Robot

- Home

- Investment Opportunities

- Industries

- Robot

-

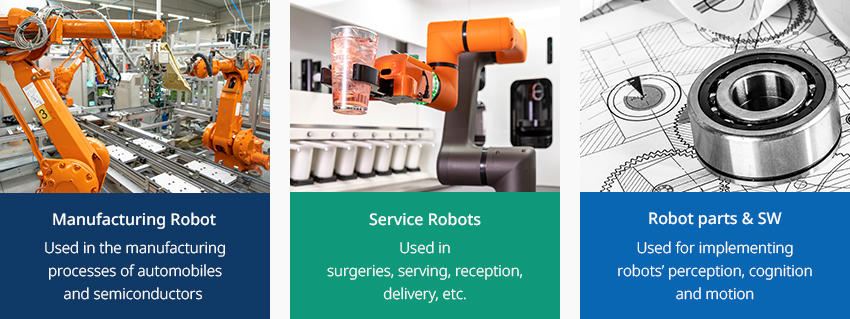

Korean Robotics Industry Concept and Characteristics OpenKorean Robotics Industry Concept and CharacteristicsAn intelligent robot is a mechanical device that perceives the external environment by itself and operates autonomously by judging the situation (Article 2 of the Intelligent Robots Development And Distribution Promotion Act). It is categorized as manufacturing robots and service robots depending on its use and application, and robot parts and related software constitute the downstream industry."Types of Robots"Characterized by connectivity, intelligence, and interaction, the robotics industry is a future high-tech industry that contributes to the digital transformation of industries and generates new businesses and added value. Manufacturing robots are becoming intelligent by converging with AI and the cloud as they drive flexible production and increased productivity at manufacturing sites.In the case of service robots, the introduction of robots in various areas is accelerating as the market for non-face-to-face services has recently expanded due to COVID-19 and as the demand has increased for using robots in tackling various social challenges such as welfare, safety, and logistics.The robotics industry is a convergent industry that is easy to link with other industries and requires high technical skills. Dominated by a handful of players due to the high entry barrier, top five countries of China, Japan, the United States, Germany, and Korea currently account for 73% of the total market.

