- Home

- Investment Opportunities

- Industries

- Cultural Content

Cultural Content

-

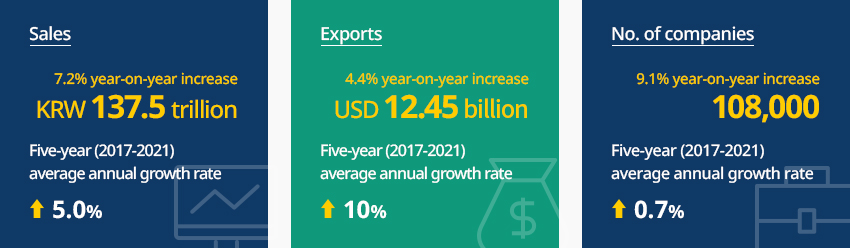

Korea’s Cultural Content Industry Showing Strong Sales and Growing into a High Value-Added Industry 내용닫기Korea’s Cultural Content Industry Showing Strong Sales and Growing into a High Value-Added IndustryThe Korean cultural content industry is showing strong sales and exports and has steadily grown into a high value-added industry. In 2021, the industry generated KRW 137.5 trillion in sales (up 7.2% year-on-year), exported USD 12.45 billion (up 4.4% year-on-year) and has about 108,000 businesses (up 9.1% year-on-year) to record average annual growth rates of 5.0% for sales, 10.0% for exports, and 0.7% for the number of businesses.The industry's overall trade balance amounted to USD 11.25 billion as the game category led the industry's trade surplus with high export value and the cultural content category proving its status as a high value-added industry with a value-added rate of 38.6%.

- 매출

- 전년 대비 7.2% 증가 137.5조 원

- 5년간(‘17~’21) 연평균 증가율

- 5.0% 상승

- 수출

- 전년 대비 4.4% 증가 124.5억 $

- 5년간(‘17~’21) 연평균 증가율

- 10% 상승

- 사업체수

- 전년 대비 9.1% 증가 10만 8천개

- 5년간(‘17~’21) 연평균 증가율

- 0.7% 상승

"Current Status of the Korea’s Cultural Content Industry"한국 콘텐츠 산업 현황 정보 제공 Category Number of Companies Number of Employees Sales

(KRW million)Value-added

(KRW million)Value-added Rate

(%)Exports

(USD 1,000)Imports

(USD 1,000)Trade Balance

(USD 1,000)Publishing 34,011 175,898 24,697,753 9,740,089 39.4 428,379 317,939 110,440 Cartoon 4,919 10,825 2,132,149 799,955 37.5 81,980 7,584 74,396 Music 34,001 59,583 9,371,728 3,141,082 33.5 775,274 14,031 761,243 Movies 1,034 13,240 3,246,109 1,143,769 35.2 43,033 37,897 5,136 Gaming 10,991 81,856 20,991,342 8,663,127 41.3 8,672,865 312,331 8,360,534 Animation 647 6,131 755,520 301,552 39.9 156,835 8,524 148,311 Broadcasting 1,133 50,160 23,970,709 8,621,601 36 717,997 60,761 657,237 Advertisement 6,627 74,485 18,921,883 6,200,701 32.8 258,167 341,654 83,487 Characters 2,901 16,597 5,003,908 2,080,238 41.6 412,990 81,226 331,764 Knowledge and Information 10,108 87,704 19,946,243 8,423,451 42.2 660,850 9,314 651,536 Content Solutions 2,256 38,256 8,470,614 3,907,217 46.1 244,527 13,443 231,084 Total 108,628 614,734 137,507,958 53,022,781 38.6 12,452,897 1,204,704 11,248,193 ※ Source: Ministry of Culture, Sports and Tourism (2023). 2021 Content Industry Statistics -

