- Home

- Investment Opportunities

- Latest Information

- Industry Focus

Industry Focus

- Auto parts

Status of Korea’s Future Vehicle (Eco-Friendly and Autonomous Vehicles) Market

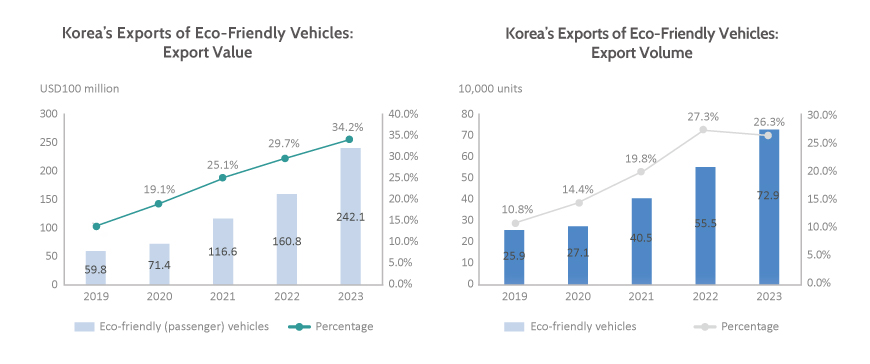

Korea’s Exports of Eco-Friendly Vehicles Hit a New Record in 2023

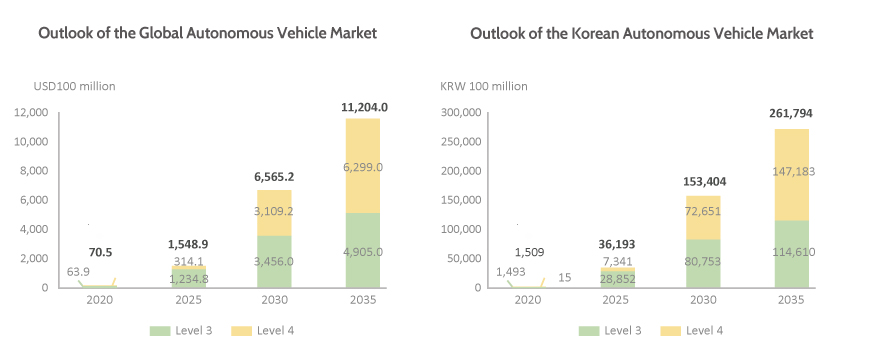

The Korean Market Expected to Thrive Along with the Global Autonomous Vehicle Market

Korea's Ambitious Future Vehicle Transition Goals and the Government’s Support

| Type | Description |

|---|---|

| 2022 Action Plan for Distribution of Eco-Friendly Vehicles (Feb. 2022) |

ㆍ(Targets) Strengthening of the 2030 zero-emission vehicle registration target from 3.85 million to 4.5 million in accordance with Korea’s upgraded NDCs * Raised targets for zero-emission vehicles to 3.62 million EVs (raised from 3 million) and 0.88 million FCEVs (raised from 0.85 million) by 2030, while maintaining the target for hybrid vehicles at 4 million |

| Global Top Three Automotive Powerhouses Strategy | ㆍ(Targets) Global production of 3.3 million EVs and achieving 12% global market share by 2030, Investment of over KRW 95 trillion in the automotive industry from 2022 to 2026, and Training of 30,000 future vehicle experts by 2030 |

| Mobility Innovation Roadmap (Sep. 2022) |

ㆍ (Commercialization) Launching of Level 4 buses and shuttles by 2025 and Level 4 passenger cars by 2027 ㆍ (Regulations) System development for Level 4 by 2024 for the commercialization of Level 4 in 2027 ㆍ(Infrastructure) Establishment of real-time communication infrastructure for roads nationwide (about 110,000km) by 2030, and development by 2027 in congested areas such as urban centers |

| Special Act on Future Vehicles (enacted in Jan., effective from Jul. 2024)) |

ㆍ (Scope Definition) Inclusion of software in the scope of future vehicle technologies and parts by considering the characteristics of future vehicles defined as software defined vehicles (SDV) ㆍ(Support) Support for building core competencies for competitive future vehicles such as technology development, commercialization, and standardization ㆍ (Special Regulations) Inclusion of special regulations to promote investment in Korea’s future vehicle industry and strengthen the supply chain |

Korean Automakers’ Strategies to Lead the Future Vehicle Market

Korean automakers are also joining the race for partnerships and technology development to grasp opportunities in the autonomous driving market. Hyundai and Kia acquired autonomous driving software 42dot (August 2022), and Motional, established as an autonomous driving joint venture with Aptiv (March 2020), saw its global ranking rise among autonomous driving technology developers9 . Motional plans to roll out robotaxis in major US cities in 2024, and RideFlux, a startup developing autonomous driving technology, is focused on commercializing Level 4, including demonstrating its Level 4 autonomous driving car-sharing technology in Jeju Island (November 2023). In addition, Hyundai and Kia announced a roadmap to strengthen software technology by applying Over-the-Air (OTA) software updates to all new cars by 2025 and investing a total of KRW 18 trillion by 2030 (September 2022).

Korea is striving to join the world’s top-tier of future vehicle makers by flexibly transitioning to future vehicles and expanding industry boundaries. The Korean future vehicle market is expected to continue its growth with join effort of dedicated support from the government and adaptable strategy against surrounding environment from the management.

By Yeonhong Yu (yhyu1@katech.re.kr), Sumin Kim(kimsm@katech.re.kr)

Korea Automotive Technology Institute (KATECH)

2) USD 54.1 billion in 2022 (KITA)

3) The Society of Automotive Engineers (SAE) defines Level 3 as conditional automation, Level 4 as high automation, and Level 5 as full automation. In general, vehicles at Levels 3 and above are classified as autonomous vehicles.

4) New Deal Industries Analysis Report (Korea Eximbank, December 2020)

5) Frost&Sullivan(2022)

6) The target of distributing 4 million HEVs was maintained.

7) Special Act for the Successful Transition and Ecosystem Development of the Future Vehicle Parts Industry

8) (Hyundai and Kia) Production of 3.64 million EVs by 2030, (Hyundai) sales of 2 million EVs by 2030, (Kia) sales of 1.6 million EVs worldwide by 2030

9)Automated Driving Systems Ranking Released by Guidehouse Insights: (2019) Hyundai Motor Company – 15th, (2020) Motional – 6th, (2021) Motional – 6th, (2023) Motional – 5th