- Home

- Investment Opportunities

- Industries

- Semiconductor

Semiconductor

-

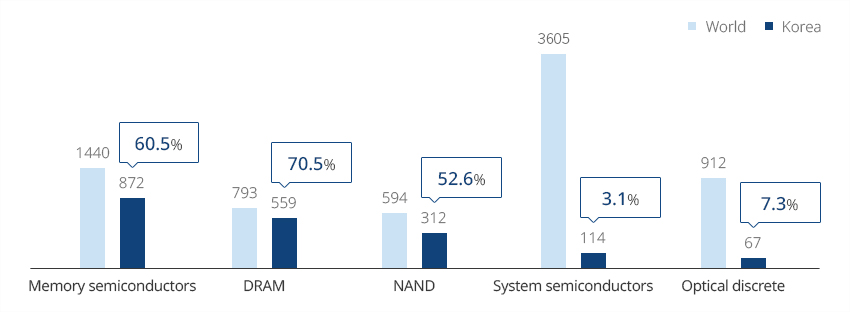

World's No. 1 Memory Semiconductor Producer No. 2 Semiconductor Producer CloseWorld's No. 1 Memory Semiconductor Producer No. 2 Semiconductor ProducerThe semiconductor sector continued growing since the 1980s as semiconductors were used in computers, smartphones and others. The global semiconductor market reached USD 604 billion in 2022. Korea held a global semiconductor market share of 17.7% in 2022, and continued to rank No. 2 in the world for ten straight years since 2013."Semiconductor Market Shares of Major Producers (2001~2022)"※ Source: OMDIA 2023More specifically, Korea accounted for 60.5% of the global memory semiconductor market, with DRAM market share of 70.5% and NAND market share of 52.6%. Korean-made memory semiconductors possess the world’s best technology. Korea continues to focus on R&D and investment in order to keep its competitive advantage. In addition, Korea is pushing to expand its foundry market share based on ultra-fine processing technology, and the country accounts for 17.3% of the global foundry market."Semiconductor Market Shares of Major Producers (2022)"

Semiconductor Market Shares of Major Producers (2022) Category, World, Korea Category World Korea Memory semiconductors 1440 872 (60.5%) DRAM 793 559 (70.5%) NAND 594 312 (52.6%) System semiconductors 3605 114 (3.1%) Optical discrete 912 67 (7.3%)  ※ Source: OMDIA 2023

※ Source: OMDIA 2023 -

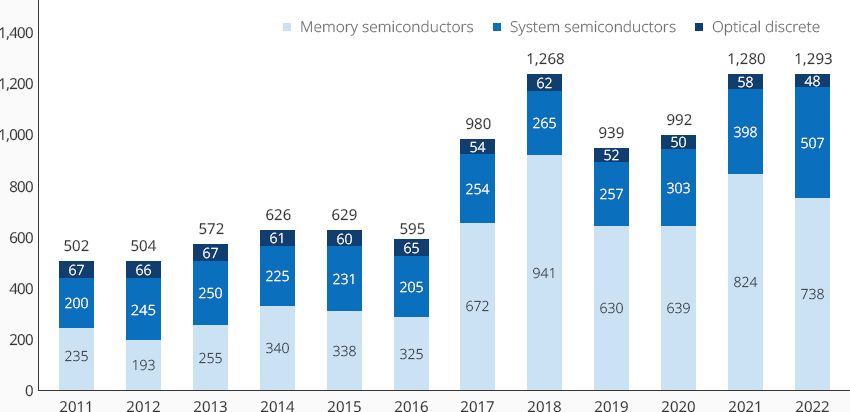

Korea’s Principal Export Item Leading the Economy OpenKorea’s Principal Export Item Leading the EconomyKorea’s total export of semiconductors in 2022 amounted to USD 129.2 billion, of which memory semiconductors accounted for USD 73.8 billion or 57.46%. Semiconductors are one of Korea’s principal export items, accounting for 18.9% of total exports as of 2022, leading the Korean economy and industry."Korea’s Semiconductor Export Trend (2011-2022)"