Strong Brand Power of K-Content Leading Korea’s Cultural Content Industry 내용닫기Strong Brand Power of K-Content Leading Korea’s Cultural Content IndustryWorld’s No. 7, the Korean Cultural Content Industry On Track to Gaining Global Market ShareThe Korean cultural content market size is approximately USD 79.1 billion (2023 forecast), ranking seventh in the world. The market was significantly grown based on the popularity of the Korean Wave in the global market for the past two decades while K-Content also emerging as a strong brand power.Going forward, the market size is also expected to grow at an average annual rate of 4.26% for six years from 2021 to reach USD 86.4 billion in 2026 to add its influence in the global cultural content industry."Size of the Global Cultural Content Market and Prospect"(Unit: USD 100 million, %)

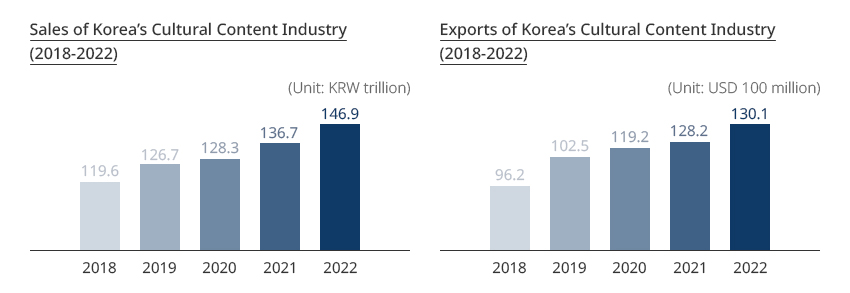

Size of the Global Cultural Content Market and Prospect 순위 국가 2021p 2022 2023 2024 2025 2026 ‘21-’26 연평균 성장률(%) 1 미국 9,798 10,573 11,120 11,588 11,965 12,307 4.67 2 중국 4,461 4,837 5,209 5,566 5,920 6,273 7.05 3 일본 2,082 2,175 2,238 2,297 2,351 2,403 2.91 4 영국 1,203 1,309 1,392 1,457 1,514 1,566 5.41 5 독일 1,130 1,209 1,272 1,316 1,348 1,377 4.04 6 프랑스 773 834 871 903 925 944 4.08 7 한국 702 753 791 819 843 864 4.26 8 캐나다 662 721 763 798 828 852 5.19 9 이탈리아 438 476 499 517 531 544 4.46 10 호주 422 457 482 502 516 527 4.55 ※ Source: KOCCA (2022). 2022 Overseas Content Market AnalysisA high-growth, high-value-added industry that continues to grow despite the economic downturnDespite the global economic downturn, the Korean cultural content industry is growing rapidly in sales and exports. The Korean cultural content industry has seen steady growth in both sales and exports over the past five years (2018-2022), with exports growing at a higher rate than sales. Going forward, the proportion of exports and overseas sales is expected to gradually expand, as Korean cultural content yield more influence in the global market."Sales and Exports of Korea’s Cultural Content Industry (2018-2022)"한국 콘텐츠산업 매출액 규모 (‘18년-’22년) (단위 : 조원)- 2018 : 119.9

- 2019 : 126.7

- 2020 : 128.3

- 2021 : 136.7

- 2022 : 146.9

- 2018 : 96.2

- 2019 : 102.5

- 2020 : 119.2

- 2021 : 128.2

- 2022 : 130.1

※ Source: Ministry of Culture, Sports and Tourism (2023)Also noteworthy is that the Korean cultural content industry is a high-value-added industry with high input-output efficiency. Well-crafted key content and content IPs can help expand to various business models, eading to value creation through sales, exports and others. A good example of the industry's appeal to investors is the investment of foreign sovereign wealth funds in Kakao Entertainment, which has its own IPs and diverse business capabilities.Moreover, the Korean cultural content industry is known to have a significant economic and social ripple effect as it drives consumption and exports in related industries. The Korean cultural content industry is known to induce production worth KRW 36 trillion (as of 2019) in related upstream and downstream industrys.Studies show that when exports of cultural content increase by USD 100 million, exports of related consumer goods increase by USD 180 million while inducing production worth USD 510 million and create 2,982 jobs (as of 2022).Excellence and relatability of K-content recognized in the global marketK-content such as Squid Game, Minari, and BTS has been recognized for its excellence and relatability around the world by making global successes and winning awards at major global competitions. Their global success It is analyzed as a factor of global box office success because itThe global popularity of K-content stems from the fact that people around the world can relate to K-content as it deals with various social issues and topics that everyone can sympathize with, such as wealth inequality and the history of immigrants, while backed by detailed emotional lines of characters and cohesive storylines."K-Content’s Rise to Fame in the Global Market"- 오징어게임 - 넷플릭스

