FAQ

- Home

- Investment Guide

- FAQ

- FAQ

- All

- Definitions

- Notification

- Establishment of Corporation

- Real Estate Acquisition

- Taxation and Accounting

- Factory Establishment and Location

- Labor

- Environment

- Visa

- Settlement

- Legal Interpretations

-

Yes. With regard to a surviving corporation that received reduction or exemption of acquisition tax for a merger deemed qualified, where any ground prescribed under Article 44-3 (3) of the Corporate Tax Act arises within three years from the date the merger is registered, the acquisition tax reduced or exempted pursuant to the proviso of Article 57-2 (1) of the Act on Restriction of Special Cases Concerning Local Taxation excluding its subparagraphs shall be collected as penalty.

According to Article 57-2 (1) of the Act on Restriction of Special Cases Concerning Local Taxation, “acquisition tax on property for business acquired by not later than December 31, 2024 by transfer in the course of a merger prescribed by Presidential Decree as a merger that falls under Article 44 (2) or (3) of the Corporate Tax Act” shall be reduced or exempted. Under the Act, both qualified mergers and mergers deemed qualified are subject to reduction or exemption of acquisition tax. Also, the aforementioned Article only stipulates that the reduced or exempted acquisition tax shall be collected as penalty where any ground prescribed under Article 44-3 (3) of the Corporate Tax Act arises within three years from the date the merger is registered, and does not specify the types of mergers where the reduction or exemption of acquisition tax shall be collected as penalty. In addition, in regard to the causes for collection of reduced or exempted acquisition tax as penalty, instead of quoting the entire paragraph of Article 44-3 (3) of the Corporate Tax Act, the subparagraphs of the Article are cited for the reasons for collection of the reduced or exempted acquisition tax as penalty. In this regard, it cannot be considered that “excluding cases deemed as a qualified merger pursuant to Article 44 (3)” prescribed in Article 44-3 (3) of the Corporate Tax Act applies to the causes for collection as penalty tax. In other words, it is clear according to the meaning of the legal text that surviving corporations upon mergers deemed qualified shall be included in the scope of entities subject to collection of reduced or exempted acquisition tax as penalty pursuant to the proviso of Article 57-2 (1) of the Restriction of Special Cases Concerning Local Taxation Act excluding its subparagraphs.

A corporation that underwent a merger deemed qualified is excluded from the scope of corporations subject to discontinuation of application of special taxation under Article 44-3 (3) of the Corporate Tax Act, because unlike qualified mergers, mergers deemed qualified fall under cases where a corporation merges with a wholly owned subsidiary, and therefore they are qualified for special taxation regardless of whether they satisfy the requirements for recognition as qualified mergers pursuant to the subparagraphs of Article 44 (2) of the same Act. And based on this, some opinions argue that because reduction or exemption of acquisition tax for merged corporations under Article 57-2 (1) of the Act on Restriction of Local Taxation applies to corporations that underwent mergers deemed qualified regardless of whether the corporation satisfies the conditions for recognition as a qualified merger, and consequently mergers deemed qualified should be excluded from the scope of cases where the reduced or exempted acquisition tax should be collected as penalty, just like special taxations for merged corporations pursuant to the Corporate Tax Act.

However, national tax and local tax are two separate taxes which differ in terms of objective of taxation, subject of taxation, etc. and they can be applied differently pursuant to their respective objective of legislation and purpose of taxation. In this regard, a separate set of rules and regulations can be prescribed for the same subject of taxation. Consequently, where national tax regulations are only partially cited in a law related to local tax, the regulations should only be applied to the Article citing the regulation and not to the other parts of the law, so this is not a valid argument.

Therefore, with regard to a merged corporation that received reduction or exemption of acquisition tax for a merger deemed qualified, where any ground prescribed under Article 44-3 (3) of the Corporate Tax Act arises within three years from the date the merger is registered, the acquisition tax reduced or exempted pursuant to the proviso of Article 57-2 (1) of the Act on Restriction of Special Cases Concerning Local Taxation excluding its subparagraphs shall be collected as penalty. -

In this case, it is not mandatory for the provider of information communication service, etc. to comply with the relevant Korean Industrial Standards.

Considering the fact that the main sentence of Article 8 (1) of the Information Communications Network Act prescribes matters related to the establishment and public notice of the standards for information and communications network and recommends providers of information and communication services to comply with the standards, it should be deemed that the proviso of the same Article stipulates exceptions related to the Ministry of Science and ICT’s establishment and public notice of standards and the recommendation to use such standards, and this cannot be interpreted that this provision regulates that providers of information communication service, etc. are mandated to comply with the Korean Industrial Standards.

