Battery

- Home

- Investment Opportunities

- Industries

- Battery

-

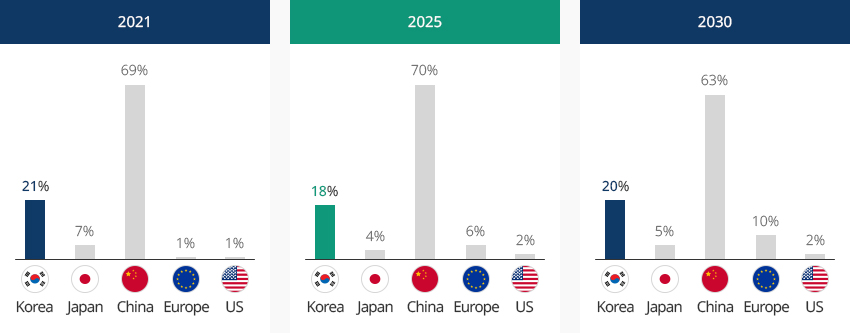

Status and Growth of Korea's Battery Industry CloseStatus and Growth of Korea's Battery IndustryKorea is the world's second-largest battery producer accounting for 21% of the world's electric vehicle battery (including ESS) capacity (as of 2021). The country has globally competitive manufacturers of finished battery products, and is also performing well in the materials segment such as anode and cathode materials."EV (including ESS) Battery Production Capacity Breakdown and Outlook"

