- Home

- Investment Opportunities

- Industries

- Machinery

Machinery

-

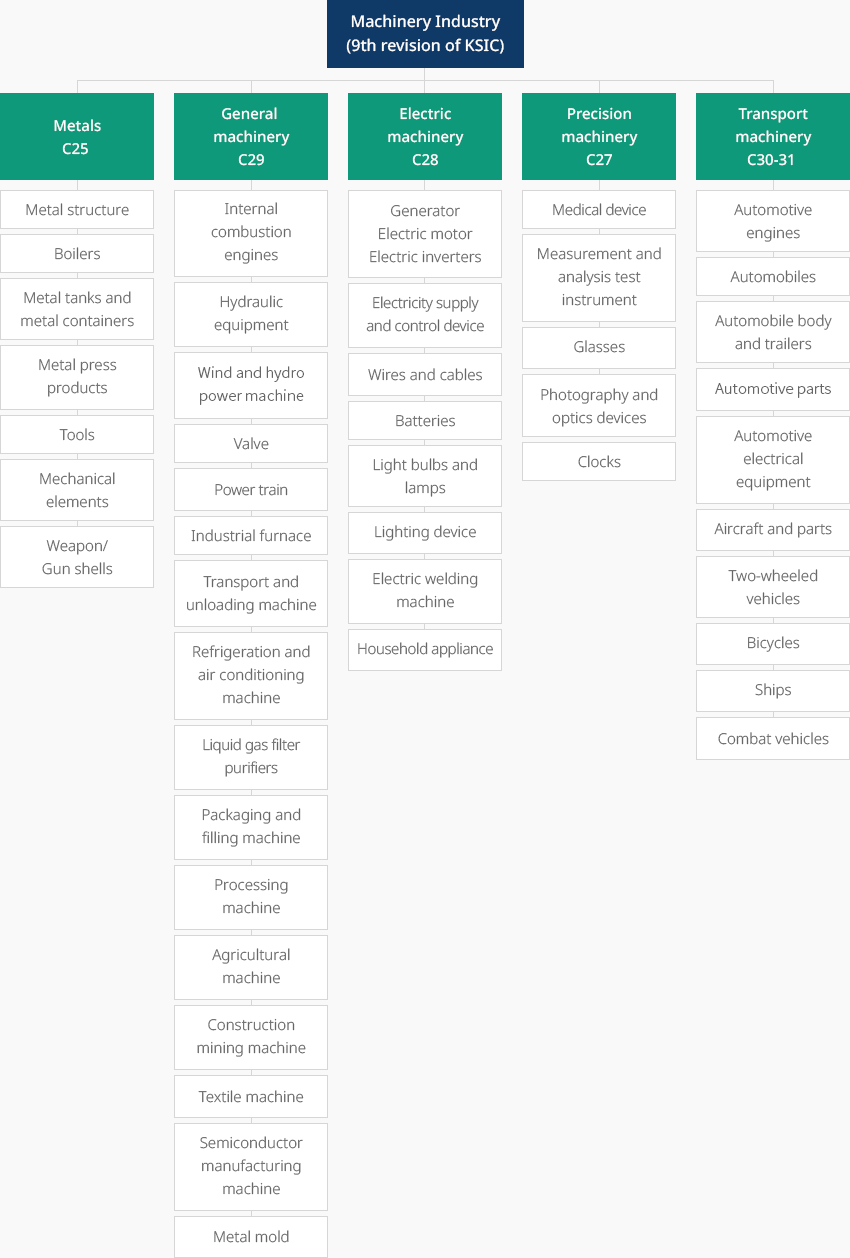

Definition of Machinery Industry OpenDefinition of Machinery IndustryThe machinery industry refers to five major industries including general machinery, electrical machinery, precision machinery, transport machinery, and metal products (assembly metal) according to the Korean Standard of Industry Classification (KSIC)."Classification of Five Major Machinery Industries according to the

Korean Standard of Industry Classification (KSIC)" Machinery Industry (KISC 9th Revision)