In addition, the proviso of Article 8 (1) of the same Act prescribes that the matters for which the Korean Industrial Standards under Article 12 of the Industrial Standardization Act have already been established shall comply with such standards in order to provide a system that prevents information communication network certification matters and Korean Industrial Standards certification matters from overlapping so that they can be reasonably applied and operated, so it is difficult to deem that the purpose of such provision is to make it obligatory for the providers of information and communication service, etc. to comply with the Korean Industrial Standards.

Moreover, there are no regulations that prescribe sanctions on violations of the proviso of Article 8 (1) of the Information and Communications Network Act or regulations mandating the use of products and services that comply with the Korean Industrial Standards. Also, there are no regulations placing sanctions on cases in which the Korean Industrial Standards have not been complied with. Judging from such facts, the proviso of Article 8 (1) of the Act cannot be interpreted as a mandate on the provider of information communication service, etc. to obligatorily use the Korean Industrial Standards.

Therefore, in this case, it can be concluded that the provider of information communication service, etc. is not obligated to comply with the relevant Korean Industrial Standards pursuant to the proviso of Article 8 (1) of the Act. -

No. A completed district can not be excluded from “development project districts” just because the operator of the development project has completed part of the development project and underwent an inspection on completion of works.

This question is about whether a development project district where inspection on completion of works was completed is excluded from the scope of “development project district”. However, the Free Economic Zone Act does not provide a definition of “development project district”, so the meaning of “development project district” should be determined based on the content and purpose of the related regulations of the Act.

In accordance with the proviso of Article 7-5 (1) of the Free Economic Zone Act, the proviso of Article 14 (1) of the Act and Article 6-2 (2) of the Enforcement Decree of the Act, a person who intends to engage in any acts such as the change in the form and quality of land, the construction of buildings, and the installation of structures shall obtain permission from the competent Mayor/Do Governor and the competent Mayor/Do Governor shall grant permission to the extent that does not hinder the relevant development project. If so, “development project district” should be deemed as a district where a free economic zone development project is implemented or shall be implemented. And when considering the objective of the above regulations, it should be regarded that within the relevant district, acts that disrupt the implementation of development projects are restricted, in order to facilitate the implementation of development projects in a free economic zone.

Also, under Articles 4 (4), (5) and (8) of the Free Economic Zone Act and Article 3 of the Enforcement Decree of the same Act, it is prescribed that the Minister of Trade, Industry and Energy shall finalize or establish a development plan for a free economic zone (hereafter “development plan”) in order to designate a free economic zone, and where a free economic zone is designated, the Minister shall publish the details of such designation in the Official Gazette and give a notice thereof. In this regard, it is proper to consider that “development projects” under the Free Economic Zone Act are included in the scope of “development plans”, and therefore refers to all development projects to be implemented within the development period.

Moreover, the Free Economic Zone Act prescribes matters regarding procedures after inspection on completion of works such as method of disposal of prepared land, in addition to matters related to development projects such as the preparation of land, the construction or installation of housing, industrial facilities, and public facilities. Considering this and the matters discussed so far, it cannot be said that a “development project” under the Free Economic Zone Act is limited only to development activities per se in a free economic zone, and it should be concluded that the term encompasses the processes related to the disposal of the end product of development projects.

However, in Article 22 (4) of the Guidelines on the Development of Free Economic Zones (notice of the Ministry of Trade, Industry and Energy no. 2018-188) which prescribes the matters necessary for the establishment of free economic zone development plans pursuant to the Free Economic Zone Act, it is stated that development plans and implementation plans can be changed in a “completed district” by applying Articles 7 and 9 of the Free Economic Zone Act mutatis mutandis. In this regard, even if the district is completed after inspection of completion of works pursuant to the Free Economic Zone Act, the original development plan can be changed and implemented if there is a need to change or add the details of the development project.

In this regard, even if part of a development project in a district for a development project is completed and the district is completed after undergoing an inspection for completion of works, it shall be deemed that the procedures necessary for the implementation of the development project should be managed in accordance with the Free Economic Zone Act until the period for the development project is completed. Therefore, interpreting that the aforementioned project district falls under a development project district and thus preventing the disruption of implementation of the development project shall be in compliance with the legislative objective and purpose of the Free Economic Zone Act.br />

Hence, a completed district is not excluded from “development project district” pursuant to the proviso of Article 7-5 (1) of the Free Economic Zone Act only for the reason that the district’s development project has been partially completed and an inspection of completion of works was conducted on the district. p> -

In the case where the head of a local government leased land, etc. that the local autonomous body owns to a foreign-invested company pursuant to Article 13 (1) of the Foreign Investment Promotion Act and then renewed the lease period pursuant to Article 11 of the same Act, the total period of lease before and after the lease renewal may be over 50 years.

