- Home

- Investment Opportunities

- Industries

- Pharma & Bio

Pharma & Bio

-

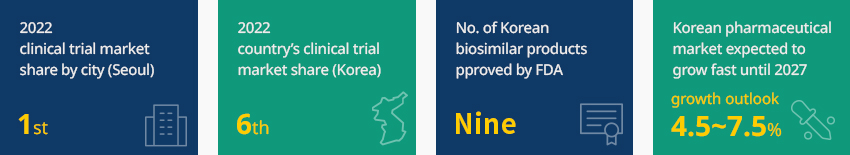

Competitiveness in Global Clinical Trial and International Regulatory Environment CloseCompetitiveness in Global Clinical Trial and International Regulatory EnvironmentWorld’s 5th Largest Clinical Trial MarketThe Ministry of Food and Drug Safety analyzed the data on the clinical trials registration system of the US National Institutes of Health (ClinicalTrials.gov) and found that Korea’s share in the industry-led clinical trial market ranked no. 5 in 2022, compared to no. 6 in 2021. Seoul, in particular, has continued to rank first in global clinical trial city rankings for three consecutive years. Its multinational clinical trial ranking was no. 11, which is still the highest among Asian countries.Korea is standing out globally in the biosimilar category: as of December 2022, nine out of forty biosimilar products approved by the United Sates Food and Drug Administration were developed by Korea, and the number of approved products was the second highest following the United States. With the joining of the Pharmaceutical Inspection Convention and Pharmaceutical Inspection Co-operation Scheme (PIC/S) in 2014 and the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) in 2016, Korea is recognized as a global leader in pharmaceuticals regulation.In May 2019, Korea became the seventh country to be listed on the EU Whitelist. Korea is now exempt from the GMP written confirmation of drug substances, which the EU demands to exporters. The World Health Organization has been working towards installing the Global Training Hub for Biomanufacturing (GTH-B) to help develop the bio capabilities of low and middle income countries having difficulties procuring vaccines. In February 2022, Korea was solely designated as the GTH-B and is championing efforts to resolve the global inequality in vaccines supply and build the global healthcare safety net.According to IQVIA, a global pharmaceutical market research agency, Korea's pharmaceutical market is the 13th largest in the world and is expected to record high growth rates between 4.5 and 7.5% until 2027.※ Source: Ministry of Food and Drug Safety / Korea Biotechnology Industry Organization /IQVIA

