- Home

- Investment Opportunities

- Industries

- Display

Display

-

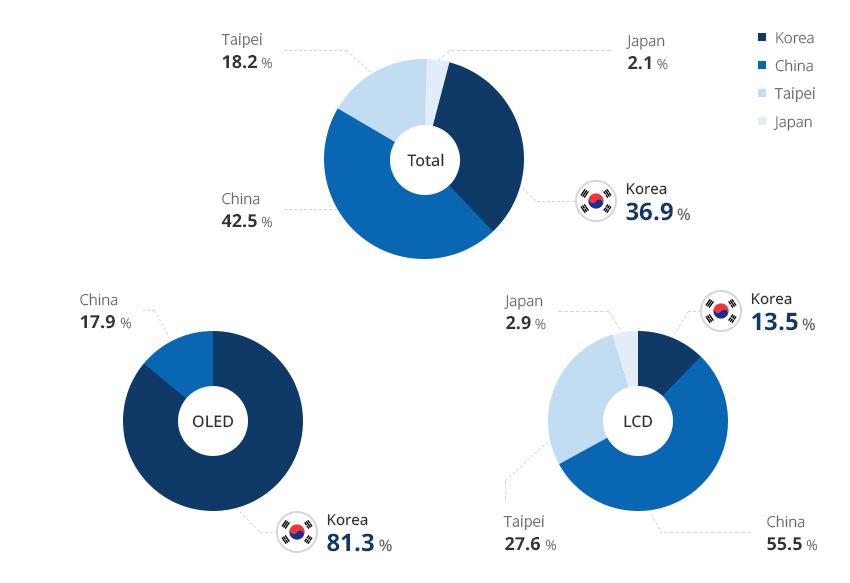

Korea, Leading the Next-Generation OLED Market and Technology OpenKorea, Leading the Next-Generation OLED Market and TechnologyA display panel is an image displaying device (panel) that shows various information on a screen for people to see, and plays the role of the eye of the industry.Korea has maintained the world's top position in the display industry for seventeen years since 2004, and most notably in the field of OLED acknowledged as the next generation display, Korea leads the world with a global market share of 81.3% (2022).Based on continuous R&D, Korea is leading OLED technology by introducing the world's first rollerable TV and foldable OLED. Korea's OLED production technology is three to five years ahead of its competitors, and while some small and medium-sized OLEDs are produced by competitors, Korea is the exclusive producer of large OLEDs.In the 1990s, display panels were mainly produced by four countries in Northeast Asia (Korea, China, Japan, and Taiwan), starting with Japan's investment in LCDs. In recent years, however, Korea and China have emerged as major producers.China started leading the global market share from 2021 based on large-scale investment in LCDs, while Korea strategically reduced LCD production and focused on investing in OLEDs to expand production as the panels are rapidly being adopted in major home appliances such as mobile phones and TVs as well as IT products.

-

Creation of New Markets with Innovative Convergent Technologies OpenCreation of New Markets with Innovative Convergent TechnologiesKorea is proactively responding to new demand markets such as virtual reality, automotive, aircraft, architecture, medical, and interior by developing not only variable displays with no design restrictions such as foldable, rollable, and stretchable displays, but also transparent OLEDs and 3D displays such as holograms.After successfully mass-producing the world's first quantum dot (QD) display product in 2021, Korea is striving to develop next-generation technologies such as micro LEDs and micro displays for AR and VR while refining OLED technologies.Korea plans to invest KRW 62 trillion by 2026 in large-scale OLEDs and QD.The production of OLEDs for IT products such as laptops and tablets as well as for mobile phones and TVs will help Korea continuously lead the trends of next-generation technology.

