- Home

- Investment Opportunities

- Industries

- Automobile Parts

Automobile Parts

-

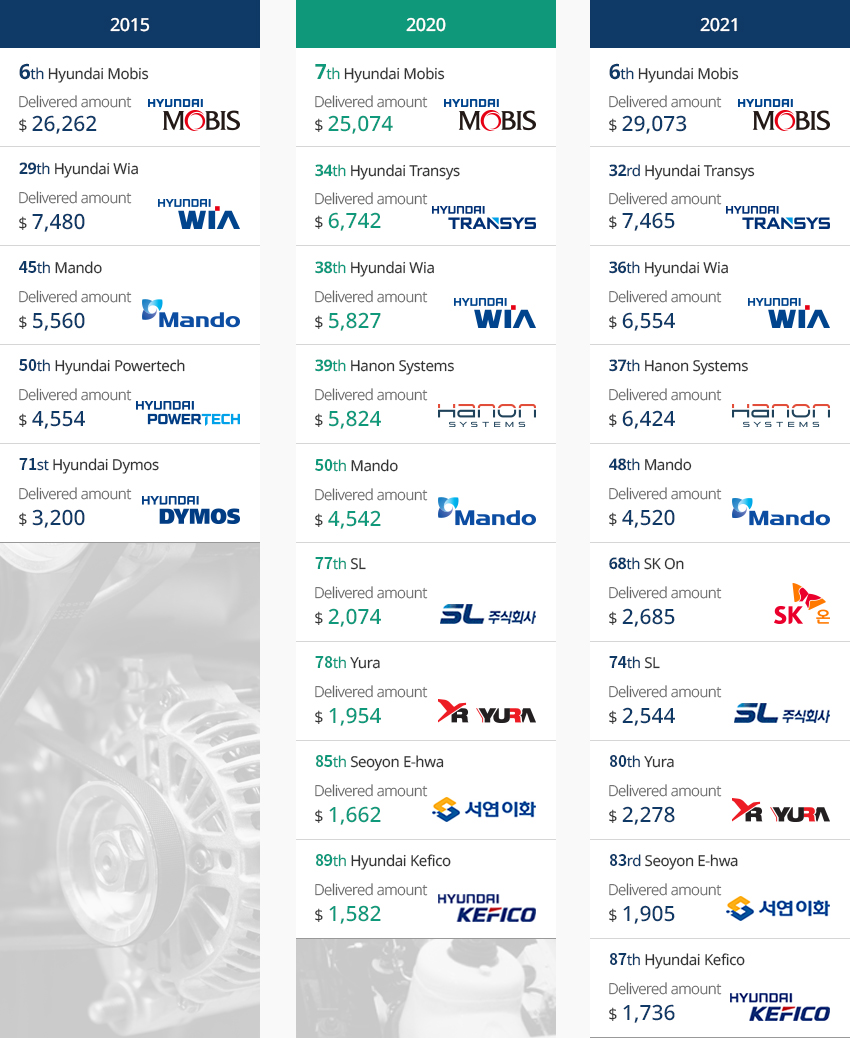

World’s Fifth Biggest Producer of Finished Vehicles and Competitive Automotive Parts Industry CloseWorld’s Fifth Biggest Producer of Finished Vehicles and Competitive Automotive Parts IndustryRanked fifth in the world and boasting an annual production capacity of more than 4 million vehicles, the Korean automotive industry is rapidly responding to paradigm shifts such as electrification, autonomous driving, and mobility services. In particular, the auto industry is quickly incorporating batteries, IT and other technologies and enjoying strong growth.In 2021, ten Korean auto parts companies were listed on the world's top 100 automotive parts producers in 2021 (by sales). The ten companies achieved sales of USD 65.1 billion, accounting for 8.2% of the sales of top 100 parts producers. Compared to 2020, one more Korean parts producer joined the top 100 list, and the share of Korean auto parts producers' sales increased by 0.8 percentage points. The figures indicate that as the global demands for vehicles start recovering from COVID-19, Korean companies have been able to normalize production faster than their competitors. Moreover, whereas the global automobile production slowed since the second half of 2021 due to shortages in automotive semiconductors, the Korean automobile industry reduced production disruptions by successfully managing the supply chain. After COVID-19, the Korean economy was able to recover quickly from the pandemic thanks to its stable social system and infrastructure. The Korean automotive industry, based on the well-established supply chain, also experienced less production decline during the crisis, and maintained solid demands based on the stable domestic market to quickly recover from the crisis and normalize operations compared to competitors."Korean Companies on the World’s Top 100 Auto Parts Makers List"(Unit: USD million)