Korea’s Semiconductor Export Trend (2011-2022) Year, Memory semiconductors, System semiconductors, Optical discrete Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Memory semiconductors 235 193 255 340 338 325 672 941 630 639 824 738 System semiconductors 200 245 250 225 231 205 254 265 257 303 398 507 Optical discrete 67 66 67 61 60 65 54 62 52 50 58 48 합계 502 504 572 626 629 595 980 1,268 939 992 1,280 1,293  ※ Source: OMDIA 2023

※ Source: OMDIA 2023 -

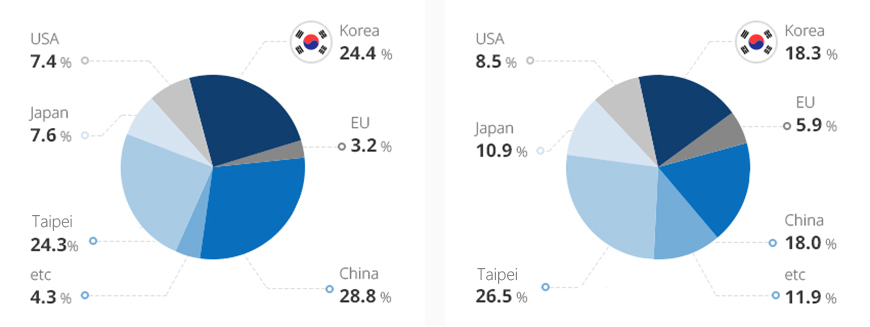

Appeal of Korea's Semiconductor Market OpenAppeal of Korea's Semiconductor MarketKorea has the world's third largest semiconductor manufacturing facility after China and Taiwan, and it accounts for about 17.9% of the world's total semiconductor production capacity. The semiconductor production capacity of East Asia including Japan, Taiwan, and China amounts to about 79.3% of global capacity. Korea's geographical advantages also provides an optimal environment for companies looking to enter the East Asian semiconductor market."Major Semiconductor Manufacturers and Shares (2022)"※ Source : SEMI 2023With such large-scale semiconductor manufacturing facilities, Korea is one of the world's most active investors in semiconductor facilities along with Taiwan and China and has a vast semiconductor equipment/materials market. As of 2022, Korea accounts for 24.4% of the global semiconductor equipment market and 18.3% of the semiconductor materials market. Given that China's market share of 28.8% includes the investment of Samsung Electronics and SK Hynix operating in China, Korea's semiconductor equipment/materials market is larger than the figure suggests. For producers of semiconductor equipment and materials, Korea and Korean companies present great opportunities.

World's Major Semiconductor Equipment Markets

World's Major Semiconductor Equipment Markets- Korea 24.4%

- China 28.8%

- Taiwan 24.3%

- Japan 7.6%

- USA 7.4%

- EU 3.2%

- etc 4.3%

World's Major Semiconductor Materials Markets- Korea 18.3%

- Taiwan 26.5%

- China 18.0%

- etc 11.9%

- Japan 10.9%

- USA 8.5%

- EU 5.9%

※ Source : SEMI 2023

※ Source : SEMI 2023 -

Business Expansion in Korea’s Semiconductor Market by Global Materials, Parts, and Equipment Companies OpenBusiness Expansion in Korea’s Semiconductor Market by Global Materials, Parts, and Equipment CompaniesMany global companies in the fields of semiconductor materials, parts, and equipment based - one of Korea’s flagship industries - are entering Korea. Lam Research, a US semiconductor etching and deposition equipment maker, established Lam Research Manufacturing Korea in 2011. Since then, its domestic production has grown continuously, and in 2021, a new facility with an area of 5,170 m2 went into operation in Hwaseong, Gyeonggi. The company opened the Lam Research Technology Center in 2022 and is playing a crucial role in strengthening Korea's semiconductor ecosystem by developing key technologies and equipment in Korea. ASML, the exclusive supplier of advanced EUV exposure equipment, is building a state-of-the-art EUV cluster in Hwaseong. Many other semiconductor materials companies, such as TOK, DuPont, Merck, and Ulvak are expanding their investment for production within Korea. Numerous semiconductor materials, parts and equipment producers are operating their R&D businesses in Korea and collaborating in projects with global players operating in Korea.Onsemi, a US developer of power semiconductors, invested KRW 1.4 trillion in Korea to build a SiC power semiconductor plant and a cutting-edge research center in Korea. Through these efforts, Onsemi plans to work together with the Korean auto industry and seek opportunities in the EV market with high growth potentials."Korean Equipment, Materials and Parts Producers Specializing in Each Semiconductor Manufacturing Process"