-

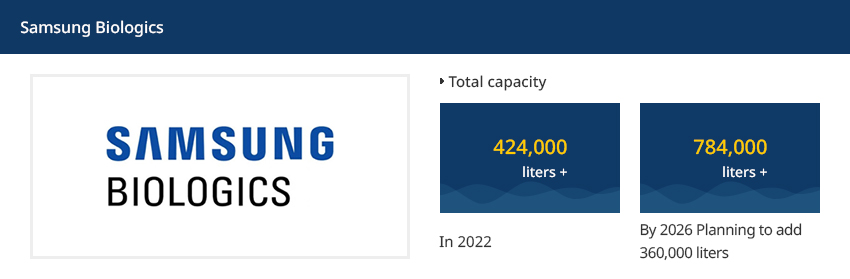

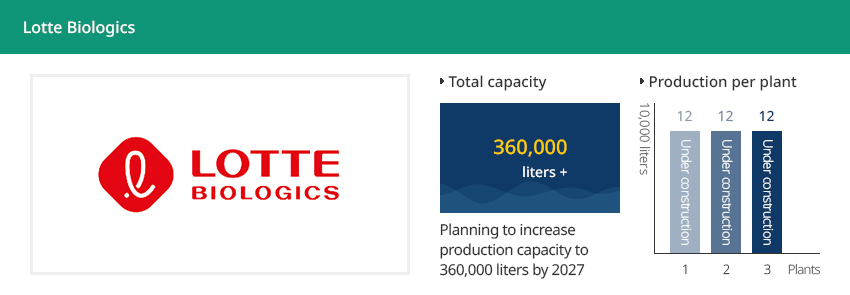

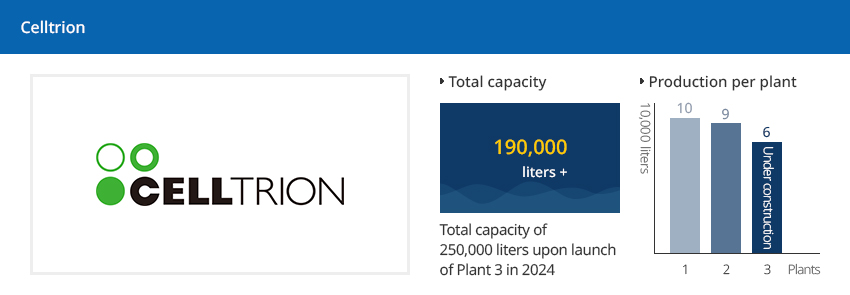

World-Class Biopharmaceutical Production Facilities OpenWorld-Class Biopharmaceutical Production FacilitiesKorea is raising its status as a global biopharmaceutical production base. In 2022, Samsung Biologics produced 424,000 liters to boast the world's biggest consignment production capacity and plans to add 360,000 liters by 2026.Lotte Biologics acquired Bristol-Myers Squibb's bio plant in Syracuse, New York in May 2022. The company also built three biopharmaceutical consignment production plants with a capacity of 120,000 liters in Korea, with plans to increase the capacity to 360,000 liters by 2027 in Korea alone.

-

Overall Growth of the Bio Industry OpenOverall Growth of the Bio IndustryAccording to the Ministry of Food and Drug Safety (MFDS), the size of Korea's pharmaceutical market exceeded KRW 25 trillion won (USD 21 billion) in 2021 by growing at an average annual growth rate of 4% over the past five years, supported by increased production and imports of COVID-19 vaccines and treatments.As of 2021, the domestic pharmaceutical production reached KRW 25.4906 trillion won (about USD 21 billion), up 3.8% year-on-year and recorded an average annual growth rate of 5.8% over the past five years. Of the total pharmaceutical production value, finished pharmaceutical products accounted for 88.0% and raw materials for 12.0%. In 2021, pharmaceutical exports reached KRW 11.3642 trillion (about USD 9.9 billion), up 14.0% year-on-year. During the same period, imports reached KRW 11.2668 trillion (about USD 9.6 billion), up 31.5% year-on-year."Korea’s Pharmaceutical Industry in Recent Five Years"(Unit: KRW 100 million, %)

Korea’s Pharmaceutical Industry in Recent Five Years Category, Production, Exports, Imports Category Production Exports Imports KRW 100 million USD 100 million Rate of change KRW 100 million USD 100 million Rate of change KRW 100 million USD 100 million Rate of change 2017 203,580 180 8.3 46,025 41 27.1 63,077 56 -3.6 2018 211,054 192 3.7 51,431 47 11.7 71,552 65 13.4 2019 223,132 191 5.7 60,581 52 17.8 80,549 69 12.6 2020 245,662 208 10.1 99,648 84 64.5 85,708 73 6.4 2021 254,906 223 3.8 113,642 99 14 112,668 98 31.5 ※ Rate of change: Rate of change compared to the previous year

※ Source: 2021 Domestic Pharmaceutical Market and Production Records, Ministry of Food and Drug Safety, August 31, 2022 -