-

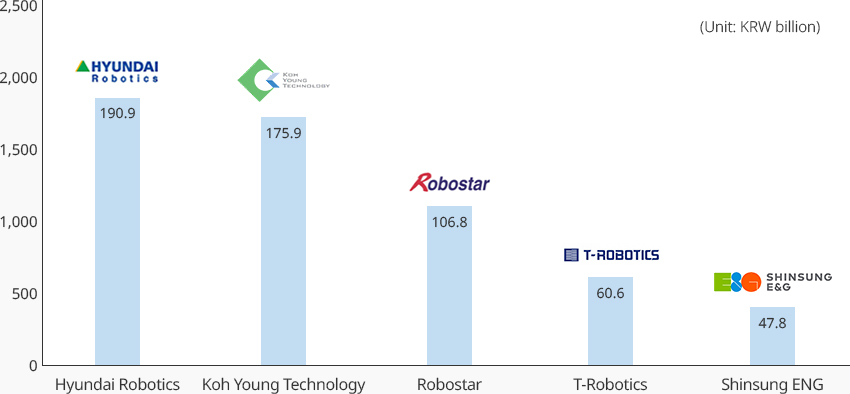

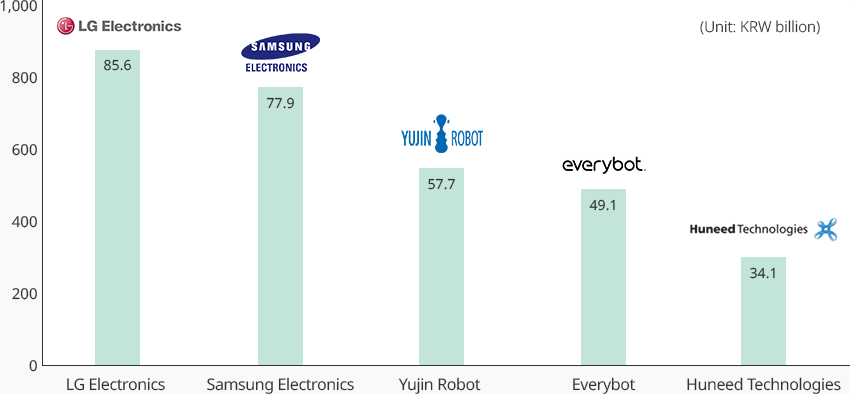

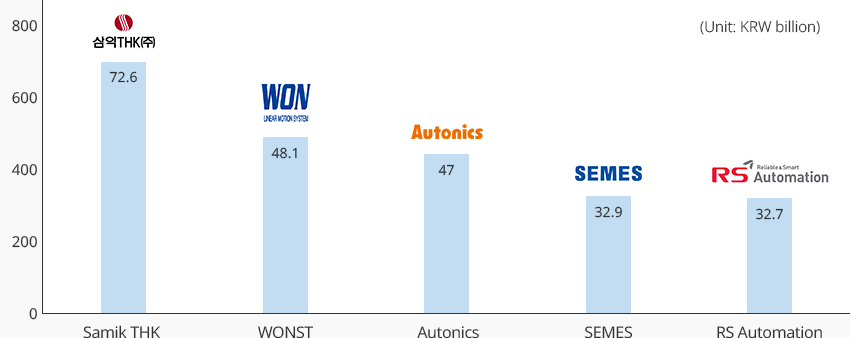

Domestic and Global Market Size and Status of Different Types of Robots OpenDomestic and Global Market Size and Status of Different Types of RobotsThe global robotics market is worth about USD 24.3 billion as of 2020 (USD 13.2 billion for manufacturing robots and USD 11.1 billion for service robots), with a growth rate of 8.5% for manufacturing robots and 10.2% for service robots (2015-2020). By 2024, the global manufacturing robot market is expected to grow to USD 17.9 billion and the service robot market to USD 16.2 billion (World Robotics 2021, IFR).According to the 2021 Robotics Industry Survey, sales volume of the Korean robotics industry is expected to grow from KRW 5.5 trillion in 2020 to KRW 6.7 trillion in 2024 by recording an average annual growth rate of 5.4% (2015-2020), with manufacturing robots, service robots and robot parts growing by 2.1%, 6.4%, and 11.7%, respectively.As the world sees the end of the pandemic, the manufacturing robot segment is expected to grow from USD 13.2 billion in 2020 to USD 17.9 billion in 2024 by recording an average annual growth rate of 8%. The world's major producers of manufacturing robots including ① FANUC (Japan, 10%) ② ABB (Sweden, 10%) ③ YASKAWA (Japan, 8%) ④ KUKA (China, 7%) and ⑤ MITSUBISHI ELECTRIC (Japan, 5%) take up 40% of the total market.The sales volume of Korean manufacturing robots is expected to grow from KRW 2.86 trillion in 2020 to KRW 3.1 trillion in 2024 by recording an average annual growth rate of 2.1%, and major players include Hyundai Robotics (KRW 190.9 billion in sales in 2020), Koh Young Technology (KRW 179.5 billion), Robostar (KRW 106.8 billion), T-Robotics (KRW 60.6 billion), and Shinsung ENG (KRW 47.8 billion)."Sales of Korea’s Major Manufacturing Robot Producers"In the case of service robots, the demand for medical, cleaning, and logistics robots is increasing due to the spread of the non-face-to-face service market, and the market size is expected to grow from USD 11.1 billion in 2020 to USD 16.2 billion in 2024 by recording an annual growth rate of 10%.Major global players include ① INTUITIVE SURGICAL producing surgical robots (US, 13%), ② DJI producing drones (China, 13%), ③ Daifuku producing material handling robots (Japan, 5%), ④ iROBOT producing cleaning robots (US, 3%), and ⑤ DELAVAL producing farming robots (Sweden, 1%)."Major Global Producers of Service Robots"Meanwhile, the sales volume of Korean service robots is expected to grow at an annual average growth rate of 6.4% from KRW 0.8 trillion in 2020 to KRW 1.1 trillion in 2024, driven by the commercialization of high-performance and high-end surgical robots. Major domestic players include LG Electronics (KRW 85.6 billion of sales in robotics in 2020), Samsung Electronics (KRW 77.9 billion of sales in robotics), Yujin Robot (KRW 57.7 billion), Everybot (KRW 49.1 billion), and Huneed Technologies (KRW 34.1 billion)."Sales of Korea’s Major Service Robot Producers"The robot parts segment is expected to enjoy high growth especially in the market for parts (grippers, controllers, etc.) that are used in flexible production of a wide variety of products.Within the segment, Japan is leading hardware, while the United States and European countries are strong in software.The Korean robot parts market was worth KRW 1.7 trillion in 2020 with drive parts (30.4%) and control parts (25.8%) accounting for 56.2% of the domestic parts market.Major players include Samik THK (KRW 72.6 billion of sales in 2020), WONST (48.1 billion), Autonics (47 billion), SEMES (32.9 billion), and RS Automation (32.7 billion)."Sales of Korea’s Major Robot Parts Producers"

