Consumer goods

- Home

- Investment Opportunities

- Industries

- Consumer goods

-

Global Trendsetter Backed by Innovative Technology CloseGlobal Trendsetter Backed by Innovative TechnologyKorea is leading the skincare and functional products market by using various raw materials based on its excellent technology. The global functional cosmetics market is valued at USD 47 billion (in 2017, 16% of the total), and whitening, hydration, and moisturizing products are especially popular in Southeast Asia. Having introduced the functional cosmetics system for the first time in the world (in 1999), Korea is leading the functional cosmetics market by tapping into various raw materials and technologies. In addition, Korea has continuously launched cosmetics made with various herbal, natural, and organic ingredients to keep pace with the clean beauty trend. Korea is ranked fourth in the global skin care market share and stands out in the derma cosmetics segment based on excellent R&D technology.

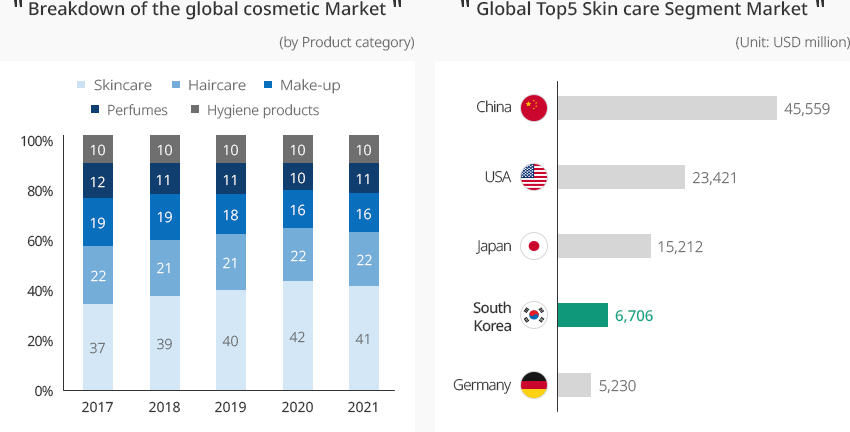

Breakdown of the global cosmetic Market (by Product category)

Breakdown of the global cosmetic Market (by Product category)Breakdown of the global cosmetic Market Year Skincare Haircare Make-up Perfumes Hygiene Products 2017 37 22 19 12 10 2018 39 21 19 11 10 2019 40 21 18 11 10 2020 42 22 16 10 10 2021 41 22 16 11 10 Global Top5 Skin care Segment Market (Unit : USD million)- China - 45,559

- USA - 23,421

- Japan - 15,212

- South Korea - 6,706

- Germany - 5,230

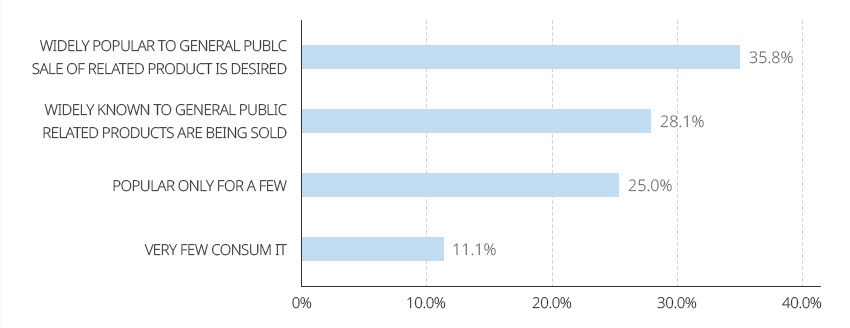

Korea is home to some of the world's top ODM/OEMs and facilities, making it easy to launch innovative products. Several leading international makeup brands have already partnered with Korean ODM/OEMs to champion the global market. Korean consumers are quick to respond to innovative technologies and new products, and have high standards for quality and safety. In that regard, Korea is suited to be a test bed for cosmetic makers looking to assess the viability of their newly-developed products.In recent years, there has been a growing demand for customized cosmetics and beauty devices, especially among younger consumers. With AI and AR-based applications and mobile devices, customized cosmetics with their beauty technologies accurately recommend products by considering the individual characteristics of consumers. Leading international brands such as L'Oreal and Yves Saint Laurent have also entered the customized cosmetics market. Korea has a large pool of beauty technology startups specializing in customized devices and innovative technologies based on Korea's excellence in IT technology. The Ministry of Food and Drug Safety's approval of the customized cosmetics sales business system in 2022 helped lay a solid foundation for the growth of customized cosmetics. Moreover, Korea's growing cultural influence and status is also raising global interest in and awareness of cosmetics made in Korea."Popularity of K-Beauty Products Worldwide in 2021"

