- Home

- Investment Opportunities

- Industries

- Information and Communication Technologies

Information and Communication Technologies

-

The World’s First and Best IT Powerhouse CloseThe World’s First and Best IT PowerhouseKorea is a global leader in the ICT industry.

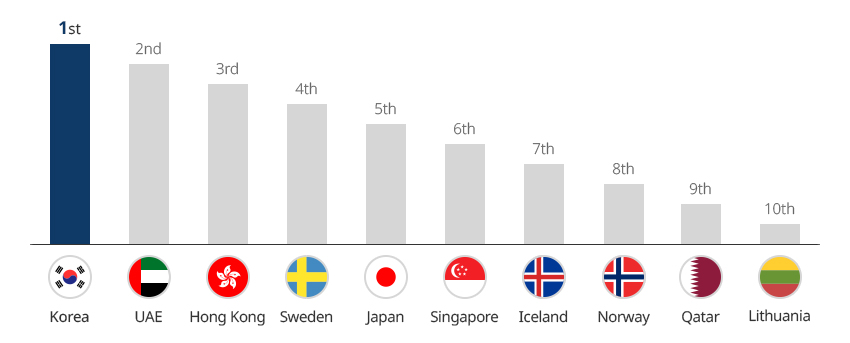

Korea was the first country in the world to commercialize CDMA in 1996, LTE-A in 2013, and 5G in 2019. The country is acknowledged as a global ICT leader based on its high level of ICT related technologies and penetration rate."ICT Adoption in 2020"

- 1st Korea

- 2nd UAE

- 3rd Hong Kong

- 4th Sweden

- 5th Japan

- 6th Singapore

- 7th Iceland

- 8th Norway

- 9th Qatar

- 10th Lithuania

※ ICT adoption: Evaluated based on the status of high-speed internet and active adoption of new technologies

※ ICT adoption: Evaluated based on the status of high-speed internet and active adoption of new technologies

※ Source: WEF(World Economic Forum) Global Competitiveness Report 2020"Global Standing of Korea’s Digital Industry" ICT Infrastructure

ICT InfrastructureICT Infrastructure Country, Ranking Country Ranking Korea 1st UK 2nd Denmark 3rd Finland 5th Singapore 6th US 7th UAE 13th Japan 14th France 18th China 20th ※ WIPO, Global Innovation Index 2022

ICT ExportICT Export Country, Exports Country Exports China 701.6 Hong Kong 319.6 Taiwan 182.9 Korea $148.1B US 138.4 Singapore 125.9 Vietnam 109.1 Malaysia 81.2 Germany 71.6 Mexico 66.6 ※ UNCTAD 2020

e-Commerce Ratioe-Commerce Ratio Country, Ranking Country Ranking UK 1st Korea 2nd China 3rd Indonesia 4th US 5th Australia 6th Canada 7th ※ WIPO, Global Innovation Index 2021

Cyber Security IndexCyber Security Index Country, Ranking Country Ranking US 1st UK 2nd Korea 3rd Japan 7th US 8th Australia 9th Canada 13th Canada 22th Canada 33th Canada 34th ※ ITU 2020

Govt AI ReadinessGovt AI Readiness Country, Ranking Country Ranking US 1st Singapore 2nd UK 3rd Canada 7th Germany 8th Korea 10th France 11th Japan 12th Norway 13th Australia 14th ※ Oxford Insights 2021

Mobile Internet ConnectivityMobile Internet Connectivity Country, Ranking, Connectivity Country Ranking Connectivity Korea 1st 99.98% Finland 2nd 92.8% Slovenia 3rd 92.3% Spain 5th 83.9% Switzerland 6th 77.7% Estonia 7th 75.2% US 8th 72.0% ※ OECD 2021

-

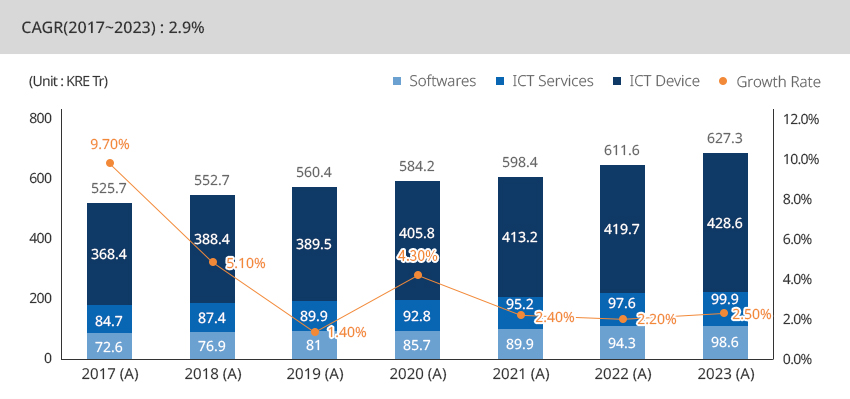

Major Industry Leading the National Economy OpenMajor Industry Leading the National EconomyIn 2022, the ICT industry accounted for 13.0% of Korea’s GDP and led the nation’s economic growth.In 2022, total production of the ICT industry reached KRW 560 trillion, up 5.1% year-on-year. A close look at the industry shows that ICT devices accounted for 70.3% of the industry's total production, up 5.9% year-on-year to KRW 388.4 trillion, ICT services accounted for 15.8%, up 3.2% to KRW 87.4 trillion, and software accounted for 13.9%, up 5.4% year-on-year to KRW 76.9 trillion. Especially noteworthy is the software sector, which is expected to grow the fastest at an average annual rate of 7.0% during 2017-2023."ICT Industry Production (Sales) and Outlook"