Article 13 (3) of the Foreign Investment Promotion Act stipulates that the lease period can be within 50 years, and Paragraph 11 of the same Article prescribes that the lease period in Paragraph 3 of the same Article can be renewed and that the renewed lease period cannot exceed the lease period prescribed by Paragraph 3 of the same Act. In this regard, the lease period can be up to 50 years and can be renewed for a period not exceeding the previous lease period without any consideration of the accumulated lease period. In addition, there are no regulations restricting the number of times the lease period can be renewed or the total period of lease before and after the lease renewal.

Therefore, it cannot be interpreted that the total period of lease before and after the renewal as prescribed by Article 13 (11) of the same Act should be not more than 50 years.

In addition, the proviso of Article 21 (1) of the Co-owned Properties and Goods Management Act, which is the general law concerning co-owned properties by a local government, stipulates that the period for which permission is granted to use or profit from donated property as prescribed by Article 7 (2) of the same Act shall be from the date on which permission was given for gratuitous use to the date on which the total amount of fee reaches the value of the donated property. However, the maximum period for using or profiting from the property – referred to as the total usable period - is set at 20 years.

Also, the proviso of Article 7 (3) stipulates that the period for using or profiting from donated property can be renewed once up to 10 years within the scope of the total usable period. In other words, it is stated that the total period for which permission is granted to use or profit from donated property cannot exceed 20 years.

If the legislation was meant to restrict the total extended lease period to 50 years, there would have been a regulation on the total lease period like the proviso of Article 7 (3) of the aforementioned Act. In this regard, interpreting that the total extended lease period should not exceed 50 years would limit the lease period in the Act and therefore be unacceptable. -

If an aircraft owned by a foreign company is imported on lease for direct use, it is not considered “import on use” stated in Article 7 (6) of the Local Tax Act, which deems that the importer has acquired the imported object.

Under subparagraph 1 of Article 6 of the Local Tax Act, "Acquisition" means original acquisition (excluding acquisition of a taxable asset that has already existed, such as acquisition by a decision of expropriation), acquisition by succession, or all other acquisitions with or without compensation which include acquisition resulting from sale, exchange, inheritance, donation, contribution, investment in kind to a corporation, construction, repair, reclamation of public waters, creation, etc. of land through reclamation, and any other acquisition similar thereto.

Also, Article 7 (1) of the Local Tax Act prescribes that acquisition tax shall be imposed on a person who has "acquired" aircraft. Also, paragraph 2 of the same Article states that aircraft is deemed acquired when it is practically acquired even if the acquisition of such aircraft is not registered or recorded under the relevant statutes. In addition, Article 7 (6) of the same Act is a clause on deemed acquisition tax, which prescribes that where a person imports any article subject to acquisition tax which is held by a foreigner on lease for the purpose of directly using it, the importer of such article shall be deemed to have acquired it.

In principle, in the case of “Lease” under Article 7 (6) of the Local Tax Act for taxation purposes, the form or appearance of the taxation requirement does not immediately constitute “acquisition” under subparagraph 1 of Article 6 of the same Act. However, in spite of this, “import on lease” is considered acquisition and local tax is imposed, and the reason for this is as follows.

In regard to the lease in question, the pre-condition is that the importer shall assume ownership of the taxable object after the lease period has expired, and therefore it is possible to consider that the taxable object has been de facto acquired at the point when the importer has imported and leased the taxable object. However, if acquisition tax is imposed at the actual time of acquisition of the taxable object after the period of lease had expired, the object's residual value will be significantly lower than the reasonable amount, which would be unfair in terms of tax equity. Therefore, based on the principle of tax equity and the purpose of acquisition tax-related regulations, local tax is imposed on the importer (lessee) who has taxable capacity, in compliance with the principle of substantial taxation.

Finance lease, where ownership of the leased object is to be transferred after long-term lease, can be considered de facto acquisition. On the other hand, where an aircraft owned by a foreign company is imported on operating lease for direct use, the foreign lease company continues to have legal, formal, and substantial ownership of the aircraft because the aircraft is to be returned after short-term use. Consequently, it would be in violation of the principle of substantial taxation to consider the "lease" as "acquisition" and deem the importer (lessee) as the payer of acquisition tax by applying Article 7 (6) of the Local Tax Act to import on operating lease as well.

Consequently, it can be concluded that import of a foreign company-owned aircraft on operating lease for direct use is not considered "import on lease" where the importer is considered to have acquired the aircraft pursuant to Article 7 (6) of the Local Tax Act. -

Where a client of a building designates a construction engineer as a site manager in accordance with Article 24 (6) of the Building Act, the scope of duties of the construction engineer is restricted to the area of construction under attached Table 1 subparagraph 3 of the Enforcement Decree of the Construction Technology Promotion Act.