Korea is home to some of the world's top ODM/OEMs and facilities, making it easy to launch innovative products. Several leading international makeup brands have already partnered with Korean ODM/OEMs to champion the global market. Korean consumers are quick to respond to innovative technologies and new products, and have high standards for quality and safety. In that regard, Korea is suited to be a test bed for cosmetic makers looking to assess the viability of their newly-developed products.In recent years, there has been a growing demand for customized cosmetics and beauty devices, especially among younger consumers. With AI and AR-based applications and mobile devices, customized cosmetics with their beauty technologies accurately recommend products by considering the individual characteristics of consumers. Leading international brands such as L'Oreal and Yves Saint Laurent have also entered the customized cosmetics market. Korea has a large pool of beauty technology startups specializing in customized devices and innovative technologies based on Korea's excellence in IT technology. The Ministry of Food and Drug Safety's approval of the customized cosmetics sales business system in 2022 helped lay a solid foundation for the growth of customized cosmetics. Moreover, Korea's growing cultural influence and status is also raising global interest in and awareness of cosmetics made in Korea."Popularity of K-Beauty Products Worldwide in 2021"

- WIDELY POPULAR TO GENERAL PUBLC SALE OF RELATED PRODUCT IS DESIRED - 35.8%

- WIDELY KNOWN TO GENERAL PUBLIC RELATED PRODUCTS ARE BEING SOLD - 28.1%

- POPULAR ONLY FOR A FEW - 25.05%

- VERY FEW CONSUM IT - 11.1%

※ Source : Statista Note(s) : Worldwide, South Korea;November 1, 2020 to October 31, 2021; 15-59 years old; 8,500 resp ondents

※ Source : Statista Note(s) : Worldwide, South Korea;November 1, 2020 to October 31, 2021; 15-59 years old; 8,500 resp ondents -

Korea’s Growing Influence in the Global Market OpenKorea’s Growing Influence in the Global MarketFor the past five years, Korea held the ninth place in global market share, following traditional cosmetics leaders such as the US, UK, and Japan."Global Cosmetic Market Share(%)"

Global Cosmetic Market Share(%) No, Country, Year No. Country 2017 2018 2019 2020 2021 1 USA 19.2 19.0 18.7 18.9 19.4 2 China 12.3 13.3 14.6 15.9 16.7 3 Japan 7.4 7.3 7.2 6.5 6.2 4 Brazil 4.7 4.6 4.5 4.8 4.3 5 Gemany 4.2 4.1 4.0 4.1 3.9 6 UK 3.8 3.7 3.5 3.4 3.3 7 France 3.4 3.2 3.1 3.0 2.9 8 India 3.0 3.0 2.9 2.9 2.9 - 9

