Korea's New Growth Engine, Pharmaceutical Industry

The pharmaceutical industry is garnering the most attention amid the development of biotechnology due to global aging, the pandemic, and the 4th industrial revolution. Unlike other manufacturing industries, it is directly related not only to economic value but also to a healthy life. And hence, the pharmaceutical industry is considered the only industry that safeguards public health while driving the country's economic growth. Also, global blockbuster new drugs record tens of trillions of won in annual sales, generating enormous high-value-added products. And the infrastructure of drug development and drug production as well as the relevant capabilities directly impact people's right to health in emergencies such as pandemics. In particular, the pharmaceutical industry's importance is growing amid crises that may occur internationally, such as COVID-19, trade conflicts in developed countries, and wars. In that sense, it is natural that developed countries and other countries around the world are nurturing the pharmaceutical industry.

The United States, which has the largest pharmaceutical market in the world, established the Medical Advanced Research Projects Agency (ARPA-H) under the National Institute of Health (NIH) in March to step up the development of innovative treatments for incurable diseases. In September, President Biden signed an executive order for advancing the bio-industry to protect the country's bio-industry.

China has streamlined drug approval processes and encouraged new drug development through the China Food and Drug Administration (CFDA) innovation. The country's plan is to increase the scale of the bio-industry up to CNY 10 trillion by 2030 and to strengthen the industry's international competitiveness. In 2018, the UK also laid out plans to establish the UK Research and Innovation (UKRI) by integrating seven research groups, including the Biotechnology and Bioscience Research Society (BBSRC), the Medical Research Council (MRC), Innovate UK, and Research England. It has also announced plans to double its future bioeconomic impact of 2014’s GBP 220 billion by 2030. In addition, countries worldwide—for example, Germany's "High-Tech Strategy 2025" and Japan's "Bio Strategy 2030"—are scrambling to dominate the global market by announcing their policies to promote the pharmaceutical industry.

In Korea, the Yoon administration, launched in May, selected “To leap forward as a global center of bio and digital health” as a national agenda, and set policy goals such as jumping into a vaccine treatment powerhouse and fostering the bio-health industry. In particular, the Korea Pharmaceutical and Bio-Pharma Manufacturers Association (KPBMA) gathered about 80 corporate CEOs in one place ahead of the 20th presidential election last year and proposed key strategies for nurturing the pharmaceutical industry to the presidential candidates at the time. The association requested the creation of an R&D environment to develop global blockbuster new drugs and the establishment of the “Pharmaceutical Bio Innovation Committee,” a control tower that will systematically and efficiently foster the industry. The government appears to agree with this idea and is actively preparing a policy to promote the pharmaceutical industry. At the 4th Emergency Meeting on People's Livelihood Stabilization in July, President Yoon reiterated that "the bio-industry protects public health and is directly linked to our economic growth by creating high-income jobs" and mentioned that he would cultivate the bio-health industry as a national core strategic industry.

K-PHARM Going Global

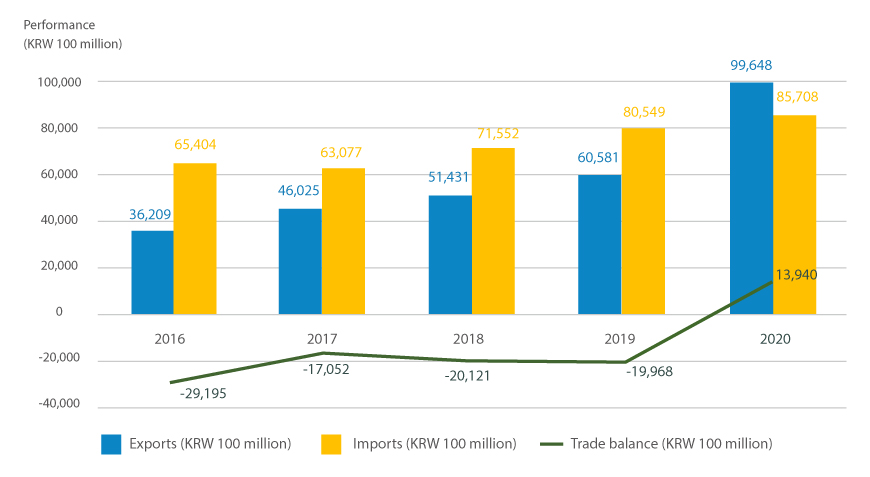

Korea's pharmaceutical is producing record results yearly based on manufacturing facilities at the level of advanced countries alongside active R&D investment. According to the Ministry of Food and Drug Safety, domestic drug exports grew by roughly 30.5% from KRW 3.6 trillion in 2016 to 4.6025 trillion the following year and have steadily escalated since then, reaching KRW 9.9 trillion in 2020. The number of exporting countries amounts to 214, located in North America, Europe, and Asia. Moreover, according to a survey by the KPBMA, 78 domestic pharmaceutical companies have 13 branch offices overseas and 192 overseas corporations.

Export and import performance and trade balance of medicine by year

※Source : the Ministry of Food and Drug Safety

The license-out performance of companies also reached KRW 5.3 trillion in 2018, KRW 8.5 trillion in 2019, KRW 10.1 trillion in 2020, and KRW 13.3 trillion in 2021. As of October this year, 12 technology export contracts worth about $3.4 billion (excluding non-disclosure contracts) were made. It means the global market is paying attention to the pipelines of domestic pharmaceutical companies. International events such as the J.P. Morgan Healthcare Conference, BIO USA, American Society of Clinical Oncology (ASCO), and American Diabetes Association (ADA) are the main stages on which domestic pharmaceutical companies present their R&D results. Domestic companies are also steadily entering developed markets, such as biosimilars and new synthetic drugs. According to the industry, as of October, about 27 items were approved by the US Food and Drug Administration (FDA) and about 22 items were approved by the European Medicines Agency (EMA).

