he theme of the 2016 World Economic Forum held in Davos, Switzerland was the fourth industrial revolution. In retrospect, the first industrial revolution was led by the steam engine. The second industrial revolution occurred with the development of electricity, which later led to mass production. With the advent of computers and the internet, the third industrial revolution was then driven by the automated production system. At the turn of the 21st century, people now live under the influence of the fourth industrial revolution, which is characterized by the ubiquitous mobile internet, cheaper, smaller, yet stronger sensors and “smart” products. As such, the fourth industrial revolution will significantly change consumption, production and employment patterns. Thus, it is time for corporations, governments and individuals to realize such changes and respond more proactively.

Advanced countries around the world are making reliable investments in large-scale public technologies, especially in the fields of aerospace, nuclear fusion and accelerators, regardless of external economic or political influences. In particular, the aerospace industry can greatly increase public interests as its technology can be applied to other industries, evenly distributing the benefits of science and technology development to ordinary people.

The aerospace industry is an integrated industry that combines advanced technologies in various segments, such as machinery, electronics, materials and IT. It is therefore an industry indicative of a nation’s level of technological development and industrial capabilities. The industry creates many jobs and completed aerospace goods can create much higher added-

value compared to the input of raw materials. It has also far reaching implications for other industries. According to the

National Statistics Agency’s 2013 data, the aerospace industry’s

value-added ratio stood higher at 43 percent than the railway

industry’s 36.7 percent and the auto industry’s 30.1 percent. In

the BOK’s 2013 list of production inducement coefficients, the

aerospace industry showed a higher percentage of 3.83 percent

than the auto industry’s 3.65 percent and the shipbuilding industry’s 3.61 percent. It provides the basis for national strategic

industries, such as the defense and space industries, because it

enhances defense capability and its component technologies can

be utilized for the space industry. Despite a long product development cycle and high market entry barriers, successful entry

ensures stable and long-term (more than 20 years) revenue generation.

In the global aerospace market, large global corporations such

as Boeing and Airbus are maintaining oligopoly and the verticalization of the aerospace parts industry is becoming more evident. The global supply chain is also going through a change as

the Risk Sharing Partnership, in which major component suppliers share costs and profits in developing civilian aircrafts, and

global outsourcing is increasing in number. The global aerospace market was worth USD 547.8 billion in 2015, and the size

of the market is expected to reach USD 739.1 billion by 2024.

The civilian aircraft market will continue to grow at an average

annual growth rate of 3.5 percent, from USD 254.1 billion in

2015 to USD 346.3 billion. Although the military aircraft market has little potential to grow, it is diversifying into different

sub-markets. In the military aircraft market, high-performance

aircrafts, including unmanned aircrafts, are emerging. The component equipment market and the MRO (maintenance, repair

and overhaul) market are also seeing stable growth. The sales of

the MRO market is expected to increase as the aircraft manufacturing market is expanding and the number of maintenance

outsourcing for existing aircrafts is increasing.

The domestic aerospace industry is also seeing continuous

development. In the 1970s to 1980s, Korea manufactured aircrafts by assembling parts and introducing foreign technologies.

Since 2006, it has started to independently develop a supersonic

speed trainer aircraft and jointly developed civilian aircrafts

with other countries. In 2015, production and exports of the

domestic aerospace industry increased greatly compared to the

previous year. Domestic production was worth USD 4.9 billion,

a 12.5 increase from the previous year, thanks to the expanded

outsourcing from global corporations and increased demand for

completed aircrafts such as the T-50.

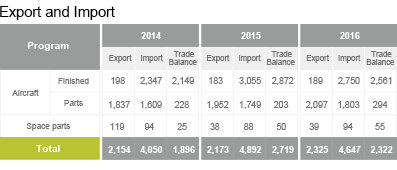

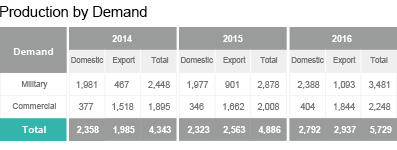

The country’s trade deficit, which decreased up until 2013 and increased starting in 2014, is a result of the growing purchase of civilian transportation aircrafts. Despite increasing exports to Boeing, Airbus and T-50, FA-50 military aircraft could not narrow the trade deficit compared to the previous year. The domestic aircraft industry is expected to pick up speed due to the export of T-50s, FA-50s and internationally co-developed parts. In domestic production by demand, dependence on military demand was 59 percent and the commercial sector occupied 41 percent. This ratio is still far from that of the global market.

Since 2010, Korea’s aerospace production and exports increased 15 percent and 21 percent annually. As of 2014, Korea ranked among the top 15 countries in terms of aerospace technology. Despite rapid growth, however, there is a considerable gap between Korea and other advanced countries Korea’s global market share stands at a mere 0.9 percent. Therefore, in order for Korea to become a global player, the country needs to increase its competitiveness in high value added sectors such as new materials, and lay the groundwork for the development of small and medium-sized enterprises. In Korea, three major

companies, such as KAI (Korea Aerospace

Industries), Korean Air and Hanwha Techwin, account for 83

percent of total sales in the aerospace industry. In the aerospace

component market, airframe structure took up 64 percent of

sales, engine components 19 percent, avionics 10 percent, and

airframe accessory 7 percent as of 2015.

The domestic aerospace industry is driven by the exports of

civilian products as well as SMEs which directly win bids for

overseas component supplies. Exports of completed military

aircrafts, such as T-50s, are also increasing. The Ministry of

Trade, Industry and Energy is providing support for production

and exports of the domestic aerospace industry, particularly in

terms of R&D, infrastructure, and marketing support. The ministry is also fostering an optimum environment for aircraft performance examinations. This includes the Sacheon Aerospace

Special Industrial Complex, Yeongcheon and Jinju flight test

facilities and Goheung National Comprehensive Flight Test

Center. The government is also promoting the aerospace industry through global business partnering. For instance, KOTRA’s

overseas trade centers identify the needs of global corporations,

introduce Korean companies to them and help Korean companies improve their technological capability and product/service

quality through events like trade fairs.

For the aerospace industry, Korea set up a number of goals,

including strengthening ongoing development and utilization of

artificial satellites. It also hopes to become one of the top seven

countries in the aerospace industry. Up until now, Korea developed 13 artificial satellites and is operating four of them. Multipurpose working satellite number six and seven, next-generation small and medium satellites and geostationary multi-purpose satellites are currently being developed. Not only that, the

country has begun to advance projects on moon exploration to

expand its space exploration activities. It is also undertaking a

performance test for the engine combustion of the domestically developed space launch after its 75-ton class engine is assembled. Thus, Korea is increasing investment in future technologies such as space exploration, space stations and geostationary

orbit launches.

Klaus Schuwab, author of The Fourth Industrial Revolution,

said, “The gap is widening between those who embrace change

and those who resist it.” Since the size, speed, and scope of the

fourth industrial revolution will be of a formidable change that

we have never experienced before, individuals and organizations alike should brace themselves for the change. While the

fourth industrial revolution challenges the aerospace industry

and technology, it can also provide new opportunities like never

before.