Under Article 24 (6) of the Building Act, it is only prescribed that one construction engineer as defined in subparagraph 15 of Article 2 of the same Act shall be appointed as a site manager, but the scope of duties of the construction engineer is not specified. Therefore, the clause on the scope of duties of a construction engineer under Article 24 (6) of the Building Act should be, in principle, interpreted as close to its general meaning, while at the same time the legislative purpose of the Act and its relation to other Acts, etc. should be taken into consideration.

When we look at the definitions, subparagraph 15 of Article 2 of the Framework Act on the Construction Industry defines "construction engineer" as "a person deemed to have expertise or skills in construction works under related statutes or regulations". Under subparagraph 8 of Article 2 of the Construction Technology Promotion Act, the term is defined as a person prescribed by Presidential Decree who has the qualifications, etc. necessary for construction works or construction engineering, and subparagraph 1 of the same Article prescribes that "construction work" means construction works set forth in subparagraph 4 of Article 2 of the Framework Act on the Construction Industry which states that the said term means civil engineering works, landscaping works, environmental installation works, and other works to install, maintain and repair facilities.

However, a site manager under Article 24 (6) of the Building Act is a person who is placed at the construction site pursuant to subparagraph 12 of Article 2 of the same Act where the client of a construction conducts construction, substantial repair, or change of the use, of a building, installation of building service, or erection of a structure. Therefore, based on the laws related to construction engineers, the Framework Act on the Construction Industry, and the Construction Technology Promotion Act, it is appropriate to interpret that the scope of duties of the construction engineer is restricted to "construction" under item d of subparagraph 3 of attached Table 1 of the Construction Technology Promotion Act.

In addition, it is considered that a site manager appointed by the client of a building should conduct duties such as "supporting the client of a building so that the building and land comply with this Act or other related Acts", "inspection and management of whether a building's location, size, etc. comply with the drawings and specifications", "duties related to process management such as review of matters regarding the construction plan and change of design", "inspection and management of the proper installation of safety facilities and compliance with safety standards", in accordance with Building Act by utilizing understandings and expertise regarding building planning and building construction.

The site manager should have the technology or skills mainly in the field of construction in order to adequately perform the duties. This further confirms that it is fair to conclude that the scope of duties of the construction engineer who can be appointed as a site manager pursuant to Article 24 (6) of the Building Act should be restricted to the field of construction under subparagraph 3 (item d) of attached Table 1 of the Enforcement Decree of the Construction Technology Promotion Act, which covers specialized fields such as architectural structure, construction machinery and equipment, building construction, interior architecture, construction quality management, building planning and architectural design. -

No. A corporation applying for registration as a damage adjusting business does not necessarily have to include a part-time certified damage adjuster in its certified damage adjusters when matters related to them are stated in the application for registration pursuant to Article 97 (1) 4 of the Enforcement Decree of the Act.

Article 97 (1) of the Enforcement Decree of the Act stipulates “matters relating to the employment of certified damage adjusters under Article 98” (subparagraph 4) as one of the matters to be stated in a written application for registration. This is because the matters to be stated are confined to “matters under Article 98,” and also because Articles 98 (1) and (2) of the Enforcement Decree prescribe matters regarding certified damage adjusters who should be employed by a corporation applying for registration as a damage adjusting business, the matters of the employment of certified damage adjusters to be stated in the application should be considered as those related to the standards for the employment of certified damage adjusters in accordance with paragraphs 1 and 2 of the same Article.

However, Article 98 (1) of the Enforcement Decree of the Act prescribes that a corporation intending to run a damage adjusting business should keep “two or more full-time certified damage adjusters” (proviso). And in such case, “one or more full-time certified damage adjusters” shall be kept for each type of business to be run pursuant to the classification of certified damage adjusters prescribed by Ordinance of the Prime Minister (second sentence). In paragraph 2 of the same Article, it is stated that if such corporation intends to establish a branch or business office, it shall keep “one or more certified damage adjusters” for each type of business to be run pursuant to the classification of certified damage adjusters prescribed by Ordinance of the Prime Minister.

Considering that Articles 98 (1) and (2) of the Enforcement Decree of the Act clearly differentiate “full-time certified damage adjusters” from “certified damage adjusters” depending on whether or not a branch or office is established while stipulating the standards for the employment of certified damage adjusters for a company applying for registration as a damage adjusting business, it is not necessary to include a part-time certified damage adjuster in the category of certified damage adjusters belonging to the corporation, that shall be written in the application for registration under Article 97 (1) 4 of the said Enforcement Decree. .

< Insurance Business Act >

Article 187 (Damage Adjusting Business)

(1) A person who intends to engage in damage adjusting business shall register himself or herself with the Financial Services Commission.

(2) A corporation that intends to engage in damage adjusting business shall have at least as many certified damage adjusters as the number prescribed by Presidential Decree.

(3) (Omitted)

(4) Necessary matters concerning the registration and business standards of damage adjusting business shall be prescribed by Presidential Decree.