Korean Equipment, Materials and Parts Producers Specializing in Each Semiconductor Manufacturing Process Category, Equipment, Material, Parts Category Equipment Material Parts Lithography SEMES, PSK, DONGJIN NEPES, PKL, ENF, SK siltron S&S TECH, FST Etching SEMES, GigaLane, ZEUS, Adaptive Plasma soulbrain, FOOSUNG, ENF, WONIK MATERIALS MiCo, MKP, Lotvacuum, SK materials Deposition WONIK IPS, TES, Sus ENETEC, AP Systems SK materials, WONIK MATERIALS, soulbrain, FOOSUNG MECARO, MiCo, WONIK QnC, NP Diffusion AP Systems, RFPT WONIK QnC, NP SKC solmics, KKQ Metallization TOP ENGINEERING, JUSUNG, AP Systems soulbrain, GO Element MiCo, MKP Polishing&Cleaning ZEUS, KC TECH, PSK, TES SK materials, Musin, OCI, soulbrain, ENF SYNOPEX, MKP, S&T Metrology & Inspection AUROS, SFA, NEXTIN, E-SOL Park SYSTEMS XAVIS Packagin & Testing UniTest, HANMI, nepes, EXICON SEMES, EO TECHNICS, NEON, DONGJIN MiCo, LEENO, ISC