- 미나리 - 골든 글로브 등 국제 영화제 수상작

- BTS - HYBE 기획사

Global Cultural Content Production System and Talented WorkforceThe Korean content industry is establishing a global content production system and recruiting excellent human resources, driven by the popularity of K-content around the world. OTT platforms at home and abroad are increasing the demand for original content production, leading to the establishment of Korean content production companies and production studios with eyes set on the global market.CJ ENM, JTBC, and other Korean conglomerates are launching and acquiring content production companies, as well as establishing virtual production studios for creating realistic content.Moreover, the pool of highly skilled production talent is expanding, from skilled production experts who have been leading the Korean Wave content production for more than 20 years to those who have recently produced global box office hits.The establishment and strengthening of this robust content production pipeline and the accompanying growth of related talent are creating a strong trust that what works in Korea works in the global market.- CJ ENM

- JTBC

Dynamic Combination of Innovative Technologies and Creative Cultural Content and Strong SupportBased on world-class ICT and internet networks, the Korean cultural content industry is rapidly adopting and integrating state-of-the-art media technologies and expanding its convergence industry landscape.The growth outlook of this market is very promising as convergent content with advanced technologies can reduce the cost and time of content production for investors and enable the production of high-quality content.The government is also supporting the exchange and collaboration of tech companies and cultural content producers, as well as training relevant workforce by introducing various related projects and systems through relevant agencies. -

Government Providing Full Support with Content Industry Policies and Incentives 내용열기Government Providing Full Support with Content Industry Policies and IncentivesThe Korean government announced four national agendas for promoting the cultural content industry in order to facilitate the transformation to a service economy to generate new growth engines and spread the appeal of K-content around the world. Also proposed are various detailed tasks to be implemented by related ministries such as strengthening support for companies and ventures and providing policy financing aimed at making K-content a game changer in the export landscape."Government policies supporting the cultural content industry (2023)"

국정과제

- 신성장동력 확보를 위한 서비스 경제 전환 촉진

- K-콘텐츠의 매력을 전 세계로 확산

- 글로벌 미디어 강국 실현

- 국민과 동행하는 디지털·미디어 세상

관계부처추진과제

- K-콘텐츠, 수출 지형을 바꾸는 게임 체인저

- 콘텐츠 스타트업·벤처 전 주기 지원

- 역대 최대 규모 7,900억 원 정책금융(K-콘텐츠펀드, 콘텐츠IP 펀드 조성 등) 지원

- 1만 명 콘텐츠 인재 양성

- K-콘텐츠 및 연관산업 수출 확대 (기업 해외 진출 지원 거점 확대 등)

목표 및 예산

K-콘텐츠 23년 콘텐츠 분야 총 예산 : 약9,743억원

- 매출액

- (’23) 153조원 (’27) 200조원

- 수출액

- (’23) 150억 달러 (’27) 220억 달러

- 한류팬 수

- (’20) 1.2억명 (’27) 3.6억명

※ Source: Ministry of Culture, Sports and Tourism (2023) and press releasesIn addition, various tax incentives are offered to boost the industry.Especially noteworthy is the provision allowing tax credit for video content production costs, which is the only provision covering the cultural content industry in the Tax Special Exception Limitation Act that is specifically designed for the manufacturing industry.The provision is a tax benefit granted for the production of programs aired on TV and movies premiered in a cinema, and original OTT content has been added to the tax credit list."Tax Credit for Video Content Production Costs"Tax Credit for Video Content Production Costs Category Description Scope Production costs of movies premiered in a cinema for seven days or more (one day or more for art films), televised drama, animation, documentary, comedy programs, and OTT content (added). Deduction rate and method Certain rates of video content production costs (10% for small-sized enterprises, 7% for medium-sized enterprises and 3% for large-sized enterprises) deducted from the income tax or corporate tax of the taxable year in which the video content first broadcasts or premiers in a cinema. Deducted costs Video content production costs incurred at home and abroad during the following processes. - 1. Preparation for production