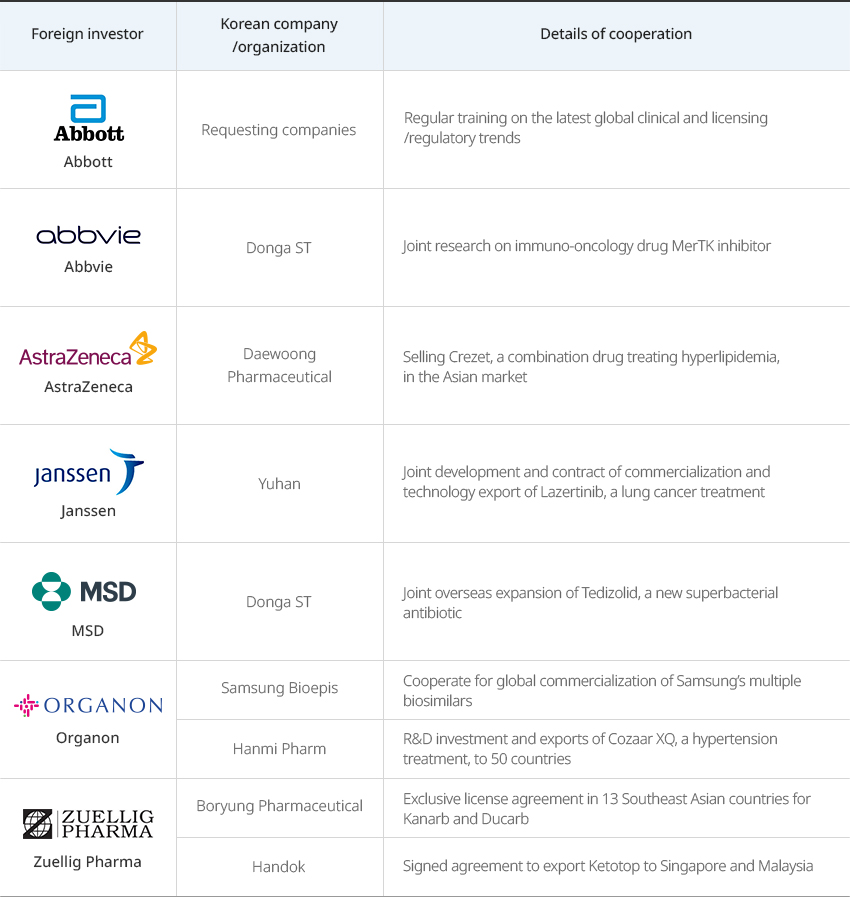

Global Pharmaceutical Companies Performing More Clinical Studies and Joint R&D in Korea OpenGlobal Pharmaceutical Companies Performing More Clinical Studies and Joint R&D in KoreaThe total R&D costs invested by 31 global companies operating in Korea continue growing and reached approximately KRW 715.3 billion (about USD 600 million) in 2021, according to the Korea Research-based Pharma Industry Association. These companies conducted as many as 1,590 clinical studies in Korea in 2021 alone.Global pharmaceutical companies share their experiences and cooperate with Korean pharmaceutical companies to enter overseas markets. In addition, they have formed the 'joint incubator platform operated by global pharmaceutical companies and startups’ with KOTRA to help Korea bio startups enter the global market."Multinational and Korean Pharmaceutical Companies Jointly Entering the Global Market"

Multinational and Korean Pharmaceutical Companies Jointly Entering the Global Market Foreign investor, Korean company/organization, Details of cooperation Foreign investor Korean company/organization Details of cooperation Abbott Requesting companies Regular training on the latest global clinical and licensing/regulatory trends Abbvie Donga ST Joint research on immuno-oncology drug MerTK inhibitor AstraZeneca Daewoong Pharmaceutical Selling Crezet, a combination drug treating hyperlipidemia, in the Asian market Janssen Yuhan Joint development and contract of commercialization and technology export of Lazertinib, a lung cancer treatment MSD Donga ST Joint overseas expansion of Tedizolid, a new superbacterial antibiotic Organon Samsung Bioepis Cooperate for global commercialization of Samsung’s multiple biosimilars Hanmi Pharm R&D investment and exports of Cozaar XQ, a hypertension treatment, to 50 countries Zuellig Pharma Boryung Pharmaceutical Exclusive license agreement in 13 Southeast Asian countries for Kanarb and Ducarb Handok Signed agreement to export Ketotop to Singapore and Malaysia  ※ Source: Korea Research-based Pharma Industry Association 2022 Annual ReportGlobal pharmaceutical companies are conducting various new drug development research together with domestic pharmaceutical companies, medical institutions, and research institutes."Joint R&D Cases of Multinational Pharmaceutical and Korean Companies"

※ Source: Korea Research-based Pharma Industry Association 2022 Annual ReportGlobal pharmaceutical companies are conducting various new drug development research together with domestic pharmaceutical companies, medical institutions, and research institutes."Joint R&D Cases of Multinational Pharmaceutical and Korean Companies"