- Korea

- 2.8

- 2.7

- 2.7

- 2.5

- 2.6

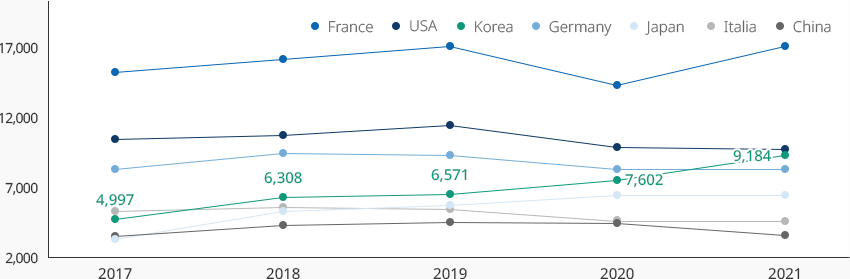

10 Italy 2.5 2.4 2.4 2.3 2.3 Global Market Size (USD Million) 511,548 522,902 533,111 514,643 529,302 ※ Source : EuromonitorBetween 2017 and 2020, Korea was the world’s fourth biggest exporter of cosmetics, and was ranked No. 3 in 2021 by overtaking Germany."Global Top 5 Cosmetic Exporters""Global Exporters of Cosmetics Products"Global Exporters of Cosmetics Products No, Country, Year No. Country 2017 2018 2019 2020 2021 1 France 15,245 16,983 17,552 15,319 17,853 2 USA 10,162 10,737 11,006 9,741 9,573 - 3

- Korea

- 4,997

- 6,308

- 6,571

- 7,602

- 9,184

4 Germany 8,691 9,684 9,472 8,221 8,061 5 Japan 3,703 5,252 5,868 6,790 7,470 6 Italy 5,175 5,790 5,682 4,894 5,300 7 China 3,778 4,411 4,760 4,751 4,830 ※ Source : Itc, KITA -

Korean Companies Attracting Foreign Investors OpenKorean Companies Attracting Foreign InvestorsAcquisition of Gowoonsesang Cosmetics (owner of derma cosmetics brand Dr.G) by M (Swiss company)M completely acquired Gowoonsesang Cosmetics, which had developed the derma cosmetics brand Dr.G for the past twenty-two years. The acquisition signifies that global players are highly interested in beauty products made with new technologies such as derma cosmetics. The case also shows the presence of Korean brands and companies that are already building global recognition in this segment based on innovative technologies.Acquisition of Have & be (owner of derma cosmetics brand Dr. Jart) by E (US company)Prior to the above case, an American global cosmetics group acquired Korea's Have & be, which owns the highly-recognized derma-cosmetics brand Dr. Jart. The case is another testament to the growing global interest in derma-cosmetics and the status of Korean tech companies showing clear strengths amidst the trend.Establishment of a production facility in Korea by R (French company)R, a French pet food maker, has established a feed production plant in Gimje, Jeonbuk. The plant exports 90% of its production and is virtually serving as R's production headquarters in the Asia-Pacific region.