< Insurance Business Act >

Article 97 (Registration of Damage Adjusting Business)

(1) A person who intends to register his or her damage adjusting business pursuant to Article 187 (1) of the Act shall submit a written application stating each of the following matters to the Financial Services Commission:

1. Name (in the case of a corporation, trade name and the name of the representative);

2. Location of its office;

3. Type and scope of the business he or she intends to carry on;

4. Matters relating to the employment of certified damage adjusters under Article 98.

(2) to (4) (Omitted)

Article 98 (Standards for Operation of Damage Adjusting Business)

(1) A corporation intending to run damage adjusting business under Article 187 (2) of the Act shall keep two or more full-time certified damage adjusters. In such cases, one or more full-time certified damage adjusters shall be kept for each type of business to be run pursuant to the classification of certified damage adjusters prescribed by Ordinance of the Prime Minister..

(2) Where any corporation under paragraph (1) intends to establish branches or business offices, it shall keep one or more certified damage adjusters for each type of business to be run pursuant to the classification of certified damage adjusters prescribed by Ordinance of the Prime Minister.

(3) to (7) (Omitted)

-

No. When food wastes or byproducts of agriculture and fisheries are used as raw materials, “composted organic fertilizer production facilities” are not included in the scope of “organic fertilizer manufacturing facilities” pursuant to Article 29 (7) 4 of the Enforcement Decree of the Farmland Act. .

The purpose of the Farmland Act is to contribute to the strengthening of agricultural competitiveness, balanced development of the national economy, and preservation of national environment through the efficient usage and management of farmland (Article 1). Meanwhile, the purpose of the Fertilizer Control Act is to maintain and promote agricultural productivity, and to protect agricultural environment by preserving the quality of fertilizers, as well as ensuring their smooth supply/demand and price stability (Article 1). In this regard, it is fair to say that regulations related to agricultural activities shall be interpreted in a coordinated and coherent manner under the purpose of relevant laws.

