Korea’s future mobility industry is accelerating its structural transformation amid global paradigm shifts such as electrification, autonomous driving, and the transition to software-defined vehicles (SDVs). From January to September 2025, Korea’s automobile exports reached a record high of USD 54.1 billion, driven by strong growth in eco-friendly vehicle exports. Meanwhile, domestic R&D investment in the future mobility industry 1) expanded from KRW 33.3 trillion in 2022 to KRW 36.4 trillion in 2024, reflecting an average annual growth rate of 3.1 percent. By actively participating in the global race to develop next-generation vehicle technologies, Korea is building a robust future mobility ecosystem that underpins innovation and sustainable growth in its automotive industry.

Growth of Korea’s future mobility industry and reinforcement of global competitiveness

Korea’s eco-friendly vehicle market: simultaneous growth in domestic sales and exports

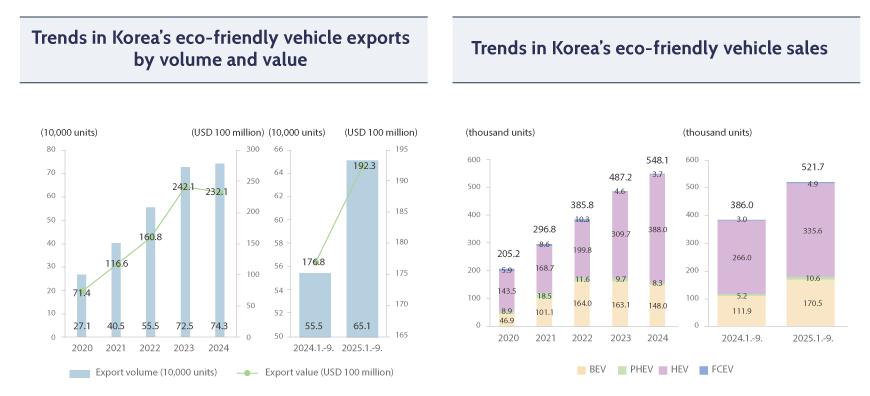

In 2025, Korea’s eco-friendly vehicle sector is recording strong export performance in tandem with expanding domestic sales. Despite the impact of U.S. tariff policies, exports have remained robust, supported by rising demand in Europe, the launch of new models, and sustained strength in the hybrid segment. From January to September 2025, domestic sales increased across all categories of eco-friendly vehicles. 2) In particular, domestic sales of electric vehicles surged by 52.4 % year-on-year to 169,712 units, surpassing the previous all-time annual record within the first nine months of the year. Over the same period, exports of eco-friendly vehicles reached 651,000 units, representing a 17.3% increase compared to the previous year; their share of total automobile exports came close to 35.6% by value and 31.7% by volume. As of 2024, Korea ranks third globally in electric vehicle exports, ninth in plug-in hybrid exports, and fourth in hybrid vehicle exports, illustrating its world-class competitiveness in eco-friendly mobility.

* Source: Korea Automobile & Mobility Industry Association; Korea International Trade Association, SNER

Korea’s future mobility competitiveness evolving through connected, autonomous, and SDV technologies

Korea is rapidly advancing vehicle connectivity and autonomous driving infrastructure. According to Counterpoint Research, the penetration rate of embedded connectivity in vehicles sold domestically is expected to increase from about 83% in the second quarter of 2025 to nearly 100% by 2030. Korea has secured a strong competitive edge in connected car services and industrial convergence, and by 2030, around 88% of connected vehicles in the country are projected to be 5G-based. 3) In 2023, Korea adopted C-V2X as the standard for next-generation Cooperative Intelligent Transport Systems (C-ITS) and completed nationwide 5G network deployment in April 2024, thereby establishing key infrastructure for autonomous driving and software-defined vehicle (SDV) operation. Building on the spread of future mobility technologies and infrastructure, Korea’s autonomous driving integrated solutions market is forecast to grow at an average annual rate of 16.2%, from around USD 800 million in 2022 to approximately USD 1.9 billion by 2028.4)

Korea’s cross-ministerial policy initiatives and ecosystem building for the transition to future mobility

The Korean government is strengthening policy support to enhance future mobility competitiveness through regulatory reform and institutional improvements. Following the entry into force of the Mobility Innovation Act in October 2023 5), a total of 25 regulatory sandbox exemptions for pilot and demonstration projects had been granted as of 2024. In January 2024, the government also unveiled a Regulatory Innovation Plan for Eco-friendly Mobility, identifying 43 improvement tasks across three core areas 6). Furthermore, with the enforcement of the Future Automobile Parts Industry Act in July 2024, Korea broadened the scope of future vehicle technologies to include software and related solutions. On the basis of this Act, a Future Mobility Industry Strategy Dialogue was convened in November 2025 7), marking the start of a full-fledged effort to foster the future mobility industry ecosystem.