-

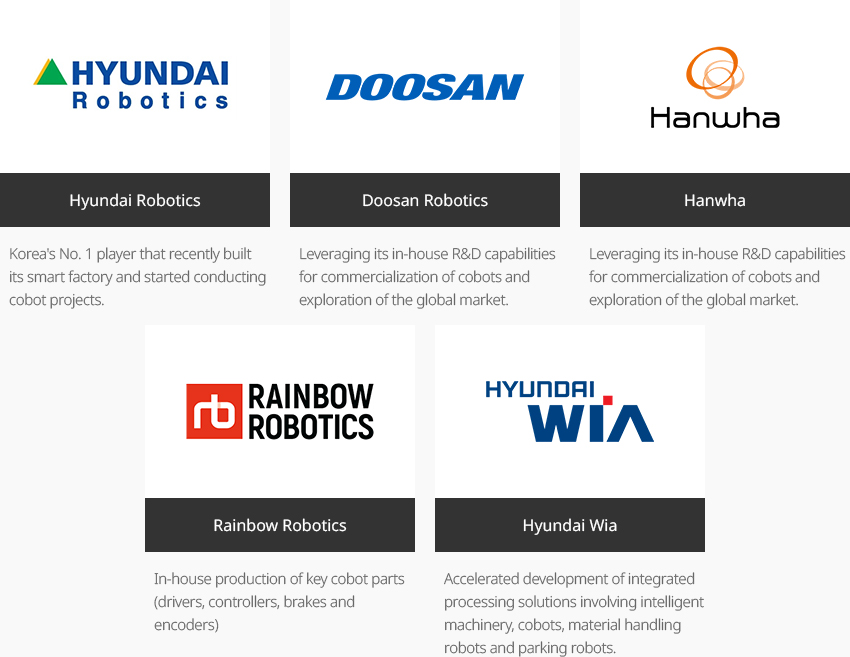

Latest Industry Trends OpenLatest Industry TrendsWhereas Korea is a follower of Japanese and European companies in the manufacturing robot segment, it is competing by focusing investment in collaborative robots (cobots) while expanding application through convergence with AI and self-driving technologies.

- Hyundai Robotics - Korea's No. 1 player that recently built its smart factory and started conducting cobot projects.

- Doosan Robotics - Leveraging its in-house R&D capabilities for commercialization of cobots and exploration of the global market.

- Hanwha - Leveraging its in-house R&D capabilities for commercialization of cobots and exploration of the global market.

- Rainbow Robotics - In-house production of key cobot parts (drivers, controllers, brakes and encoders)

- Hyundai Wia - Accelerated development of integrated processing solutions involving intelligent machinery, cobots, material handling robots and parking robots.

In the service robot segment, major Korean companies have recently been expanding their investment in robotics by acquiring or buying shares of robotics companies while also applying robotics technologies in existing business models."Recent Launches of Service Robots by Major Korean Companies"

In the service robot segment, major Korean companies have recently been expanding their investment in robotics by acquiring or buying shares of robotics companies while also applying robotics technologies in existing business models."Recent Launches of Service Robots by Major Korean Companies"Recent Launches of Service Robots by Major Korean Companies Name of company, Description Name of company Description Hyundai Motors

Acquisition of Boston Dynamics and development in three major areas of wearable robots (Vex, Cex and Mex), services robots (DAL-e) and micromobility (MobED and PnD). LG Electronics

Equity investment in domestic and overseas robotics companies* and launch of the CLOi series for provision of optimized solutions for different spaces such as hotels, hospitals, and restaurants. - Invested KRW 96 billion in robot manufacturing companies including Robostar (KRW 80 billion, 33.4% share), Bossa Nova Robotics (USD 3 million), Angel Robotics (KRW 3 billion), Acryl (KRW 1 billion) and Robotis (KRW 9 billion).

