Industry Focus

- Home

- Investment Opportunities

- Latest Information

- Industry Focus

Despite the global economic recession in 2021 caused by the COVID-19 pandemic, sales of the petrochemical industry in the first half of 2021 recorded KRW 42.7 trillion, up 39.2 percent on-year, and operating profits of KRW 7.1 trillion, up 16.6 percent year-on-year. The sales increase is attributable to geopolitical factors, such as the increase in international oil prices, explosive increase in demand from China, and facility operation shutdown due to a cold-wave in the US and an earthquake in Japan, as well as the concentration of regular facility maintenance activities.

The most important viable in predicting the petrochemical industry in 2022 will be the recovery of China’s demand. As the global economic growth rate in 2022 is estimated to be above pre-COVID-19 levels, the trend of demand recovery is expected to continue. However, the uncertainty in China is expected to play a great role. China’s control over electric consumption, contracted demand due to its zero-COVID quarantine policy, and little change before the Winter Olympics in February all put a damper on the expectation for demand recovery in China. Also, the price increase of raw materials (Naphtha) due to rising international oil prices and oversupply stemming from facility expansion of ethylene is expected to continue.

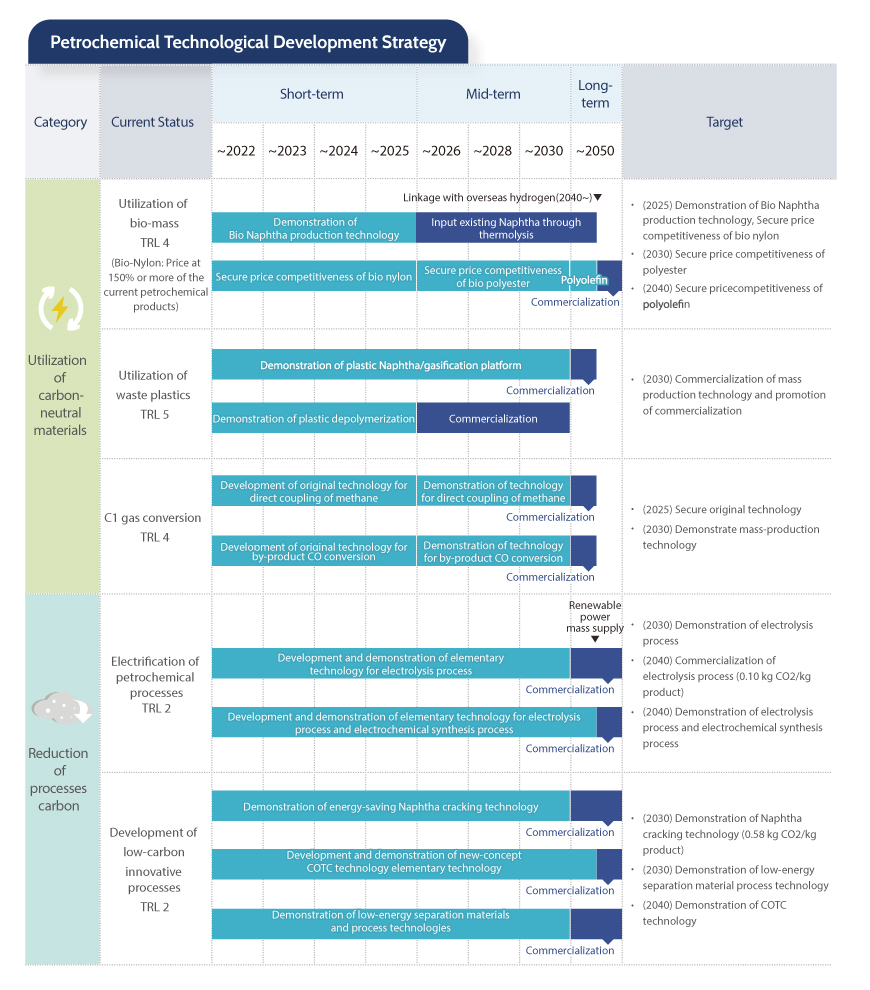

Response to Climate Change Crisis: Efforts towards Realization of Carbon-Neutrality in 2050

Leading the White-Bio Industry by ESG Management and Circular Economy

ESG management has successfully taken root in multinational companies based on their excellent technological prowess around the world, especially making great achievements in the environment sector, as they work towards net-zero carbon goals. However, it has become a new trade barrier as they request the same standards to their suppliers.

Korea also introduced K-Taxonomy to promote investment in ESG, providing standards to evaluate the appropriateness of eco-friendly economic activities, including carbon neutrality and environment preservation. In addition, it is necessary to operate policies and systems of regulation policies, support policies and systems, R&D, infrastructure and human resources development to foster the white bio industry in Korea. The white bio industry is a convergence new industry that applies bio technologies to the carbon-based chemical industry, requiring collaboration between bio companies and chemical companies. The government plans to actively support the creation of the white bio industries by pushing for bioplastic demonstration projects and technological development of bio-based next generation materials.

| Section | Tasks |

|---|---|

| Realize the circular economy through expansion of bioplastic development and distribution | - Support technological development for commercialization of bioplastic materials - Gradual expansion of usages by verifying effective value through demonstration projects - Realistic operation of bio plastic certification system - Provide full life cycle treatment system for bioplastics |

| Strengthen the value chain focused on white bio high value-added products |

- Promote application of new bio technologies by improving regulations - Advance the value chain by establishing partnership between innovation actors |

| Establish common ground to revitalize the industrial ecosystem | - Prepare on-the-job training programs and nurture convergence talents - Support the creation of intelligent property rights and entry to overseas market - Establish infrastructure to support commercialization |

By Kim Daewung (dwkim@kpia.or.kr)

Korea Petrochemical Industry Association

<The opinions expressed in this article are the author’s own and do not reflect the views of KOTRA>