- Home

- Incentives

- R&D Center

- Business-Affiliated Research Institutes, etc.

Business-Affiliated Research Institutes, etc.

※ Related laws: Article 14.2 of the Basic Research Promotion and Technology Development Support Act, Article 16.2 of the Enforcement Decree of the Act

Notification

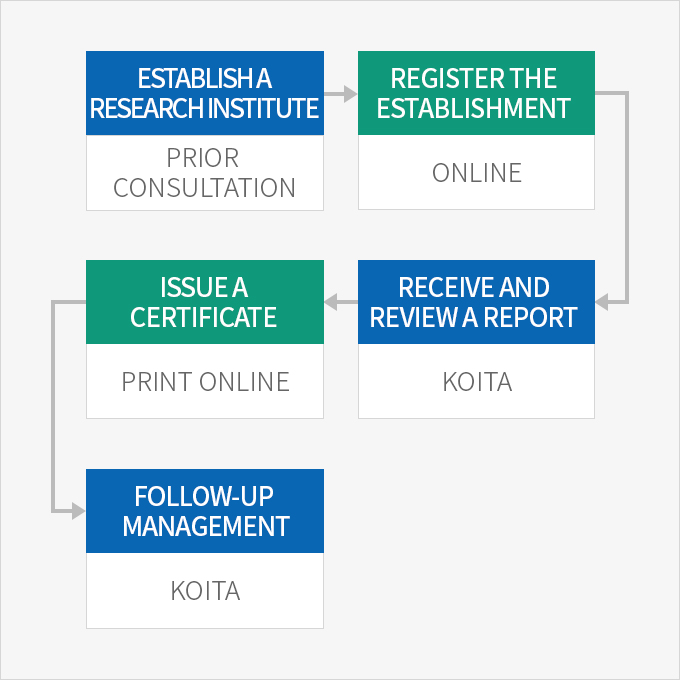

- establish a research institute - prior consultation

- register the establishment - online

- receive and review a report - koita

- issue a certificate - print online

- follow-up management - koita

Requirements for Approval

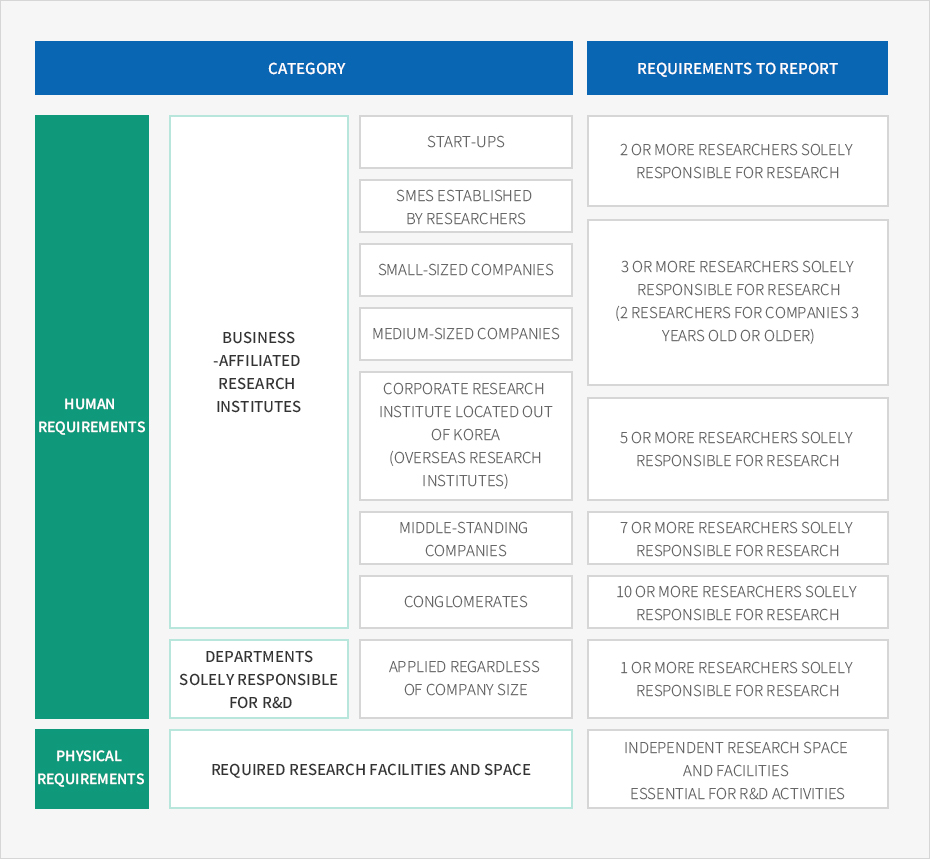

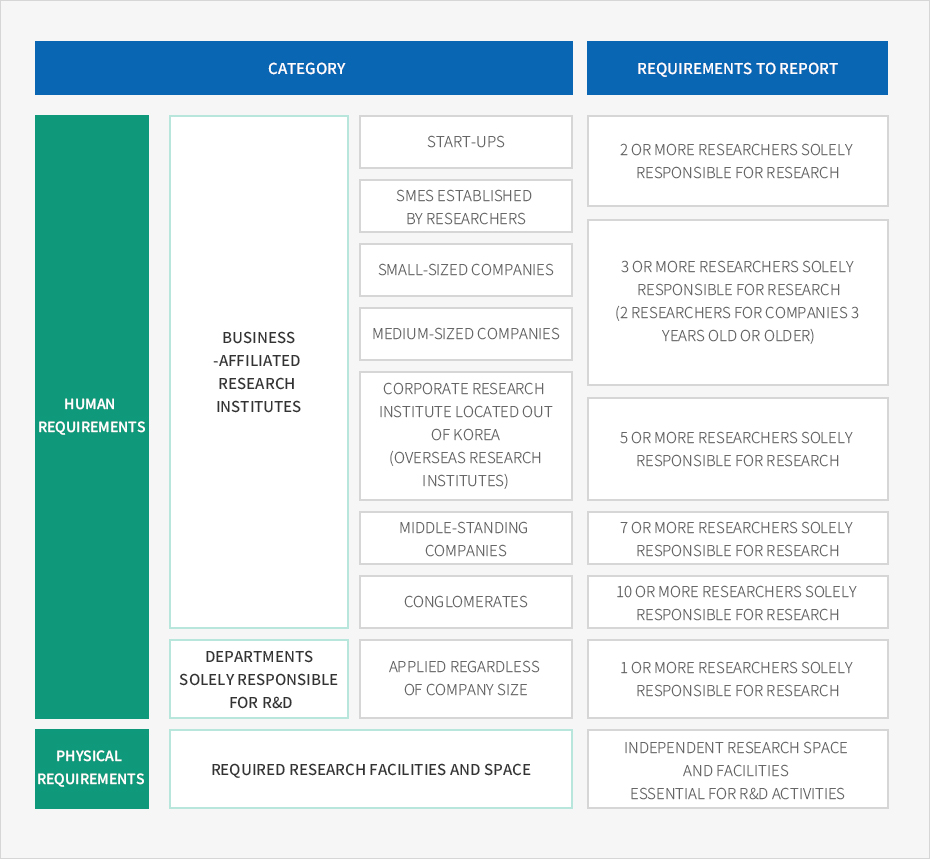

| category | requirements to report | ||

|---|---|---|---|

| human requirements | business-affiliated research institutes | start-ups | 2 or more researchers solely responsible for research |

| SMEs established by researchers | |||

| small-sized companies | 3 or more researchers solely responsible for research(2 researchers for companies 3 years old or older) | ||

| medium-sized companies | 5 or more researchers solely responsible for research | ||

| corporate research institute located out of Korea (overseas research institute) | |||

| middle-standing companies | 7 or more researchers solely responsible for research | ||

| conglomerates | 10 or more researchers solely responsible for research | ||