Machinery Industry (KISC 9th Revision)-

Metals C25

- Metal structure

- Boilers

- Metal tanks and metal containers

- Metal press products

- Tools

- Mechanical elements

- Weapon/Gun shells

-

General machinery C29

- Internal combustion engines

- Hydraulic equipment

- Wind and hydro power machine

- Valve

- Power train

- Industrial furnace

- Transport and unloading machine

- Refrigeration and air conditioning machine

- Liquid gas filter purifiers

- Packaging and filling machine

- Processing machine

- Agricultural machine

- Construction mining machine

- Textile machine

- Semiconductor manufacturing machine

- Mold

-

Electric machinery C28

- Generator, Electric motor, Electric inverters

- Electricity supply and control device

- Wires and cables

- Batteries

- Light bulbs and lamps

- Lighting device

- Electric welding machine

- Household appliance

-

Precision machinery C27

- Medical device

- Measurement and analysis test instrument

- Glasses

- Photography and optics devices

- Clocks

-

Transport machinery C30-31

- Automotive engines

- Automobiles

- Automobile body and trailers

- Automotive parts

- Automotive electrical equipment

- Aircraft and parts

- Two-wheeled vehicles

- Bicycles

- Bicycles

- Combat vehicles

※ Source: Statistics Korea

※ Source: Statistics Korea -

Metals C25

-

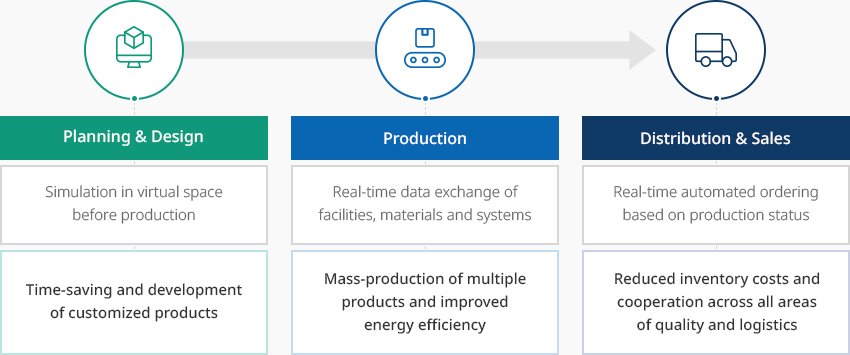

Capacity of the Manufacturing System Improved by the Spread of Smart Factories OpenCapacity of the Manufacturing System Improved by the Spread of Smart FactoriesThe Korean machinery industry maintains price competitiveness and is closely linked to related industries, such as automobiles, aviation, shipbuilding, semiconductors, and displays.As of 2022, Korea was the world's third largest semiconductor equipment market following China and Taiwan, with a market size of USD 21.51 billion. Growth in high-performance computing and automotive semiconductors is driving the need for enhanced semiconductor fab capacity. The market size is expected to grow as Korea is increasing domestic and US investment.In 2021, production of Korea's machine tool industry reached USD 4.5 billion, up 6.4% from the previous year to rank 6th in the world while the nation's exports grew by 15.7% year-on-year to USD 2.2 billion and ranked 7th in the world. In the same period, consumption reached approximately USD 3.4 billion and Korea's global market share was 4.3% or 6th largest in the world. The industry has recently enjoyed a renaissance supported by the growth of EVs, medical devices, and defense projects that critically require precision parts. More specifically, the demand is increasing for machining centers, which are high-end machines capable of complex processing in various patterns. Machine tools also known as the mother machine as they process materials such as metals needed for building machines.Supply capacity of the manufacturing system is expected to further strengthen based on the spread of smart factories, which Korea is focusing on as its main industry, . Smart factories are human-centered, high-tech intelligent factories that integrate the entire production process from product planning to sales with ICT (information and communication technology) to produce customized products at minimal cost and time. Smart factories are distinguished according to the degree of utilizing ICT technologies and ICT capability.In 2021, the Korean construction machinery market was worth USD 106.8 billion, accounting for 4.6% of the global market. The Korean construction machinery market is expected to continue growing as the fourth industrial revolution facilitates smart construction and electrification of construction machinery and the technological development and use of hydrogen fuel cells and high-efficiency equipment are accelerated."Korea’s Major Machinery Industries"