-

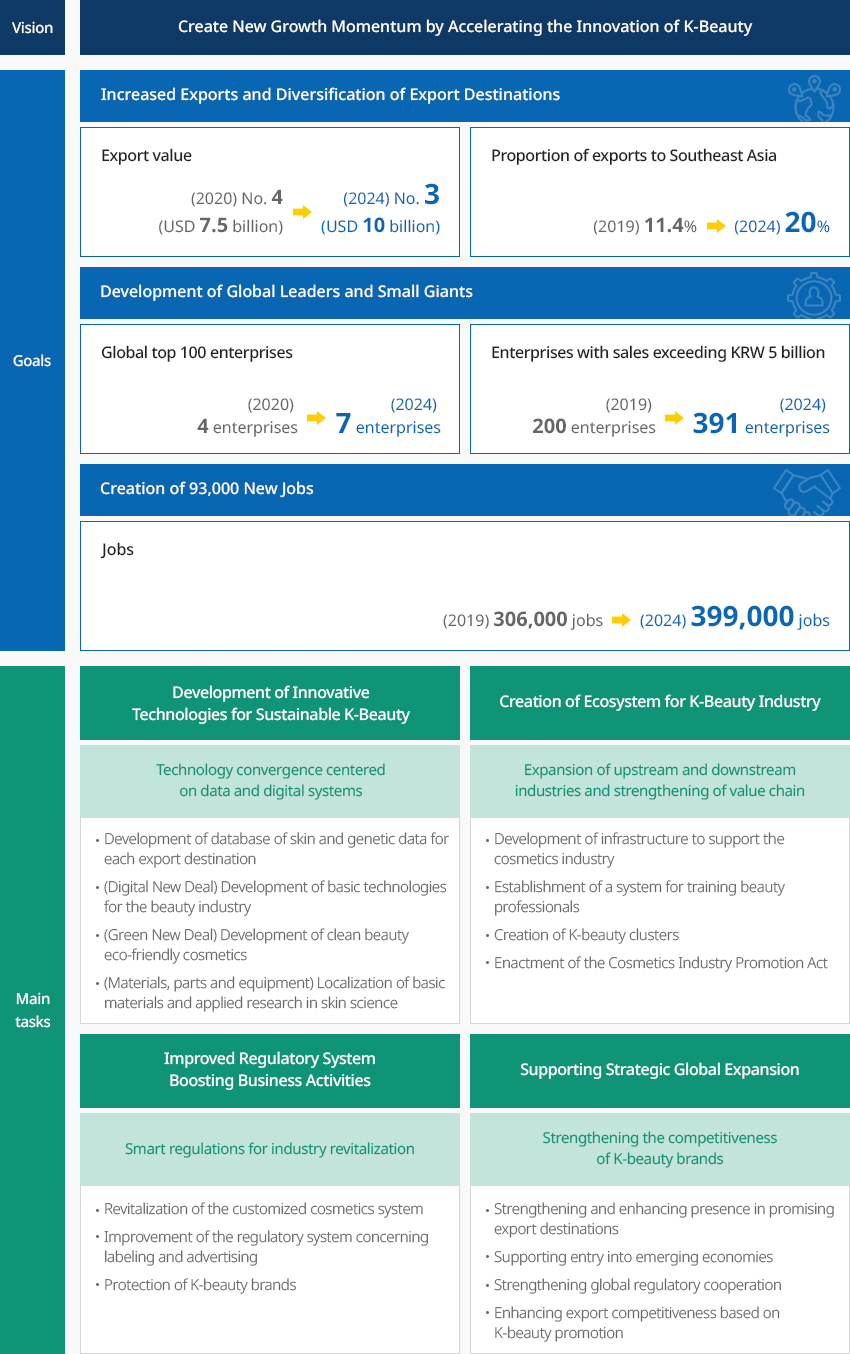

Establishment of All-Round Infrastructure for Advancement of the K-Beauty Industry OpenEstablishment of All-Round Infrastructure for Advancement of the K-Beauty IndustryIn 2021, the Korean government announced a comprehensive strategy for driving job growth, creating synergy with the Korean Wave, and leading the global cultural trends by innovating K-Beauty.

Vision - Create New Growth Momentum by Accelerating the Innovation of K-BeautyGoals

Vision - Create New Growth Momentum by Accelerating the Innovation of K-BeautyGoals- Increased Exports and Diversification of Export Destinations

- Export value: (2020) No. 4 (USD 7.5 billion) → (2024) No. 3 (USD 10 billion)

- Proportion of exports to Southeast Asia: (2019) 11.4% → (2024) 20%

- Development of Global Leaders and Small Giants

- Global top 100 enterprises: (2020) 4 enterprises → (2024) 7 enterprises

- Enterprises with sales exceeding KRW 5 billion: (2019) 200 enterprises → (2024) 391 enterprises

- Creation of 93,000 New Jobs

- Jobs: (2019) 306,000 jobs → (2024) 399,000 jobs

Main tasks- Development of Innovative Technologies for Sustainable K-Beauty - Technology

convergence centered on data and digital systems

- Development of database of skin and genetic data for each export destination

- (Digital New Deal) Development of basic technologies for the beauty industry

- (Green New Deal) Development of clean beauty eco-friendly cosmetics

- (Materials, parts and equipment) Localization of basic materials and applied research in skin science

- Creation of Ecosystem for K-Beauty Industry - Expansion of upstream and downstream

industries and strengthening of value chain

- Development of infrastructure to support the cosmetics industry

- Establishment of a system for training beauty professionals

- Creation of K-beauty clusters

- Enactment of the Cosmetics Industry Promotion Act

- Improved Regulatory System Boosting Business Activities - Smart regulations for

industry revitalization

- Revitalization of the customized cosmetics system

- Improvement of the regulatory system concerning labeling and advertising

- Protection of K-beauty brands

- Supporting Strategic Global Expansion - Strengthening the competitiveness of

K-beauty brands

- Strengthening and enhancing presence in promising export destinations

- Supporting entry into emerging economies

- Strengthening global regulatory cooperation

- Enhancing export competitiveness based on K-beauty promotion

In line with the above strategy, the Korean Ministry of Health and Welfare is supporting efforts to strengthen basic cosmetics technologies such as skin and materials by introducing Innovative Growth Skin Health Basic Technology Development Project (2023, KRW 7.1 billion).It is also implementing projects to create and strengthen the overall ecosystem of the cosmetics industry in areas of infrastructure, regulatory system, workforce training, export support, and K-beauty promotion.

