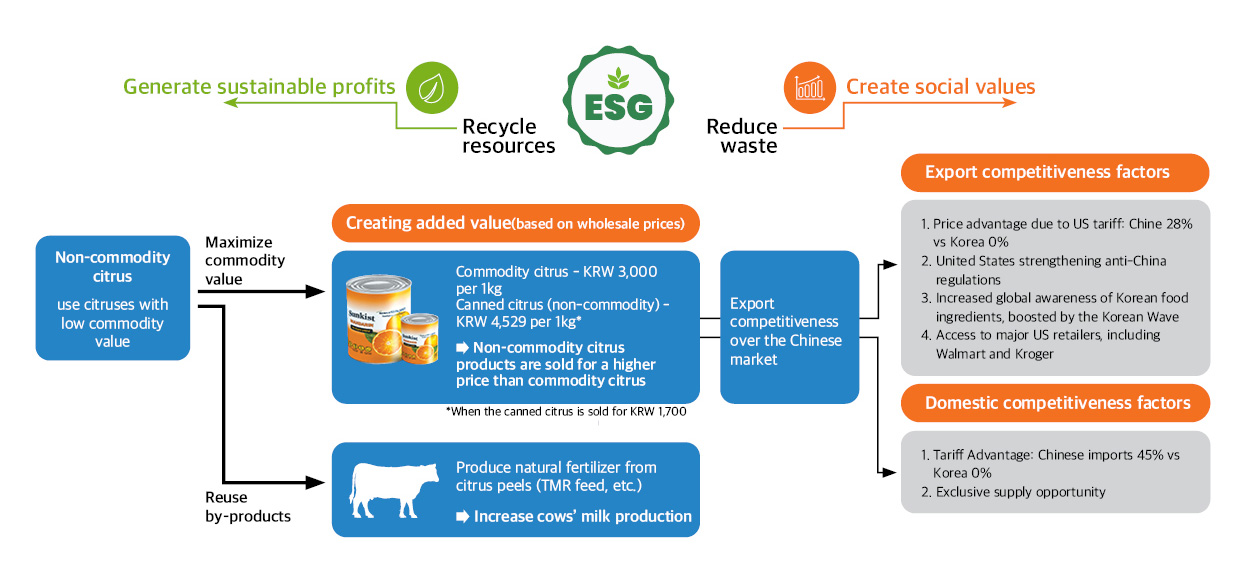

ESG management for the citrus processing industry |

Q I’ve been told that you plan to only use Jeju citruses that are non-commodity.

FBH’s citrus cups and canned products use only diced citrus flesh, making non-commodity citrus perfectly suitable. Non-commodity refers to fruits that may not look smooth or have external flaws, making them harder to sell as fresh produce; however, they are still perfectly edible and tasty. As of March 2024, while 1kg of commodity citrus costs around KRW 3,000, 1kg of canned non-commodity citrus sells for KRW 4,529. This shows that processing non-commodity citrus is a high value-added activity, yielding products that command higher prices than their commodity counterparts.

Q The factory’s first production line will be able to produce between 10 to 50 thousand tons of products. Once it is complete, how do you plan to secure enough citruses to support the production capacity?

The citrus industry constitutes 32% of the gross income from Jeju’s local primary industries as of 2023. Out of the total citrus production, 20% (around 100,000 tons) is classified as non-commodity, and 40,000 tons are typically discarded after meeting the needs of local food companies producing citrus juice. We require about 10,000 tons of citruses to start our operations, which can be easily sourced from these discarded products.

Conceptual diagram of the citrus processing industry through ESG management.

Q Then, in a way, FBH is an upcycling business because you use produce about to be discarded and turn them into new products.

That is correct. In addition to our food products, we plan to launch natural fertilizers, animal feeds, and cosmetics made from citrus peels. By recycling these by-products, we not only reduce waste but also generate profit. With this initiative, we aim to pioneer a new chapter in the biofoodtech industry and establish ourselves as a leader in ESG management in Jeju.

|

Jeju brand, seeking to establish a global market presence |

Q I heard that you plan to relocate your headquarters to Jeju. Can you tell us more about it?

The relocation reflects our confidence and expectations for this project, which is designed to promote shared growth by utilizing Jeju’s homegrown produce. We decided that moving the headquarters to Jeju would allow us to manage all processes more effectively. We anticipate completing the relocation in September next year, coinciding with the completion of the factory. Future plans include increasing the number of production lines to three, based on the availability of raw materials. Each line requires 36 workers, so we expect to need more than 100 employees in total, including headquarters staff, likely leading to further hiring.

Q What about your proposal to create a co-brand to access the global market with the island’s various products?

We plan to expand beyond citruses by launching our own processed food brands using carrots, buckwheat, and other local products. Through this initiative, FBH will also serve as a channel for broader distribution. Leveraging Sunkist’s existing network of 59 licensed distributors worldwide, most of whom are major distributors and manufacturers, FBH aims to enhance its global market competitiveness. We forecast total sales of KRW 12.8 billion next year, with KRW 4 billion expected from our own products. Achieving these targets will require collaboration with various Korean F&B businesses. FBH is positioned to develop and distribute products, but securing enough citruses requires an interim platform to connect producers, wholesalers, and distributors. Therefore, I invite more businesses to engage with Jeju. As Jeju’s population recently fell below 700,000, FBH is committed to building a corporate infrastructure that encourages local youth to pursue their dreams on the island, fostering close cooperation among businesses, consumers, and producers. Through these efforts, FBH aims to set a positive example as a global business.

The history of FB Holdings(FBH).