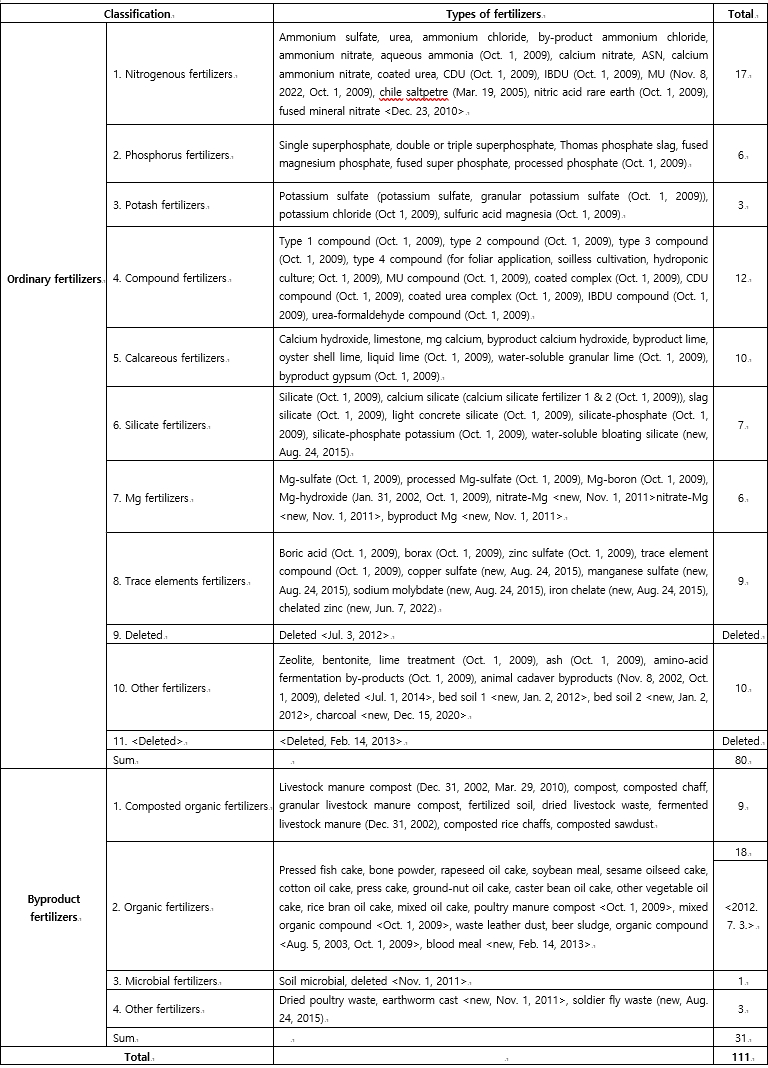

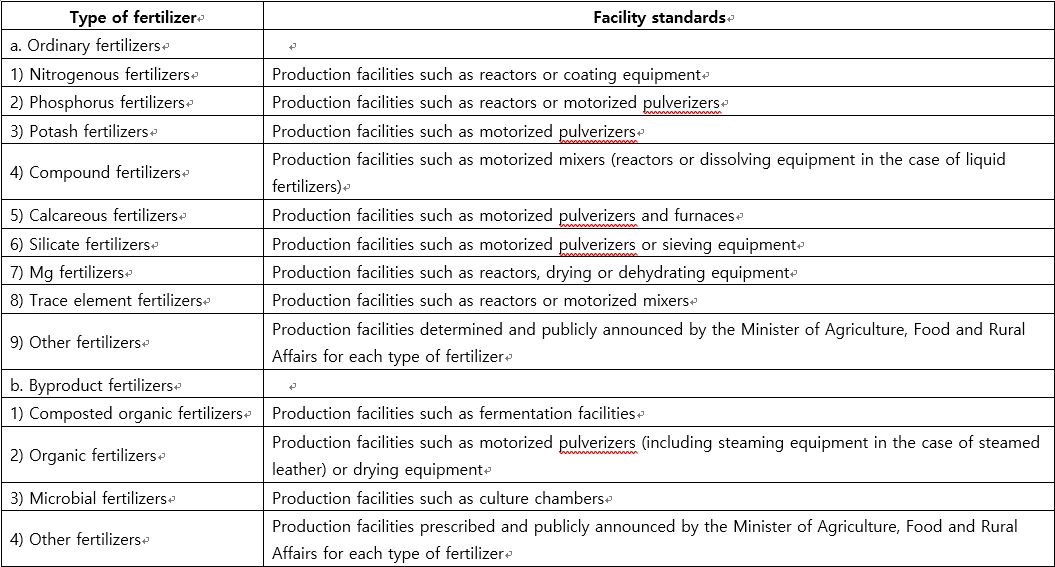

Given that the Farmland Act does not specifically prescribe the meaning or scope of “organic fertilizer manufacturing facilities”, the scope of such facilities permitted in an agricultural promotion area shall be determined based on the classification of the Fertilizer Control Act. Under Article 11 (1) of the Fertilizer Control Act, a person intending to operate a business of producing and selling, or distributing or supplying fertilizers free of charge shall register as a fertilizer production business. Also, in subparagraphs 2 (b) 1 and 2 of attached Table 2 of the Enforcement Decree of the Farmland Act which stipulates the facility standards for registering a fertilizer production business, composted organic fertilizers and organic fertilizers are classified separately. In addition, under the aforementioned regulation, the facility standards required for composted organic fertilizers are prescribed as “production facilities such as fermentation facilities”, while those applied to organic fertilizers are stated as “production facilities such as motorized pulverizers or drying equipment”. In addition, under Articles 2 (2) 1 and 2 and attached Tables 1 and 3 of the guidelines for establishing legal standards for fertilizers publicly announced by the Administrator of the Rural Development Administration in accordance with Articles 4 and 26 of the Fertilizer Control Act and Article 19 (2) 1 of the Enforcement Decree of the same Act, composted organic fertilizers and organic fertilizers are separately defined and the legal standards for each type of fertilizer under the two categories are prescribed. .

In this regard, based on the system of classification under the Fertilizer Control Act which separately defines composted organic fertilizers and organic fertilizers, it can be said that composted organic fertilizers are different from organic fertilizers with regard to the types of production facilities, legal standards, etc.

Therefore, because Article 29 (7) 4 of the Enforcement Decree of the Farmland Act prescribes that the facilities that can be installed in an agricultural promotion area shall be “organic fertilizer production facilities”, it is reasonable to conclude that “composted organic fertilizer production facilities” are not included in the scope of “organic fertilizer production facilities” that can be installed in an agricultural promotion area.

Furthermore, when considering the purpose of the Farmland Act, which is to strengthen agricultural competitiveness through efficient usage and management of farmland, and also the objective of Article 32 (1) of the same Act, which specifies restrictions on acts in an agricultural promotion area in order to preserve farmland in the area, the acts that are permitted inside an agricultural promotion area pursuant to the subparagraphs of the aforementioned Article and Articles 29 (2) through (7) of the Enforcement Decree of the Act should be regarded as a restrictive and positive list, and therefore it should be restrictively interpreted that installation of “organic fertilizer production facilities” under Article 29 (7) 4 of the Enforcement Decree is permitted as long as it does not disrupt the effective utilization of farmland and strengthening of agricultural competitiveness.

Article 32 (Restriction on Acts in Specific-Use Areas)

(1) No one shall engage in any act of utilizing land, other than the acts prescribed by Presidential Decree and directly related to agricultural production or farmland improvement within an agricultural promotion area: Provided, That the foregoing shall not apply to the following:

1. ~ 8. (Omitted)

9. Installation of facilities prescribed by Presidential Decree and necessary for development of agricultural and fishing villages, including the development of income sources of agricultural and fishing villages.

