KOTRA and Korea Venture Investment to hold Global Sovereign Wealth Fund Investment Attraction Consultation

Sovereign Wealth Fund Investors to be gathered...raising expectation to make large-scale investment in Korean startups

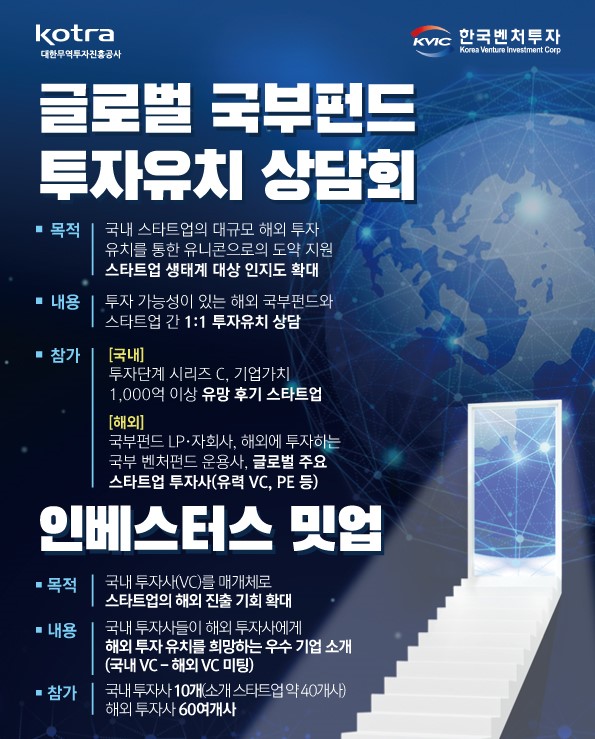

North American and Asian sovereign wealth funds will be gathered to look for promising domestic startups. KOTRA (President & CEO Yu Jeoung-yeol) and Korea Venture Investment Corp. (CEO Lee, Young-min) will hold an online ‘Global Sovereign Wealth Fund Investment Attraction Consultation’ on September 6-10. Startups can raise the their recognition and corporate value at the same time by attracting large-scale funds from highly reputational investors, which provides an opportunity to leap into a unicorn or decacon. For this reason, especially late-stage startups are showing a great interest in attracting investment from overseas sovereign wealth funds.

Participants to be present in the event include △Vertex Holdings under Singapore's Temasek △Golden Gate, a venture capital which manages venture funds invested by Temasek, △Goldman Sachs, which manages venture funds invested by Middle East sovereign wealth funds, among others. In order to respond to their demand, domestic startups in the late investment stage whose corporate value worth KRW 100 billion or more, including unicorns with a corporate value of more than 1 trillion won, will participate.

Lee Young-min, CEO of Korea Venture Investment Corp., said, "This event is a good opportunity for excellent domestic startups to attract foreign investment and grow into unicorns, and for domestic venture capitals to expand their network with global investors."

Meanwhile, the 'Investors Meetup Consultation', where foreign investors and domestic venture capitalists are planned to meet up to discuss foreign investment attraction for domestic startups, will also be held online during the same period. At this event, domestic startups directly invested in the portfolios managed by domestic venture capitals will be introduced to overseas venture capitals, discussing investment measures.

In this conference, 10 domestic venture capital companies such as △Shinhan Venture Capital △KB Investment △The Wells Investment will participate and consult with about 40 portfolio startups to attract foreign investment. From abroad, more than 60 companies including Hong Kong Aspex Management and Australia's AFG Ventures will participate.

KOTRA's President & CEO Yu Jeoung-yeol said, “This event will be focused on providing opportunities for cooperation between Korean startups, global sovereign wealth funds, and large overseas investors," adding "we will actively support Korea's startups to grow into global unicorns through investment attraction."

Source: KOTRA (August 26, 2021)