-

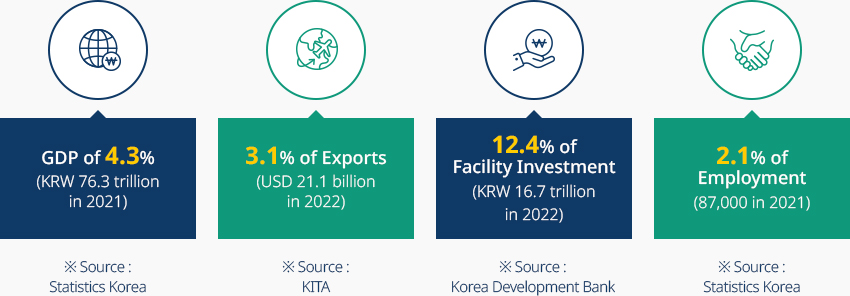

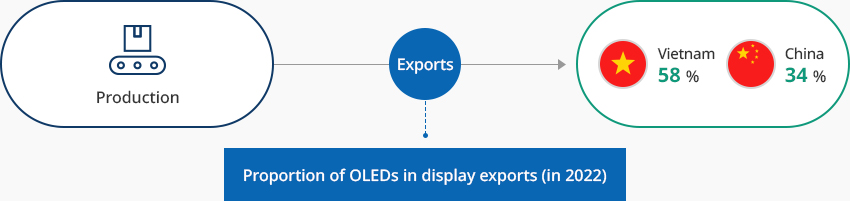

Korea’s Stable Display Industry Ecosystem OpenKorea’s Stable Display Industry EcosystemThe Korean display industry has an organic industrial ecosystem linking the nation's major panel producers (e.g., Samsung Display and LG Display) and manufacturers of materials, parts and equipment and is also known for its export-oriented global supply chain.The industry consists of two panel manufacturers leading large-scale facility investment and about 1,290 small and medium-sized enterprises producing materials, parts and equipment.The advancement of panel technology raised the localization rate of small and medium-sized enterprises to 65%, with companies from the United States, Japan, and EU countries supplying key materials and equipment used in panel manufacturing.As the country makes more OLED investment, domestic production of displays reached KRW 76.3 trillion or 4.3% of GDP (in 2021), total exports reached USD 21.1 billion or 3.1% of national exports (in 2022), and facility investment and employment accounted for 12.4% (in 2022) and 2.1% (in 2021) of the manufacturing industry, respectively to support Korea's economic growth."Korean Machinery Industry within the Manufacturing Sector (as of 2021)"The majority of exports are to Vietnam (58%) and China (34%) where display module factories and producers of TVs and mobile phones are locatedThe share of OLEDs in display exports has increased to 72% (in 2022) as the sector shifts to a high-value-added export structure."Export Structure of the Display Industry (proportion)"

