With the global economy showing signs of recovery,

Korea’s export volume has jumped over the last three months

After showing a prolonged lull

in growth rates, Korean

exports finally began recording

positive growth since

November 2016. The long streak of sagging

exports had stopped and a spike in

exports continued for three consecutive

months. Though the recent export volume

is slightly lower than what it used to be a

couple of years back, the jump in exports

for more than three consecutive months is

encouraging news to the Korean economy.

Before making judgments about

future export performances, however, it is

important to figure out what factors have

contributed to the recent improvements.

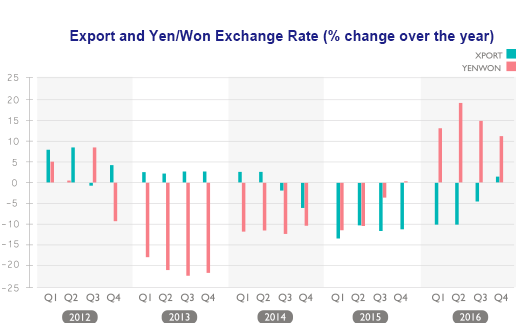

The major factor behind this export

turn-around is the exchange rate—especially

the yen/won rate. From mid-2015

and onward, the yen/won rate began to

surge from about 9 won per yen to 11.3

won by the middle of 2016, which is

about 25 percent the yen appreciation rate

against the won. This appreciation

implies Korean exports have become

more price competitive compared to its

Japanese counterparts. As seen in the

graph below, the movement of the

yen/won exchange rate is closely related

to Korean export growth. For example,

the yen/won exchange rate began to fall

for 12 quarters since Q4 of 2012 until Q3

of 2015, and this period of the depreciating

yen matches exactly with the period

of declining exports from Q3 of 2014 to

Q3 of 2016. Judging from the structural

relationship between the exchange rate

and Korea’s trade, strong export growth

will continue this year.

Another major factor is the general

improvement in the global economy. As

the IMF forecasts suggested this January,

the world economic outlook this year

seems to be better than last year. The

global economy is expected to grow 3.4

percent this year as opposed to 3.1 percent

in 2016. The United States is expected

to grow to 2.3

percent this year, compared 1.6 percent last year. Emerging market economies are expected to grow 4.6 percent this year, which is a significant

improvement from 4.2 percent in

2016. On this note, circumstances are

expected to improve throughout the

world. If this is the case, then global

exports will expand significantly and

Korea should be going down the right

path.

Of course there are some challenges

ahead. First, the U.S. Department of

Treasury will decide on its watch list

countries this April, and political and

financial tensions could erupt. Second,

the Federal Reserve is expected to raise

the federal funds rate and this would

cause the global interest rate to increase,

which would discourage spending and

investments. Third, the seemingly protectionist

policy of the Trump administration,

especially the border adjustment tax

(BAT), or the re-examination of NAFTA

and/or existing multilateral trade frameworks

such as WTO might have a dampening

effect on global trade. But free and

fair trade is what the Trump administration

really cherishes and global trade

should eventually flourish as long as the

notion of fair and free trade is kept intact.

Fourth, how fast the Chinese economy

will recover from its sluggish growth, and

how the UK can continue smooth negotiations with EU are issues that still remain up in the air.

Despite all the uncertainties

and risks, it is strongly believed that this

year seems to be better than the last one.

No matter what the decision of the

Constitutional Court, sooner or later

Korea is going to have a new president

and new leadership this year.

In order to accelerate export performances,

Korea should fully utilize opportunities

arising from the Trump administration’s

investment in infrastructure. When

it comes to the construction of dams,

bridges, canals, pipelines, railroads and

highways, Korean companies have been

one of the most efficient in the field. Also

Korea should continue to maintain its

strong FTA network with the United States. Minor

adjustments to it may be inevitable but

the complete scraping of the agreement is

unthinkable because the agreement centers

heavily on mutual benefits for both

countries.