- Home

- Investment Opportunities

- Latest Information

- Industry Focus

Industry Focus

- Machinery and manufacturing

Recent Trends of the Korean Machinery Industry

Highly Volatile Situation Continues Due to Rising Instability

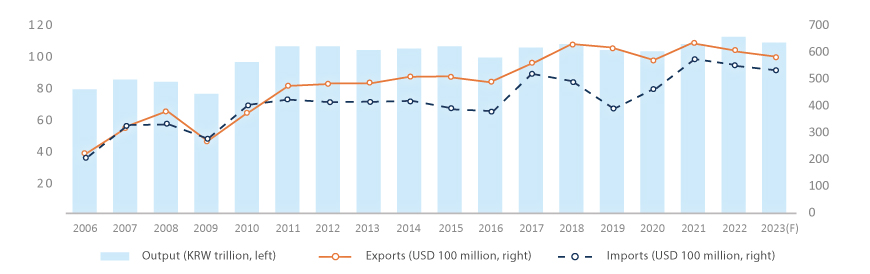

In 2023, domestic consumption continued recovery, but output and exports are expected to decline compared to 2022 due to the severe export slump. At the same time, geopolitical risks triggered by the Israel-Hamas war are likely to play a role. Exports of machinery to China and semiconductor exports, which were expected to rebound in the second half of 2023, continue to stagnate, and a significant growth in demand appears unlikely as high inflation and interest rates weaken the real purchasing power.

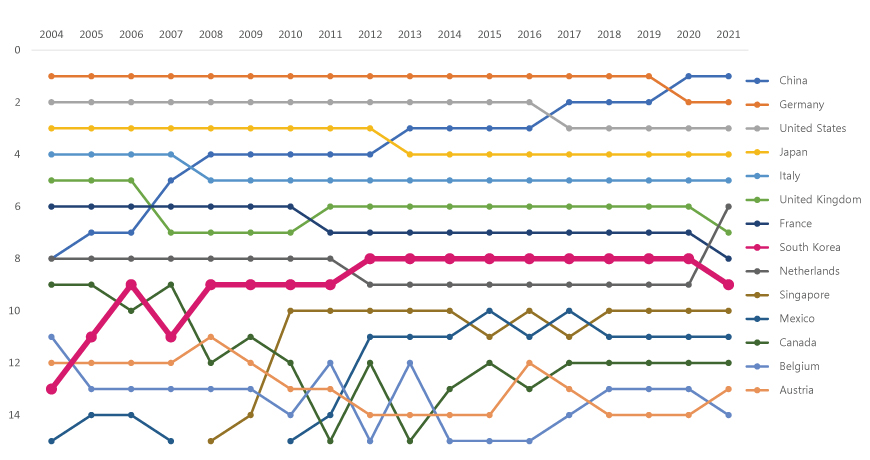

The Korean machinery industry has stayed in the 8th place in the global ranking since 2012, but the country's global ranking of the general machinery industry fell from the 8th place to the 9th place in 2021, affected by a 30 percent increase in exports of Netherland's extreme ultraviolet (EUV) lithography systems.

* Source: Page 2, “Achievements of the Machinery Industry in 2022 and the Outlook for 2023,” Korea Institute of Machinery and Materials (KIMM) Machinery Technology Policy, Issue No. 111 published on Feb. 27, 2023.

Global Ranking of General Machinery Exports

Trends of the Machinery Industry by Sector

In the plant industry, plant orders placed up to Q3 2023 increased by 10.2% year-on-year to USD 19.0 billion. While orders received from the Middle East surged, orders from Europe plummeted. Plant orders are expected to record a year-on-year increase in 2023 as Middle Eastern countries actively build infrastructure.

Players in the construction machinery industry are focusing on developing main parts and technologies needed in intelligent, robotized construction machinery. In terms of performance, the country is expected to perform better year-on-year as the strong growth in the US and the Middle East offsets decreases in the domestic market and emerging countries including China. In addition, performance is expected to improve in the second half of 2023 as Middle Eastern countries build new cities and infrastructure.

In the semiconductor equipment industry, domestic consumption and exports declined as demand from the downstream ICT industry continued to weaken, but the recovery of memory prices is expected to help improve exports. In the display equipment industry, exports of the LCD sector continued declining, while OLED exports grew. Especially noteworthy is that OLED shipments are expected to recover in the second half of 2023 as demands improve.

Outlook of the Machinery Industry in 2024

| Sectors | Outlook |

|---|---|

| Machine Tool | ㆍ(Stagnant) The sector is expected to decline year-on-year due to various factors limiting the recovery of capex - Slow growth of the global economy and high uncertainties will limit the recovery of capex - ’Q3 2023 orders fell by 10.8% year-on-year, and Q4 orders are also expected to decline by 5-10% year-on-year |

| Plant | ㆍ(Flat)The sector is expected to remain flat for the third consecutive year, or grow by 1-2% - Demands are expected to improve, driven by growing demands for LNG in Europe - Demands for building eco-friendly plants (e.g., nuclear power plants, SMRs and infrastructure) are expected to increase |

| Construction Machinery | ㆍ (Flat) Domestic consumption is expected to remain sluggish, while exports will remain at the previous year's level. - The sector may achieve a moderate recovery from the second half of 2024, if the government's measures to boost the construction industry (e.g., an increase in the SOC budget) prove effective. - Uncertainties in the global demand linger due to the prolonged war in Ukraine and geopolitical risks in the Middle East |

| Semiconductor | ㆍ(Stable) A significant growth is expected in 2024 due to the base effect of the industry’s situations - ’The sector is expected to grow by 13.5% year-on-year to USD 600.4 billion in 2024 and enable the related semiconductor equipment market to grow together. |

| Display | ㆍ(Stable) The growth of new markets (e.g., auto) is expected to boost OLED exports - Growing demands of flagship products and new market segments are expected to drive the growth of the display equipment industry. |

By Hyungbae GIL( (hbgil@kimm.re.kr))

Senior Researcher, Korea Institute of Machinery & Materials (KIMM)

<* The opinions expressed in this article are the author’s own and do not reflect the views of KOTRA>