Joint R&D Cases of Multinational Pharmaceutical and Korean Companies Foreign investor, Korean company/organization, Details of cooperation Foreign investor Korean company/organization Details of cooperation AstraZeneca Donga ST Joint research on three leading substances for immuno-oncology Boehringer Ingelheim Yuhan Joint development of pipeline for nonalcoholic steatohepatitis (NASH) therapy - In the process of a meet-up with a promising Korean startup BMS Samsung Biologics Concluded a production contract for a new commercial bio-antibody drug - Signed CDAs and conducting technical review with multiple Korean companies GSK Major Korean research institutes Joint R&D on next-generation anti-cancer drugs, first trial in patient research on immuno-oncology drug candidates Leo Pharma - Launched LEO Open Innovation Lab program, a skin disease research support program Moderna National Institute of Infectious Diseases Joint research of mRNA vaccine International Vaccine Institute Signed a memorandum of understanding for vaccine R&D MSD - Joint R&D on anti-cancer drugs with various Korean bio ventures, such as Genexine, Medpacto, Parmepsin, and NKMAX Novartis Korea Biotechnology Industry Organization Jointly hosting an open innovation challenge to support Korean bio companies’ global entry and build partnership networks KT Signed a memorandum of understanding for discovering and fostering startups specializing in digital healthcare services. Pfizer - Hosting ‘INSPIRE’ programs (from 2012 to present) Performed 60 global clinical trials in Korea in 2021 alone Roche - Partnered with the Korean Society of Medical Oncology, Korean Cancer Study Group, National Cancer Center, and Korea Health Industry Development Institute for building an ecosystem for Korea’s precision medicine. Sanofi-Aventis - Promoting collaboration with promising bio-startups in Korea to develop next-generation anti-cancer drugs Sanofi-Pasteur SK Bioscience Global joint research on next-generation pneumococcal conjugate vaccine  ※ Source: Korea Research-based Pharma Industry Association 2022 Annual Report