In line with the above strategy, the Korean Ministry of Health and Welfare is supporting efforts to strengthen basic cosmetics technologies such as skin and materials by introducing Innovative Growth Skin Health Basic Technology Development Project (2023, KRW 7.1 billion).It is also implementing projects to create and strengthen the overall ecosystem of the cosmetics industry in areas of infrastructure, regulatory system, workforce training, export support, and K-beauty promotion.overall ecosystem of the cosmetics industry in areas of infrastructure Category, Description Category Description Infrastructure - Supporting the construction of the Skin Genome Analysis Center (2023, KRW 3.8

billion) for collection and analysis of skin genome data

→Supporting the construction of the Osong International K-Beauty School, a comprehensive K-beauty education center

Regulatory system - Operation of the Cosmetics Support Center (2023, KRW 2.4 billion)

→ Evaluating the stability of raw materials, providing overseas market information, and supporting the obtainment of overseas licenses

Workforce training - Operation of K-Beauty Academy

→ Fostering field experts such as cosmetics GMP, formula experts, and export experts and enhancing global awareness

Export support - Project for supporting the overseas expansion of small and medium-sized

cosmetics companies (2023, KRW 1 billion)

→ Supporting sales in overseas cosmetics promotion centers, PR pop-up booths, etc.

K-beauty promotion - Supporting the branding of K-beauty by building the K-beauty Promotion Center (in Myeongdong, Seoul) (2023, KRW 1.08 billion)

