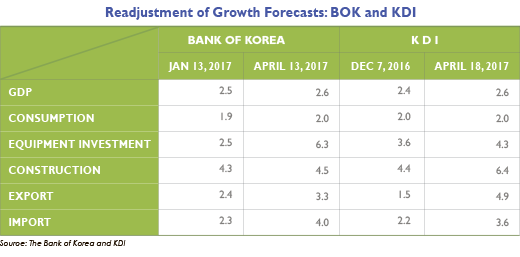

Two of the most renowned economic

research institutes in

Korea have recently modified

their economic forecasts for

2017. Led by the Bank of Korea (BOK),

which adjusted the country’s growth projection

from 2.5 percent to 2.6 percent for

2017, the Korea Development Institute

(KDI) has also upgraded it projection levels

from 2.4 percent to 2.6 percent. In a

span of just three to four months, both

institutions changed their views of the

2017 Korean economy and upgraded

growth rates by 0.1 to 0.2 percentage

points, making their forecasts identical at

2.6 percent. But despite this similar

action, the reasons behind their hike are

quite different.

For the BOK, the prime reason for its

projection growth comes from the rise of

equipment investments. In the previous

projection published in January 2017, the

BOK expected equipment investments to

grow by 2.5 percent. But in the April, it

modified it to 6.3 percent, rendering an

increase of 3.8 percentage points.

Equipment investment, which takes up

about 30 percent of the GDP, would have

contributed to an increase of 1.14 percentage

points in the GDP growth rate.

On the other hand, KDI’s revision of its

economic forecast is mostly due to the

export sector. Previously, KDI projected

that exports would grow 1.5 percent for

2017, but now changed it to 4.9 percent—

equivalent to almost 1.7 percentage

points in the GDP growth rate.

Therefore, despite the apparent similarity

in raising the growth forecasts for 2017,

the BOK underscores equipment investment

while KDI stresses exports.

Equipment investment has been generally

lackluster in 2016, showing negative

growth rates at about –2.3 percent. So, a

recent acceleration in this sector might

have been a natural rebound from its

decline in 2016. As

the average growth

rate of equipment investment fluctuated around 2 percent for the last six years, the

BOK’s forecast of a 6.3 percent increase

in 2017 seems somewhat astounding.

the average growth

rate of equipment investment fluctuated around 2 percent for the last six years, the

BOK’s forecast of a 6.3 percent increase

in 2017 seems somewhat astounding.

Exports, meanwhile, began improving

from the middle of 2016 and finally ended

the months-long streak of negative

growth. In the first two months of 2017,

export grew at 20 percent compared to

the year before, and this trend is expected

to continue.

But there are some issues that the

Korean government should pay close

attention to in order to accelerate export

growth in the future. First, recent prices

of semiconductors and petrochemical

products have been declining, creating a

strain on two of Korea’s most powerful

export markets. Second, the yen has been

depreciating since Brexit. Last June, it hit

JPY 101 per dollar, rebounding back to

JPY 116 by December. Although fluctuating

early this year, it still remained

above the JPY 110 mark, which is still 10

percent higher than last year. Third, the

Korean won has been appreciating quickly

from around KRW 1200 per dollar to

KRW 1100. Fourth, retaliatory measures

by China after the decision to deploy

THAAD (Terminal High Altitude Area

Defense) are casting a cloud over Korea’s

export environment.

Considering these challenges, Korea’s

growth engine should be sought after

in two areas: investment and consumption. Here, the expansionary fiscal policy of

the central government should play a key

role. On this note, the IMF and the US

Treasury Department suggested that the

Korean government should expand its fiscal

policy function to encourage economic

growth.

Taking this into mind, the Korean government

should think about which fields

to focus its fiscal expenditures on. The

primary area of fiscal action could be on

welfare expenditures, supporting the

unemployed, the elderly or the disabled.

It could also be spent on R&D to assist in

the growth of new technologies and products.

Other options include renovating old

towns and villages, educating the youth

and enhancing the competitiveness of

industries through investments. With the

new administration soon to take office,

political leaders must find a consensus on

which areas need fiscal action first.