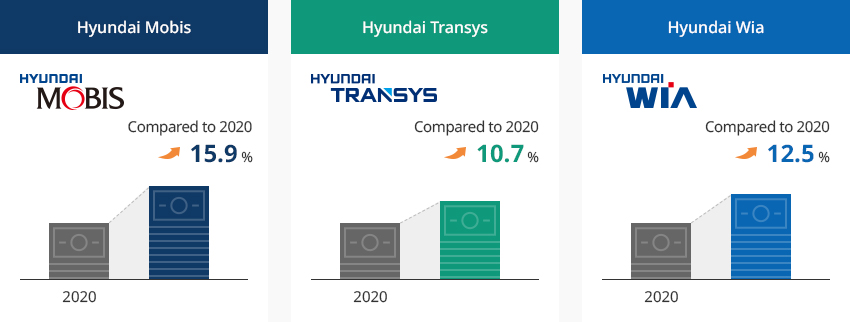

Korean Companies on the World’s Top 100 Auto Parts Makers List Year(2010,2015,2019) Name of company, Delivered amount 2015 2020 2021 Name of company Delivered amount Name of company Delivered amount Name of company Delivered amount Hyundai Mobis (6th) 26,262 Hyundai Mobis (7th) 25,074 Hyundai Mobis (6th) 29,073 Hyundai Wia(29th) 7,480 Hyundai Transys(34th) 7,742 Hyundai Transys(32th) 7,465 Mando(45th) 5,560 Hyundai Wia(38th) 5,827 Hyundai Wia(36th) 6,554 Hyundai Powertech(50th) 4,554 Hanon Systems(39th) 5,824 Hanon Systems(37th) 6,424 Hyundai Dymos(71th) 3,200 Mando(50th) 4,542 Mando(48th) 4,520 SL(77th) 2,074 SK On(68th) 2,685 Yura(78th) 1,954 SL(74th) 2,544 Seoyon E-hwa(85th) 1,662 Yura(80th) 2,278 Hyundai Kefico(89th) 1,582 Seoyon E-hwa(83th) 1,905 Hyundai Kefico(87th) 1,736  ※ Source : Automotive News (July 2022)The sales of auto parts producers decreased as COVID-19 and semiconductor shortages slowed the production of finished cars, but some companies were able to improve their added-values and increase sales. Hyundai Mobis moved up one spot to sixth place on the Top 100 list as sales grew by 15.9% from 2020 to USD 29 billion, and Hyundai Transys and Hyundai Wia also moved up two spots with sales growing by 10.7% and 12.5%, respectively.Growing production of electric vehicles (EVs) also helped raise the rankings of Korean parts producers. Hanon Systems, which produces EV air conditioning systems, moved up two spots by increasing sales by 10.3 percent, while SK On, an EV battery supplier, made it to the top 100 list with sales reaching USD 26.8 billion. SL supplying LED lamps and ADAS components and Yura supplying electronic modules and wiring systems saw their sales increase significantly by 23.6 percent and 16.6 percent, respectively, compared to 2020.

※ Source : Automotive News (July 2022)The sales of auto parts producers decreased as COVID-19 and semiconductor shortages slowed the production of finished cars, but some companies were able to improve their added-values and increase sales. Hyundai Mobis moved up one spot to sixth place on the Top 100 list as sales grew by 15.9% from 2020 to USD 29 billion, and Hyundai Transys and Hyundai Wia also moved up two spots with sales growing by 10.7% and 12.5%, respectively.Growing production of electric vehicles (EVs) also helped raise the rankings of Korean parts producers. Hanon Systems, which produces EV air conditioning systems, moved up two spots by increasing sales by 10.3 percent, while SK On, an EV battery supplier, made it to the top 100 list with sales reaching USD 26.8 billion. SL supplying LED lamps and ADAS components and Yura supplying electronic modules and wiring systems saw their sales increase significantly by 23.6 percent and 16.6 percent, respectively, compared to 2020. -

Automobile Industry Leading the Korean Economy OpenAutomobile Industry Leading the Korean EconomyThe automobile industry, along with the semiconductor industry, leads Korea's manufacturing sector, accounting for more than 10% of the country's major indexes including production, employment, and exports. Although the number of businesses accounts for only 6% of the manufacturing industry, the automobile industry is greatly contributing to job creation by accounting for 11% of total employment in the manufacturing sector. The Korean automobile industry is constantly working to expand its overseas market to overcome the limitations coming from the small size of the domestic market, and the government is committed to supporting the industry."Status of Korea’s Automobile Industry"