CAGR(2017~2023) : 2.9% (Unit : KRE Tr)

CAGR(2017~2023) : 2.9% (Unit : KRE Tr)ICT Industry Production (Sales) and Outlook Year, Softwares, ICT Services, ICT Device, Total, Growth Rate Year Softwares ICT Services ICT Device Total Growth Rate 2017(A) 72.6 84.7 368.4 525.7 9.70% 2018(A) 76.9 87.4 388.4 552.7 5.10% 2019(A) 81 89.9 389.5 560.4 1.40% 2020(A) 85.7 92.8 405.8 584.2 4.30% 2021(A) 89.9 95.2 413.2 598.4 2.40% 2022(A) 94.3 97.6 419.7 611.6 2.20% 2023(A) 98.6 99.9 428.6 627.3 2.50%  ※ Bank of Korea's classification of GDP by economic activity in the Korea National Account and the scope of ICT industry: ICT manufacturing and equipment are classified as Electrical and Electronic Equipment Manufacturing Industry' and ICT service industry is classified as Information and Communication Industry (telecommunications, publishing, broadcasting, film, information services).

※ Bank of Korea's classification of GDP by economic activity in the Korea National Account and the scope of ICT industry: ICT manufacturing and equipment are classified as Electrical and Electronic Equipment Manufacturing Industry' and ICT service industry is classified as Information and Communication Industry (telecommunications, publishing, broadcasting, film, information services).

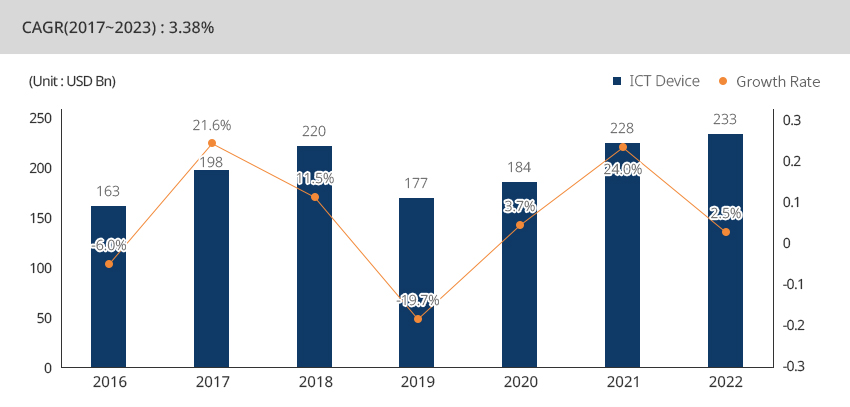

※ KISDI 2023In 2022, ICT exports reached a record high of USD 233.32 billion, imports reached USD 152.47 billion, and the trade balance stood at USD 80.85 billion.The ICT industry contributed to the nation's economic growth by accounting for 30-40% of total exports."ICT Exports and Growth Rate" CAGR(2017~2023) : 2.9% (Unit : USD Bn)

CAGR(2017~2023) : 2.9% (Unit : USD Bn)ICT Exports and Growth Rate Year, ICT Device, Growth Rate Year ICT Device Growth Rate 2016 163 -6.0% 2017 198 21.6% 2018 220 11.5% 2019 177 -19.7% 2020 184 3.7% 2021 228 24.0% 2022 233 2.5%  ※ ICT exports as a percentage of all industries: (2020) 35.8% → (2021) 35.3% → (2022) 34.1%

※ ICT exports as a percentage of all industries: (2020) 35.8% → (2021) 35.3% → (2022) 34.1%

※ ICT exports trend (USD billion) : (2019) 176.86 → (2020) 183.51 → (2021) 227.61 → (2022) 233.32