Samsung Electronics

Announcement of new investment of KRW 240 trillion in robots and AI in the next three years. Launch of AI robots and a wearable walking-assist robot (GEMS-H) "Expansion of Existing Robotics Projects"Expansion of Existing Robotics Projects Company, Description Company Description Naver Labs Construction of a robot-friendly building (Naver 1784) as a testbed and launch of new businesses* based on AI, robotics and cloud (ARC). Three major telecom companies Investment in digital platform* projects that use robots in installation, remote control, after-sales service and network construction. - Subscription service for quarantine robots (KT and SKT), network-based pharmaceutical delivery robot service (LG U+)

Self-driving companies Expansion from a product-focused model to service platform projects utilizing robots such as robot delivery platform (Neubility) and self-driving robot platform (Twinny) -

Foreign Investment Success Story OpenForeign Investment Success StoryCompany B, a US service robot developer and manufacturer, was looking for a stable production base after signing a large-scale robot supply contract with a major US franchise. After considering (1) Korea's abundant human resources, (2) close link of the upstream and downstream industries, and (3) the government policies supporting foreign investors, it decided to invest in Korea in the first half of 2023 and is planning to build a production plant in the second half."Serving Robot of Company B"Company B reported its first investment in March 2023, with plans to invest a total of USD 40 million over the next five years.It also plans to explore the field of security and surveillance robots by establishing an R&D center in Korea.The company initially searched for a production site across Asia, including China and Korea, but chose Korea by considering Korea's infrastructure of related industries and the trade war between the US and China.

-

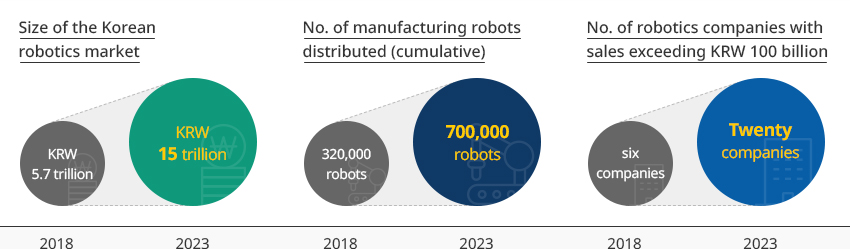

Policies and Incentives OpenPolicies and IncentivesThe Ministry of Trade, Industry and Energy (MOTIE) established the 3rd Master Plan for Intelligent Robots (2019-2023) after deliberating the plan at the policy council of the Intelligent Robots Development and Distribution Promotion Act and finalized the robotics industry development policy with a vision to join the ranks of the world's top 4 leaders of the robotics industry.Based on the plan, the ministry set objectives to increase the size of the domestic robotics market to KRW 15 trillion, achieve annual sales of KRW 100 billion by distributing 700,000 manufacturing robots and foster twenty robotics companies by 2023."3rd Master Plan for Intelligence Robots"

3rd Master Plan for Intelligence Robots Index, 2018, 2023 Index 2018 2023 Size of the Korean robotics market KRW 5.7 trillion KRW 15 trillion No. of manufacturing robots distributed (cumulative) 320,000 robots 700,000 robots No. of robotics companies with sales exceeding KRW 100 billion Six companies Twenty companies Major projects include expanding the distribution of manufacturing robots by focusing on three major manufacturing industries 1), fostering four major technologies of service robots 2), and strengthening the fundamental of the roboticss industry ecosystem.1) Three main parts: Controllers, sensors and grippers

2) Four major service robot technologies: robot software platform, grabbing technology, image processing, and human robot interface (HRI). -

Five Advantages of Korea that Appeal to Foreign Investors OpenFive Advantages of Korea that Appeal to Foreign Investors1.Closely-linked upstream and downstream industries

In 2020, Korea’s manufacturing sector accounted for 25.4% of GDP, which is the 2nd highest in the world and demonstrates the country’s status as a traditional manufacturing powerhouse

2.Excellent Human ResourcesIn 2020, Korea ranked 1st in the number of researchers per 1,000 economically-active people with 16.6 researchers (followed by Sweden with 15.82)

3.Provision of various incentives to foreign investorsIncentives including tax benefits, cash subsidies and location support

4.Government initiative to foster the robotics industryEleven local governments installed teams dedicated to robotics businesses and are implementing related projects.

5. FTAs with countries around the worldAs of 2022, Korea's FTAs with 59 countries around the world have been signed and are in effect, and agreements with 10+ countries are in progress.