Status of Korea’s Automobile Industry Number of Companies (units), Employment (1,000 persons), Production Amount (KRW billion), Added Value (KRW billion), Exports (USD million), Trade Balance (USD million) Category Number of Companies

(units)Employment

(1,000 persons)Production Amount

(KRW billion)Added Value

(KRW billion)Exports

(USD million)Trade Balance

(USD million)Finished cars 32 85,508 90,758 22,721 54,067 38,695 Ratio 0.0% 3.0% 6.1% 4.1% 7.9% Auto parts 4,607 246,085 104,629 31,317 23,316 16,554 Ratio 6.6% 8.5% 7.0% 5.7% 3.4% ※ Source : Statistics Korea, KITA※ Note- Number of companies, employment, production, and added value as of 2020; exports and trade balance as of 2022

- The ratio is the ratio out of the manufacturing industry, but the ratio of exports is the ratio out of total export.

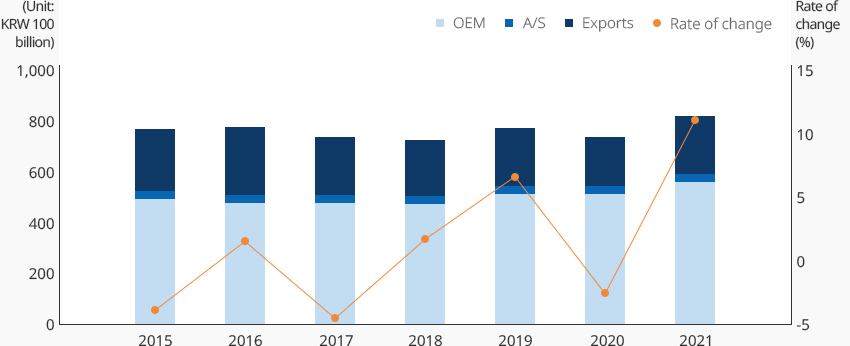

In 2021, Korea's auto parts industry recorded KRW 80.8 trillion in sales, up 10.7% from 2020, and surpassed the pre-COVID-19 level. OEM sales reached KRW 55.2 trillion and accounted for 68.3% of total sales, while OEM exports accounted for 26.9% with KRW 21.7 trillion and after-sales parts accounted for 4.8% with KRW 3.9 trillion. As the pandemic has somewhat subsided in 2021, automobile production has normalized and procurement costs have increased due to higher unit costs of parts, resulting in an increase of the sales of the Korean auto parts industry."Korea’s Auto Parts Industry: Sales Trends"※ Source: Korea Auto Industries Coop. Association (KAICA)