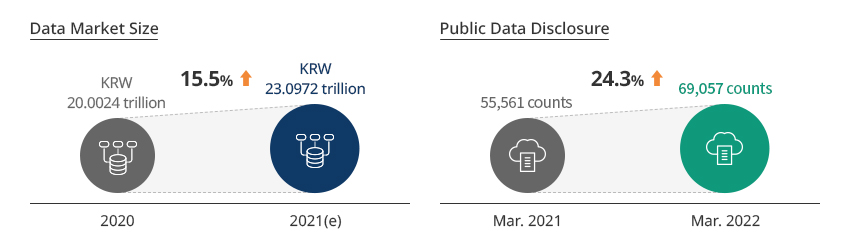

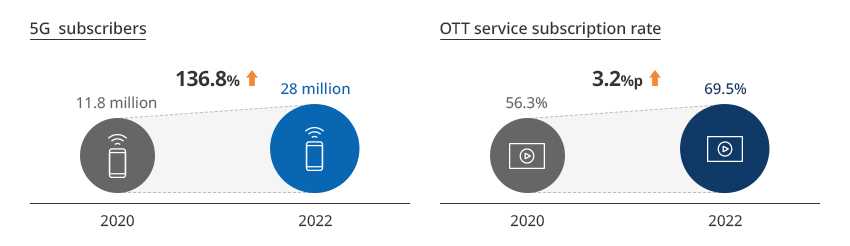

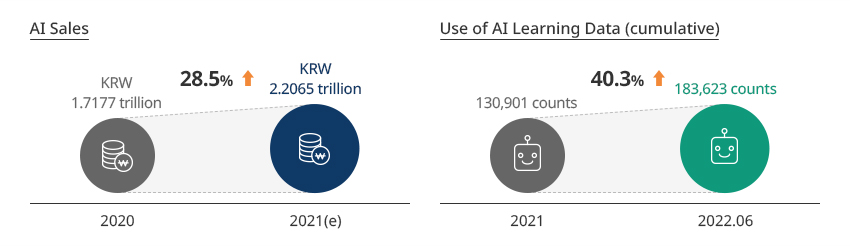

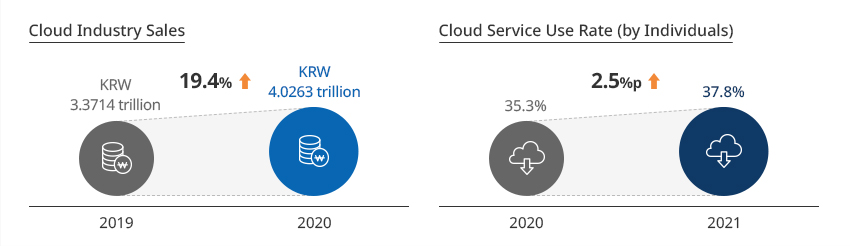

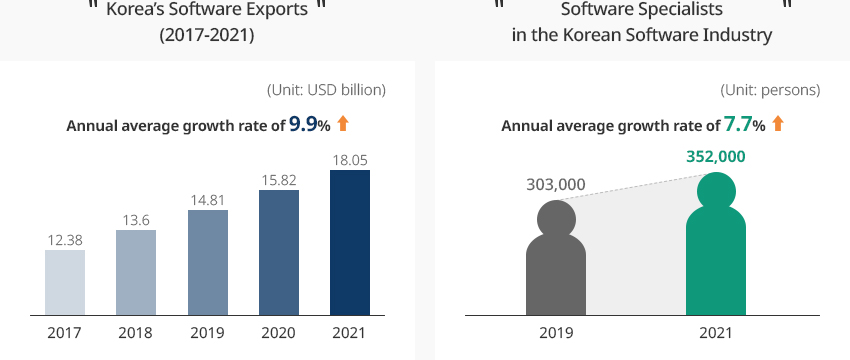

※ Source: Ministry of Science and ICT, 2023ICT Service and SoftwareIn 2021, the overall market size of the data industry reached KRW 23.9 trillion by posting a significant growth of 15.5% year-on-year. The number of public data disclosed through the Digital New Deal policy reached 69,057, up by 24.3% year-on-year. In addition, the number of subscribers to the world's first commercialized 5G service in 2019 reached 29.6 million as of March 2023 and grew by 136.8% from 2020, while OTT service subscription rate reached 69.5% in line with accelerating digitalization."Size of Data Market and Counts of Disclosed Public Data""5G and OTT Service Subscription Rates"※ Source: ITSTAT 2022In 2021, AI sales reached KRW 2.1 trillion by continuing a steep growth rate of 28.5% year-on-year. The use of AI learning data, which is needed for AI technology development and service innovation, reached 183,000 counts in June 2022, up by more than 40% year-on-year. Meanwhile, the cloud industry, which is an integral part of the digital transformation process, generated KRW 4.2 trillion in revenue in 2020 to post a significant year-on-year growth rate of 19.4%, while the use rate of cloud services by individuals grew by 2.5% from 35.3% in 2020 to 37.8% in 2021."AI Sales and Use of AI Learning Data""Size of Korean Cloud Industry and Types of Services"※ Source : ITSTAT 2022The Korean software industry exported USD 18.05 billion in 2021 to record an annual average of 9.9%. The number of software specialists also grew at an annual average of 7.7% to 352,000 in 2021. Korea’s Software Exports (2017-2021) (Unit: USD billion) Annual average growth rate of 9.9%

Korea’s Software Exports (2017-2021) (Unit: USD billion) Annual average growth rate of 9.9%- 2017 : 123.8

- 2018 : 136

- 2019 : 148.1

- 2020 : 158.2

- 2021 : 180.5

Software Specialists in the Korean Software Industry (Unit: persons) Annual average growth rate of 7.7%- 2019 : 30.3

