In January 2022, Gartner announced that the market size of the global semiconductor market in 2021 surpassed USD 500 billion for the first time, recording USD 583.5 billion, up 25.1 percent from the prior year. In particular, the growth rates of major global memory-semiconductor manufacturers were especially higher—Samsung Electronics 31.6%, SK Hynix 40.5%, and Micron 29.1%—than that of the overall global semiconductor market. The forecast by Morgan Stanley, published in its report “Memory, winter is coming” in August last year, that the semiconductor market will suffer overall depression due to over-supply caused by sluggish demand for memory semiconductor and that falling chip prices appeared to be way off the mark.

Korea’s Semiconductor Industry with Growing Internal & External Significance

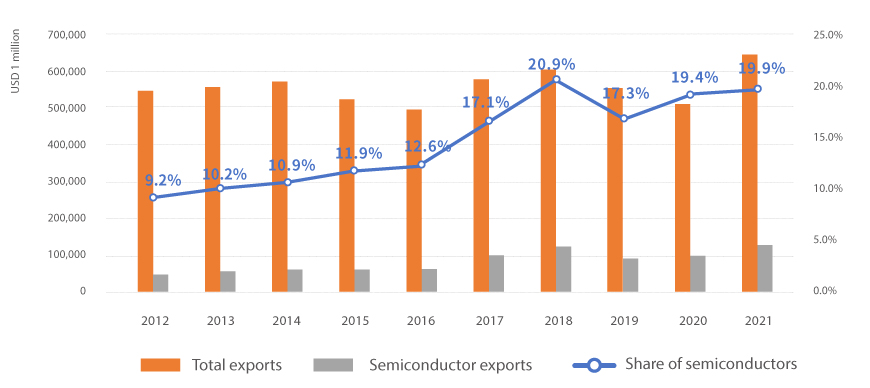

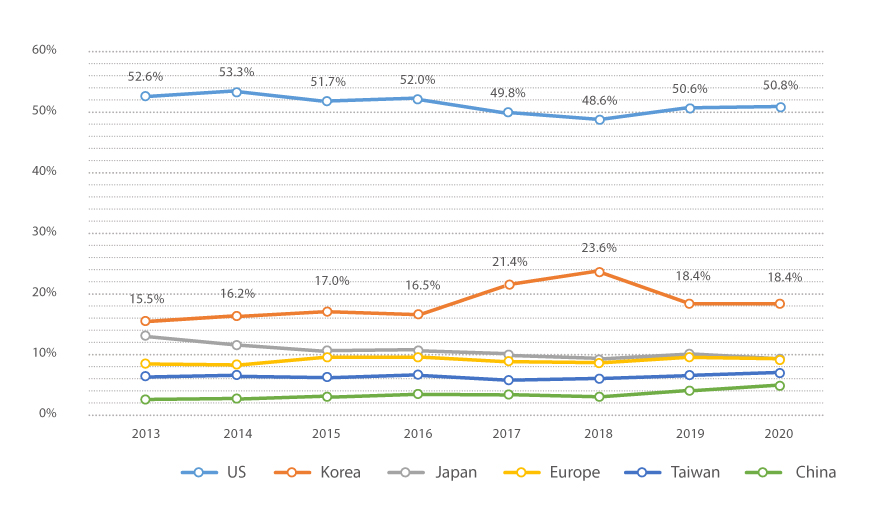

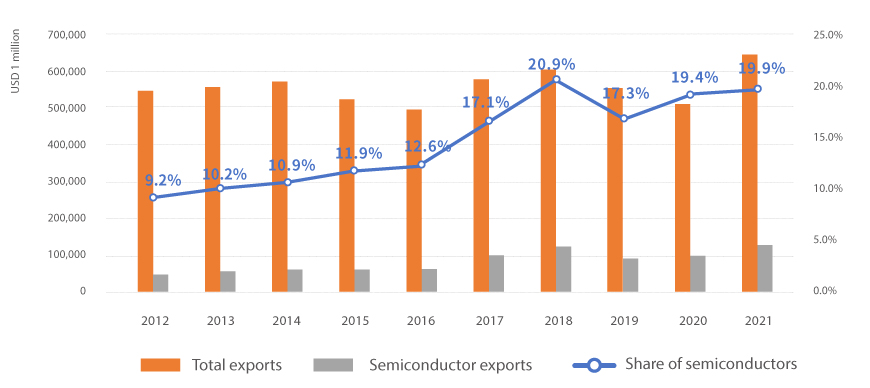

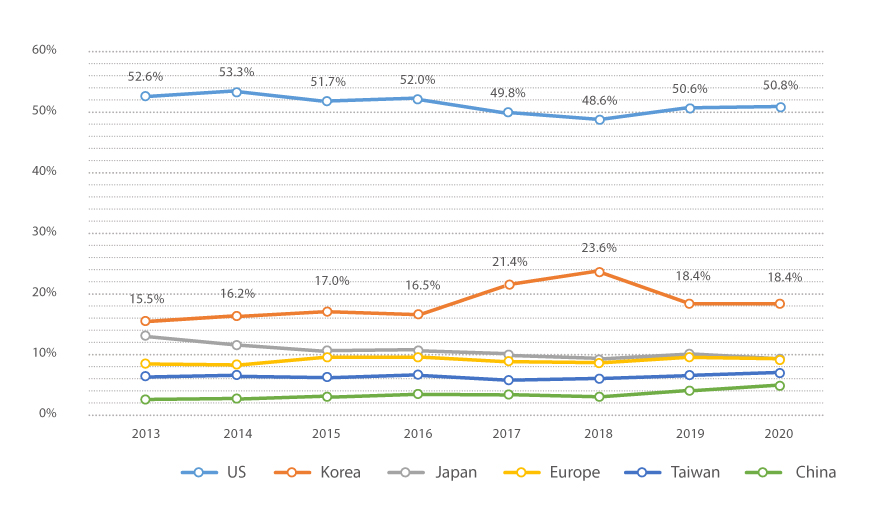

The semiconductor began to stand out as Korea’s No.1 export item in 2010, when it first outperformed shipbuilding and petrochemical products. Since 2013, it has maintained No.1 position and has driven Korea’s exports, accounting for 20 percent share of all exports every year after first exceeding 17.1 percent in 2017. Also, its market share in the global semiconductor market surpassed that of Japan in 2013, clinching the No.2 position, and this has been maintained since then. In particular, Korea’s market share in the global memory semiconductor market is especially high at 60 percent. Korea’s semiconductor industry has grown to become a driver of Korea’s exports internally, and a player with great influence on the global market externally.

