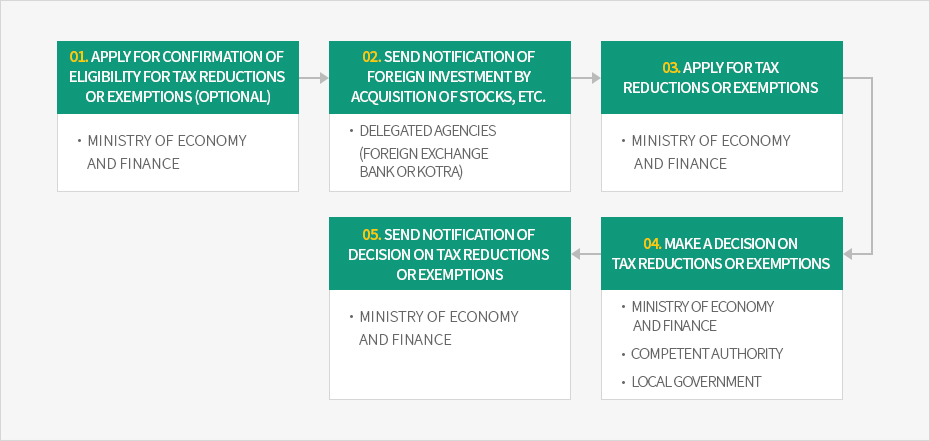

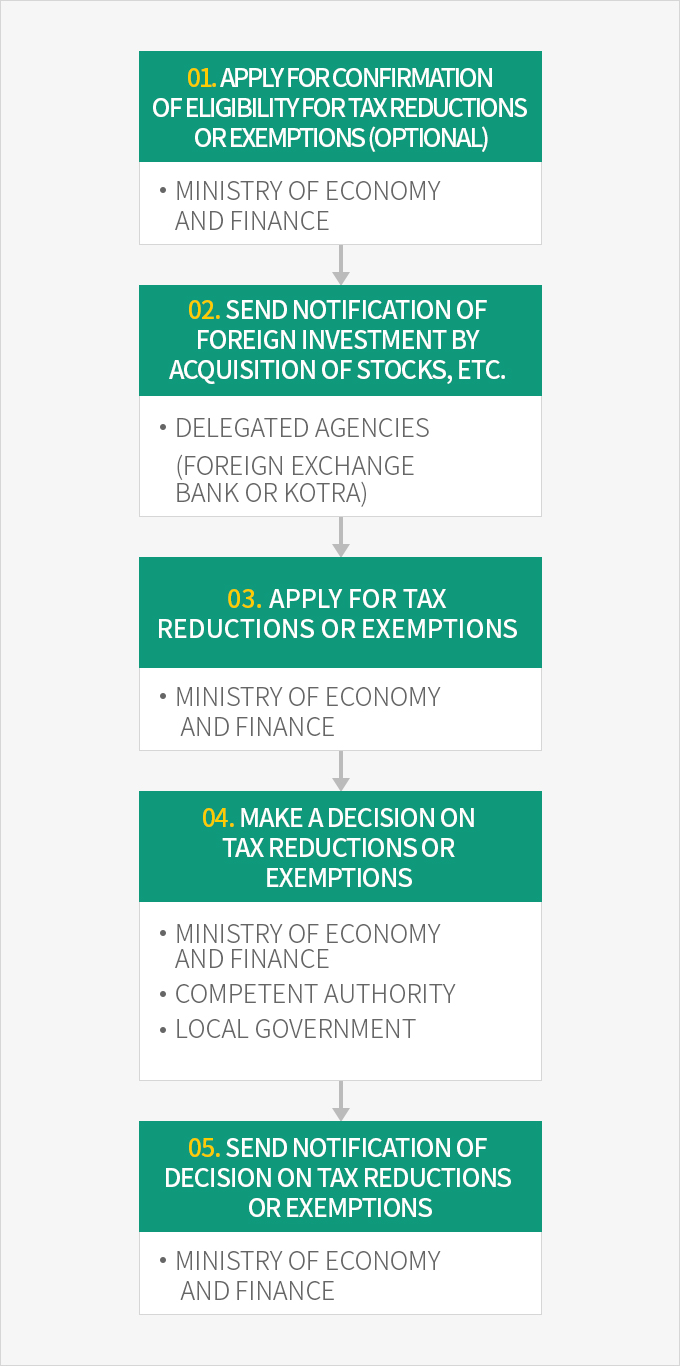

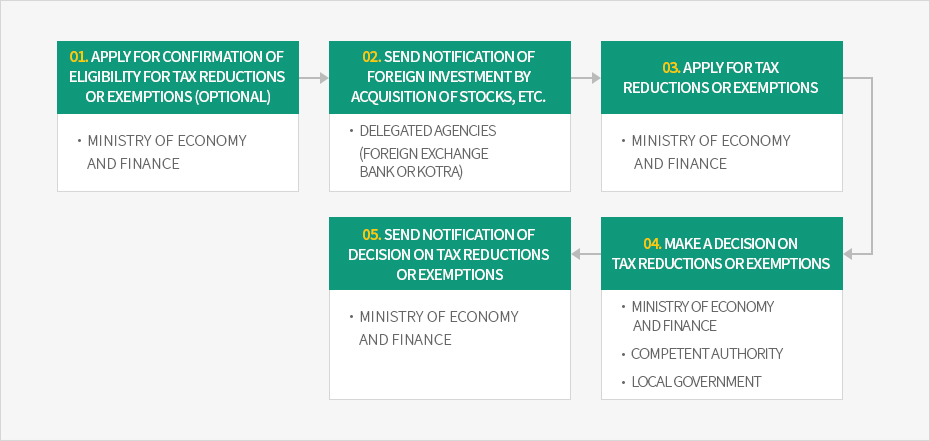

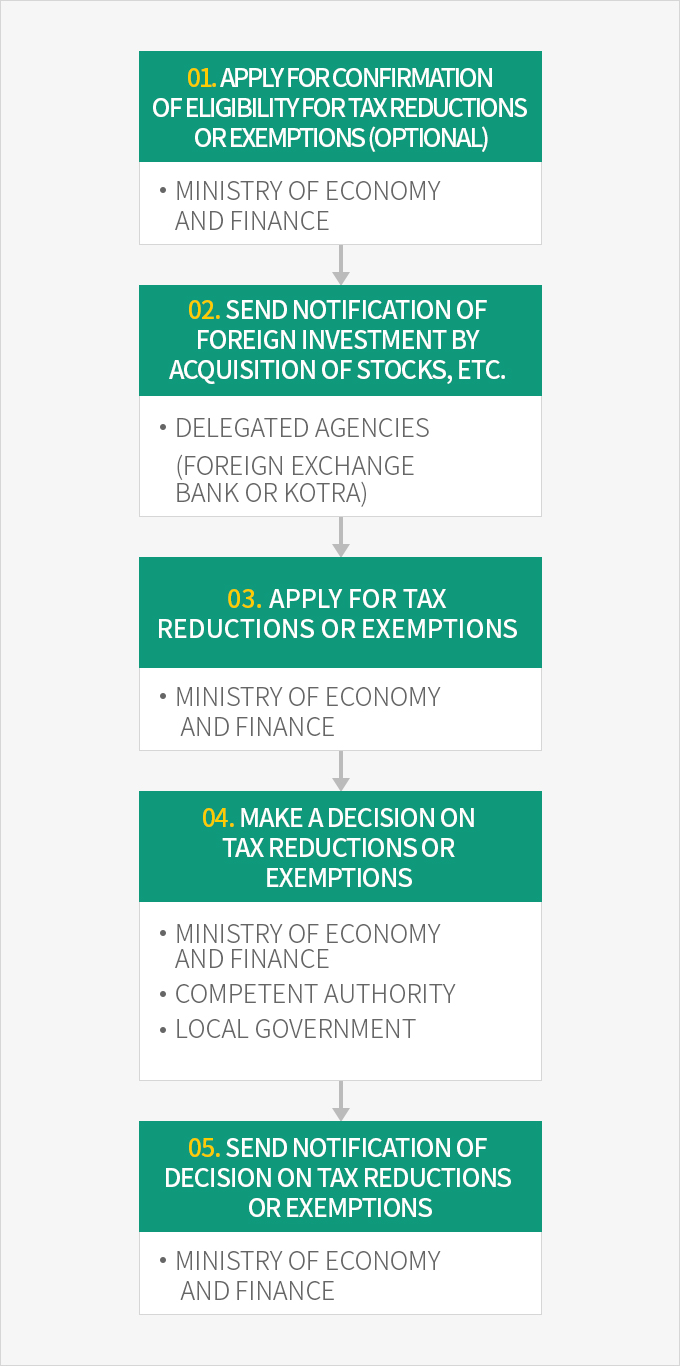

Application Procedures for Tax Reductions or Exemptions

- 조세감면 대상사업 사전확인 신청(선택사항) - 기획재정부

- 주식 등의 취득에 의한 외국인 투자신고 - 수탁기관(외국환은행 및 KOTRA)

- 조세감면 신청 - 기획재정부

- 조세감면 여부 결정 - 기획재정부, 관련부처, 지방자치단체

- 조세감면 여부 통보 - 기획재정부

Confirmation of Eligibility for Tax Reductions or Exemptions

A foreign investor may request a confirmation of eligibility for tax reductions or exemptions before sending notification of a foreign investment. The confirmation process verifies simply whether the foreign investor’s technology is subject to tax reductions or exemptions, hence, an application for tax reductions or exemptions must be made after notification of the investment.

Decision and Notification of Tax Reductions or Exemptions

The Minister of Economy and Finance must discuss applications for tax reductions or exemptions or for changes of tax reductions or exemptions with ministers of other relevant ministries and heads of local government. The Minister must make a decision on any tax reduction or exemption and send notification of the result to the applicant, the director of the National Tax Service, the commissioner of customs, and the head of the concerned local government within twenty days.

In inevitable cases, the processing period can be extended up to twenty days.

Preliminary Notification of Businesses Ineligible for Tax Reductions or Exemptions

If a business has been deemed ineligible for a tax reduction or exemption, the Minister of Economy and Finance must give a preliminary notification of this determination within twenty days from the date the application was submitted. The applicant may file a written form along with supplementary explanatory materials to request a review of the appropriateness of the preliminary notification within twenty days from the date the notification was delivered. The Minister of Economy and Finance must make a decision on any tax reductions or exemptions and send notification of the results within twenty days from the date of request.

※ Related laws : Article 121.2.8 of the Restriction of Special Taxation Act, Article 116.3.1~6 of the Enforcement Decree of the Act