- 2021 : 35.2

※ Source: Ministry of Science and ICT’s Software Exports Survey, 2022

※ Source: Ministry of Science and ICT’s Software Exports Survey, 2022 -

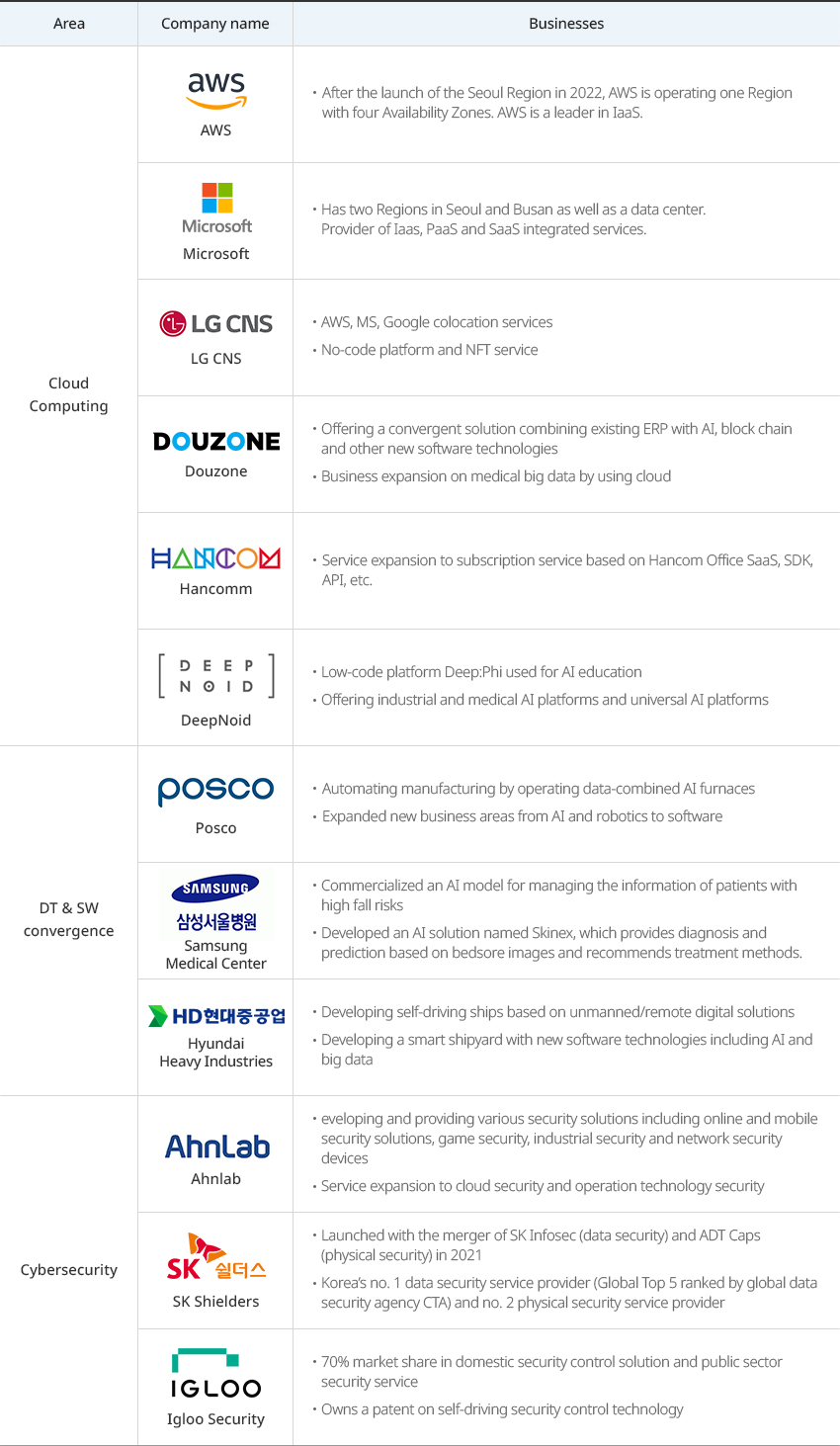

Where Digital Transformation Accelerates OpenWhere Digital Transformation AcceleratesThe rapid spread of cloud services in Korea was triggered by the saturation of wired and wireless network service penetration, the universalization of 5G services and the introduction of e-um 5G services, and the expansion of telecommuting and OTT services that have triggered data demand during the pandemic. Demands for data security, the biggest challenge to the expansion of cloud services, are expected to continue increasing while stable networks and security are expected to further accelerate the demand for digital transformation in the Korean manufacturing industry."ICT Areas with High Demands for Digital Transformation and Major Players"

ICT Areas with High Demands for Digital Transformation and Major Players Area, Company name, Businesses Area Company name Businesses Cloud Computing AWS - After the launch of the Seoul Region in 2022, AWS is operating one Region with four Availability Zones. AWS is a leader in IaaS.

Microsoft - Has two Regions in Seoul and Busan as well as a data center. Provider of Iaas, PaaS and SaaS integrated services.

LG CNS - AWS, MS, Google colocation services

- No-code platform and NFT service

DOUZONE - Offering a convergent solution combining existing ERP with AI, block chain and other new software technologies

- Business expansion on medical big data by using cloud

Hancomm - Service expansion to subscription service based on Hancom Office SaaS, SDK, API, etc.

DeepNoid - Low-code platform Deep:Phi used for AI education

- Offering industrial and medical AI platforms and universal AI platforms

DT & SW convergence Posco - Automating manufacturing by operating data-combined AI furnaces

- Expanded new business areas from AI and robotics to software

Samsung Medical Center - Developing self-driving ships based on unmanned/remote digital solutions

- Developing a smart shipyard with new software technologies including AI and big data

Hyundai Heavy Industries - Developing self-driving ships based on unmanned/remote digital solutions

- Developing a smart shipyard with new software technologies including AI and big data

Cybersecurity Ahnlab - Developing and providing various security solutions including online and mobile security solutions, game security, industrial security and network security devices

- Service expansion to cloud security and operation technology security

SK Shielders - Launched with the merger of SK Infosec (data security) and ADT Caps (physical security) in 2021

- Korea’s no. 1 data security service provider (Global Top 5 ranked by global data security agency CTA) and no. 2 physical security service provider

Igloo Security - 70% market share in domestic security control solution and public sector security service