※ Source: Korea Research-based Pharma Industry Association 2022 Annual Report -

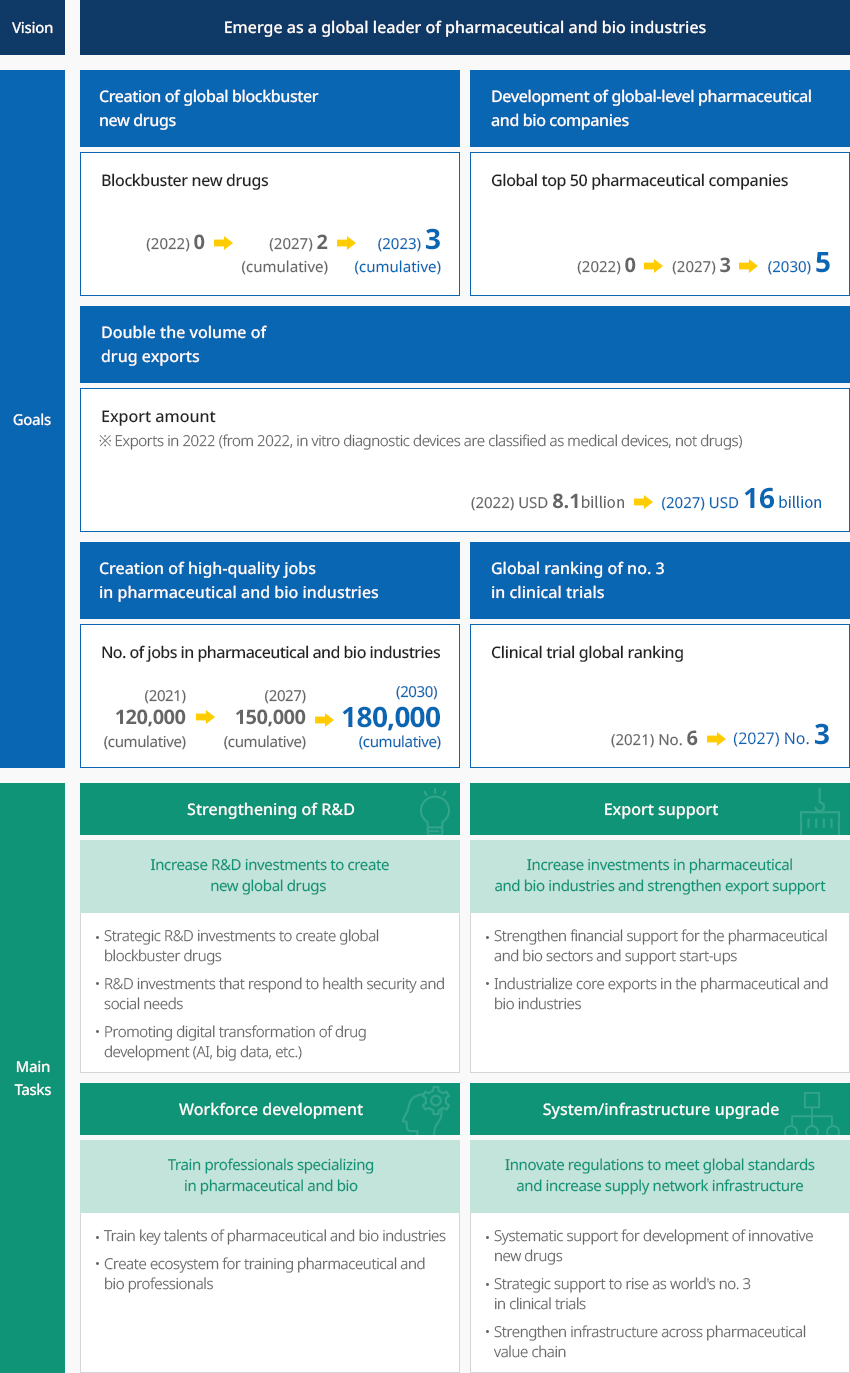

Government Policies to Foster Pharmaceutical and Bio Industries OpenGovernment Policies to Foster Pharmaceutical and Bio IndustriesThe Korean government with a vision to "emerge as a global leader of pharmaceutical and bio industries" announced in March 2023 the 3rd Master Plan for Fostering and Supporting Pharmaceutical and Bio Industries to Emerge as a Global Leader of Bio and Healthcare (Draft) (2023-2027) with related ministries."3rd Master Plan for Fostering and Supporting Pharmaceutical and Bio Industries (Draft)"

Vision - Emerge as a global leader of pharmaceutical and bio industriesGoals

Vision - Emerge as a global leader of pharmaceutical and bio industriesGoals- Creation of global blockbuster new drugs - Blockbuster new drugs (2022) 0 → (2027) 2 (cumulative) → (2030) 3 (cumulative)

- evelopment of global-level pharmaceutical and bio companies - Global top 50 pharmaceutical companies (2022) 0 → (2027) 3 → (2030) 5

- Double the volume of drug exports - Export amount (‘22) (2022) USD 8.1 billion* →

(2027) USD 16 billion

* Exports in 2022 (from 2022, in vitro diagnostic devices are classified as medical devices, not drugs) - Creation of high-quality jobs in pharmaceutical and bio industries - No. of jobs in pharmaceutical and bio industries (2021) 120,000 (cumulative) → (2027) 150,000 (cumulative) → (2030) 180,000 (cumulative)

- Global ranking of no. 3 in clinical trials - Clinical trial global ranking (2021) No. 6 → (2027) No. 3

major task- Strengthening of R&D - Increase R&D investments to create new global drugs

- Strategic R&D investments to create global blockbuster drugs

- R&D investments that respond to health security and social needs

- Promoting digital transformation of drug development (AI, big data, etc.)

- Export support - Increase investments in pharmaceutical and bio industries and

strengthen export support

- Strengthen financial support for the pharmaceutical and bio sectors and support start-ups

- Industrialize core exports in the pharmaceutical and bio industries

- Workforce development - Train professionals specializing in pharmaceutical and bio

- Train key talents of pharmaceutical and bio industries

- Create ecosystem for training pharmaceutical and bio professionals

- System/infrastructure upgrade - Innovate regulations to meet global standards and

