Industry Focus

- Home

- Investment Opportunities

- Latest Information

- Industry Focus

As of 2020, Korea was ranked 5th in e-commerce market size, with its mobile shopping growing at the fastest pace in the world. In 2020, online shopping transactions increased even more due to the prolonged COVID-19 pandemic. In addition, the accelerating digital transformation across all economic sectors has brought about innovation in the retail industry with the application of 4th industrial revolution technologies. An evolution towards the era of Retail 4.0 is underway, spurred by the spread of the “omni-channel” (integrating online and offline channels), and the emergence of new business models based on data.

Key to the retail industry in the post-COVID-19 era

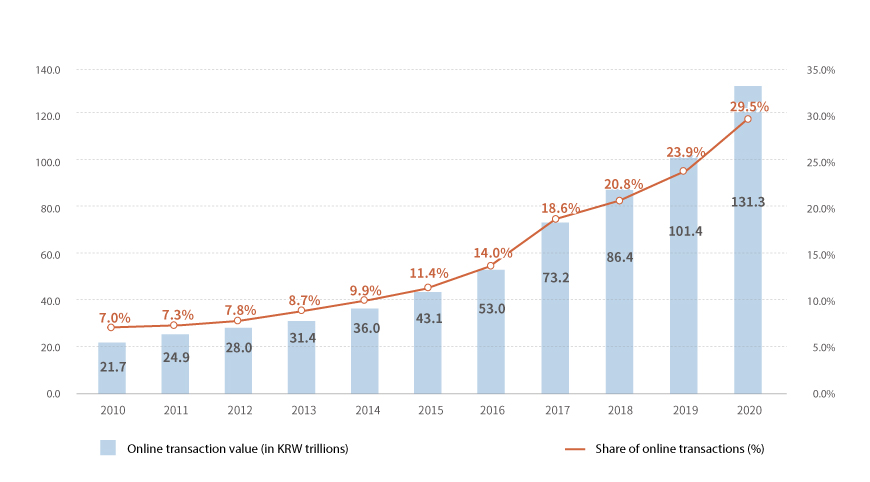

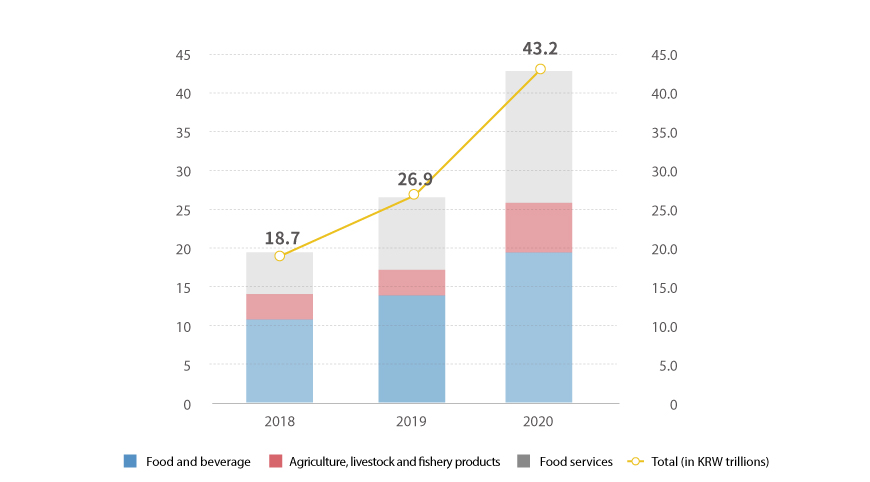

The market size of Korea’s e-commerce industry grew at an average of 19.7 percent per annum in the period of 2010-2020 to KRW 31 trillion in 2020. In particular, the share of mobile e-commerce has risen, taking up 67.9 percent of total online shopping as of 2020. By product category, the online transaction value of food and beverage (KRW 19.6 trillion) was the highest, followed by home electric appliances, electronic and telecommunication equipment (KRW 18.1 trillion), and food services (KRW 17.3 trillion). As people have been refraining from dining out due to the COVD-19 pandemic, refrigerated deliveries and online purchasing of foods have been on the rise. The online transaction value of food services rose 78.0 percent from the previous year, recording the highest growth rate. The values of online transactions of agriculture, livestock and fishery products, and food & beverage also rose 66.9%, 46.4%, respectively, from the previous year. By the type of services, the shares of total shopping sites and specialty sites were 67.9% and 32.1%, respectively, with the former more than doubling than the latter (as of 2020, Statistics Korea). This is attributable to the fact that an increase in e-commerce transactions has been led by large-platform operators.

| Strategy | Details |

|---|---|

| Establish a retail data dam | ㆍExpand standardized database of product information - Establish standardized database of around 3 million products ㆍLay the foundation for the usage of retail data - Establish and publicize retail data platform - Provide data and data analysis service |

| Foundation for delivery logistics innovation | ㆍExpand fulfillment service centers and spread a standard model - Expand fulfillment service centers and spread a standard model ㆍInnovative contactless logistics and delivery service by exploiting drone and robot -Commercialize drone and robot delivery by utilizing demonstration project and regulation sandbox |

| Stimulate globalization of e-commerce | ㆍExpand overseas logistics depots for online export - Expand overseas shared logistics center and bolster fulfillment service ㆍCooperate globally on retail channels and enter overseas market - Expand promotion support for companies entered overseas retail channels ㆍActively participate in global trade rule-setting process |