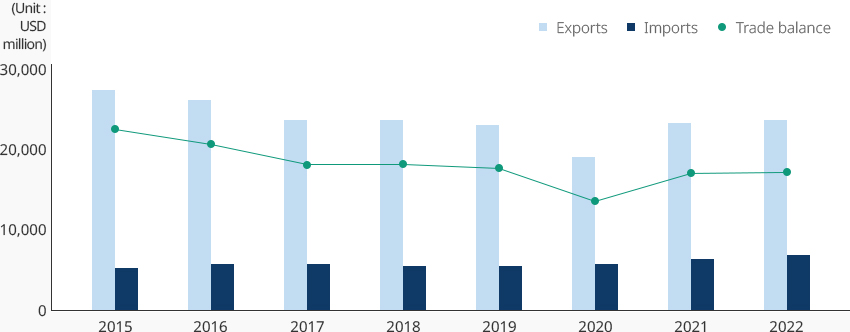

Note: Based on primary parts makersKorea's auto parts exports have been stagnant due to the global automobile production disruption caused by the shortage of automotive semiconductors and the economic downturn caused by the war in Ukraine. However, as demand has recovered from slump caused by COVID-19, export unit costs have increased due to vehicle upgrades and electrification, reaching USD 23.3 billion in 2022 and recovering to pre-COVID levels. Korean auto parts are mostly exported to the United States (USD 8.03 billion), Mexico (USD 1.82 billion), Slovakia (USD 1.38 billion), China (USD 1.38 billion), Vietnam (USD 1.16 billion), and India (USD 1.14 billion), which represent the world's largest auto producers and emerging producers. Exports of the auto parts industry account for 3.4% of Korea's total exports, the seventh highest after semiconductors, automobiles, petrochemicals, machinery, steel, and petroleum products. The industry recorded a trade surplus of USD 16.5 billion.Korea mostly exports other automobile parts, transmissions, body parts, brake systems and accessories. Exports of transmissions, brake parts, and driving axle parts, which are considered as core parts, are increasing, while battery exports are also on the rise due to the growing demand for EVs."Korea’s Auto Parts Industry: Import and Export Trends"※ Source : KITAStrengthened environmental regulations and diversified vehicle models have increased the demand for electrified vehicles such as electric vehicles (EVs), plug-in-hybrid vehicles, and hydrogen fuel cell vehicles. The structure of the automotive industry is also shifting from internal combustion engine vehicles to electrified vehicles. Especially in the process of recovering from COVID-19, governments of major countries have introduced policies to support the future vehicle industry by providing subsidies for electrified vehicles and strengthening R&D and building infrastructure for future vehicles such as electrified vehicles and autonomous vehicles.The Korean auto industry is also performing well by distributing electrified vehicles, rapidly increasing exports of electric and hydrogen vehicles, and preparing laws and systems for autonomous vehicles. In particular, Korean companies command a global market share of more than 30% in batteries, and Korea automakers have commercialized hydrogen fuel cell vehicles (FCEVs) for the first time in the world and topped global FCEV sales. In 2022, electrified vehicles including electric vehicles, hydrogen fuel cell vehicles, and hybrid vehicles accounted for 22.5% of production, 23.1% of exports, and 26.2% of domestic sales, and shares continue to increase."Korea’s EV Production and Sales Trends"(Unit: units)Korea’s EV Production and Sales Trends Category, Year Category 2020 2021 2022 Production Domestic Demand Exports Production Domestic Demand Exports Production Domestic Demand Exports BEV 152,174 46,197 119,718 230,177 96,666 154,014 318,070 157,264 200,120 PHEV 30,523 13,235 26,065 52,600 19,701 37,957 47,310 13,114 46,173 FCEV 6,594 5,786 1,041 9,639 8,502 1,121 10,804 10,164 400 HEV 254,725 161,450 124,503 352,271 222,869 211,807 469,732 260,341 287,956 Total 444,016 226,668 271,327 644,687 347,738 404,899 845,916 440,883 534,649 ※ Source : Korea Automobile Manufacturers Association, Korea Automobile Importers & Distributors Association -

Government Strengthening Support to Maintain Competitiveness through Swift Conversion to Future Vehicles OpenGovernment Strengthening Support to Maintain Competitiveness through Swift Conversion to Future VehiclesThe Korean government's policies for future vehicles are not limited to autonomous vehicles and EVs, but are expanding the scale from existing manufacturing to services such as connected cars, autonomous driving, and car sharing. Based on the Future Vehicle Industry Development Strategy and the Autonomous Vehicle Policy Roadmap, the Korean government's policies to support future vehicles are focused on autonomous driving and EVs, and are gradually expanding to the areas of connected cars and car sharing. The government is focusing on boosting the penetration of EVs and resolving the lack of infrastructure, while for autonomous vehicles, it is concentrating in catching up with technologies, running autonomous driving testbeds, and supporting parts companies to accelerate the transition to future vehicles.By 2030, the Korean government plans to transform 1,000 parts companies into future vehicle companies by: establishing a comprehensive support platform for preparing the parts industry for the future; supporting parts makers' business model innovation; and providing the means for business reorganization (e.g., technology, manpower, funds, and processes) compatible with company characteristics such as company size and contracting stage.Having announced the Global Big 3 Auto Industry Strategy in 2022, the government is continuously pursuing policies related to the auto industry for a rapid and flexible transition to future vehicles and the expansion of boundaries of the auto industry to incorporate new mobility. To that end, the government devised policy tasks for joining the global top-tier in the field of electrification, flexibly transitioning the overall industrial ecosystem, building a stable supply chain, and creating new industries for autonomous driving and mobility. The government aims to increase annual EV production to 3.3 million units by 2030 and raise Korea's global market share to 12% by encouraging the auto industry to invest more than KRW 95 trillion over the next five years (2022-2026) and training 30,000 future vehicle professionals by 2030.In addition, the Korean government is working towards enacting a special act on the transition to future vehicles to: foster and support small and medium-sized parts companies as they are essential for the auto industry supply chain; establish a basic plan for revitalizing the ecosystem of the future vehicle parts industry; train auto parts specialists; and establish a supply chain platform.