<Pic. 1> Share of Semiconductors in Korea’s Exports

* Source: KITA (2022)

<Pic. 2> Global Semiconductor Market Share by Countr

* Source : OMDIA(2021), etc.

Global Semiconductor Market Riding on Growth Momentum

In 1980 when semiconductors began to be deployed, the scale of the global semiconductor market was small, valued at USD 10.6 billion. In 15 years, it crossed the USD 100 billion threshold in 1995, reaching USD 134.7 billion. After 10 years, it exceeded the USD 200 billion mark in 2005, growing to a USD 208.4 billion market. Due to the global economic crisis afterwards, the growth momentum of the global semiconductor market also slowed down. But it began to recover in 2015, and reached USD 421.7 billion in 2018, crossing the USD 400 billion threshold. Continuing this accelerated growth, the market scale exceeded USD 500 billion in 2021. So, the period it takes for the market to grow by USD 100 billion seems to be getting shorter. With the semiconductor market projected to grow at around 10 percent this year, this period is going to be just one year. Looking around, it is getting harder to find the electronics devices without semiconductors, while products with various functions are continuing to be developed. In addition, the demand for memory semiconductors for servers is growing explosively driven by the progress of platform services. Machines are already creating, processing, and storing data by themselves, even faster than humans. Thus, demand for semiconductors is expected to grow further, accelerating the growth of the global semiconductor market.