- Owns a patent on self-driving security control technology

-

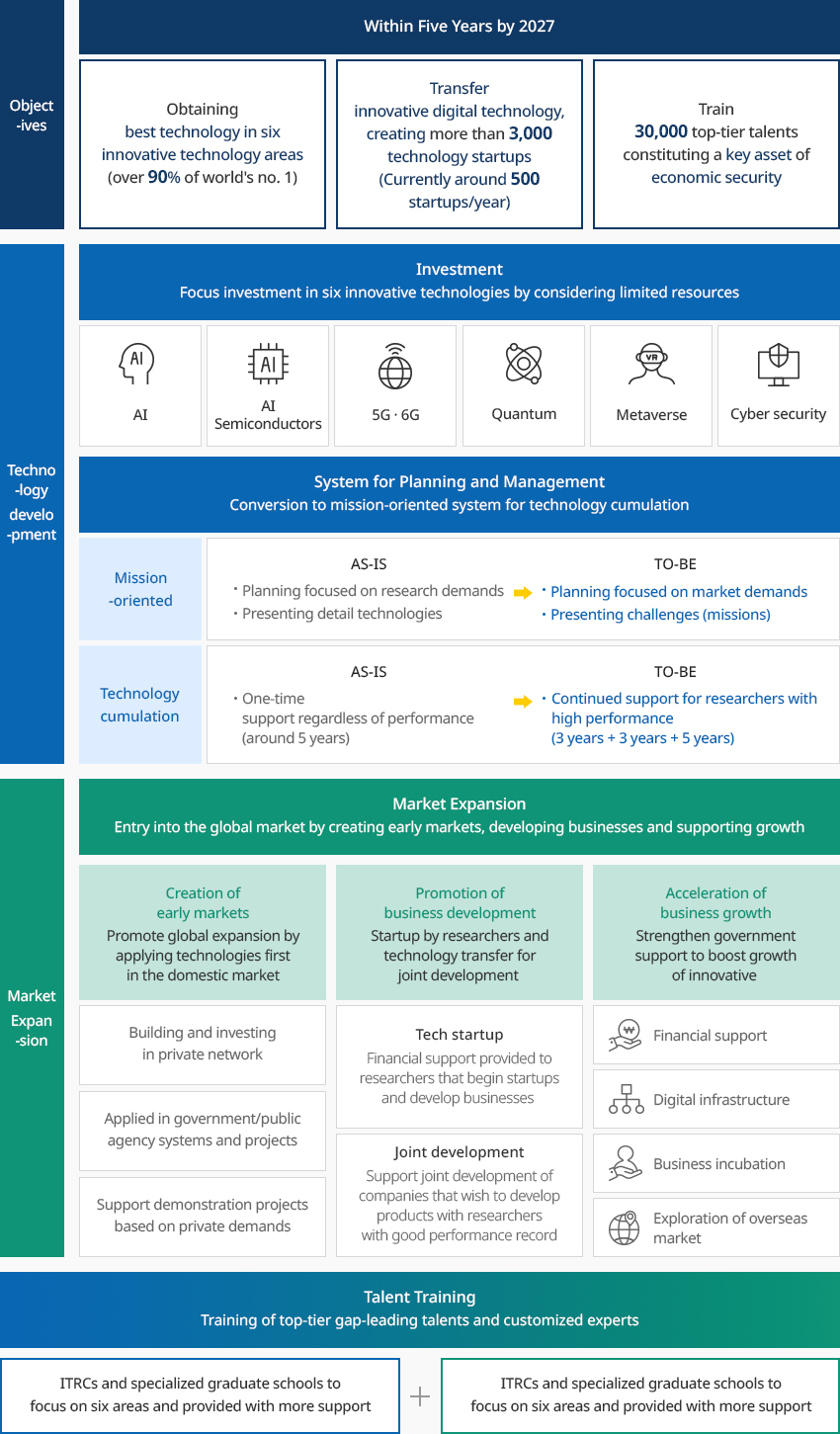

Digital Technology Innovation and Diffusion Strategy OpenDigital Technology Innovation and Diffusion StrategyAccording to the Digital Innovation and Diffusion Strategy announced in June 2022, the Korean government plans to invest heavily in six major innovative technology areas (i.e., AI, AI semiconductors, 5G-6G, quantum, metaverse, and cybersecurity) to explore and expand domestic and global markets. The government will support startups, technology transfer, growth, and overseas expansion in order to create the market in early stages and achieve excellent results. It will also strengthen support for Information Technology Research Centers (ITRCs) and specialized graduate schools to foster top-tier gap-leading advanced research specialists and experts needed in the field. The main objectives of the strategy include accumulating technology in the six major innovative technology fields, transferring innovative digital technology, creating more than 3,000 technology startups, and training 30,000 top-tier talents."Rising as a Global Leader of Digital Transformation"

Objectives - Within Five Years by 2027

Objectives - Within Five Years by 2027- Obtaining best technology in six innovative technology areas (over 90% of world's no. 1)

- Transfer innovative digital technology, creating more than 3,000 technology startups (Currently around 500 startups/year)

- Train 30,000 top-tier talents constituting a key asset of economic security

Technology developmentInvestment - Focus investment in six innovative technologies by considering limited resources- AI

- Semiconductors

- 5G · 6G

- Quantum

- Metaverse

- Cyber security

System for Planning and Management - Conversion to mission-oriented system for technology cumulation- Mission-oriented : AS-IS (Planning focused on research demands, Presenting detail technologies), TO-BE(Planning focused on market demands, Presenting challenges (missions))

- Technology cumulation : AS-IS (One-time support regardless of performance (around 5 years)), TO-BE(Continued support for researchers with high performance (3 years + 3 years + 5 years))