-

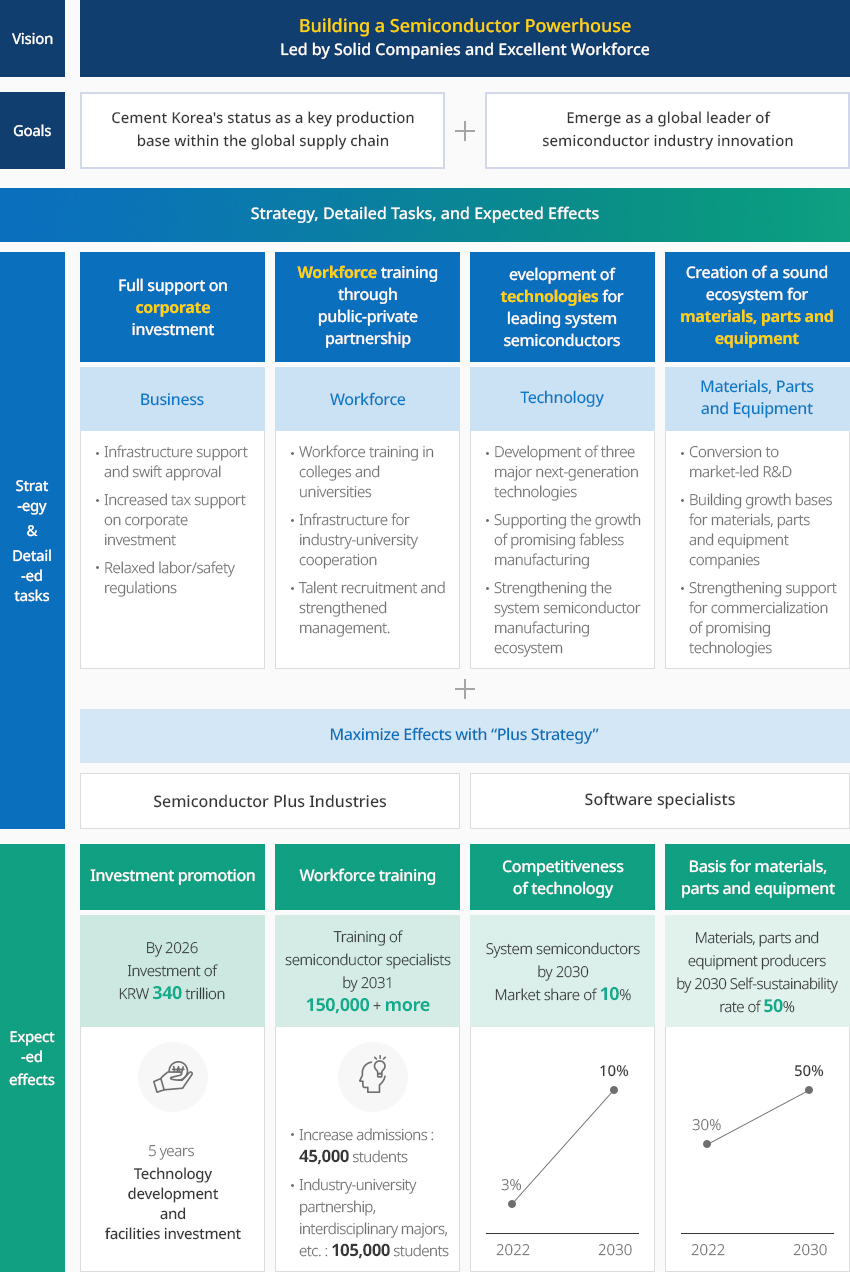

Semiconductor Powerhouse Strategy Announced to Make Korea a Leader of the Global Semiconductor Industry OpenSemiconductor Powerhouse Strategy Announced to Make Korea a Leader of the Global Semiconductor IndustryThe Korean government's announcement of the K-Semiconductor Strategy (in May 2021), the Semiconductor Powerhouse Strategy (in July 2022), and the Strategy for Strengthening the System Semiconductor Ecosystem (in March 2023) shows its strong commitment to build a semiconductor power house by fostering the system semiconductor sector rather than focusing only on memory semiconductors.With a vision to build the world's best semiconductor supply chain, the Korean government strengthened tax support for investment in semiconductor facilities (15-25%) and R&D (30-50%), and it is also actively improving labor and environmental regulations to facilitate semiconductor investment. The government plans to further support the establishment of infrastructure (i.e., water supply and power systems) in the semiconductor complexes in Pyeongtaek and Yongin where new and additional construction of large-scale semiconductor manufacturing facilities are ongoing.Through regulatory reforms and financial support, the government plans to train and supply 150,000 professionals for the semiconductor industry by 2030. It will also support the R&D partnership between companies by creating clusters specializing in each area of semiconductor technology."Semiconductor Powerhouse Strategy"

Vision - Building a Semiconductor Powerhouse Led by Solid Companies and Excellent WorkforceGoals - Cement Korea's status as a key production base within the global supply chain + Emerge as a global leader of semiconductor industry innovationStrategy & Detailed Tasks

Vision - Building a Semiconductor Powerhouse Led by Solid Companies and Excellent WorkforceGoals - Cement Korea's status as a key production base within the global supply chain + Emerge as a global leader of semiconductor industry innovationStrategy & Detailed Tasks- Full support on corporate investment - Business

- Infrastructure support and swift approval

- Increased tax support on corporate investment

- Relaxed labor/safety regulations

- Workforce training through public-private partnership - Workforce

- Workforce training in colleges and universities

- Infrastructure for industry-university cooperation

- Talent recruitment and strengthened management.

- Development of technologies for leading system semiconductors - Technology

- Development of three major next-generation technologies

- Supporting the growth of promising fabless manufacturing

- Strengthening the system semiconductor manufacturing ecosystem

- Creation of a sound ecosystem for materials, parts and equipment - Materials, Parts

and Equipment

- Conversion to market-led R&D

- Building growth bases for materials, parts and equipment companies

- Strengthening support for commercialization of promising technologies

Maximize Effects with “Plus Strategy” - Semiconductor Plus Industries, Software specialistsExpected effects- Investment promotion : By 2026 Investment of KRW 340 trillion - 5 years Technology development and facilities investment

- Workforce training : Training of semiconductor specialists by 2031 150,000 + more

- Increase admissions 45,000 students

- Industry-university partnership, interdisciplinary majors, etc. 105,000 students

- Competitiveness of technology : System semiconductors by 2030 Market share of 10% (2022:3%, 2030:10%)

- Basis for materials, parts and equipment : Materials, parts and equipment producers by 2030 Self-sustainability rate of 50% (2022:30%, 2030:50%)