Establishing a Global Top Supply Chain by Strengthening Ecosystem

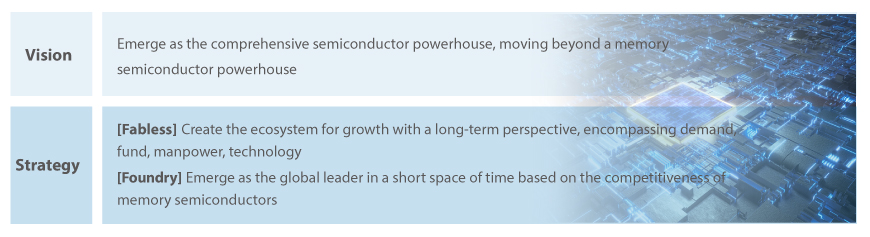

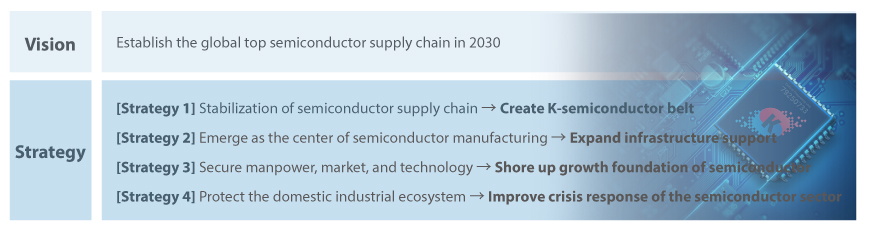

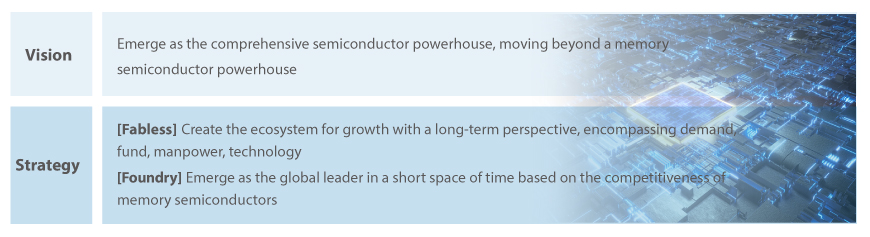

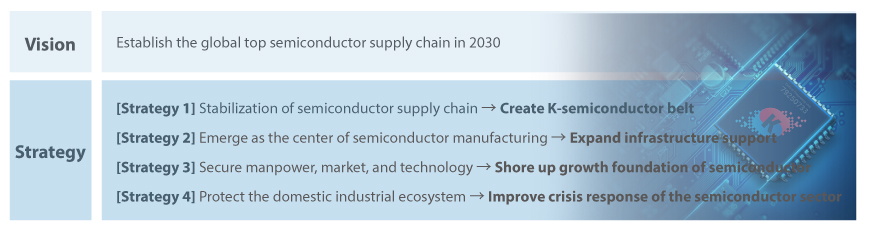

Korea’s semiconductor industry has focused on fostering memory semiconductor based on a strategy of choice and focus. As a result, Korea’s memory semiconductor has gained significant competitiveness, while system semiconductors have been left behind. Memory semiconductors and system semiconductors differ in terms of market and characteristics. Thus, the need to secure competitiveness in system semiconductors has been continuously voiced to become a semiconductor powerhouse. The Korean government unveiled the ‘System Semiconductor Vision and Strategy (April 2019)’ and the ‘K-Semiconductor Strategy (May 2021)’ to emerge as the comprehensive semiconductor powerhouse, moving beyond improving the system semiconductor sector. What the two policies have in common are: strengthening the competitiveness of memory semiconductors and system semiconductors domestically and expanding domestic production by shoring up the ecosystem of Korea’s semiconductor industry. It was clearly a faster move than Japan and European countries who began to voice the need to grow the semiconductor manufacturing industry domestically only after the shortage of semiconductors for vehicles, started at the end of 2020, became serious.

The ‘System Semiconductor Vision and Strategy’ is a policy initiated to strengthen ecosystem of the domestic semiconductor industry based on recognition that Korea’s semiconductors have weakness in system semiconductors due to its focus on memory semiconductors in the past. Ultimately, the policy aims to facilitate realization of the comprehensive semiconductor powerhouse by advancing the competitiveness of system semiconductors, building on the improved ecosystem of semiconductor industry. This also relates to establishment of supply chain, which is emphasized by the K-Semiconductor strategy. If these policies produce results, the Korean semiconductor industry will be able to produce semiconductors without being impacted by external environmental changes, becoming a center of stable supply chain in the global semiconductor market.

<Pic. 3> System Semiconductor Vision and Strategy

* Source: Ministries concerned jointly (2019)

<Pic. 4>K-Semiconductor Strategy

* Source: Ministries concerned jointly(2021)

By Yang-Paeng KIM (ypkim@kiet.re.kr)

Korea Institute for Industrial Economics & Trade