-

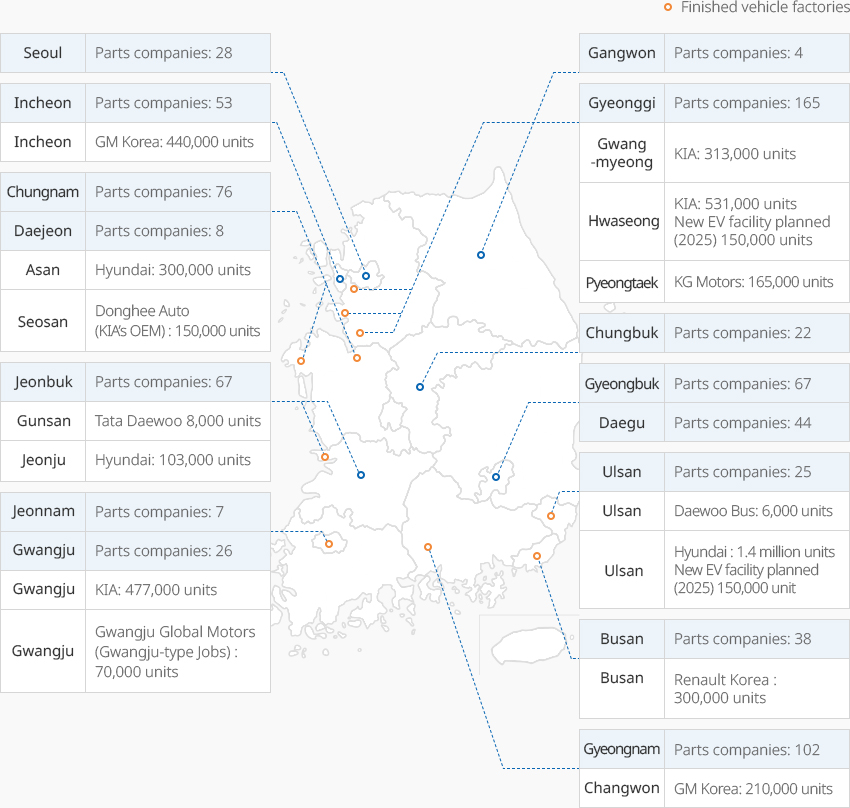

Production Facilities Expansion and Regional Specialization Strategies for Strengthening the Competitiveness of Future Cars OpenProduction Facilities Expansion and Regional Specialization Strategies for Strengthening the Competitiveness of Future CarsThe Korean automotive industry is relatively evenly dispersed across the country and can be divided into three clusters of the West Coast cluster covering the Seoul metropolitan area, the Southeast cluster led by Ulsan, and the Honam cluster including Gwangju and Gunsan.The Seoul metropolitan area is home to Kia Motors and GM Korea, as well as research centers and factories, including Hyundai Motor's Namyang Research Center and an experimental city (K-City) dedicated to testing autonomous vehicles. Chungcheong region has 106 primary suppliers concentrated in Cheonan, Asan, and Dangjin, while the Southeast region is home to major Korean automakers such as Hyundai Motor, Renault Korea, and GM Korea and 276 primary parts suppliers.Moreover, the growing demand for EVs has led to the expansion of new production facilities needed for producing EVs. Hyundai Motor announced plans to build and operate EV production facility with an annual production capacity of 150,000 units in Ulsan in 2025. Kia Motors also broke ground on a new plant for producing 150,000 electric PBVs (Purpose Built Vehicles) per year in Hwaseong, which will be completed in 2025."Finished Vehicle Factories and Primary Parts Makers Across Korea"

Finished Vehicle Factories and Primary Parts Makers Across Korea

Finished Vehicle Factories and Primary Parts Makers Across Korea- Seoul:Parts companies 28

