- Home

- Investment Opportunities

- Latest Information

- Industry Focus

Industry Focus

- Display

Status of the Display Industry

Display Industry: Expected to Continue Growing based on the Growing Markets for Premium Electronics and Convergence Products

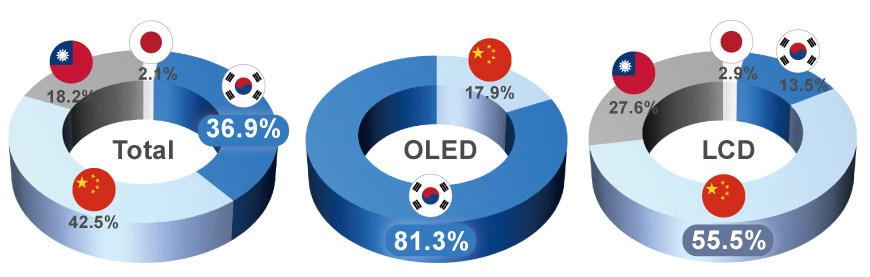

Based on continuous R&D, Korea is leading the OLED technology by introducing the world's first rollable TV and foldable OLED. Korea's OLED production technology is three to five years ahead of its competitors, and while some small and medium-sized OLEDs are produced by competitors, Korea is the exclusive producer of large OLEDs.

In the 1990s, display panels were mainly produced by four countries in Northeast Asia (Korea, China, Japan, and Taiwan), starting with Japan's investment in LCDs. In recent years, however, Korea and China have emerged as major producers. China started leading the global market share from 2021 based on large-scale investment in LCDs, while Korea strategically reduced LCD production and focused on investing in OLEDs to expand production as panels are rapidly being adopted in major home appliances such as mobile phones, TVs, and other IT products.

The Korean display industry centers on major panel producers (e.g., Samsung Display and LG Display) and manufacturers of materials, parts (822 companies) and equipment (473 companies) used in the panel manufacturing process. Manufacturing sites of Samsung Display (in Cheonan and Asan) and LG Display (Paju and Gumi) represent a display ecosystem densely concentrated with materials, parts and equipment makers. Notably, the Cheonan and Asan region housing Samsung Display was designated as a Specialized Industrial Complex for Strategic High-Tech Industries (in July 2023), laying the foundation for fostering the next-generation display market.

Market Outlook and Government Policies to Foster the Display Industry

As the Global Market is Being Reorganized with a Focus on OLEDs, the Government is Strengthening Support to Create a Super-Gap in OLED Technologies and Accelerate the Creation of New Markets

The Korean display industry is driving innovation in the ICT market, but competitors are catching up fast. China continues to support OLEDs at the national level in addition to LCDs, while Taiwan and Japan are increasing their investment in next-generation micro LED technology to overcome their disadvantageous positions in the OLED sector.

In response to the challenges, the government announced the 'Display Industry Innovation Strategy' with a vision to secure super-gap technologies and regain the world's No. 1 position by 2027 through a joint public-private partnership.

| Vision | Reclaiming the World's No. 1 Display by 2027 |

|---|---|

| Five Major Strategies | ❶ Fully support private investment ❷ Create 3 new markets ❸ Secure super-gap technologies ❹ Build a solid supply chain ❺ Develop human resources |

Five core technologies* of the display industry have been designated as national strategic technologies under the Act on Restriction on Special Cases Concerning Taxation (implemented in February) to provide companies investing in related facilities with corporate tax deductions of 15% for large and middle market enterprises and 25% for small and medium-sized enterprises and help ease the burden of investing. As companies producing related materials, part and equipment as well as display makers are eligible for the tax deductions, the law can widely benefit SMEs and middle market enterprises. In addition, the government facilitates investment by consulting with relevant ministries and local governments to ease regulations that companies find difficult to comply. As a result, inspections for new facilities handling hazardous chemicals and transportation procedures for large equipment were made more rational..

Moreover, the Korean government introduced a quota tariff system to strengthen industrial competitiveness and facilitate the supply of goods. The quota tariff is a flexible tariff system that can be applied temporarily by reducing the rate within the range of 40%p to the basic tariff rate for price stability and smooth supply. Since eligible items are selected through semiannual or annual demand surveys, companies planning to import a certain product needs to apply for the quota tariff in advance

Foreign-Invested Companies Successfully Operating in Korea

By Jo Eunsook ( (jes@kdia.org))

Head of Office, Industry Policy Team, Korea Display Industry Association

<The opinions expressed in this article are the author’s own and do not reflect the views of KOTRA.>