- Full support on corporate investment - Business

-

Semiconductor Clusters Led by Samsung Electronics and SK Hynix OpenSemiconductor Clusters Led by Samsung Electronics and SK HynixSemiconductor companies are concentrated in the Gyeonggi-do region, with some in Chungcheongbuk-do and Chungcheongnam-do. Pangyo-Giheung-Hwaseong-Pyeongtaek-Onyang and Icheon-Cheongju will be connected to Yongin to complete the K-Semiconductor Belt, the world’s largest semiconductor supply chain.Samsung Electronics plans to build a new factory in Pyeongtaek, in addition to Suwon, Giheung, and Hwaseong, which will form the world’s largest semiconductor production belt in the world. SK Hynix will build a 4.15 million m2 semiconductor cluster in Yongin, Gyeonggi-do, where it will construct four fabs over a ten-year period starting in 2015. Samsung Electronics also plans to build a total of six fabs in the Pyeongtaek cluster, of which three fabs have been constructed. In addition, Samsung Electronics recently announced additional investments in its foundries located mostly in Yongin.In addition to the clusters in Pyeongtaek and Yongin, there are other clusters specializing in semiconductor equipment and materials that have attracted investment from Korean as well as foreign companies. ASML is investing in the EUV cluster in Hwaseong. There are also clusters specializing in semiconductor equipment and materials in Pyeongtaek and Cheonan, with the Korean government providing policy support for these clusters."K-Semiconductor Belt"The Pangyo cluster for system semiconductor companies is also expanding. There are many fabless companies located here, as well as many IT companies that are customers of fabless companies. Its proximity to Seoul gives it an advantage in attracting high-level talent, and there are R&D centers of other semiconductor companies besides fabless companies."Pangyo System Semiconductor Cluster"

-

Complex nameSuwon Deltaplex (Block 3)

-

Initial designation date2008.12.26

-

Designated area(m2)847,409

-

ManagementGyeonggi-do Suwon City

-

Nearby RailwaySuwon Station

-

Distance from station(km)4

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)49

-

Industrial water Supply capacity(ton/day)3195(㎥/day)

-

Affiliation local governmentGyeonggi-do Suwon City

-

Population1,190,074

-

Complex namePangyo 2nd Techno Valley[formerly: Pangyo Creative Economy Valley]

-

Initial designation date2015.11.30

-

Designated area(m2)430,402

-

ManagementGyeonggi-do Seongnam City

-

Nearby RailwayOksu Station

-

Distance from station(km)19

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)45

-

Industrial water Supply capacity(ton/day)2025(㎥/day)

-

Affiliation local governmentGyeonggi-do Seongnam City

-

Population940,668

-

Complex nameHwaseong Songsan Techno Park General Industrial Complex

-

Initial designation date2016.12.26

-

Designated area(m2)528,723

-

ManagementHwaseong Urban Corporation

-

Nearby RailwaySuwon Station

-

Distance from station(km)34

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)59

-

Industrial water Supply capacity(ton/day)2,034(㎥/day)

-

Affiliation local governmentGyeonggi-do Hwaseong City

-

Population842,864

-

Complex nameGunpo High-tech Industrial Complex

-

Initial designation date2013.12.27

-

Designated area(m2)287,619

-

ManagementGyeonggi-do Gunpo City

-

Nearby RailwaySuwon Station

-

Distance from station(km)10

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)38

-

Industrial water Supply capacity(ton/day)1,376(㎥/day)

-

Affiliation local governmentGyeonggi-do Gunpo City

-

Population275,508

-

Complex nameJeungpyeong 2nd General Industrial Complex

-

Initial designation date2009.11.20

-

Designated area(m2)702,807

-

ManagementChungcheongbuk-do Jeungpyeong County

-

Nearby RailwayJeungpyeong Station

-

Distance from station(km)6

-

Nearby AirportCheongju International Airport

-

Distance from airport(km)17

-

Industrial water Supply capacity(ton/day)3,348(㎥/day)

-

Affiliation local governmentChungcheongbuk-do Jeungpyeong County

-

Population81,949

-

Complex nameLG Digital Park General Industrial Complex

-

Initial designation date2012.04.26

-

Designated area(m2)125,312

-

ManagementGyeonggi-do Pyeongtaek City

-

Nearby RailwayOsan Station

-

Distance from station(km)22

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)72

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentGyeonggi-do Pyeongtaek City

-

Population527,166