- Increased Exports and Diversification of Export Destinations

-

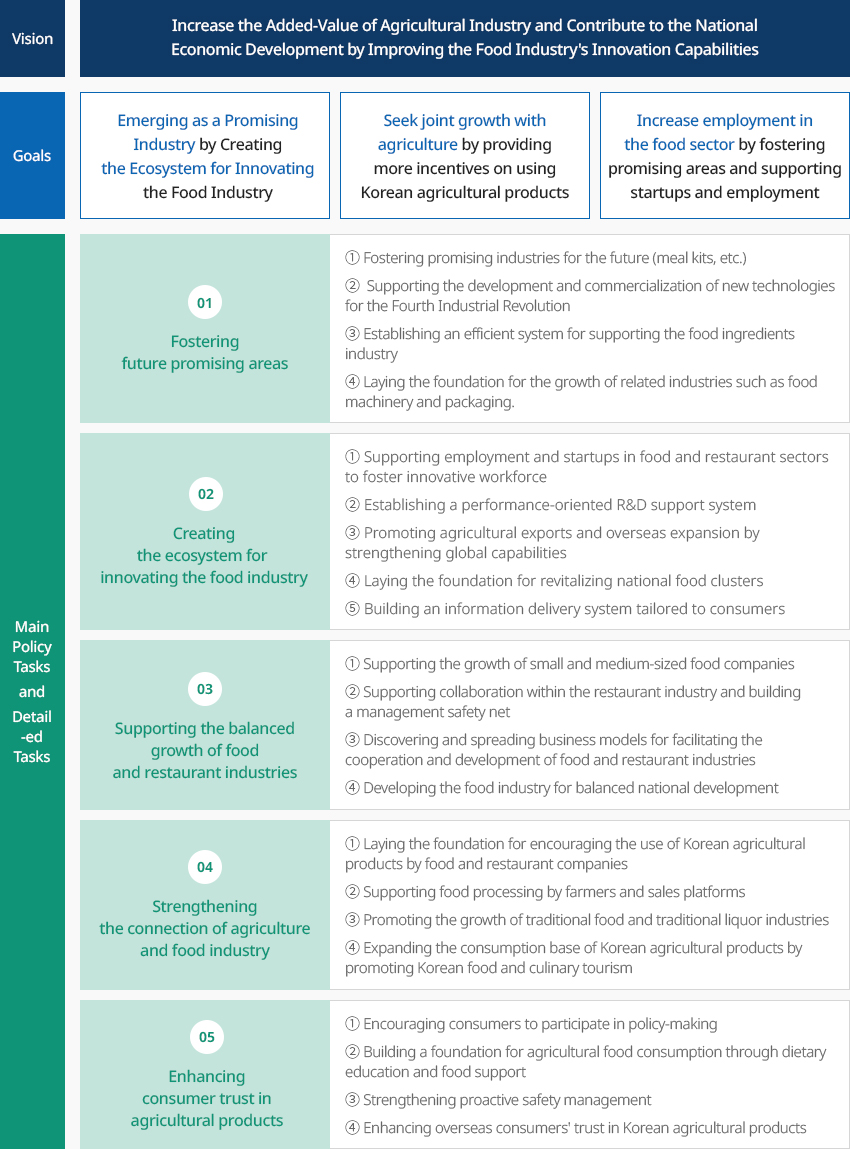

Securing the innovative growth engine of the future food industry OpenSecuring the innovative growth engine of the future food industryIn an effort to embrace the transition to a digital and low-carbon economy in the post-COVID-19 era, the Korean government announced the 3rd Master Plan for Food Industry Promotion in 2021 to strengthen the food and beverage industry's capabilities and raise its global status.

Vision - Increase the Added-Value of Agricultural Industry and Contribute to the National Economic Development by Improving the Food Industry's Innovation CapabilitiesGoals

Vision - Increase the Added-Value of Agricultural Industry and Contribute to the National Economic Development by Improving the Food Industry's Innovation CapabilitiesGoals- Emerging as a Promising Industry by Creating the Ecosystem for Innovating the Food Industry

- Seek joint growth with agriculture by providing more incentives on using Korean agricultural products

- Increase employment in the food sector by fostering promising areas and supporting startups and employment

Main Policy Tasks and Detailed Tasks- 01. Fostering future promising areas

- ① Fostering promising industries for the future (meal kits, etc.)

- ② Supporting the development and commercialization of new technologies for the Fourth Industrial Revolution

- ③ Establishing an efficient system for supporting the food ingredients industry

- ④ Laying the foundation for the growth of related industries such as food machinery and packaging.

- 02. Creating the ecosystem for innovating the food industry

- ① Supporting employment and startups in food and restaurant sectors to foster innovative workforce

- ② Establishing a performance-oriented R&D support system

- ③ Promoting agricultural exports and overseas expansion by strengthening global capabilities

- ④ Laying the foundation for revitalizing national food clusters

- ⑤ Building an information delivery system tailored to consumers

- 03. Supporting the balanced growth of food and restaurant industries

- ① Supporting the growth of small and medium-sized food companies

- ② Supporting collaboration within the restaurant industry and building a management safety net

- ③ Discovering and spreading business models for facilitating the cooperation and development of food and restaurant industries

- ④ Developing the food industry for balanced national development

- 04. Strengthening the connection of agriculture and food industry

- ① Laying the foundation for encouraging the use of Korean agricultural products by food and restaurant companies

- ② Supporting food processing by farmers and sales platforms

- ③ Promoting the growth of traditional food and traditional liquor industries

- ④ Expanding the consumption base of Korean agricultural products by promoting Korean food and culinary tourism

- 05. Enhancing consumer trust in agricultural products

- ① Encouraging consumers to participate in policy-making

- ② Building a foundation for agricultural food consumption through dietary education and food support