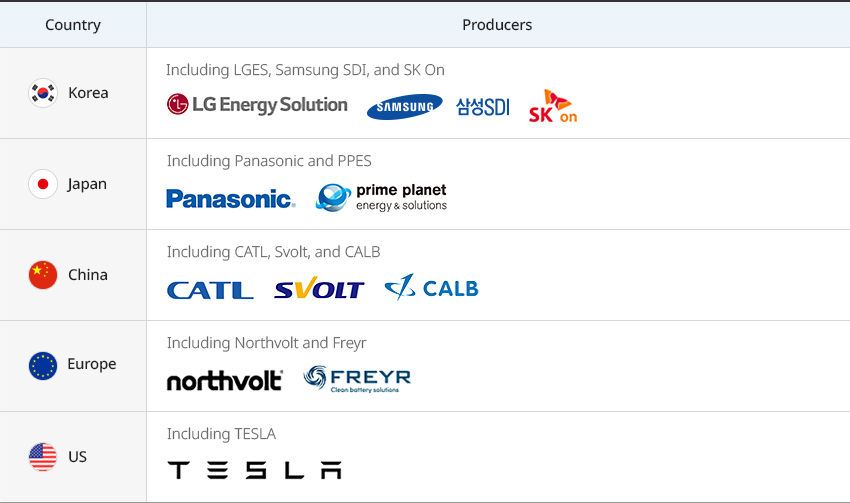

EV (including ESS) Battery Production Capacity Breakdown and Outlook Country, Year Country 2021 2025 2030 Korea 21% 18% 20% Japan 7% 4% 5% China 69% 70% 63% Europe 1% 6% 10% US 1% 2% 1% Total 100% 100% 100% ※ Source : SNE Research, 2022 Global Outlook for Expansion of LIB Production Lines (~2030)"World’s Major Battery Producers"Korea in its 2050 Carbon Neutrality Roadmap proposed expanding the use of EVs as one of the solutions to turning carbon-free, and various incentives and policy support have been introduced. Korean consumers are also increasingly favoring EVs, while major OEMs, including Hyundai Motor Group, are expanding their production of EVs to meet government policies and consumer expectations. More specifically, Hyundai Motor Group EVs is contributing to the expansion of domestic EV production and sales by launching highly competitive EVs based on the Electric-Global Modular Platform (E-GMP), a platform dedicated to EVs. IONIQ 5, IONIQ 6, EV6, and GV60 running on the E-GMP platform have won various awards including the European Car of the Year and the World Car of the Year."E-GMP Models"Korea is seeing a surge in EV sales, which grew from 46,909 units in 2020 and 101,112 units in 2021 to 162,987 units in 2022. Moreover, the Korean government has set a goal of supplying 4.5 million EVs by 2030 by expanding the infrastructure of chargers and charging stations, encouraging the retirement of internal combustion engine vehicles, and offering incentives for EV purchases. The rapid growth of the Korean EV market and the government support present a promising future for the domestic EV market. The growth in the EV market and government support greatly benefit the domestic battery industry as batteries account for 30 to 40 percent of EV unit costs."EV Sales in Korea"Korea's major battery producers - LG Energy Solution, SK On, and Samsung SDI - boast the know-how and technology based on 20 to 30 years of experience in the industry. The rich experience in battery production also worked in favor of building automatic facilities in their factories. Automation facilities are key to production efficiency as they contribute to improving and maintaining battery yields (input to output ratio).The Inflation Reduction Act (IRA) introduced by the US government also poses a good opportunity to raise the profile of K-batteries. The IRA stipulates that battery minerals and components must be sourced from North America or from countries that have signed a free trade agreement with the US. As Korea is an FTA partner of the US, battery materials processed in Korea meet the IRA tax credit requirements, which is expected to encourage battery material producers wishing to benefit from the IRA tax benefit to further invest in Korea. -

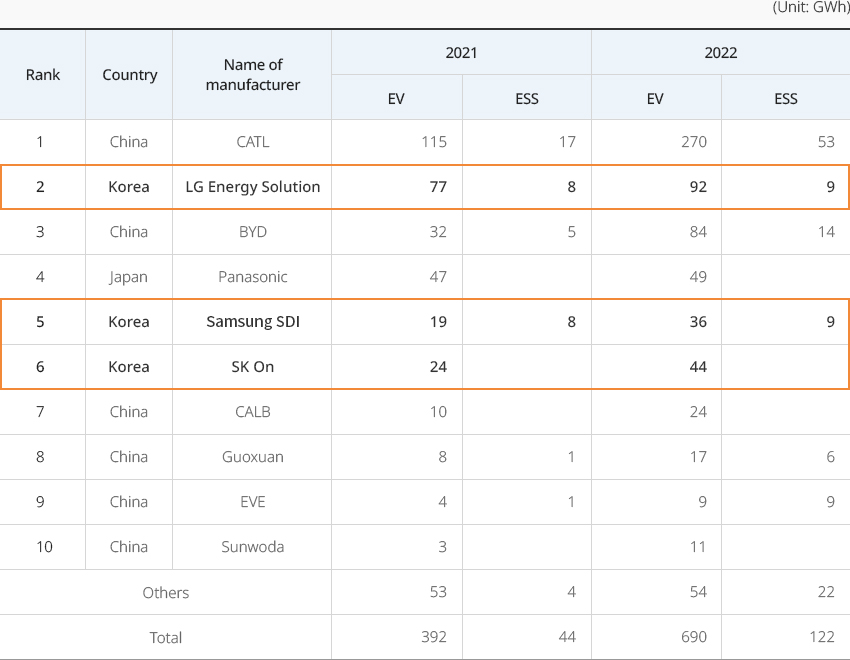

Battery Cells, All Focused in Korea OpenBattery Cells, All Focused in KoreaThe Korean battery industry is booming and enjoying what can be described as the K-battery renaissance, driven by the electrification trend and the subsequent surge in battery demand. According to SNE Research, battery sales in EV and ESS markets reached 812 GWh in 2022, up 86% year-on-year. More specifically, the EV battery segment grew by 76% from 392 GWh to 690 GWh, and the ESS battery segment grew by 177% from 44 GWh to 122 GWh. In contrast to the nation's sluggish exports in the second half of 2022, the battery sector recorded the largest export volume ever, with a 15.2% increase from USD 8.7 billion in 2021 to USD 9.99 billion in 2022."Sales of Major Global Battery Producers"