In parallel, the government is pursuing strategies for technology development and commercialization. In August 2025, it announced a plan to promote the commercialization of fully autonomous vehicles as one of seven flagship projects under the new government’s economic growth strategy, focusing on core technology development and improvements to legal and institutional frameworks for data use and real-world demonstrations. In addition, Korea has been implementing a cross-ministerial Autonomous Driving Technology Development Program from 2021 to 2027, backed by a total budget of KRW 1 trillion and aimed at securing Level 4 autonomous driving capabilities.

Trends in Korean companies’ future mobility strategies

Domestic automakers are actively responding to rising demand for hybrid vehicles by expanding their hybrid lineups, while also strengthening the price competitiveness of electric vehicles to boost both domestic sales and exports. Hyundai Motor Company and Kia are enhancing their capabilities to launch new models, including mass-market EVs and purpose-built vehicles (PBVs) 8), while KG Mobility and Renault Korea are likewise broadening their eco-friendly vehicle portfolios to capture opportunities in the global market.

Korean companies are also concentrating on technology development to advance software-defined vehicles (SDVs). Hyundai Motor Group announced plans to apply its software platform, Pleos, to an SDV pace car by 2026 and to begin full-scale deployment from 2027 (as of March 2025). In addition, the Group signed an MOU with NVIDIA in October 2025 to drive innovation in physical AI technologies and strengthen future mobility solutions. Autonomous driving startup Autonomous A2Z, founded in 2018, entered the global autonomous driving technology rankings in 2023 9)and has continued to climb since then, while RideFlux expanded the operation of its Level 4 autonomous buses to four regions10) nationwide (as of October 2025). Korea’s automotive industry is accelerating a full-scale structural transition centered on three pillars: electrification, autonomous driving, and software innovation. With government future mobility policies moving in tandem with corporate investments in AI, SDV, and eco-friendly technologies, Korea is steadily strengthening its technological, manufacturing, and infrastructure capabilities—laying a solid foundation to emerge as a global hub for future mobility.

1) Software Policy & Research Institute, Analysis of domestic future vehicle software based on a survey of 2,485 companies (Apr. 2025)

2) Battery electric vehicles (BEV), plug-in hybrid electric vehicles (PHEV), hybrid electric vehicles (HEV), and fuel cell electric vehicles (FCEV)

3) Counterpoint Research, Hyundai Motor Company and Kia achieve No. 1 in domestic connected car sales in Q2 2025 (Sept. 2025).

4) Intelligent Transport Society of Korea, Strategic Technology Roadmap for SMEs: Cooperative Autonomous Driving Solutions (2025–2027).

5) Act on the Support for the Innovation and Revitalization of Mobility

6) removal of barriers to corporate investment (19 tasks), creation of a safe ecosystem (12 tasks), and expansion of consumer-friendly demand bases (12 tasks)

7) Announcement of the K-Mobility Global Leadership Strategy (Nov. 2025): ① Expansion of policy financing to overcome U.S. tariffs, increased subsidies for electric passenger vehicles, etc. ② Additional support for EV transition incentives and fostering specialized future vehicle parts companies, etc. ③ Development of an E2E-AI autonomous driving model by 2027, development of SDV/AIDV standard platforms, and mass production of autonomous vehicles by 2028, etc. ④ Creation of a KRW 50 billion future mobility technology innovation fund, etc.

8) Refers to purpose built mobility (PBM), meaning vehicles that are designed and manufactured for specific uses or applications.

9) Guidehouse Insights, global autonomous driving technology rankings: entered at 13th in 2023 and rose to 11th in 2024.

10) Jeju, Sejong, Busan, and Seoul