Article 29 (Acts that are permitted in an agricultural promotion area)

(1) to (6) (Omitted)

(7) "Facilities prescribed by Presidential Decree and necessary for development of agricultural and fishing villages" prescribed by Article 32 (1) 9 of the Act means the following facilities:

1. ~ 3. (Omitted)

(7) "Facilities prescribed by Presidential Decree and necessary for development of agricultural and fishing villages" prescribed by Article 32 (1) 9 of the Act means the following facilities:

1. ~ 3. (Omitted)

4. Organic fertilizer manufacturing facilities using food waste or agricultural or fisheries by-products whose total area measures less than 3,000 m2 (10,000 m2 for facilities installed by a local government organization or an agricultural producers' group)

4-2 to 10. (Omitted)

Article 2 (Definition)

The terms used in this Act are defined as follows:

1. and 2. (Omitted)

3. The term "by-product fertilizer" means any fertilizer the legal standards of which are established under Article 4 and which is produced by utilizing by-products, human excrements and urine, food wastes, soil-microbiological products (including manufactured products and soil-enzyme agents), soil activation agents, etc. produced in the course of operating an agriculture, forestry, livestock, fishery, manufacturing, or marketing business;

4. The term "legal standards" means the standards determined and publicly announced by the Minister of Agriculture, Food and Rural Affairs with regard to any fertilizer, the standards of which is deemed necessary to be determined by the Minister of Agriculture, Food and Rural Affairs for the purpose of maintaining the quality of the fertilizer, for matters such as the minimum quantity of its main raw materials, the maximum allowable content of harmful ingredients of the fertilizer, the content of additional ingredients required for maintaining the effects of its main ingredients, its best before date, etc.;

5 and 6. (Omitted)

Article 4 (Establishment of Legal Standards)

(1) to (3) (Omitted)

(4) Where the Minister of Agriculture, Food and Rural Affairs intends to perform the establishment, etc. of legal standards, he or she shall publicly notify them publicly 30 days in advance.

Article 11 (Registration of Fertilizer Production Business)

(1) Any person who intends to run a business of producing and selling, or distributing or supplying fertilizers free of charge (including those who intend to reclaim fertilizers from wastes provided for in the Wastes Control Act and sell, or distribute or supply them free of charge) shall register raw materials for production, certified ingredients, etc. with the head of a Si (including a Special Self-Governing City Mayor and a Special Self-Governing Province Governor; hereinafter the same shall apply)/Gun/Gu (referring to the head of an autonomous Gu; hereinafter the same shall apply) for each kind of fertilizer, as prescribed by Presidential Decree: Provided, That this shall not apply in cases of a by-product fertilizer production business not in excess of the scale prescribed by Presidential Decree.

(2) (Omitted)

(3) Facilities required for the registration of a fertilizer production business prescribed in paragraph (1) and other registration standards shall be prescribed by Presidential Decree.

(4) to (8) (Omitted)

Article 12 (Facilities necessary for registration of fertilizer production business and other registration standards, etc.)

(1) The facilities necessary for registration of fertilizer production business and the registration standards pursuant to Article 11 (3) of the Act are as prescribed by attached Table 2.

■ Enforcement Decree of the Fertilizer Control Act [Attached Table 2]

Facilities necessary for registration of fertilizer production business and other registration standards (related to Article 12 (1))

1. Common facilities

Storage warehouse (not applicable for by fertilizer production business using by-products) and quantity check and packaging equipment (only where fertilizer is packaged and sold).

2. Production facility by type of fertilizer

Establishment of Legal Standards for Fertilizers (Public Notice of Rural Development Administration)

Article 2 (Classification of Fertilizers)

(1) (Omitted)

(2) Byproduct fertilizers pursuant to subparagraph 3 of Article 2 of the Act shall be classified as follows:

1. “Composted organic fertilizers” refers to fertilizers produced through the process of composting using byproducts, human excrement or food waste generated in the business of agriculture, forestry, livestock and fisheries, and production and sales as its main raw materials, and ordinary fertilizers other than those prescribed in attached Table 5 should not be added.

2. “Organic fertilizers” refers to fertilizers produced using organics as its main raw materials, which guarantee a minimum amount of nitrogen, phosphate, potassium, and organic matters

3 & 4. (Omitted)

(3) The classification and types of fertilizers pursuant to paragraphs 1 and 2 are as prescribed in attached Table 1.

[Attached Table 1] Classification and Types of Fertilizers

-

"In this case, the individual business does not lose its status as a business starter.