Sales of Major Global Battery Producers Rank, Country, Name of manufacturer, 2021, 2022 Rank Country Name of manufacturer 2021 2022 EV ESS EV ESS 1 China CATL 115 17 270 53 2 Korea LG Energy Solution 77 8 92 9 3 China BYD 32 5 84 14 4 Japan Panasonic 47 49 5 Korea Samsung SDI 19 8 36 9 6 Korea SK On 24 44 7 China CALB 10 24 8 China Guoxuan 8 1 17 6 9 China EVE 4 1 9 9 10 China Sunwoda 3 11 Others 53 4 54 22 Total 392 44 690 122  ※ Source : SNE Research (2023), Sales Volume Analysis of Global EV and ESS Markets in 2022In particular, LG ES (LG Energy Solution), SK Innovation, and Samsung SDI, the so-called "Big Three" champions of the Korean battery industry, have been recognized for their competitiveness in the global market. According to the market share of lithium-ion batteries (LIBs) as of 2021, the three companies are the top players in the lithium-ion battery market in different size segments. CATL is the top player in segment of medium-sized LIBs, which are mainly used in batteries for EVs, but LG Energy Solution also boasts a high share of 22.8%. Its performance is encouraging considering that China has the world's largest EV market."Status of the Lithium Ion Battery (LIB) Market"