-

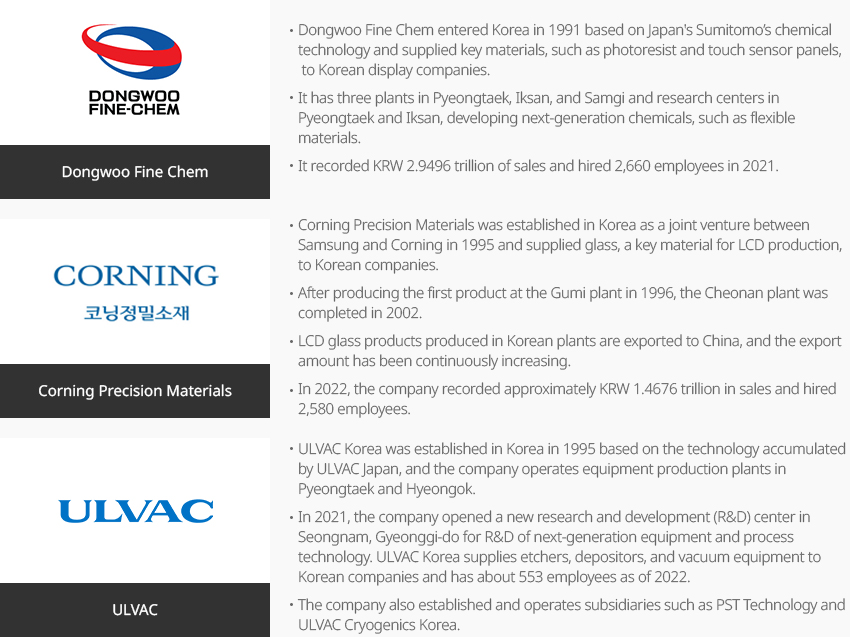

Foreign-Invested Companies Successfully Operating in Korea OpenForeign-Invested Companies Successfully Operating in KoreaThe growth of Korean panel companies since 2000 has attracted many foreign companies to enter Korea especially in the fields of parts, materials and equipment as the domestic base is still weak.Most of parts and materials companies produce liquid crystals, glass and films in Korea while equipment companies include those producing in Korea and those installing, repairing and exchanging products.

- Dongwoo Fine Chem

- Dongwoo Fine Chem entered Korea in 1991 based on Japan's Sumitomo’s chemical technology and supplied key materials, such as photoresist and touch sensor panels, to Korean display companies.

- It has three plants in Pyeongtaek, Iksan, and Samgi and research centers in Pyeongtaek and Iksan, developing next-generation chemicals, such as flexible materials.

- It recorded KRW 2.9496 trillion of sales and hired 2,660 employees in 2021.

- Corning Precision Materials

- Corning Precision Materials was established in Korea as a joint venture between Samsung and Corning in 1995 and supplied glass, a key material for LCD production, to Korean companies.

- After producing the first product at the Gumi plant in 1996, the Cheonan plant was completed in 2002.

- LCD glass products produced in Korean plants are exported to China, and the export amount has been continuously increasing.

- In 2022, the company recorded approximately KRW 1.4676 trillion in sales and hired 2,580 employees.

- ULVAC

- ULVAC Korea was established in Korea in 1995 based on the technology accumulated by ULVAC Japan, and the company operates equipment production plants in Pyeongtaek and Hyeongok.

- In 2021, the company opened a new research and development (R&D) center in Seongnam, Gyeonggi-do for R&D of next-generation equipment and process technology. ULVAC Korea supplies etchers, depositors, and vacuum equipment to Korean companies and has about 553 employees as of 2022.

- The company also established and operates subsidiaries such as PST Technology and ULVAC Cryogenics Korea.

- Dongwoo Fine Chem

-

Increased Tax Deduction on R&D and Facility Investment Introduced to Boost Investment OpenIncreased Tax Deduction on R&D and Facility Investment Introduced to Boost InvestmentThe Korean government is providing various types of support, including a tax credit for R&D expenses in the display field and for facility investment.More specifically, the government designated five technologies, including OLED, quantum dot (QD), micro LED panel technology, and related minor technologies, as national strategic technologies in 2022, allowing corporate tax deduction of 15% for large and medium-sized enterprises and 25% for small and medium-sized enterprises when they invest in facilities. Moreover, companies whose 2023 investment exceed the average investment in the previous three years are eligible for an additional deduction of 10% of the difference.Investment in R&D and facilities related to seven designated technologies and facilities, including AMOLED, micro LED, and QD (Quantum Dot), will receive a tax credit. As related materials, parts, and equipment as well as panels are subject to the tax credit, many small and medium-sized enterprises are utilizing this system."Technology Eligible for Tax Credit"