increase supply network infrastructure

- Systematic support for development of innovative new drugs

- Strategic support to rise as world's no. 3 in clinical trials

- Strengthen infrastructure across pharmaceutical value chain

-

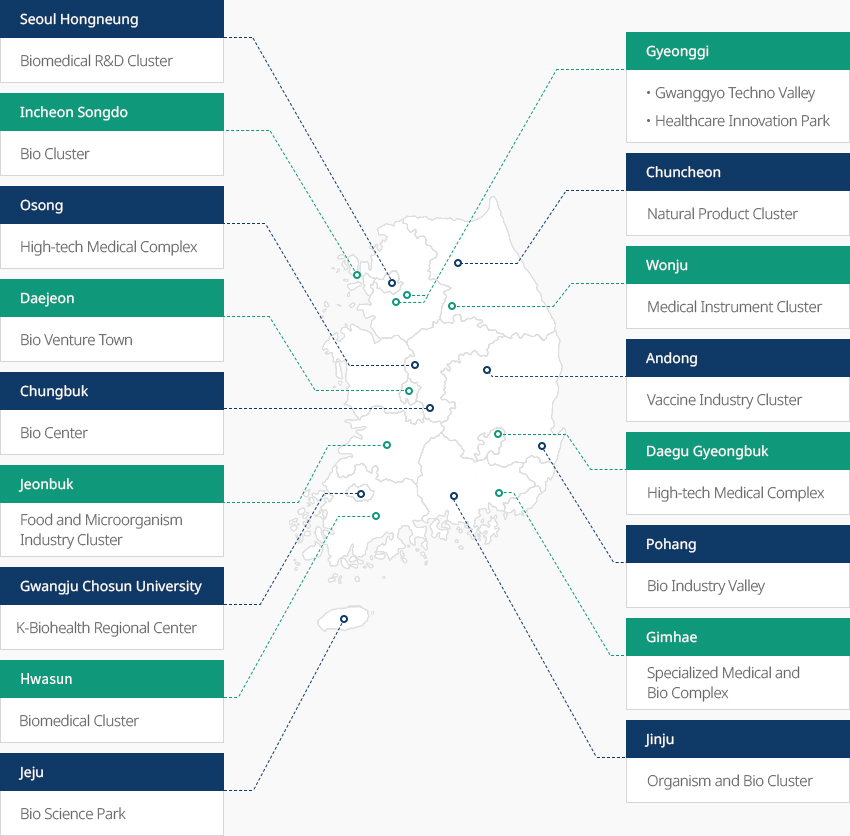

Bio Clusters Across Korea OpenBio Clusters Across KoreaAcross Korea, eighteen clusters are operating in full-scale, including Songdo Bio Complex specializing in biopharmaceuticals and CMO, and Osong Medical Industrial Complex specializing in biopharmaceuticals and BT-based medical devices. The government plans to add two clusters to strengthen expertise and support new high-tech industries."Bio Clusters Across Korea (18 Clusters)"

- Seoul Hongneung Biomedical R&D Clust

- Gyeonggi Gwanggyo Techno Valley, Healthcare Innovation Park

- Incheon Songdo Bio Cluster

- Osong High-tech Medical Complex

- Chuncheon Natural Product Cluster

- Daejeon Bio Venture Town

- Chungbuk Bio Center

- Wonju Medical Instrument Cluster

- Andong Vaccine Industry Cluster

- Jeonbuk Food and Microorganism Industry Cluster

- Daegu Gyeongbuk High-tech Medical Complex

- Gwangju Chosun University K-Biohealth Regional Center

- Pohang Bio Industry Valley

- Hwasun Biomedical Cluster

- Gimhae Specialized Medical and Bio Complex

- Jinju Organism and Bio Cluster

- Jeju Bio Science Park

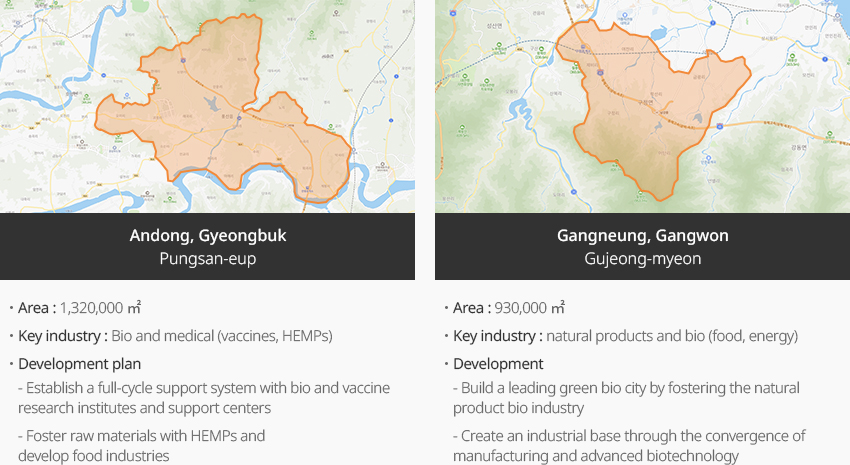

※ Source: 3rd Master Plan for Fostering and Supporting Pharmaceutical and Bio Industries (March 24, 2023. Jointly announced by government ministries)"National Industrial Complex Candidate Sites"

※ Source: 3rd Master Plan for Fostering and Supporting Pharmaceutical and Bio Industries (March 24, 2023. Jointly announced by government ministries)"National Industrial Complex Candidate Sites"

- Andong, Gyeongbuk Pungsan-eup

- Area : 1,320,000 ㎡

- Key industry : Bio and medical (vaccines, HEMPs)