- Semiconductor Equipment: Market size (2022) No. 3 in the world USD 21.51 billion

- Processing Machinery: Production (2021) No. 6 in the world USD 4.5 billion, Exports (2021) No. 7 in the world USD 2.2 billion

- Construction Machinery : Market size (2021) No. 6 in the world USD 16.08 billion

※ Source: Semiconductor Equipment and Materials International (April 2023), Gardner, Korea Machine Tool Manufacturers’ Association, Korea Construction Equipment Manufacturers' Association, International Construction"The Concept of Smart Factories"

※ Source: Semiconductor Equipment and Materials International (April 2023), Gardner, Korea Machine Tool Manufacturers’ Association, Korea Construction Equipment Manufacturers' Association, International Construction"The Concept of Smart Factories"

- Planning & Design

- Simulation in virtual space before production

- Time-saving and development of customized products

- Production

- Real-time data exchange of facilities, materials and systems

- Mass-production of multiple products and improved energy efficiency

- Distribution & Sales

- Real-time automated ordering based on production status

- Reduced inventory costs and cooperation across all areas of quality and logistics

※ Source: Korea Smart Manufacturing Office (KOSMO)

※ Source: Korea Smart Manufacturing Office (KOSMO) -

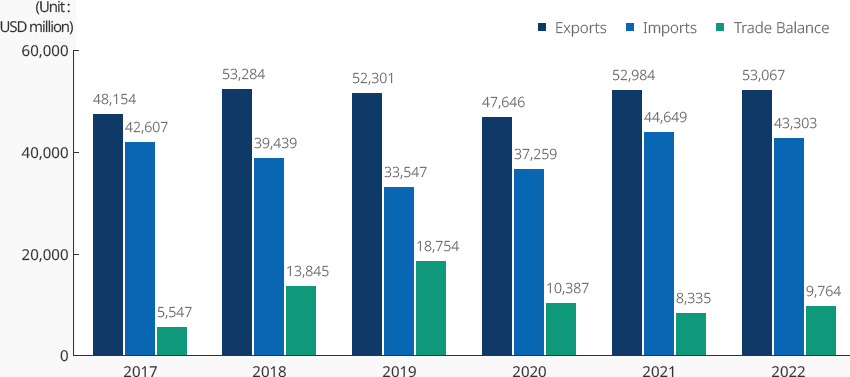

Export-based Growth Outlook as Korea’s Core Industry OpenExport-based Growth Outlook as Korea’s Core IndustryThe machinery industry is truly Korea's core industry that ranked No. 5 in terms of production value, No. 1 in terms of the number of businesses, No. 2 in terms of the number of employees, and No. 4 in terms of added-value, among the nation's manufacturing industries.