Market Expansion - y into the global market by creating early markets, developing businesses and supporting growth- Creation of early markets - Promote global expansion by applying technologies first

in the domestic market

- Building and investing in private network

- Applied in government/public agency systems and projects

- Support demonstration projects based on private demands

- Promotion of business development - Startup by researchers and technology transfer

for joint development

- Tech startup : Financial support provided to researchers that begin startups and develop businesses

- Joint development : Support joint development of companies that wish to develop products with researchers with good performance record

- Acceleration of business growth - Strengthen government support to boost growth of

innovative companies in six major areas

- Financial support

- Digital infrastructure

- Business incubation

- Exploration of overseas market

Talent Training - Training of top-tier gap-leading talents and customized experts (ITRCs and specialized graduate schools to focus on six areas and provided with more support + ITRCs and specialized graduate schools to focus on six areas and provided with more support) ※ Source : Ministry of Science and ICT, Digital Innovation and Diffusion Strategy (June 28, 2022)

※ Source : Ministry of Science and ICT, Digital Innovation and Diffusion Strategy (June 28, 2022) -

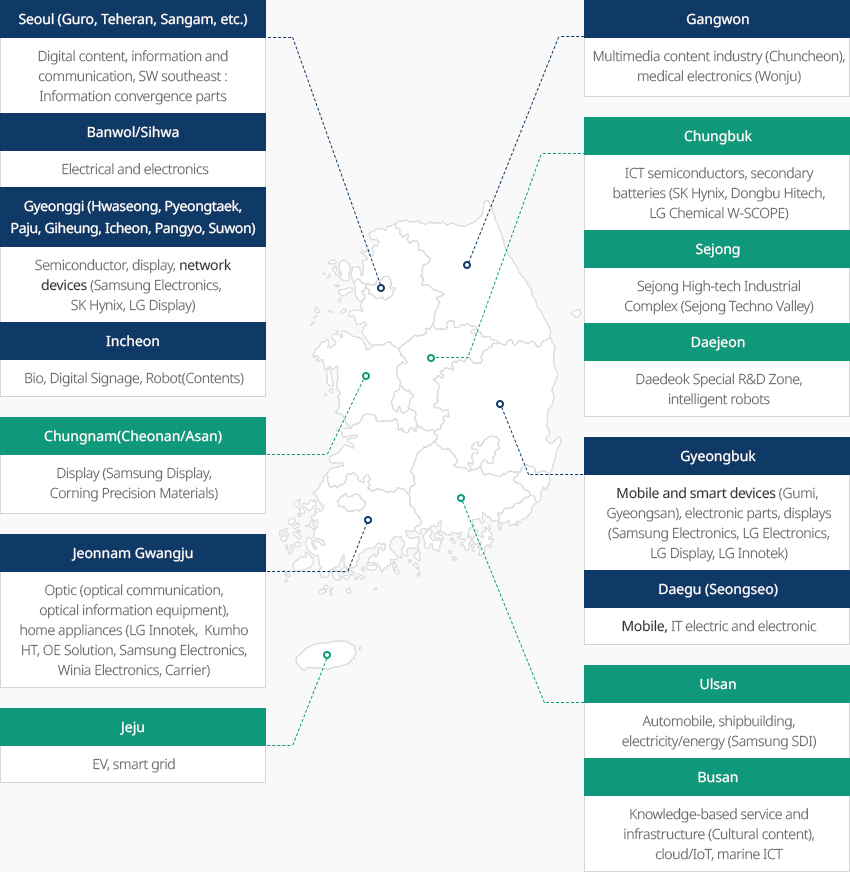

ICT Clusters OpenICT ClustersICT ManufacturingIn Korea, ICT clusters are distributed per region. By sector, smartphone clusters are located in the Seoul Metropolitan Area and the Daegu/Gyeongbuk area, and network equipment clusters are located in the Seoul Metropolitan Area."ICT Clusters Across Korea"

“ ICT Clusters in Korea ”

“ ICT Clusters in Korea ”- Seoul(Guro, Tehran, Sangam, etc): Digital content, information and communication, SW southeast: Information convergence parts

- Banwol/Sihwa: electrical and electronic

- Gyeonggi (Hwaseong, Pyeongtaek, Paju, Giheung, Icheon, Pangyo, Suwon): Semiconductor, display, network equipment (Samsung Electronics, SK Hynix, LG Display)

- Incheon: Bio, digital signage, robots (content)

- Chungnam (Cheonan/Asan): Display (Samsung Display, Corning Precision Materials)

- Jeonnam Gwangju: Mining (optical communication, optical information equipment), home appliances(LG Innotek, Kumho HT, OE Solution, Samsung Electronics, Winia Electronics, Carrier)

- Jeju: EV, smart grid

- Gangwon:Multimedia content industry (Chuncheon), medical electronics (Wonju)

- Chungbuk: ICT semiconductors, secondary batteries, etc. (SK Hynix, Dongbu Hitech, LG Chemical, W-SCOPE)

- Sejong: Sejong High-tech Industrial Complex (Sejong Techno Valley)

- Daejeon: Daedeok Special R&D Zone, intelligent robots

- Gyeongbuk: Mobile and smart devices (Gumi, Gyeongsan), electronic parts, displays (Samsung Electronics, LG Electronics, LG Display, LG Innotek)

- Daegu (Seongseo): Mobile, IT Electric and Electronic

- Ulsan: Automobile, shipbuilding, electricity/energy (Samsung SDI)

- Busan: Knowledge-based service and infrastructure (cultural content), Cloud/IOT, marine ICT

