Korean Government’s Aerospace Policy

Aviation

The Korean government announced the Comprehensive Ten-year Master Plan to support and foster the aviation industry. The Third Master Plan for Aerospace Industry Development covering the period from 2021 to 2030 was established in 2020 in accordance with Article 3 of the Aerospace Industry Development Promotion Act (Establishment of Master Plan for Aerospace Industry Development) and Article 3 of the Enforcement Decree. Based on the vision of joining the world’s top seven aviation powerhouses in the 2030s by upgrading and advancing the aviation industry, the plan aims to build a foundation for the future aviation industry by upgrading the existing aviation industry, opening new markets, and advancing R&D. To that end, the plan proposes four strategies and 12 major tasks.

Four strategies and 12 tasks

* Source: 3rd Master Plan for Aerospace Industry Development (2021-2030)

The strategies and tasks will help Korea join the ranks of the world’s aviation leaders and generate results such as increased production (from KRW 7 trillion in 2019 to KRW 26.3 trillion in 2035), more jobs (from 18,000 in 2019 to 67,000 in 2035), and fostering hidden champions (from 10 in 2019 to 30 in 2035).

Space

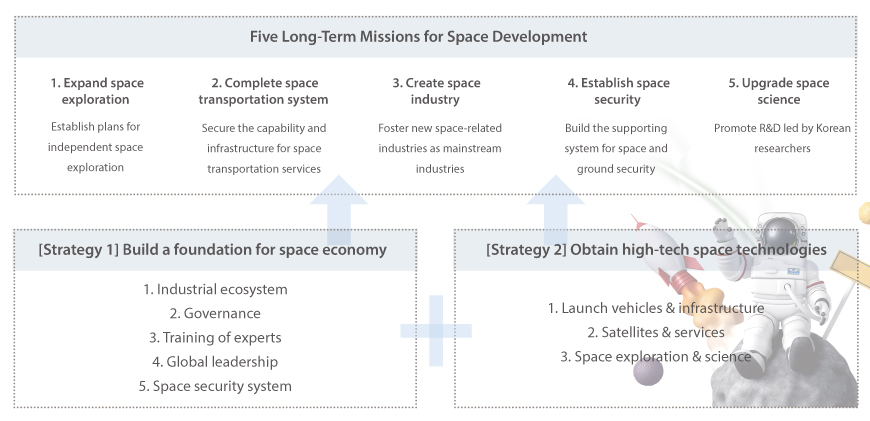

Every five years, the government sets mid- to long-term policy goals and directions for the nation’s space development and presents strategies and plans to develop the space industry in order to facilitate R&D, build infrastructure, train experts, facilitate international cooperation, and boost the private sector’s space development. In accordance with Article 5 of the Space Development Promotion Act (Master Plan for Promotion of Space Development) and Article 2 of the Enforcement Decree, the Fourth Master Plan for Promotion of Space Development was established in 2022 to fulfill Korea’s roadmap toward building the future space economy. Based on the vision of becoming a global powerhouse in the space economy by 2045, the government identified five missions as long-term strategic goals and two action plans as means of meeting the goals.

Strategies & Tasks

* Source: 4th Master Plan for Promotion of Space Development

Based on the master plan, the government expects to open the new space era, where the private sector leads the innovation of space technologies, begins exploring the space in full-scale by expanding the scope of exploration, and increases the value of space by leveraging it in tackling social problems and ensuring public safety. Furthermore, the government designated space industry clusters, which will be created by linking research institutes, companies, and educational institutions, in order to promote the convergence of the space industry and enable the collaboration among related industries. Under the plan, clusters will be built so that Jeonnam will specialize in launch vehicles, Gyeongnam will focus on satellites, and Daejeon will cover research and training exports. From 2024 to 2031, a total of KRW 600 billion will be invested to link the clusters into a single belt and create synergistic effects.

Status of Korea’s Aerospace Industry

The global aviation industry suffered a severe setback in 2020 due to the sharp decline in trade and passengers caused by the outbreak of COVID-19, but has started to gradually recover. As of December 2023, 15,519 domestic flights were operated, an increase of about 97.6% compared to 7,852 domestic flights in March 2020, returning to pre-pandemic levels. Accordingly, the revenue of the Korean aviation manufacturing industry also recovered to KRW 6.3 trillion in 2022, after recording negative growth rates since 2019 (compared to KRW 4.8 trillion in 2020). The industry grew by 14.1% year-on-year in 2022 and most notably, the engine sector grew the fastest in terms of production value to grow by 20.3% year-on-year to KRW 730 million in 2022.

Table 2. Revenue & Growth Rate

(Unit: billion won)

* Source: Aerospace Industry Survey (2023), Space Industry Survey (2023)

Similarly, the space industry experienced a negative growth rate of 15% in 2020 due to the impact of COVID-19, but recovered in 2022 with 15% year-on-year growth to about KRW 3 trillion. Revenue of the space systems manufacturing sector, including satellites and launch vehicles, fell by about 3.3% year-on-year to KRW 640 billion in 2022, while revenue in the satellite-related sector grew by 21.1% year-on-year to KRW 2.3 trillion in 2022. The industry’s top five players accounted for 51.5% or about KRW 1.5 trillion in total revenue. In particular, the satellites for broadcasting and communication accounted for the highest share (71.4%), with the revenue of satellite communication antennas growing the fastest.While both the aviation and space industries have been hit hard by COVID-19, companies are continuing to invest in R&D. In 2022, the aviation industry invested about KRW 300 billion in R&D, up 16.6% year-on-year, and the space industry invested KRW 170 billion in R&D in 2022, up 8% year-on-year. These trends show that Korean aerospace companies are investing heavily in R&D for long-term growth.

Table 3. Investment amount

(Unit: billion won)

* Source: Aerospace Industry Survey (2023), Space Industry Survey (2023)(2023)

Status of Korea’s Aerospace R&D

In line with the rapid rise of urban air mobility (UAM), numerous players are working towards forming a market in Korea. The Ministry of Land, Infrastructure, and Transport has organized the UAM Team Korea (UTK) working group to commercialize the nation’s UAM by the end of 2025. To that end, the ministry launched a total of five working groups—each covering policies, aircraft and operation, infrastructure, traffic management, and value-added services—to discuss the overall ecosystem and set standards. The UTK involves seven universities, nine private companies, and 11 local governments, as well as government ministries and government-funded research institutes.

In the space sector, the government-funded Korea Aerospace Research Institute successfully launched Nuri to make Korea the world’s seventh country to obtain its own space transportation capability. For the third launch, the government plans to invite private companies to participate in launch preparation and launch operations as system integrators. In addition, the next-generation launch vehicle will be developed by the Korea Aerospace Research Institute and private companies. The government also started the Small Launch Vehicle Development Project to enable private companies to obtain launch capabilities and to foster the private-led small launch vehicle industry. Recently, Innospace, a private player, successfully staged a test launch in March 2023, getting a step closer to commercial launch services.

In addition, the government is in the process of installing a ministry dedicated to space called the Korea Aerospace Administration. Based on the current government's commitment and the active participation of industries, universities, and research organizations, the ecosystem for the aerospace industry is being shaped rapidly. Such efforts are expected to open various opportunities along with the growth of the Korean aerospace sector.

By Jun-Woo Park(park2445@kari.re.kr)

Senior Researcher, Korea Aerospace Research Institute (KARI)