The average annual growth rate of exports in the past five years (2017-2022) was 2.0%, the average annual growth rate of imports was 0.3%, and the average annual growth rate of the trade balance was 12.0%. A close look at the industry's major products show that in 2022, refrigeration and air-conditioning machinery showed the highest year-on-year growth rate of 11.4% at USD 3.29 billion, followed by machine tools that grew by 9.0% year-on-year to reach USD 2.91 billion, construction machinery that grew by 6.9% to reach USD 7.17 billion, mechanical elements that grew by 2.7% to reach USD 5.57 billion (2.7%), and motors and pumps that grew by 2.2% to reach USD 7.73 billion.Exports to major regions in 2022 show that exports to the United States increased by 15% from the previous year to stand at USD 11.68 billion, while exports to the EU grew by 5.9% year-on-year to reach USD 7.34 billion, exports to ASEAN grew by 2.8% year-on-year to reach USD 7.07 billion, and exports to India grew by 15.1% to reach USD 1.94 billion. In comparison, exports to China fell by 15.6% year-on-year to reach USD 8.7 billion."Korean Machinery Industry within the Manufacturing Sector"(as of 2021)Korean Machinery Industry in the Manufacturing Industries KSIC Middle Classification, Production Value, Number of Companies, Number of Employees, Value-added KISC Middle Classification Production Value Number of Companies Number of Employees Value-added Code Item KRW trillion Ratio Rank KRW trillion Ratio Rank 1,000 persons Ratio Rank KRW trillion Ratio Rank C Manufacturing (10~33) 1,781 100.0 - 72,510 100.0 - 2,938 100.0 - 641 100.0 - 29 Other machinery and equipment manufacturing 135 7.6 5 10,288 14.2 1 340 11.6 3 51 8.0 4 ※ Source: Statistics Korea, Survey on Mining and Manufacturing Industries conducted on businesses with ten employees or more(Unit: USD million)“Import and Export Trends of the Machinery Industry”Import and Export Trends of the Machinery Industry Type, Years Type 2017 2018 2019 2020 2021 2022 Average annual growth rate (%) (2017-2022) Exports (USD million) 48,154 53,284 52,301 47,646 52,984 53,067 2.0 Imports (USD million) 42,607 39,439 33,547 37,259 44,649 43,303 0.3 Trade Balance (USD million) 5,547 13,845 18,754 10,387 8,335 9,764 12.0 ※ Source: Korea Customs Service, Statistical Yearbook of Foreign Trade -

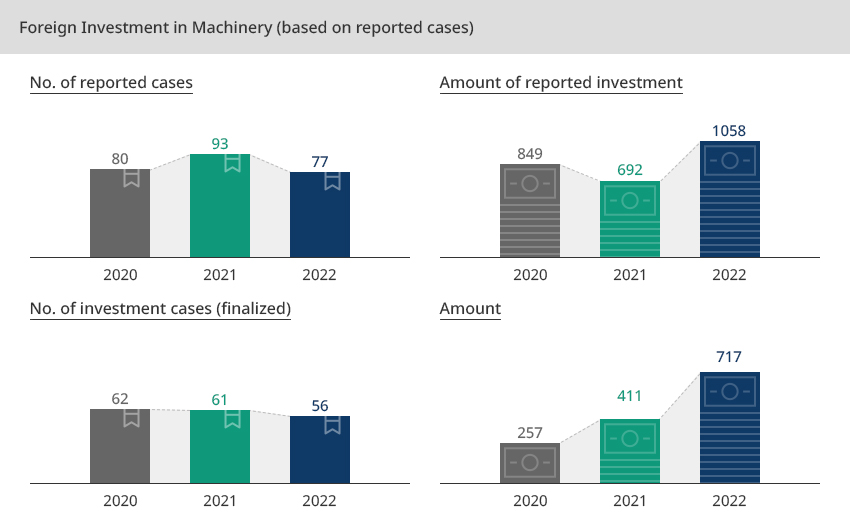

Raised Awareness of the Growth Potential and High Technology of the Machinery Industry OpenRaised Awareness of the Growth Potential and High Technology of the Machinery IndustryForeign investment in machinery is centered on semiconductor equipment, and machine tools, which decreased in 2022 from the previous year in terms of the number of investment but continued growing annually in terms of amount. The growth appears to be driven by the raised awareness of the growth potential and high technology of the machinery industry.As foreign investment in the machinery industry is vital for technology transfer, improving productivity and entering the global market, the Korean government is constantly working to attract foreign investment and make the industry globally competitive In 2021, ASML of the Netherlands, the only supplier of extreme ultraviolet (EUV) exposure equipment necessary for the production of wafers under 10 nanometers, announced its plan to invest in a training center and remanufacturing center for engineers in Hwaseong, Gyeonggi-do. It is a high-tech equipment field that will play a key role in building the K-Semiconductor Belt.

