- Home

- Investment Opportunities

- Latest Information

- Industry Focus

Industry Focus

- Other

Changes in Internal and External Conditions in 2024 and Implications for Industries

Outlook for Korea’s 13 Key Industries in 2024

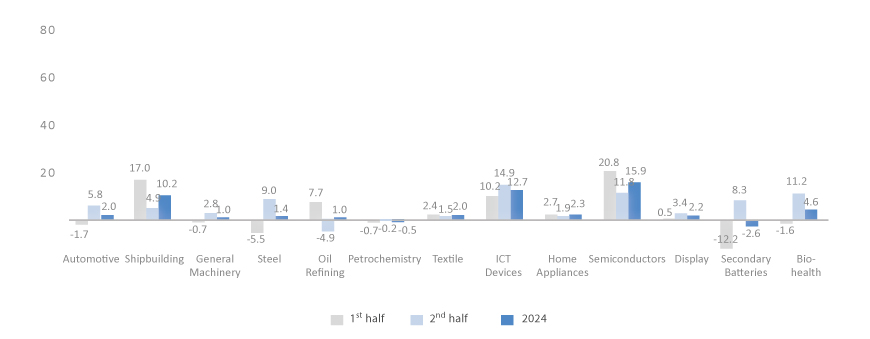

Exports Driven by the recovery of global ICT demand and the base effect, IT and new industries are expected to lead exports, which will increase by 5.2% year-on-year.

ㆍ Exports of 13 major industries: (2022) USD 536.5 billion → (2023) USD 479.9 billion → (2024) USD 504.7 billion

ㆍ Share of 13 major industries in total exports: (2022) 78.5% → (2023) 76.3% → (2024) 76.0%

- Machinery Exports of general machinery (1.0%) and automotive (2.0%) maintain growth, backed by rising demand from major export markets. Shipbuilding (10.2%) is projected to continue growing in double-digits, and the overall machinery sector is expected to increase by 2.7%.

- Materials Exports of steel (1.4%), textiles (2.0%), and oil refining (1.0%) are projected to increase, driven by rising demand from emerging economies, growing exports of high-tech materials, and the base effect. In comparison, falling unit prices are expected to make petrochemicals (-0.5%) stay flat, and the overall sector is expected to post a 0.7% growth.

- IT & New Industries Increased demand for global IT products and innovative medicines and the base effect are expected to drive exports of major industries such as semiconductors (15.9%), ICT devices (12.7%), and bio-health (4.6%), enabling the sector’s overall exports to grow by 11.4% and champion the exports of the Korean economy, but secondary batteries are expected to decline slightly (-2.6%).

Domestic Consumption Domestic consumption of the IT & new industries sector is expected to recover, driven by the launch of new ICT products and rising demand for exported intermediate goods while the materials sector is projected to grow slightly as major economic indicators improve in the second half of the year.

- Machinery Shipbuilding (84%) is expected to maintain strong growth, while increased capex is projected to slow down the decline in general machinery (-3.4%). In comparison, automotive (-2.0%) will decline as accumulated deferred demand are met and purchasing conditions worsen.

- Materials Domestic consumption is expected to grow in steel (0.6%), oil refining (1.5%), and petrochemicals (1%) as downstream industries recover in the second half of the year in line with the recovery of frontline industries. However, uncertainties in the real estate market and weakening private consumption will limit growth.

- IT & New Industries Domestic consumption of semiconductors (9.4%) and ICT devices (5.4%) is expected to recover, and bio-health (10.7%) is expected to maintain strong growth. However, secondary battery (3.3%) is expected to grow only slightly, compared to the strong growth of the previous year (68.8%) as the growth of the EV market slows down.

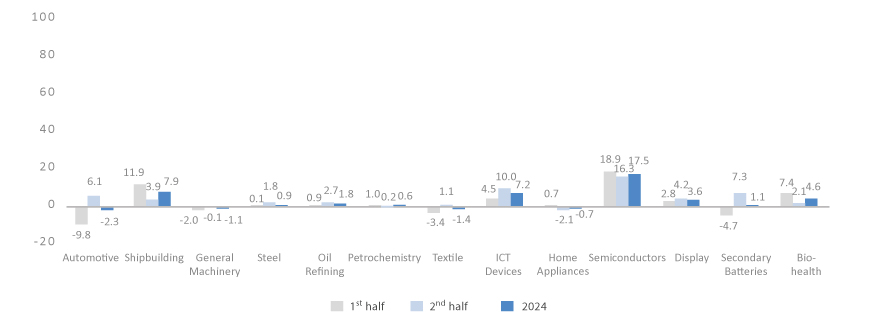

Production Production of the IT and new industries sector is expected to grow as exports and domestic consumption recover. The materials sector’s growth will be limited while the machinery sector is forecast to decline slightly.

- Machinery Automotive production (-2.3%) is expected to decline due to sluggish domestic consumption and exports; the decline in general machinery (-1.1%) production is forecast to slow down as domestic consumption recover; and shipbuilding (7.9%) is expected to increase as backlog orders are fulfilled.

- Materials Steel (0.9%), refining (1.8%), and petrochemicals (0.6%) are expected to increase slightly as demand conditions improve and capacity utilization rates normalize. However, textiles (-1.4%) are projected to decline as demand slow down and the domestic production base weaken.

- IT & New Industries Production of ICT devices (7.2%), semiconductors (17.5%), display (3.6%), and bio-health (4.6%) is expected to increase due to recovery in IT demand at home and abroad. In comparison, home appliances (-0.7%) are forecast to decline due to growing overseas production, and secondary batteries (1.1%) is expected to increase only slightly due to production cuts of exported batteries.

(Imports) Imports are expected to increase by 5.8% year-on-year as imports of the IT and new industries sector grow in line with recovery in domestic consumption.

- (Machinery) The shipbuilding industry is expected to import more equipment from overseas and the demand for high-end cars are projected to grow in the automotive industry. However, overall imports in the machinery sector are forecast to decline by 1.3% as the general machinery industry with high import volume is expected to see a decline in imports.

- (Materials) Refined petroleum and textile imports are expected to increase as Korea imports more petroleum products for the petrochemical industry and low- and medium-priced apparel. Petrochemical and steel imports are forecast to be similar to those of 2023.

- (IT & New Industries) Imports in the IT & new industries sector are expected to grow by 10.4% year-on-year, supported by rising domestic consumption of ICT and bio-health industries, growing demand for overseas brand products, and increasing imports of intermediate goods for exports.

- Machinery Sector Automotive, Shipbuilding, and General Machinery

- Materials Sector Steel, Oil Refining, Petrochemicals, and Textiles

- IT & New Industries Sector ICT Devices, Home Appliance, Semiconductors, Display, Secondary Batteries, and Bio-health

※ Source: Korea Institute for Industrial Economics and Trade (kiet.re.kr)

<* The opinions expressed in this article are the author’s own and do not reflect the views of KOTRA.>