- 2. Filming production

- 3. Post-production

* Excluded from deductible expenses are contributions to public agencies and local public corporations, advertising and PR expenses, entertainment expenses, certain labor expenses, and the aggregate of the salaries of the five actors with the highest salaries, but not more than 30% of the total production expenses.※ Source: KOCCA (2022) and press releases (2023) -

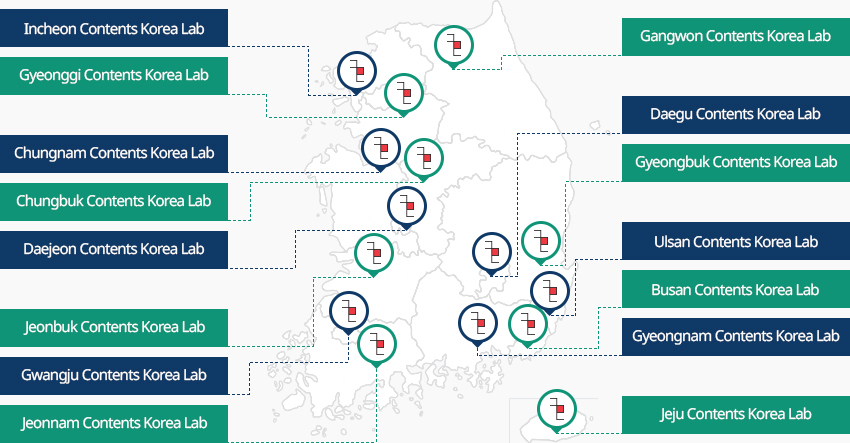

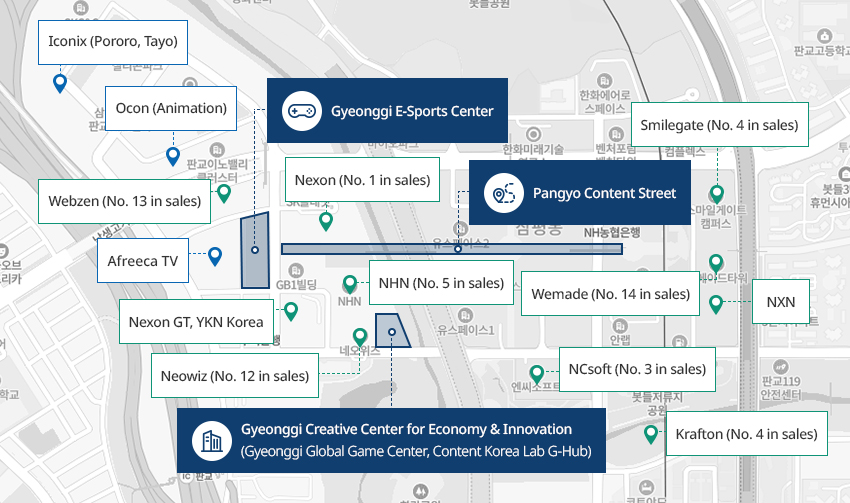

Balanced Development through the Establishment of Special Industrial Zones and the Promotion of Regional Cultural Content Industries 내용닫기Balanced Development through the Establishment of Special Industrial Zones and the Promotion of Regional Cultural Content IndustriesDesignation of cultural content business hubs, incubators, and special industrial zones for balanced developmentThe Korean government aims to create the ecosystem for regional content production and startup creation and contribute to balanced national development by establishing 16 content hubs nationwide and a total of 15 regional incubators for preliminary and early-stage startups. Moreover, special zones are designated by the types of cultural content unique to each region, and specialized projects are being implemented.A case in point in the Pangyo Game and Content Special Zone in Seongnam, Gyeonggi. A specialized project is ongoing with a total project budget of KRW 171.9 billion for the objective of creating by 2025 infrastructure for the game content industry and strengthening corporate support programs."Regional Incubators Supporting Preliminary and Early-stage Startups"