- Development plan : Establish a full-cycle support system with bio and vaccine research institutes and support centers, Foster raw materials with HEMPs and develop food industries

- Gangneung, Gangwon Gujeong-myeon

- Area : 930,000 ㎡

- Key industry : natural products and bio (food, energy)

- Development plan : Build a leading green bio city by fostering the natural product bio industry, Create an industrial base through the convergence of manufacturing and advanced biotechnology

※ Source: Fifteen national high-tech industrial complexes for creation of high-tech industry ecosystem (March 15, 2023. Ministry of Trade, Industry and Energy)

※ Source: Fifteen national high-tech industrial complexes for creation of high-tech industry ecosystem (March 15, 2023. Ministry of Trade, Industry and Energy) -

Foreign Investment Success Stories OpenForeign Investment Success StoriesCOVID-19 pandemic triggered increases in production and R&D investments in vaccines and biopharmaceuticals Cytiva, a subsidiary of US-based Danaher decided to invest in Songdo, Incheon, to establish a disposable culture bag production facility to meet growing demand in the vaccine production process. Sartorius, a German manufacturer of raw materials and equipment for biotechnology research and vaccine production, is in the process of building a production facility in Songdo, Incheon, to produce biopharmaceuticals and raw materials for biotechnology R&D in Korea. Prestige Biopharma based in Singapore continued to expand its investment in Prestige Biopharma, a vaccine and biopharmaceutical CDMO facility in Osong, Chungcheongbuk-do, and decided to establish Prestige Biopharma Korea to operate the Innovation Discovery Center for advanced biopharmaceutical R&D and global cooperation.

-

Complex nameIncheon General Industrial Complex

-

Initial designation date1973.04.01

-

Designated area(m2)1,136,269

-

ManagementIncheon Metropolitan City Corporation

-

Nearby RailwayBupyeong Station

-

Distance from station(km)7

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)29

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentIncheon Metropolitan City Michuhol-gu

-

Population2,943,491

-

Complex nameOsong Life Science Complex

-

Initial designation date1997.09.23

-

Designated area(m2)4,833,314

-

ManagementKorea Industrial Complex Corporation

-

Nearby RailwayCheongju Station

-

Distance from station(km)9

-

Nearby AirportCheongju International Airport

-

Distance from airport(km)21

-

Industrial water Supply capacity(ton/day)25000(㎥/day)

-

Affiliation local governmentChungcheongbuk-do Cheongju City

-

Population843,782

-

Complex nameGyeongbuk Bio 2nd General Industrial Complex

-

Initial designation date2016.02.29

-

Designated area(m2)299,829

-

ManagementGyeongsangbuk-do Andong City

-

Nearby RailwayAndong Station

-

Distance from station(km)19

-

Nearby AirportDaegu International Airport

-

Distance from airport(km)111

-

Industrial water Supply capacity(ton/day)1863(㎥/day)

-

Affiliation local governmentGyeongsangbuk-do Andong City

-

Population158,867

-

Complex nameGyeongbuk Bio General Industrial Complex

-

Initial designation date2004.07.05

-

Designated area(m2)941,431

-

ManagementGyeongsangbuk-do Andong City

-

Nearby RailwayYecheon Station

-

Distance from station(km)15

-

Nearby AirportDaegu International Airport

-

Distance from airport(km)111

-

Industrial water Supply capacity(ton/day)5287(㎥/day)

-

Affiliation local governmentGyeongsangbuk-do Andong City

-

Population158,867

-

Complex nameGyeonggi Hwaseong Bio Valley General Industrial Complex

-

Initial designation date2012.07.04

-

Designated area(m2)0

-

ManagementHwaseong City Corporation

-

Nearby RailwaySuwon Station

-

Distance from station(km)27

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)52.5

-

Industrial water Supply capacity(ton/day)3154(㎥/day)

-

Affiliation local governmentGyeonggi-do Hwaseong-sity

-

Population842,864

-

Complex nameIksan 4th Industrial Complex [formerly: Iksan General Medical Science]

-

Initial designation date2008.03.14

-

Designated area(m2)502,825

-

ManagementJeollabuk-do Iksan City

-

Nearby RailwayHwangdeung Station

-

Distance from station(km)4

-

Nearby AirportGunsan Airport

-

Distance from airport(km)47

-

Industrial water Supply capacity(ton/day)4,540(㎥/day)

-

Affiliation local governmentJeollabuk-do Iksan City

-

Population283,496