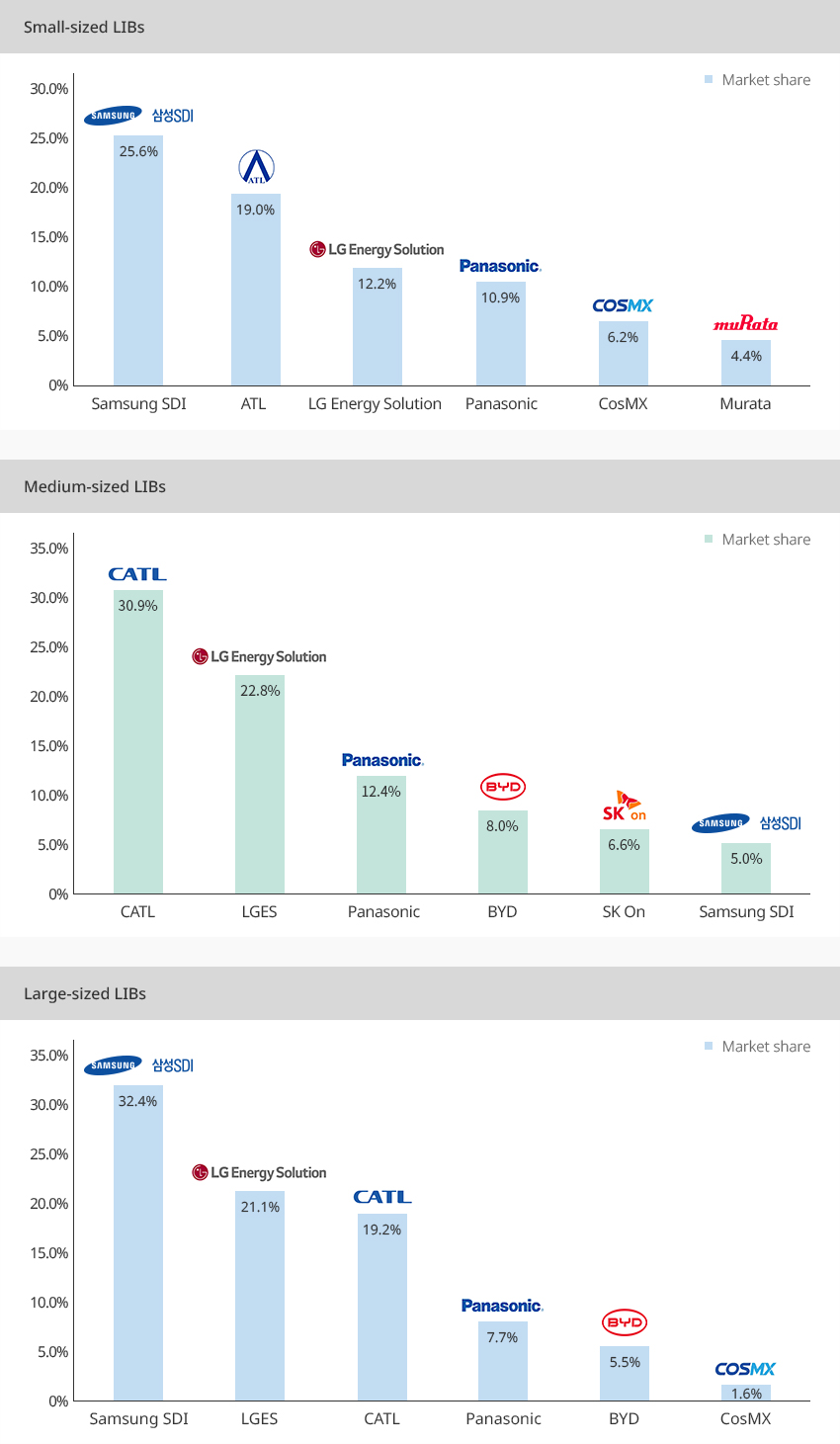

※ Source : SNE Research (2023), Sales Volume Analysis of Global EV and ESS Markets in 2022In particular, LG ES (LG Energy Solution), SK Innovation, and Samsung SDI, the so-called "Big Three" champions of the Korean battery industry, have been recognized for their competitiveness in the global market. According to the market share of lithium-ion batteries (LIBs) as of 2021, the three companies are the top players in the lithium-ion battery market in different size segments. CATL is the top player in segment of medium-sized LIBs, which are mainly used in batteries for EVs, but LG Energy Solution also boasts a high share of 22.8%. Its performance is encouraging considering that China has the world's largest EV market."Status of the Lithium Ion Battery (LIB) Market" Small-sized LIBs

Small-sized LIBs- Samsung SDI 25.6%

- ATL 19.0%

- LG Energy Solution 12.2%

- Panasonic 10.9%

- CosMX 6.2%

- Murata 4.4%

Medium-sized LIBs- CATL 30.9%

- LG Energy Solution 22.8%

- Panasonic 12.4%

- BYD 8.0%

- SKOn 6.6%

- Samsung SDI 5.0%

Large-sized LIBs- Samsung SDI 32.4%

- LG Energy Solution 21.1%

- CATL 19.2%

- Panasonic 7.7%

- BYD 5.5%

- CosMX 1.6%

※ Source : B3 (Feb. 2022)Korea's top three battery makers are investing aggressively to increase battery production capacity. SNE Research forecasts that LG Energy Solution's EV battery production capacity will triple from 173.5 GWh in 2021 and 505.5 GWh in 2025, to 1,079.5 GWh in 2030. The production capacity of SK On will also increase from 40.0 GWh in 2021 to 233.5 GWh in 2025, and Samsung SDI will upgrade its capacity from 37.5 GWh in 2021 to 156.0 GWh in 2025. Increases in production capacity are driven by LG Energy Solution's plan to increase the production of 4680 cylindrical batteries by investing KRW 4 trillion in its Ochang plant, and by SK On scheduled to expand production capacity by more than 20 GWh through the expansion of its Seosan plant in Chungnam."Major Players in the Korean Battery Industry"

※ Source : B3 (Feb. 2022)Korea's top three battery makers are investing aggressively to increase battery production capacity. SNE Research forecasts that LG Energy Solution's EV battery production capacity will triple from 173.5 GWh in 2021 and 505.5 GWh in 2025, to 1,079.5 GWh in 2030. The production capacity of SK On will also increase from 40.0 GWh in 2021 to 233.5 GWh in 2025, and Samsung SDI will upgrade its capacity from 37.5 GWh in 2021 to 156.0 GWh in 2025. Increases in production capacity are driven by LG Energy Solution's plan to increase the production of 4680 cylindrical batteries by investing KRW 4 trillion in its Ochang plant, and by SK On scheduled to expand production capacity by more than 20 GWh through the expansion of its Seosan plant in Chungnam."Major Players in the Korean Battery Industry"