Technology Eligible for Tax Credit Type, Technology Eligible for Tax Credit Type Technology Eligible for Tax Credit National strategic technology eligible for tax credit 1 AMOLED panel design/manufacturing/processing/module/operation technology 2 Design/manufacturing/processing/module/operation technology for manufacturing display panels with eco-friendly QD (Quantum Dot) materials. 3 Micro LED display panels/parts/materials/equipment manufacturing technology 4 Deposition/coating material technology for manufacturing display panels 5 Display TFT formation equipment and parts technology New growth source technology eligible for tax credit 1 9-inch or larger AMOLED panel function improvement, and parts, materials, and equipment manufacturing technology 2 Atmospheric pressure plasma etching equipment technology 3 Flexible display panel/parts/materials/equipment manufacturing technology 4 Next-generation vehicle display panels/parts/materials/equipment manufacturing technology 5 Micro LED display panels/parts/materials/equipment manufacturing technology 6 Display panel/parts/materials/equipment manufacturing technology for VR/AR/MR 7 Eco-friendly QD (Quantum Dot) nano material applied display panels/parts/materials/ equipment manufacturing technology "Technology Eligible for Tax Credit and Tax Credit Rate"Technology Eligible for Tax Credit and Tax Credit Rate Type, R&D, Tax credit rate, Rate of increase Type R&D Tax credit rate Rate of increase Large enterprises Medium-sized enterprises Small enterprises R&D General 2% 8% 25% - New growth & source technology 20~30% 30~40% National strategic technology 30~40% 40~50% Facility investment General 3% 7% 12% +10% New growth & source technology 6% 10% 18% National strategic technology 15% 15% 25% -

Quota Tariffs Introduced to Stabilize the Supply Chain OpenQuota Tariffs Introduced to Stabilize the Supply ChainThe Korean government is operating a quota tariff system to strengthen industrial competitiveness and facilitate the supply and demand of goods. The quota tariff is a flexible tariff system that can be applied temporarily by reducing the rate within the range of 40%p to the basic tariff rate for price stability and smooth supply and demand. Items subject to tariff quota are selected through a demand survey every six months or one year. The display industry is also receiving quota tariff support for manufacturing equipment, materials, and parts necessary for panel production.Whereas quota tariffs were applied to imported manufacturing equipment in the past, the recent inclusion of display manufacturing equipment in the expanded ITA agreement resulted in quota tariffs applied to materials rather than manufacturing equipment.In 2023, reducers were designated to be eligible for the quota tariff, which means they can be imported duty-free.Since eligible items are selected through an annual demand survey, companies planning to import a certain product needs to apply for the quota tariff in advance.

-

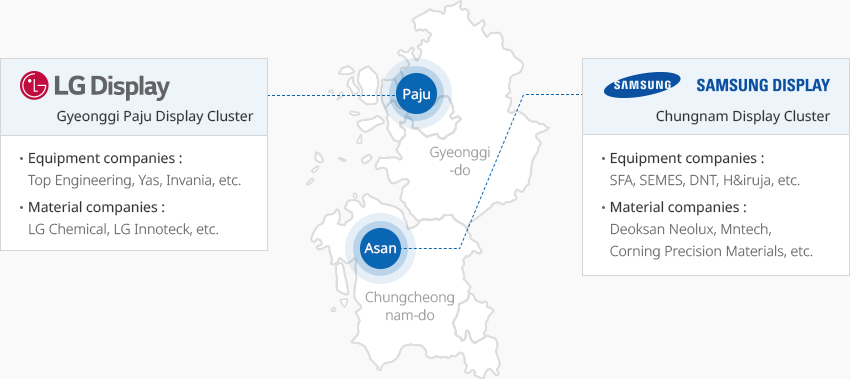

Display Clusters In Korea OpenDisplay Clusters In KoreaIn Korea, display panels are mostly produced in clusters in Asan, Chungnam, where Samsung Display is located, and in Paju, Gyeonggi, where LG Display is located. Asan and Tangjeong in Chungnam have excellent R&D capabilities enjoying the support from local governments such as display centers and the presence of more than ten universities. In addition, KTX stations provide quick access to various regions, and Pyeongtaek Port located 30 kilometers away help reduce logistics costs for imports and exports.Located nearby ports and airports, Paju can export more than 90% of its products manufactured in the area, and its proximity to the Seoul metropolitan area enables it to tap into high-quality manpower from universities in the Seoul metropolitan area. Moreover, Paju also has ample local talents thanks to agreements with nearby universities and the designation of specialized high schools."Display Clusters Around Korea"