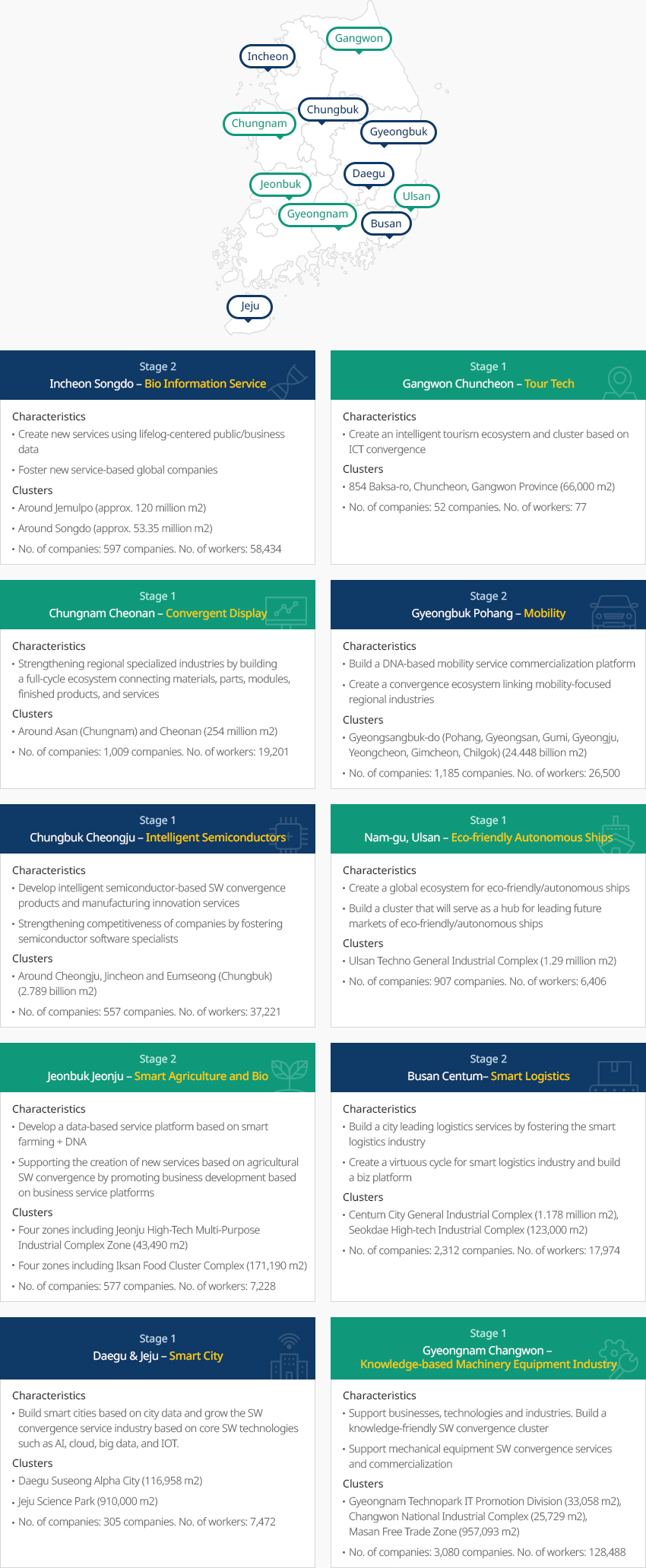

※ Source: Korea Electronic Information and Communication Industry Promotion AssociationSW Convergence ClustersThe Ministry of Science and ICT is supporting ten clusters across the country to strengthen the capability of the digital industry based on specialized industries in each region. It is also supporting regions to develop new digital industries and pursue digital transformation."ICT Clusters Across Korea"

※ Source: Korea Electronic Information and Communication Industry Promotion AssociationSW Convergence ClustersThe Ministry of Science and ICT is supporting ten clusters across the country to strengthen the capability of the digital industry based on specialized industries in each region. It is also supporting regions to develop new digital industries and pursue digital transformation."ICT Clusters Across Korea"

- Stage 2. Incheon Songdo - Bio Information Service

- Characteristics : Create new services using lifelog-centered public/business data, Foster new service-based global companies

- Clusters : Around Jemulpo (approx. 120 million m2), Around Songdo (approx. 53.35 million m2), No. of companies: 597 companies. No. of workers: 58,434

- Stage 1. Chungnam Cheonan - Convergent Display

- Characteristics : Strengthening regional specialized industries by building a full-cycle ecosystem connecting materials, parts, modules, finished products, and services

- Clusters : Around Asan (Chungnam) and Cheonan (254 million m2), No. of companies: 1,009 companies. No. of workers: 19,201

- Stage 1. Chungbuk Cheongju - Intelligent Semiconductors

- Characteristics : Develop intelligent semiconductor-based SW convergence products and manufacturing innovation services, Strengthening competitiveness of companies by fostering semiconductor software specialists

- Clusters : Around Cheongju, Jincheon and Eumseong (Chungbuk) (2.789 billion m2), No. of companies: 557 companies. No. of workers: 37,221

- Stage 2. Jeonbuk Jeonju - Smart Agriculture and Bio

- Characteristics :Develop a data-based service platform based on smart farming + DNA, Supporting the creation of new services based on agricultural SW convergence by promoting business development based on business service platforms

- Clusters : Four zones including Jeonju High-Tech Multi-Purpose Industrial Complex Zone (43,490 m2), Four zones including Iksan Food Cluster Complex (171,190 m2), No. of companies: 577 companies. No. of workers: 7,228

- Stage 1. Daegu & Jeju - Smart City

- Characteristics : Build smart cities based on city data and grow the SW convergence service industry based on core SW technologies such as AI, cloud, big data, and IOT.