- Cell

- STM

- Samsung SDI

- EIG

- SK on

- Solaredge

- RouteJD

- LG ES

- Cathode

- Sangshin EDP

- Umicore

- Ecopro

- lljin Materials

- LG Chem

- Phoneix PDE

- GS Caltex(PCT)

- L&F

- Hanwha Chemical

- Anode

- Toray Tonen

- Posco Chemtech

- Separator

- C Stec

- Asahi Kasei

- Wscope Korea

- Celgard

- SK Innovation

- Toray Tonen

- Electrolyte

- Soulbrain

- Panax Etec

- EnG tech

- Leechem

- Solvey Chemical

- Foosung

- Panax Etec

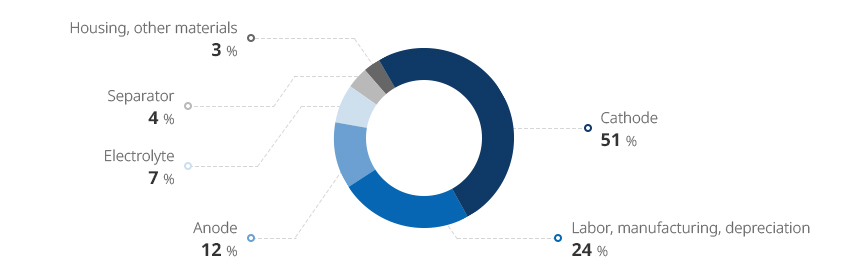

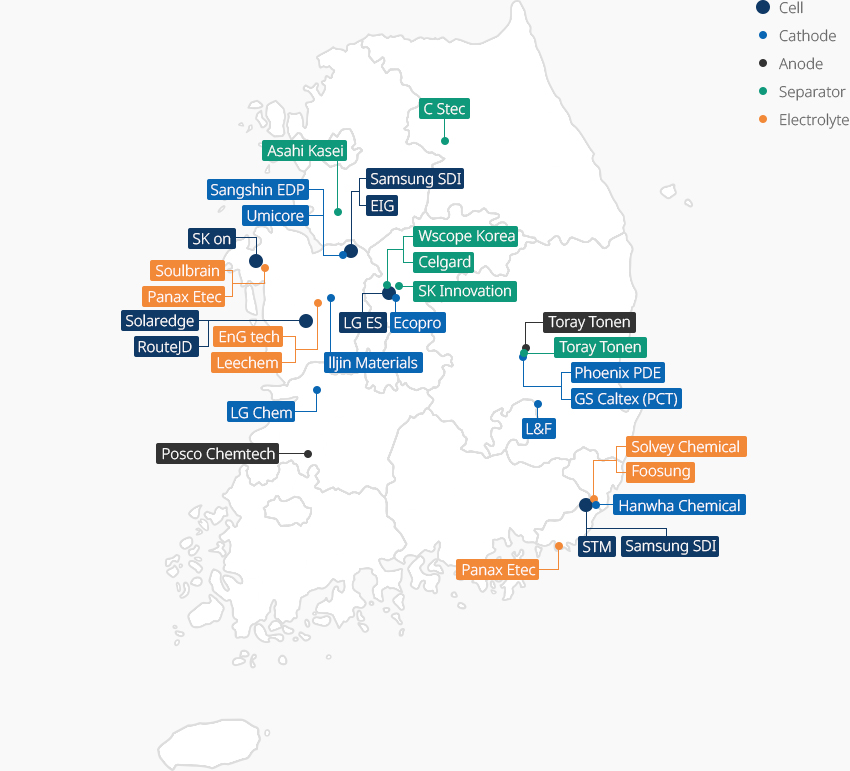

※ Source : SNE Research (2022), 2022 Global Outlook for Expansion of LIB Production LinesKorea's battery industry is recognized not just for batteries but also for its competitiveness in four key materials: anode materials, cathode materials, separators, and electrolytes. Anode materials account for about half of the cost of batteries, and Korea produces 25% of these materials used around the world. Major players include ECOPROBM, LG Chem, Samsung SDI, POSCO Future M, and L&F. Belgium's Umicore, which is one of the major producers, has a production facility in Cheonan, Chungnam and supplies to LG Energy Solution and others. There are many others, including POSCO Future M manufacturing cathode materials, SKIET specializing in separators, and ENCEM, Solbrane, and DongHwa Electrolite supplying electrolytes, all investing heavily to expand their global market share.

※ Source : SNE Research (2022), 2022 Global Outlook for Expansion of LIB Production LinesKorea's battery industry is recognized not just for batteries but also for its competitiveness in four key materials: anode materials, cathode materials, separators, and electrolytes. Anode