Strengthening competitiveness of e-commerce in preparation for digital transformation

Changes in the retail industry have been accelerated due to the contactless consumption trend triggered by the COVID-19 pandemic, and application of technologies of the 4th industrial revolution. In keeping with such changes, the Korean government has come up with “Measures to strengthen competitiveness of digital retail to respond to ‘contactless and online trends’” in March 2021. It announced Five Strategies under the vision of “Taking the lead in digital innovation of the retail industry and establishing a sustainable growth ecosystem.” In particular, the government reckons that future competitiveness of the retail industry would lie in taking advantage of data and innovation of the distribution system. As such, it laid out various policies with a focus on establishing a retail data dam and bolstering the foundation for innovative delivery logistics.

The government identified that data-based customized service provision would determine the competitiveness of the retail industry in the era of digital retail. Thus, it plans to establish a standardized database of around 3 million products by 2022 for small and mid-sized companies and startups, as well as establishing a data utilization platform by 2021. Additionally, it plans to establish ICT-based fulfillment centers to effectively deal with online transactions characterized by multi-variety small volume trading and on-time delivery, and commercialize drones and robots early for the Last-Mile innovation of delivery. To this end, the government has prepared detailed plans such as preparing guidelines for drone delivery in non-populated isolated areas (islands, mountains), and allowing delivery robots to operate on sidewalks. With the rapid growth of e-commerce worldwide, the government also formed strategies to help online retailers tap deeper into overseas markets through e-commerce by enhancing the global competitiveness of Korean companies in such ways as: establishing overseas shared logistics centers; strengthening fulfillment services; and expanding promotion for companies which entered the overseas retail channels.

Korea’s e-commerce market has been growing steadily, and the COVID-19 pandemic has further spurred its growth. The share of online transactions out of domestic retail sales is expected to continue to grow in the future. Indeed, with the prospect of market reshuffling led by large platform providers, business operators have been tapping into the possibility of expanding their spheres of business. Meanwhile, ‘Amazon’, a global e-commerce player, is to enter ‘11st Street’, an open e-commerce market, by joining hands with a domestic player ‘SK Planet’.

By Jinkyung Goo (jkgoo@kiet.re.kr)

Korea Institute for Industrial Economic & Trade

<* The opinions expressed in this article are the author’s own and do not reflect the views of KOTRA.>