- Clusters : Daegu Suseong Alpha City (116,958 m2), Jeju Science Park (910,000 m2), No. of companies: 305 companies. No. of workers: 7,472

- Stage 1. Gangwon Chuncheon - Tour Tech

- Characteristics : Create an intelligent tourism ecosystem and cluster based on ICT convergence

- Clusters : 854 Baksa-ro, Chuncheon, Gangwon Province (66,000 m2), No. of companies: 52 companies. No. of workers: 77

- Stage 2. Gyeongbuk Pohang - Mobility

- Characteristics : Build a DNA-based mobility service commercialization platform, Create a convergence ecosystem linking mobility-focused regional industries

- Clusters : Gyeongsangbuk-do (Pohang, Gyeongsan, Gumi, Gyeongju, Yeongcheon, Gimcheon, Chilgok) (24.448 billion m2), No. of companies: 1,185 companies. No. of workers: 26,500

- Stage 1. Nam-gu, Ulsan - Eco-friendly Autonomous Ships

- Characteristics : Create a global ecosystem for eco-friendly/autonomous ships , Build a cluster that will serve as a hub for leading future markets of eco-friendly/autonomous ships

- Clusters : Ulsan Techno General Industrial Complex (1.29 million m2), No. of companies: 907 companies. No. of workers: 6,406

- Stage 2. Busan Centum - Smart Logistics

- Characteristics : Build a city leading logistics services by fostering the smart logistics industry, Create a virtuous cycle for smart logistics industry and build a biz platform

- Clusters : Centum City General Industrial Complex (1.178 million m2), Seokdae High-tech Industrial Complex (123,000 m2), No. of companies: 2,312 companies. No. of workers: 17,974

- Stage 1. Gyeongnam Changwon - Knowledge-based Machinery Equipment Industry

- Characteristics : Support businesses, technologies and industries. Build a knowledge-friendly SW convergence cluster, Support mechanical equipment SW convergence services and commercialization

- Clusters : Gyeongnam Technopark IT Promotion Division (33,058 m2), Changwon National Industrial Complex (25,729 m2), Masan Free Trade Zone (957,093 m2), No. of companies: 3,080 companies. No. of workers: 128,488

-

Complex nameBit-Green Industrial Complex

-

Initial designation date2009.09.30

-

Designated area(m2)4,070,692

-

ManagementKorea Industrial Complex Corporation

-

Nearby RailwayHampyeong Station

-

Distance from station(km)30

-

Nearby AirportGwangju Airport

-

Distance from airport(km)20

-

Industrial water Supply capacity(ton/day)17130(㎥/day)

-

Affiliation local governmentGwangju Metropolitan City Gwangsan-gu, Jeollanam-do Hampyeong County

-

Population1,454,154

-

Complex nameSaemangeum District National Industrial Complex

-

Initial designation date2019.08.02

-

Designated area(m2)18,495,346

-

ManagementSaemangeum Development Agency

-

Nearby RailwayGunsan Station

-

Distance from station(km)28

-

Nearby AirportGunsan Airport

-

Distance from airport(km)15

-

Industrial water Supply capacity(ton/day)123077(㎥/day)

-

Affiliation local governmentJeollabuk-do Gunsan City

-

Population267,982

-

Complex nameUlsan Techno General Industrial Complex(Ulsan Free Economic Zone)

-

Initial designation date2013.06.20

-

Designated area(m2)1,286,977

-

ManagementUlsan Metropolitan City

-

Nearby RailwayTaehwagang Station

-

Distance from station(km)9

-

Nearby AirportUlsan Airport

-

Distance from airport(km)15

-

Industrial water Supply capacity(ton/day)2614(㎥/day)

-

Affiliation local governmentUlsan Metropolitan City Nam-gu

-

Population1,140,310

-

Complex nameChunhwa Agricultural Industrial Complex

-

Initial designation date2008.07.02

-

Designated area(m2)211,785

-

ManagementGyeongsangnam-do Miryang City

-

Nearby RailwaySangdong Station

-

Distance from station(km)14

-

Nearby AirportGimhae International Airport

-

Distance from airport(km)56

-

Industrial water Supply capacity(ton/day)633(㎥/day)

-

Affiliation local governmentGyeongsangnam-do Miryang City

-

Population105,099

-

Complex nameNamdong National Industrial Complex (Renewable Business District)

-

Initial designation date1980.09.02

-

Designated area(m2)9,504,046

-

ManagementKorea Industrial Complex Corporation

-

Nearby RailwayBupyeong Station

-

Distance from station(km)9

-

Nearby AirportIncheon Airport

-

Distance from airport(km)32

-

Industrial water Supply capacity(ton/day)49081(㎥/day)

-

Affiliation local governmentIncheon Metropolitan City Namdong-gu

-

Population2,943,491

-

Complex nameHaso Eco-friendly General Industrial Complex

-

Initial designation date2012.05.11

-

Designated area(m2)306,703

-

ManagementDaejeon Metropolitan City

-

Nearby RailwayDaejeon Station

-

Distance from station(km)17

-

Nearby AirportCheongju International Airport

-

Distance from airport(km)71

-

Industrial water Supply capacity(ton/day)1300(㎥/day)

-

Affiliation local governmentDaejeon Metropolitan City Dong-gu

-

Population1,469,431