- 인천콘텐츠코리아랩

- 경기콘텐츠코리아랩

- 충남콘텐츠코리아랩

- 충북콘텐츠코리아랩

- 대전콘텐츠코리아랩

- 전북콘텐츠코리아랩

- 광주콘텐츠코리아랩

- 전남콘텐츠코리아랩

- 강원콘텐츠코리아랩

- 대구콘텐츠코리아랩

- 경북콘텐츠코리아랩

- 울산콘텐츠코리아랩

- 부산콘텐츠코리아랩

- 경남콘텐츠코리아랩

- 제주콘텐츠코리아랩

※ Source: KOCCA"Pangyo Game and Content Special Zone"- 아이코닉스(뽀로로, 타요)

- 오콘(애니메이션)

- 웹젠 (매출 13위)

- 아프리카tv

- 넥슨gt, 플레이위드

- 네오위즈 (매출 12위)

- 경기 E스포츠 전용 경기장

- 넥슨 (매출 1위)

- nhn (매출 5위)

- 경기창조경제혁신센 (경기글로벌게임센터,콘텐츠코리아랩문화창조허브)

- 판교 콘텐츠 거리

- 스마일게이트 (매출 4위)

- 위메이드 (매출 14위)

- 엔씨소프트 (매출 3위)

- nxn

- 크레프톤 (매출 4위)

※ Source: Seongnam City GovernmentEstablishment of an IP Convergence Cluster by 2025The government plans to build by 2025 an "IP Convergence Cluster" for the convergence of content IPs.In order to induce the creation of cultural content with high growth potentials, the project is ongoing with a project budget of KRW 169.9 billion in 2023. The project aims to foster major IP companies holding key IPs for content IP convergence (e.g., production of webtoon-based animation programs) and provide funds, production infrastructure, and support technology development. -

Korea, Center of Video Content and Game Investment 내용열기Korea, Center of Video Content and Game Investment

Netflix invests in a state-of-the-art special effects studio in KoreaNetflix, a global OTT platform, is building an ecosystem of content creation and production by installing in-house studios in various parts of the world, including the US where it is headquartered, Spain, and the UK. Especially noteworth is that Netflix has chosen Korea to build its first Asian content production base.Eyeline Studios, a Netflix subsidiary that produces special effect videos, announced that it will establish a subsidiary in Seoul in 2022 and invest USD 100 million over the next five years (2023 to 2027). Eyeline Studios decided to invest in Korea by considering the potential of K-content in the global market and the excellence of Korean special effects video production specialists.The investment is expected to contribute to the development of the Korean film and drama production industry as it will help upgrade K-content through the introduction of advanced special effects technology as well as directly creating 200 jobs.

Netflix invests in a state-of-the-art special effects studio in KoreaNetflix, a global OTT platform, is building an ecosystem of content creation and production by installing in-house studios in various parts of the world, including the US where it is headquartered, Spain, and the UK. Especially noteworth is that Netflix has chosen Korea to build its first Asian content production base.Eyeline Studios, a Netflix subsidiary that produces special effect videos, announced that it will establish a subsidiary in Seoul in 2022 and invest USD 100 million over the next five years (2023 to 2027). Eyeline Studios decided to invest in Korea by considering the potential of K-content in the global market and the excellence of Korean special effects video production specialists.The investment is expected to contribute to the development of the Korean film and drama production industry as it will help upgrade K-content through the introduction of advanced special effects technology as well as directly creating 200 jobs. Tencent Increases Equity Investment in Korean Game DevelopersWith the steady growth of foreign investment in Korean game developers, Chinese IT giant Tencent continues to make new and increased investments in Korean online and mobile game companies. In July 2022, Tencent became the first Chinese game company to join the board of directors of the Korea Association of Game Industry (K-GAMES) and is expected to expand its influence in the Korean game market while continuing to invest in Korean game companies.Considering Tencent's powerful influence in the Chinese game market and the Chinese government's issuance in December 2022 of several "banhao" (game service licenses) to Korean games in the Chinese market for the first time in a year and a half, expectations are rising that Tencent's investment in Korea will provide a new opportunity for Korea game developers to launch their high-quality games in the Chinese market.