Foreign Investment in Machinery (based on reported cases) Type, Year Type 2020 2021 2022 1962~2022 Reported investment No. of cases 80 93 77 3,983 Amount 849 692 1,058 15,841 Finalized foreign investment No. of cases 62 61 56 1,786 Amount 257 411 717 9,982 ※ Source: Foreign Investment Statistics -

Strengthened Government Policies to Effectively Respond to the New Industrial Landscape of the Global Machinery Industry OpenStrengthened Government Policies to Effectively Respond to the New Industrial Landscape of the Global Machinery IndustryBased on the globalization strategy for materials, parts and equipment established by the Korean government's 11th Committee on Strengthening the Competitiveness of Materials, Parts and Equipment in April 2023, the Korean machinery industry – driven by its accumulated experience and the ability to thrive on its own - has prepared a strategy to effectively respond to the rapidly changing global industrial landscape centered on high-tech fields and to grow as a key partner amidst the reorganization of the global supply chain.The manufacturing equipment industry is drawing attention following the Korean government's announcement in April 2020 of the enforcement of the Special Act on Special Measures to Strengthen the Competitiveness of the Materials, Parts and Equipment Industry (enforced on April 1, 2020), and the Korean government's commitment to foster industrial robots is expected to further revitalize the machinery industry.The government plans to create a national industrial map driven by innovation to enable a virtuous cycle in which national strategic industries, materials, parts and equipment industries, and regional specialized industries thrive together from the new designation of specialized industrial complexes focused on national strategic high-tech industries and the additional designation of industrial complexes specializing in materials, parts and equipment. The national industrial map will help develop the nation’s high-tech materials, parts and equipment industries into a key global cluster.