- Closely-linked upstream and downstream industries (2020) - 25.4% of GDP comes from manufacturing: World’s No. 2

- Excellent Human Resources (2020) - 16.6 researchers per 1,000 economically-active people: World’s No. 1

- Provision of various incentives to foreign investors - Incentives including tax benefits, cash subsidies and location support

- Government initiative to foster the robotics industry - Eleven local governments installed teams dedicated to robotics businesses and are implementing related projects

- FTAs with countries around the world (2022) - FTAs with 59 countries around the world signed & in effect, agreements with 10+ countries in progress.

-

Korea’s Robotics Industry Clusters OpenKorea’s Robotics Industry ClustersIn order to foster the robotics industry at the regional level, the government has selected main agencies charged with promoting the robotics industry in each local government and is supporting the designation of specialized areas of robotics."Main agencies leading the robotics industry at the regional level"Institutes funded by local governments and

specialized production technology R&D centers are leading regional robotics businesses.Main agencies leading the robotics industry at the regional level Region, Name of Institute, Dedicated Teams, Major Function and Roles Region Name of Institute Dedicated Teams Major Function and Roles Busan KITECH Marine Robotics Center - Supporting R&D and testing of marine robots to foster the regional robotics industry and support the growth of robotics companies

KIRO URI_Lab, Busan - Supporting robotics companies through R&D and project implementation of robot convergence and key technologies

Daegu DMI Mechanical Robotics Research Center - Developing policies to foster Daegu's robotics industry, building robotics industry infrastructure, developing technologies, evaluating the performance of parts/modules/products, and implementing business support projects

Incheon Incheon TP Robotics Industry Center - Fostering Incheon's robotics industry by supporting businesses and building and operating infrastructure

Gwangju Gwangju TP Industrial Technology Center - Supporting the development of Gwangju's robotics industry

Daejeon Daejeon TP Intelligent Robotics Center - Planning and implementing projects in areas of robotics, intelligent machinery, drones and national defense and revitalizing the industrial ecosystem by supporting the development related technologies and marketing.

Gyeonggi GBSA Future Technology Team, 4th Industry Headquarters - Promoting the robotics industry in Gyeonggi-do with robot demonstration projects and marketing support

Bucheon, Gyeonggi BIZBC Robotics Convergence Team, Industrial Growth Center - Operating R&D, research facilities, training, marketing and networking programs to foster the robotics industries of Bucheon City and Gyeonggi-do

Gangwon GICA Museum Management Team, Management Planning Division - Managing robot experience programs, exhibitions and the Toy Robot Museum

Gyeongbuk KIRO Future Strategy Business Office - Supporting the commercialization of robotics technology, standardization and testing

Gyeongnam Gyeongnam TP Intelligent Machinery Center - Building a robotics industry ecosystem leading high-tech manufacturing technology

"Basic Direction of the Regional Robotics Industry"Select specialized areas by considering the connection with regional development plans, and continuously add new specialized areas.Basic Direction of the Regional Robotics Industry Region, Connection with Regional Development Plans, Major Functions and Roles Region Connection with Regional Development Plans Major Functions and Roles Busan Enactment of the Ordinance for Fostering Busan’s Robotics Industry (2020) - Industrial robots, lifecare robots, marine & logistics robots

Daegu Mayor's Pledge: Emerging as a Global Hub of Robotics Industry - Specializing in the five areas of service robots (crime prevention, charging, care, logistics, and delivery)

Incheon Robotics selected as a major regional strategic industry - Logistics robots, entertainment robots, etc.

Gwangju Ordinance to Support the Development of the Electronics Industry (2022): Fostering healthcare by converging medical and home appliance industries - Specialized in lifecare (mobility, rehabilitation, and living assistance)

Daejeon Mayor's pledge linked to four strategic industries of nanosemiconductors, biohealth, aerospace, and national defense - Service robots for logistics and national defense

Gyeonggi Master Plan for Development of Gyeonggi's Robotics Industry (2016) - New digital technologies (AI, 5G, etc.)

Bucheon Included in the region's five specialized industries - Promotion of robot parts industry

Gangwon Linked to the culture/education development strategy - Specializing in robot programs and education

Gyeongbuk Linked to Gyeongbuk Robotics Industry Development Strategy - Farming robots, safety and underwater robots, construction robots, etc.

Gyeongnam Included in Gyeongnam's ten strategic industries - Distributing industrial robots and improving their performance and reliability