Tencent Increases Equity Investment in Korean Game DevelopersWith the steady growth of foreign investment in Korean game developers, Chinese IT giant Tencent continues to make new and increased investments in Korean online and mobile game companies. In July 2022, Tencent became the first Chinese game company to join the board of directors of the Korea Association of Game Industry (K-GAMES) and is expected to expand its influence in the Korean game market while continuing to invest in Korean game companies.Considering Tencent's powerful influence in the Chinese game market and the Chinese government's issuance in December 2022 of several "banhao" (game service licenses) to Korean games in the Chinese market for the first time in a year and a half, expectations are rising that Tencent's investment in Korea will provide a new opportunity for Korea game developers to launch their high-quality games in the Chinese market.

-

Complex nameSongdo Knowledge and Information Industrial Complex(Incheon Free Economic Zone)

-

Initial designation date2000.09.18

-

Designated area(m2)2,401,745

-

ManagementIncheon Free Economic Zone Authority

-

Nearby RailwayBupyeong Station

-

Distance from station(km)18

-

Nearby AirportIncheon Airport

-

Distance from airport(km)31

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentIncheon Metropolitan City Yeonsu-gu

-

Population2,943,491

-

Complex nameChuncheon Urban High-tech Cultural Industrial Complex

-

Initial designation date2008.01.25

-

Designated area(m2)186,922

-

ManagementGangwon-do Chuncheon City

-

Nearby RailwayJipyeong Station

-

Distance from station(km)60

-

Nearby AirportWonju Airport

-

Distance from airport(km)78

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentGangwon-do Chuncheon City

-

Population281,854

-

Complex nameChuncheon Power IT Cultural Complex General Industrial Complex

-

Initial designation date2009.06.05

-

Designated area(m2)353,659

-

ManagementGangwon-do Chuncheon City

-

Nearby RailwayYangpyeong Station

-

Distance from station(km)49

-

Nearby AirportWonju Airport

-

Distance from airport(km)65

-

Industrial water Supply capacity(ton/day)1,706(㎥/day)

-

Affiliation local governmentGangwon-do Chuncheon City

-

Population281,854

-

Complex nameCheongju Urban High-tech Cultural Industrial Complex

-

Initial designation date2002.03.25

-

Designated area(m2)47,900

-

ManagementChungcheongbuk-do Cheongju City

-

Nearby RailwayOgeunjang Station

-

Distance from station(km)6

-

Nearby AirportCheongju International Airport

-

Distance from airport(km)9

-

Industrial water Supply capacity(ton/day)-

-

Affiliation local governmentChungcheongbuk-do Cheongju City

-

Population843,782

-

Complex namePaju Publishing Culture Information National Industrial Complex

-

Initial designation date1997.03.26

-

Designated area(m2)1,561,939

-

ManagementKorea Industrial Complex Corporation

-

Nearby RailwayPaju Station

-

Distance from station(km)17

-

Nearby AirportGimpo International Airport

-

Distance from airport(km)29

-

Industrial water Supply capacity(ton/day)2176(㎥/day)

-

Affiliation local governmentGyeonggi-do Paju City

-

Population459,158

-

Complex nameSongam General Industrial Complex

-

Initial designation date1979.07.04

-

Designated area(m2)415,946

-

ManagementGwangju City (Songam Industrial Complex Council)

-

Nearby RailwayGwangju Station

-

Distance from station(km)14

-

Nearby AirportGwangju Airport

-

Distance from airport(km)9

-

Industrial water Supply capacity(ton/day)6000000(㎥/day)

-

Affiliation local governmentGwangju Metropolitan City Nam-gu

-

Population1,454,154