The purpose of the Act is to contribute to the establishment of a solid industrial structure through sound development of small and medium enterprises (SMEs) by facilitating the establishment of SMEs and developing a firm basis for growth (Article 1). Also, under subparagraph 1 of Article 2 of the Act and Article 2 (1) of the Enforcement Decree of the Act, a “business start-up” means establishing a “new” SME, and subparagraph 3 of Article 2 of the Act prescribes “business starter” as a person who starts up an SME or a person who has been engaged in his or her business “for less than seven years since commencing the business”.

In addition, pursuant to Article 3 (1) of the Act, the Act shall apply to business startup, excluding starting up such types of businesses that are clearly against the economic order and good public morals, such as gambling business. With the amendment of the Act in December 2018 to expand the types of businesses subject to support of startup to all businesses, real estate business became subject to the law as well.

In other words, the purpose of the amendment of the Act is to make the support and benefits provided pursuant to the Act applicable to real estate businesses as well. However, if it is assumed that the “business commencement date” of a person who operated a real estate business before the amendment of the Act and became a business starter by additionally starting a wholesale and retail business under the Act is applied retroactively to the date of commencement of the real estate business and he/she loses wholesale and retail business starter status when seven years pass from the aforementioned date, it will violate the purpose of the Act and purpose of its amendment. Moreover, it will be unreasonable because the status as business starter will be lost due to unforeseen circumstances.

Under the Enforcement Decree of the Act amended in October 2020, it is stated that where an individual small and medium entrepreneur establishes a new SME while operating his/her existing business, it shall not be considered starting up a business. However, the Act prescribes transitional measures (Article 2 of the Addenda of the Act) under which a business starter that commenced business according to the regulations before the enactment of the Enforcement Decree of the Act shall be considered a business starter until seven years have not passed from the date of commencing business pursuant to the pre-amendment regulations. So, as in this case in which a person operating a real estate business became a business starter by additionally operating a wholesale and retail business, he/she shall maintain his/her status as a starter of a wholesale and retail business, in accordance with such transitional measures.

Therefore, in this case, the date of business commencement that is used to determine whether the person is a wholesale/retail business starter shall not apply retroactively to the date of commencement of the real estate business. Consequently, the business operator shall not lose his/her status as a business starter." -

" Yes, in this case, the person can be considered a “shipowner”

Under the Seafarers’ Act, the term “shipowner” means a shipowner, ship managing business operator who is entrusted with the responsibility for the operation of a ship by a shipowner and agrees to take over the rights, responsibility, and obligations of a shipowner under the Act, his/her agent, ship charterer, etc. (subparagraph 2 of Article 2). In this regard, it can be considered that a person who is or corresponds to the persons listed before “etc.” of the same subparagraph can be included in the scope of shipowners.

However, because ship managing business operators or agents are not obligated to take over all of the shipowner’s rights and responsibilities, “shipowner” cannot be limited to persons who have been entrusted with all matters regarding the ship’s operation. Also, the Seafarers’ Act does not define “operation”. Ship managing business operators manage the technical and commercial aspect of a ship in addition to the operation of a ship, and the Seafarers’ Act defines that maritime passenger transport business is a business for transporting passengers and goods and overseeing the relevant matters. In light of this, it should be considered that “operation of a ship” prescribed by subparagraph 2 of Article 2 of the Act shall include the work that is done to provide convenience to passengers of the ship.

If so, the person who leased a snack bar or restaurant in of a passenger ship is a person who is entrusted with the responsibility to provide convenience to passengers and therefore should be regarded as having taken over the rights and responsibilities of a shipowner pursuant to the Act. In this regard, it is appropriate to consider that the person who has leased a snack shop or restaurant in a passenger ship Act is a shipowner

In addition, in regard to the “seafarer labor contract” (subparagraph 9 of Article 2) and “wages” (subparagraph 10 of Article 2) under the Act, the relationship between the shipowner and seafarer is defined. And when we look at the definition of “seafarer” as “a person who is employed to provided labor in a ship to which this Act applies” (subparagraph 1 of Article 2), the definition is based on the place of employment, not the employer. In consideration of such regulation, it will be reasonable to interpret that a person who is at the position to employ seafarers – persons who are to work at a ship under the Act – should be considered shipowners unless special causes for exception apply.

If the lessee of a snack bar or restaurant who employed a seafarer to work at the bar or restaurant is not considered a shipowner, the regulations under the Act which define the employment conditions of a seafarer that a shipowner has to adhere to such as regulations on the employment contract, wage, working hours, paid leaves, etc. of seafarers will not apply. If so, it will be contradictory to the purpose of legislating the Seafarers Act, which is to apply regulations that are different from that of the Labor Standards Act stipulating the general employment relations of workers, because seafarers are exposed to special working conditions as they work and live in an isolated ship for a long period of time and are exposed to seafaring risks such as sinking or running aground of the ship. "