-

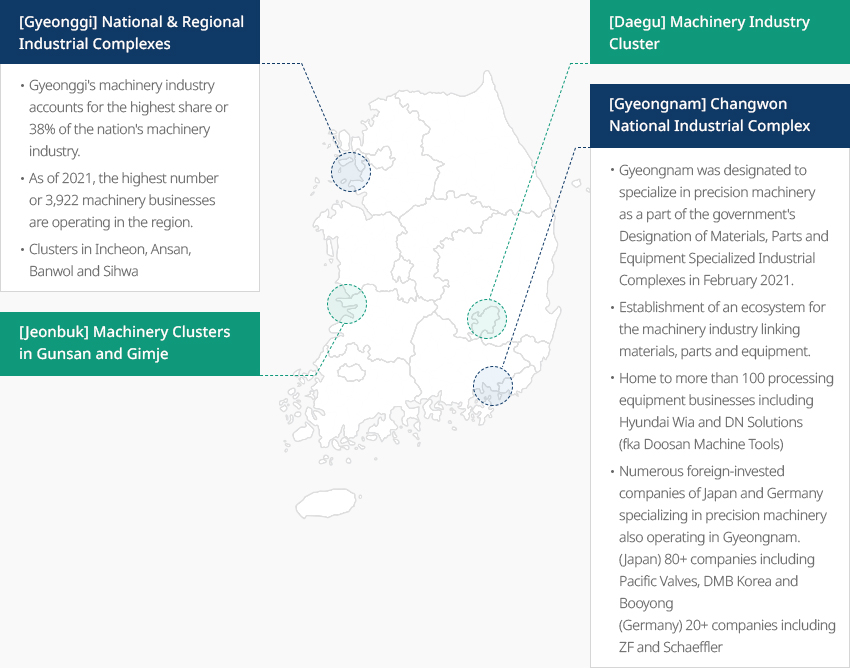

Machinery Clusters OpenMachinery Clusters Centered on Metropolitan and Gyeongnam RegionsAs of 2021, 63.1% of all operators in the Korean machinery industry were located in the Seoul Metropolitan Area and Gyeongnam. Gyeonggi accounted for the highest share of the nation's machinery industry or 38.1% while the Gyeongnam machinery industry recorded the second highest share or 13.8%.Gyeongnam has an excellent machinery industry ecosystem from materials, parts, and finished products with the Changwon National Industrial Complex at the center. DN Solutions (formerly known as Doosan Machine Tools) and Hyundai Wia, which are listed on the world's top 10 machine tool companies in terms of sales, are located in this region. Materials and parts companies, such as SeAH Changwon Integrated Special Steel, Korea Steel, and Korea NSK, are operating in this region and they supply materials and parts to machinery, automobile, aviation, and shipbuilding companies located near Changwon.Based on the Plan for Revitalizing Regional Innovation Clusters deliberated and approved by the Presidential Committee for Balanced National Development in December 2022, the Korean government allows each city or province to autonomously diagnose the level of its clusters and select the stage of development (Stage 1 or Stage 2). The aim is to strengthen local initiative so that cities and provinces that choose Stage 2 can autonomously design the budget and decide how to pursue the cluster development program. In March 2023, the Presidential Committee for Balanced National Development prepared the Stage 2 Plan for Fostering Regional Innovation Clusters of Cities and Provinces (2023-2027) and finalized the specialized industries that each city and province will foster in regional innovation clusters from 2023. As a part of the Designation of Materials, Parts and Equipment Specialized Industrial Complexes announced by the Korean government in February 2021, Gyeongnam will specialize in precision machinery, which is expected to strengthen the global supply chain of the machinery industry.

- [Gyeonggi] National & Regional Industrial Complexes

- Gyeonggi's machinery industry accounts for the highest share or 38% of the nation's machinery industry.

- As of 2021, the highest number or 3,922 machinery businesses are operating in the region.

- Clusters in Incheon, Ansan, Banwol and Sihwa

- [Daegu] Machinery Industry Cluster

- [Jeonbuk] Machinery Clusters in Gunsan and Gimje

- [Gyeongnam] Changwon National Industrial Complex

- Gyeongnam was designated to specialize in precision machinery as a part of the government's Designation of Materials, Parts and Equipment Specialized Industrial Complexes in February 2021.

- Establishment of an ecosystem for the machinery industry linking materials, parts and equipment.

- Home to more than 100 processing equipment businesses including Hyundai Wia and DN Solutions (fka Doosan Machine Tools)

- Numerous foreign-invested companies of Japan and Germany specializing in precision machinery also operating in Gyeongnam. (Japan) 80+ companies including Pacific Valves, DMB Korea and Booyong (Germany) 20+ companies including ZF and Schaeffler

※ Source: Korea Institute for Industrial Economics and Technology (KIET) (April 2023)

※ Source: Korea Institute for Industrial Economics and Technology (KIET) (April 2023) - [Gyeonggi] National & Regional Industrial Complexes

-

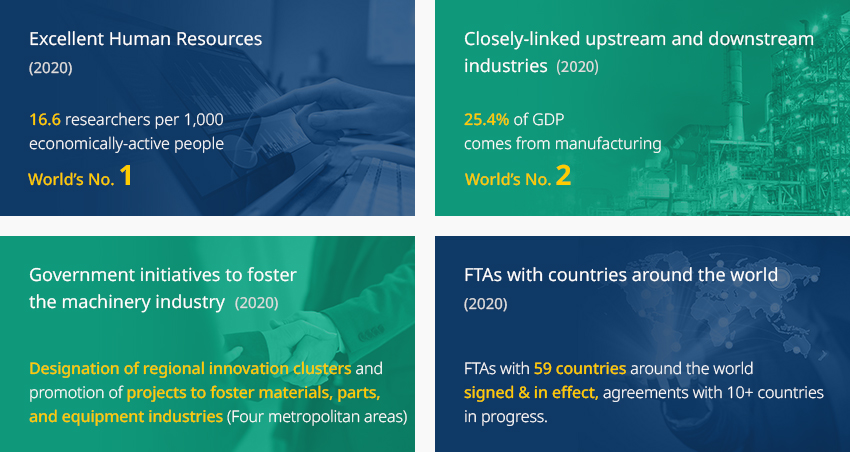

Four Advantages of Korea that Appeal to Foreign Investors OpenFour Advantages of Korea that Appeal to Foreign Investors1.Excellent human resources

In 2020, Korea ranked 1st in the number of researchers per 1,000 economically-active people with 16.6 researchers (followed by Sweden with 15.82)2.Closely-linked upstream and downstream industries

In 2020, Korea’s manufacturing sector accounted for 25.4% of GDP, which is the 2nd highest in the world and demonstrates the country’s status as a traditional manufacturing powerhouse.3.Government initiatives to foster the machinery industry

Designation of regional innovation clusters and promotion of projects to foster materials, parts, and equipment industries (Four metropolitan areas)

* Four metropolitan areas: Gyeonggi (Incheon, Ansan, Banwol, Sihwa), Jeonbuk (Gunsan, Gimje), Daegu, and Gyeongnam (Changwon)4.FTAs with countries around the world

As of 2022, Korea's FTAs with 59 countries around the world have been signed and are in effect, and agreements with 10+ countries are in progress.