materials account for about half of the cost of batteries, and Korea produces 25% of these materials used around the world. Major players include ECOPROBM, LG Chem, Samsung SDI, POSCO Future M, and L&F. Belgium's Umicore, which is one of the major producers, has a production facility in Cheonan, Chungnam and supplies to LG Energy Solution and others. There are many others, including POSCO Future M manufacturing cathode materials, SKIET specializing in separators, and ENCEM, Solbrane, and DongHwa Electrolite supplying electrolytes, all investing heavily to expand their global market share. -

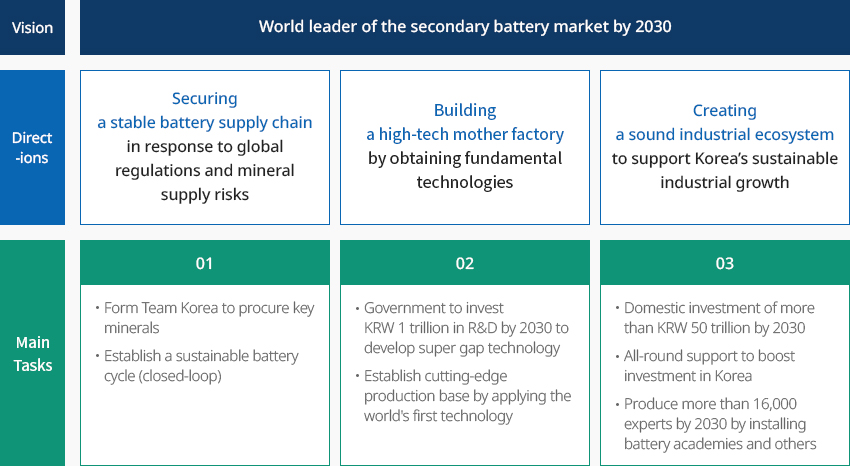

Government and Corporate Strategies to Champion the Global Battery Industry OpenGovernment and Corporate Strategies to Champion the Global Battery IndustryOn November 1, 2022, the Ministry of Trade, Industry and Energy (MOTIE) announced the Secondary Battery Industry Innovation Strategy with the vision of becoming the world leader of secondary batteries by 2030. The strategy set out objectives to increase Korea's global market share to 40% by 2030 and attract more than KRW 50 trillion in domestic investment by achieving three goals: 1) securing a stable battery supply chain, 2) building a high-tech innovation hub, and 3) creating a healthy industrial ecosystem."Secondary Battery Industry Innovation Strategy"

- Vision - World leader of the secondary battery market by 2030

- Directions

- Securing a stable battery supply chain in response to global regulations and mineral supply risks

- Building a high-tech mother factory by obtaining fundamental technologies

- Creating a sound industrial ecosystem to support Korea’s sustainable industrial growth