- ③ Strengthening proactive safety management

- ④ Enhancing overseas consumers' trust in Korean agricultural products

-

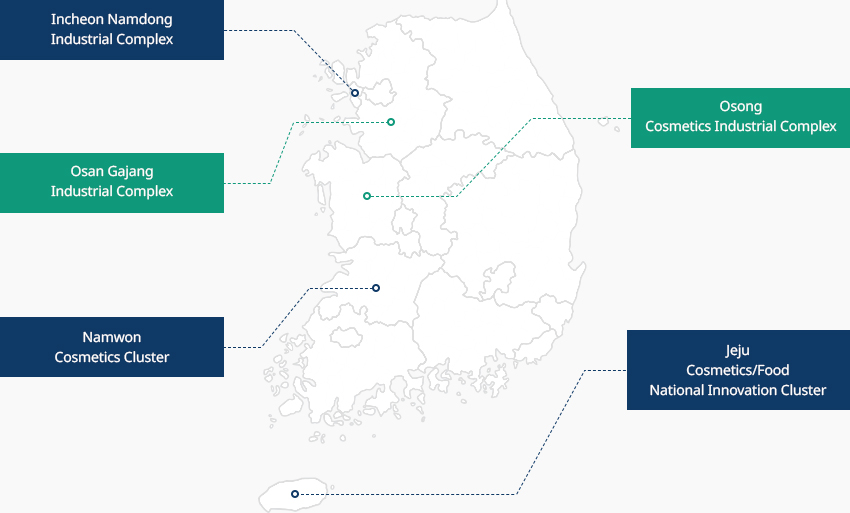

Cosmetics Companies Across Korea OpenCosmetics Companies Across KoreaDomestic cosmetics companies are located in industrial complexes across the country, including Gyeonggi, Chungbuk, and Daejeon. The areas with several cosmetics companies and research institutes and having excellent research and settlement environments are designated as clusters to create production facilities, research institutes, human resource training institutions, and infrastructure.

-

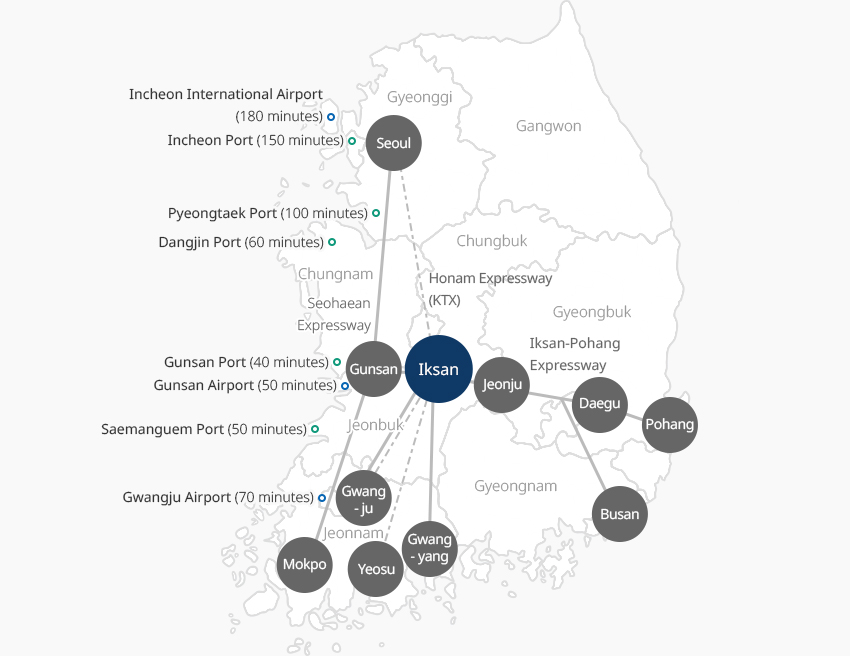

Creation of Food Clusters on a National Level OpenCreation of Food Clusters on a National LevelThe National Food Cluster is a national industrial complex built in Iksan, Jeollabuk-do by the Ministry of Agriculture, Food and Rural Affairs, Jeollabuk-do Government, and Iksan City Government as key infrastructure promoting the food industry. The cluster is built as a smart food industrial complex based on the best transportation system, logistics system, water supply, IT system, and green energy, with plans to introduce eleven business support facilities by 2024. Phase 2 of the National Food Cluster project was launched in February 2023 for construction of an industrial complex incorporating ICT and culture.