Such achievements are owing to the dedicated R&D investment of pharmaceutical companies. According to the Financial Supervisory Service, the R&D investment of 64 domestic pharmaceutical companies last year was about KRW 1.8 trillion, or 9.4% of KRW 19.6 trillion in sales. This figure far surpasses the 2.6% ratio of R&D to the average sales of the Korean manufacturing industry. Especially, Celltrion (20.8%), Ildong Pharmaceutical (19.3%), Daewoong Pharmaceutical (16.6%), Hanmi Pharmaceutical (14.4%), Dong-A ST (13.9%), Chong Kun Dang (12.2%), Samjin Pharmaceutical (12.1%), GC Green Cross (11.2%), SK Bioscience (10.7%), Yuhan (10.6%), and many other pharmaceutical firms spent more than 10% of their sales on R&D.

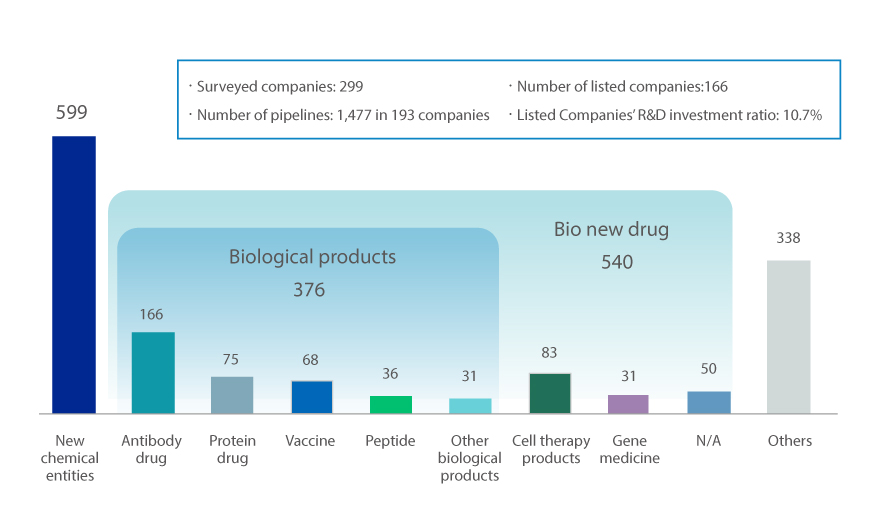

Last year, the KPBMA surveyed 299 domestic pharmaceutical companies on the progress of new drug development. As a result, there were 1,477 new drug pipelines. This is a 157.8% increase from the results of the survey conducted by the association in 2018 (100 companies, 573 pipelines). It demonstrates the active R&D investment of pharmaceutical companies.

Current pipeline of new drugs by type

※ Source : Korea Pharmaceutical and Bio-Pharma Manufacturers Association

Such efforts by the industry are also leading to improved international credibility. The Ministry of Food and Drug Safety of Korea joined the Pharmaceutical Inspection Cooperation Organization (PIC/S) back in 2014 and became a full member of the International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH) in 2016. In 2018, it was also elected to the ICH Steering Committee. Notably, in 2019, it was added to the EU whitelist, and in 2020, it signed a mutual trust agreement between South Korea and Switzerland for Good Manufacturing Practice (GMP). Moreover, early this year, it was selected as the “global bio-manufacturing workforce training hub” by the World Health Organization (WHO) in recognition of its world's second-largest pharmaceutical manufacturing capacity, experiences in consignment production of five types of COVID-19 vaccines, and bio-manufacturing process education infrastructure. Under the COVID-19 pandemic, nevertheless, it was also listed as the third country in the world that developed both treatments (Celltrion’s Rekirona) and vaccines (SK Bioscience’s Skycobi One). With the efforts of pharmaceutical companies and support from government agencies, K-Bio's entry into the global market is expected to accelerate in the future.

Open Innovation to Co-exist with Overseas Companies and Institutions

Korea's pharmaceutical industry is actively carrying out global open innovation to co-exist with overseas pharmaceutical companies and institutions. Currently, there are emerging various cases of joint development and commercialization between major domestic pharmaceutical companies and overseas companies such as Dong-A ST and MSD (joint overseas expansion of super antibiotics); Yuhan and Janssen (joint development of lung cancer drug and export of the technology); Samsung Bioepis and Organon Korea (commercialization of biosimilars); and Boryung Pharmaceutical and Zullic Pharmaceutical (export of antihypertensive drugs). The KPBMA supports Korean pharmaceutical companies moving into the Cambridge Innovation Center (CIC) in Kendall Square, Boston, USA. In June, it inked a trilateral Memorandum of Understanding (MOU) with the Korea Health Industry Development Institute, giving strength to the opening of the Korea Bio Innovation Center in Boston. Furthermore, it is ramping up the overseas expansion of domestic companies by forging cooperative relationships through participation in the Massachusetts Institute of Technology (MIT) Industrial Liaison Program (ILP) in the U.S., MedCity in the U.K., and Baselaunch in Switzerland. Besides, the association is slated to build an “Open Innovation Platform” that can collect and utilize the new drug pipelines of domestic and foreign pharmaceutical companies in one place to back active drug development between domestic and foreign companies. It is forecast that K-PHARM's entry into the global market will further expand going forward..

By Jang, Byungwon( (bwjang@kpbma.or.kr))

Vice Chairman , Korea Pharmaceutical and Bio-Pharma Manufacturers Association

* The opinions expressed in this article are the author’s own and do not reflect the views of KOTRA.