- Excellent human resources (2020) - 16.6 researchers per 1,000 economically-active people: World’s No. 1

- Closely-linked upstream and downstream industries (2020) - 25.4% of GDP comes from manufacturing: World’s No. 2

- Government initiatives to foster the machinery industry (2022) - Designation of regional innovation clusters and promotion of projects to foster materials, parts, and equipment industries (Four metropolitan areas)

- FTAs with countries around the world (2022) - FTAs with 59 countries around the world signed & in effect, agreements with 10+ countries in progress.

-

Complex nameMunbaek Precision Machinery Industrial Complex

-

Initial designation dateMar. 14, 2011

-

Designated Area (m2)399,948

-

ManagementChungcheongbuk-do Jincheon County

-

Nearby railwayOgeunjang Station

-

Distance from station (km)15

-

Nearby airportCheongju International Airport

-

Distance from airport (km)16

-

Industrial water supply capacity (ton/day)511(㎥/day)

-

Affiliated basic local governmentChungcheongbuk-do Jincheon County

-

Population81,949

-

Complex nameAsan (Bugok District)

-

Initial designation dateDec. 14, 1979

-

Designated area(m2)3,118,889

-

ManagementKorea Industrial Complex Corporation

-

Nearby railwayPyeongtaek Station

-

Distance from station(km)44

-

Nearby airportCheongju International Airport

-

Distance from airport (km)93

-

Industrial water supply capacity (ton/day)-

-

Affiliated basic local governmentChungcheongnam-do Dangjin City

-

Population166,067

-

Complex nameYulchon 1 General Industrial Complex (Gwangyang Bay Area Free Economic Zone)

-

Initial designation dateMay. 13, 1992

-

Designated area (m2)9,106,791

-

ManagementGwangyang bay area Free Economic Zone Authority

-

Nearby railwayYulchon Station

-

Distance from station(km)5

-

Nearby airportYeosu Airport

-

Distance from airport(km)5

-

Industrial water Supply capacity(ton/day)30,937(㎥/day)

-

Affiliation local governmentJeollanam-do Yeosu City

-

Population280,603

-

Complex nameBanwol Plating General Industrial Complex

-

Initial designation dateFeb. 16, 1988

-

Designated area(m2)162,045

-

ManagementGyeonggi-do Ansan City

-

Nearby railwaySuwon Station

-

Distance from station(km)13

-

Nearby airportGimpo International Airport

-

Distance from airport(km)40

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentGyeonggi-do Ansan City

-

Population653,733

-

Complex nameJinbuk Agricultural Industrial Complex

-

Initial designation dateDec. 15, 1989

-

Designated area(m2)133,170

-

ManagementGyeongsangnam-do Changwon City

-

Nearby railwayMasan Station

-

Distance from station(km)22

-

Nearby airportSacheon Airport

-

Distance from airport(km)51

-

Industrial water Supply capacity(ton/day)330(㎥/day)

-

Affiliation local governmentGyeongsangnam-do Changwon City

-

Population1,038,677

-

Complex nameJungsan General Industrial Complex

-

Initial designation dateMay. 11, 2006

-

Designated area(m2)128,392

-

ManagementUlsan Metropolitan City

-

Nearby railwayTaehwagang Station

-

Distance from station(km)17

-

Nearby airportUlsan Airport

-

Distance from airport(km)10

-

Industrial water Supply capacity(ton/day)219(㎥/day)

-

Affiliation local governmentUlsan Metropolitan City Buk-gu

-

Population1,140,310