-

Main Tasks

- 01

- Form Team Korea to procure key minerals

- Establish a sustainable battery cycle (closed-loop)

- 02

- Government to invest KRW 1 trillion in R&D by 2030 to develop super gap technology

- Establish cutting-edge production base by applying the world's first

- 03

- Domestic investment of more than KRW 50 trillion by 2030

- All-round support to boost investment in Korea

- Produce more than 16,000 experts by 2030 by installing battery academies and others

- 01

※ Source : MOTIE (Nov. 2022), “MOTIE Announces the Secondary Battery Industry Innovation Strategy through Partnership with the Private Sector”The Secondary Battery Industry Innovation Strategy presented key tasks and detailed plans to achieve the above three goals. First, the government will focus on building a public-private joint "Battery Alliance" to secure key minerals to manage supply chain disruption that may occur during battery production. Until now, individual companies have made investments to secure key minerals in Australia, Canada, and Chile. However, as the enactment of the Inflation Reduction Act posed difficulties for companies to respond on their own, the government has decided to bring together the capabilities of the public and private sectors to form Team Korea and systematically tackle challenges. Detailed plans include developing various projects to secure core minerals and supporting the refining and processing of the secured minerals, as well as developing a financial support plan to provide loans and guarantees worth KRW 3 trillion over the next five years for such projects.The second task is to provide government support in developing key battery technologies and building cutting-edge production bases. A total of KRW 20.5 trillion won (KRW 1 trillion from the government and KRW 19.5 trillion from the private sector) will be invested by 2030, including the government's investment of KRW 1 trillion government in R&D, to build R&D centers and state-of-the-art production bases and form a domestic high-tech ecosystem. LG Energy Solution will build the industry's first 4680 battery plant in Chungbuk, and Samsung SDI plans to build in Korea an all-solid-state battery pilot line, followed by an all-solid-state battery production line. The company also plans to build a new product reliability verification center and R&D center. SK On plans to build a global evaluation center and expand the R&D center to verify battery quality and innovate the processes for the objective of developing its first high-nickel battery by 2024."R&D Center and High-Tech Production Base Construction Plans of Korea’s Major Three Battery Makers"

※ Source : MOTIE (Nov. 2022), “MOTIE Announces the Secondary Battery Industry Innovation Strategy through Partnership with the Private Sector”The Secondary Battery Industry Innovation Strategy presented key tasks and detailed plans to achieve the above three goals. First, the government will focus on building a public-private joint "Battery Alliance" to secure key minerals to manage supply chain disruption that may occur during battery production. Until now, individual companies have made investments to secure key minerals in Australia, Canada, and Chile. However, as the enactment of the Inflation Reduction Act posed difficulties for companies to respond on their own, the government has decided to bring together the capabilities of the public and private sectors to form Team Korea and systematically tackle challenges. Detailed plans include developing various projects to secure core minerals and supporting the refining and processing of the secured minerals, as well as developing a financial support plan to provide loans and guarantees worth KRW 3 trillion over the next five years for such projects.The second task is to provide government support in developing key battery technologies and building cutting-edge production bases. A total of KRW 20.5 trillion won (KRW 1 trillion from the government and KRW 19.5 trillion from the private sector) will be invested by 2030, including the government's investment of KRW 1 trillion government in R&D, to build R&D centers and state-of-the-art production bases and form a domestic high-tech ecosystem. LG Energy Solution will build the industry's first 4680 battery plant in Chungbuk, and Samsung SDI plans to build in Korea an all-solid-state battery pilot line, followed by an all-solid-state battery production line. The company also plans to build a new product reliability verification center and R&D center. SK On plans to build a global evaluation center and expand the R&D center to verify battery quality and innovate the processes for the objective of developing its first high-nickel battery by 2024."R&D Center and High-Tech Production Base Construction Plans of Korea’s Major Three Battery Makers"

- LG Energy Solution

- Construction of a new production plant for manufacturing the battery industry's first 4680 cylindrical batteries (2023)