- Gangwon:Parts companies 4

- Incheon:Parts companies 53

- Incheon:GM Korea 440,000 units

-

Gyeonggi:Parts companies 165

- Gwangmyeong:KIA 313,000 units

- Hwaseong:KIA 531,000 units, New EV facility planned (2025) 150,000 units

- Pyeongtaek:KG Motors: 165,000 units

- Chungnam:Parts companies 76

- Daejeon:Parts companies 8

- Asan:Hyundai: 300,000 units

- Seosan:Donghee Auto (KIA’s OEM) : 150,000 units

- Chungbuk:Parts companies 22

-

Jeonbuk:Parts companies 67

- Gunsan:Tata Daewoo 8,000 units

- Jeonju:Hyundai: 103,000 units

- Gyeongbuk:Parts companies 67

- Daegu:Parts companies 44

- Jeonnam:Parts companies 7

-

Gwangju:Parts companies 26

- Gwangju:KIA 477,000 units

- Gwangju:Gwangju Global Motors (Gwangju-type Jobs) : 70,000 units

-

Ulsan:Parts companies 25

- Ulsan:Daewoo Bus: 6,000 units

- Ulsan:Hyundai: 1.4 million units New EV facility planned (2025) 150,000 units

-

Busan:Parts companies 38

- Busan:Renault Korea: 300,000 units

-

Gyeongnam:Parts companies 102

- Changwon: GM Korea: 210,000 units

※ Source : KAMA, KAICA

※ Source : KAMA, KAICA

※ Note: 2021 finished vehicle production capacity, based on primary parts makersIn order to transition to future vehicles by developing a balanced industrial ecosystem, the government is working towards the reorganization of specialized businesses including autonomous driving and commercial vehicles by considering the foundation of each region's automobile and parts industries and the status of future vehicle infrastructure (i.e., autonomous driving, charging stations). Based on the conditions of the automotive industry and the infrastructure for testing and certification, the government plans to build a specialized support platform involving local governments, support organizations (Techno Parks, public research institutes, etc.), and universities to prevent duplicate investments and reorganize the future vehicles sector in a balanced manner.

-

Complex nameMyeongcheon Automobile Complex

-

Initial designation date2003.07.21

-

Designated area(m2)142,673

-

ManagementChungcheongnam-do Seosan City

-

Nearby RailwayHongseong Station

-

Distance from station(km)50

-

Nearby AirportGunsan Airport

-

Distance from airport(km)124

-

Industrial water Supply capacity(ton/day)254(㎥/day)

-

Affiliation local governmentChungcheongnam-do Seosan City

-

Population175,272

-

Complex namePyeong-dong (Woljeon Small and Medium-sized Business Cooperation for Foreigners)

-

Initial designation date2013.05.15

-

Designated area(m2)99,060

-

ManagementKorea Industrial Complex Corporation

-

Nearby RailwayGwangju Station

-

Distance from station(km)21

-

Nearby AirportGwangju Airport

-

Distance from airport(km)7

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentGwangju Metropolitan City Gwangsan-gu

-

Population1,454,154

-

Complex nameSeosan Auto Valley General Industrial Complex [formerly: Seosan

-

Initial designation date1997.01.24

-

Designated area(m2)3,989,547

-

ManagementChungcheongnam-do Seosan City

-

Nearby RailwaySapgyo Station

-

Distance from station(km)49

-

Nearby AirportCheongju International Airport

-

Distance from airport(km)123

-

Industrial water Supply capacity(ton/day)7,432(㎥/day)

-

Affiliation local governmentChungcheongnam-do Seosan City

-

Population175,272

-

Complex nameDalcheon Agricultural Industrial Complex

-

Initial designation date1997.03.11

-

Designated area(m2)259,634

-

ManagementUlsan Metropolitan City Buk-gu

-

Nearby RailwayHogye Station

-

Distance from station(km)4

-

Nearby AirportUlsan Airport

-

Distance from airport(km)8

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentUlsan Metropolitan City Buk-gu

-

Population1,140,310

-

Complex nameWonju Automobile Component General Industrial Complex

-

Initial designation date2008.07.10

-

Designated area(m2)92,917

-

ManagementGangwon-do Wonju City

-

Nearby RailwayDonghwa Station

-

Distance from station(km)5

-

Nearby AirportWonju Airport

-

Distance from airport(km)25

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentGangwon-do Wonju City

-

Population352,964

-

Complex nameWanju Techno Valley General Industrial Complex

-

Initial designation date2010.12.31

-

Designated area(m2)1,311,399

-

ManagementJeollabuk-do Wanju County

-

Nearby RailwaySamrye Station

-

Distance from station(km)11

-

Nearby AirportGunsan Airport

-

Distance from airport(km)62

-

Industrial water Supply capacity(ton/day)4,792(㎥/day)

-

Affiliation local governmentJeollabuk-do Wanju County

-

Population91,741