Display Clusters Around Korea Category, Paju, Asan Tangjeong Category Paju Asan Tangjeong Distance to Incheon International Airport 50km 164km Port 50km (Incheon) 30km (Pyeongtaek, Dangjin) Seoul 35km 85km Seoul Station 60 minutes (by car and railway) 34 minutes (KTX), 90 minutes (by car) Water available for use Paldang Dam Daecheong Dam Nearby cities Ilsan Cheonan Asan * Data provided by: Korea Display Industry Association"Display Clusters Around Korea" LG Display - Gyeonggi Paju Display Cluster

LG Display - Gyeonggi Paju Display Cluster- Equipment companies: Top Engineering, Yas, Invania, etc.

- Material companies: LG Chemical, LG Innoteck, etc.

Samsung Display - Chungnam Display Cluster- Equipment companies: SFA, SEMES, DNT, H&iruja, etc.

- Material companies: Deoksan Neolux, Mntech, Corning Precision Materials, etc.

-

Complex nameAsan 2nd Techno Valley General Industrial Complex

-

Initial designation date2010.12.28

-

Designated area(m2)1,200,443

-

ManagementChungcheongnam-do Asan City

-

Nearby RailwayPyeongtaek Station

-

Distance from station(km)13

-

Nearby AirportCheongju International Airport

-

Distance from airport(km)60

-

Industrial water Supply capacity(ton/day)3915(㎥/day)

-

Affiliation local governmentChungcheongnam-do Asan City

-

Population313,871

-

Complex nameSinchon General Industrial Complex

-

Initial designation date2007.10.01

-

Designated area(m2)189,797

-

ManagementGyeonggi-do Paju City

-

Nearby RailwayHaengsin Station

-

Distance from station(km)27

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)30

-

Industrial water Supply capacity(ton/day)233(㎥/day)

-

Affiliation local governmentGyeonggi-do Paju City

-

Population459,158

-

Complex nameTanhyeon General Industrial Complex

-

Initial designation date2000.12.19

-

Designated area(m2)122,871

-

ManagementGyeonggi-do Paju City

-

Nearby RailwayMunsan Station

-

Distance from station(km)8

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)37

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentGyeonggi-do Paju City

-

Population459,158

-

Complex nameSinchang Agricultural Industrial Complex

-

Initial designation date1987.08.20

-

Designated area(m2)56,040

-

ManagementChungcheongnam-do Asan City

-

Nearby RailwayShinchang Station

-

Distance from station(km)4

-

Nearby AirportCheongju International Airport

-

Distance from airport(km)59

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentChungcheongnam-do Asan City

-

Population313,871

-

Complex nameGumi National Industrial Complex (2,3,4, Expansion Complex)

-

Initial designation date1977.04.22

-

Designated area(m2)16,651,936

-

ManagementKorea Industrial Complex Corporation

-

Nearby RailwayGumi Station

-

Distance from station(km)11

-

Nearby AirportDaegu International Airport

-

Distance from airport(km)51

-

Industrial water Supply capacity(ton/day)72327

-

Affiliation local governmentGyeongsangbuk-do Gumi City

-

Population416,551

-

Complex nameJeungpyeong 2nd General Industrial Complex

-

Initial designation date2009.11.20

-

Designated area(m2)702,807

-

ManagementChungcheongbuk-do Jeungpyeong County

-

Nearby RailwayJeungpyeong Station

-

Distance from station(km)6

-

Nearby AirportCheongju International Airport

-

Distance from airport(km)17

-

Industrial water Supply capacity(ton/day)3,348(㎥/day)

-

Affiliation local governmentChungcheongbuk-do Jeungpyeong County

-

Population81,949