- Establishment of pilot lines for next-generation batteries such as all-solid-state and lithium-sulfur batteries

- Construction of the Dream Fab verifying new products, processes, etc. applied to overseas plants

- SK On

- Development of the world's first 94 % ultra-high energy density nickel batteries

- Establishment of the Global Validation Center for battery quality improvement and process innovation

- Establishment of R&D centers for all-solid-state batteries and securing of global IPs

- Samsung SDI

- Establishment of the world's first all-solid-state battery pilot line (2023)

- Construction of a reliability verification center to verify viability of mass-producing products built with the latest technologies

- Increased R&D investment including the construction of a new R&D center

※ Source: MOTIE (Nov. 2022), “MOTIE Announces the Secondary Battery Industry Innovation Strategy through Partnership with the Private Sector”Third, the government plans to invest more than KRW 50 trillion (KRW 19.5 trillion in R&D and KRW 30.5 trillion in facility investment) by 2030 in order to provide an all-round support to companies making battery-related domestic investments. To facilitate the investment of companies, the government will provide loans and guarantees totaling KRW 5 trillion to those investing in domestic and foreign facilities. It also plans to launch an investment fund worth KRW 1 trillion and expand tax benefits this year.Fourth, the government and companies will jointly train a total of 16,000 people by 2030 to meet the demand for key talents needed in line with the growth of the domestic battery industry. The government aims to solidify the industrial foundation by training specialists and assisting MA and PhD students by establishing the battery academies and installing twelve specialized academic departments in universities.In addition, the government will work towards expanding the Secondary Battery R&D Innovation Fund to enhance the competitiveness of companies in the secondary battery sector, and will newly launch R&D for strengthening the supply chain from next year. A center for supporting the commercialization of next-generation batteries (Next-generation Battery Park) will also be established. The Secondary Battery Industry Innovation Strategy can be summarized as battery supply chain management, technology development, financial support, and human resources training. It was devised to help battery companies in various ways to support their successful business activities, thereby attracting the investment of overseas companies and improving the competitiveness of existing domestic companies. At the National Strategy Meeting on April 20, 2023, President Yoon Seok-yeol emphasized the importance of the secondary battery industry by saying, "along with semiconductors, secondary batteries are crucial to Korea's national security and strategic assets."

※ Source: MOTIE (Nov. 2022), “MOTIE Announces the Secondary Battery Industry Innovation Strategy through Partnership with the Private Sector”Third, the government plans to invest more than KRW 50 trillion (KRW 19.5 trillion in R&D and KRW 30.5 trillion in facility investment) by 2030 in order to provide an all-round support to companies making battery-related domestic investments. To facilitate the investment of companies, the government will provide loans and guarantees totaling KRW 5 trillion to those investing in domestic and foreign facilities. It also plans to launch an investment fund worth KRW 1 trillion and expand tax benefits this year.Fourth, the government and companies will jointly train a total of 16,000 people by 2030 to meet the demand for key talents needed in line with the growth of the domestic battery industry. The government aims to solidify the industrial foundation by training specialists and assisting MA and PhD students by establishing the battery academies and installing twelve specialized academic departments in universities.In addition, the government will work towards expanding the Secondary Battery R&D Innovation Fund to enhance the competitiveness of companies in the secondary battery sector, and will newly launch R&D for strengthening the supply chain from next year. A center for supporting the commercialization of next-generation batteries (Next-generation Battery Park) will also be established. The Secondary Battery Industry Innovation Strategy can be summarized as battery supply chain management, technology development, financial support, and human resources training. It was devised to help battery companies in various ways to support their successful business activities, thereby attracting the investment of overseas companies and improving the competitiveness of existing domestic companies. At the National Strategy Meeting on April 20, 2023, President Yoon Seok-yeol emphasized the importance of the secondary battery industry by saying, "along with semiconductors, secondary batteries are crucial to Korea's national security and strategic assets."