| departments solely responsible for R&D | applied regardless of company size | 1 or more researchers solely responsible for research | |

| physical requirements | required research facilities and space | independent research space and facilities essential for R&D activities | |

Support Provided

Tax and Customs Support

| Support | Related Law | |

|---|---|---|

| Tax deductions for research and HR development expenses | General research | Article 10 of the Restriction of Special Taxation Act (Attached Table No. 6) |

| New growth engines | Article 10 of the Restriction of Special Taxation Act (Attached Table No. 7) | |

| Tax deductions for R&D and HR development and facility investment | Article 25 of the Restriction of Special Taxation Act | |

| Local tax deductions for real estate to be used as business-affiliated research institutes | Article 46.1 of the Restriction of Special Local Taxation Act | |

| Special taxation for technology transfer and leasing, etc. | Article 12 of the Restriction of Special Taxation Act | |

| Income tax reductions or exemptions for foreign engineers | Article 18 of the Restriction of Special Taxation Act | |

| Special taxation for R&D-related contributions, etc. | Article 10.2 of the Restriction of Special Taxation Act | |

| Corporate tax reductions or exemptions for high-tech companies in special R&D zones | Article 12.2 of the Restriction of Special Taxation Act | |

| No income tax for research activities of researchers | Article 12.12.3 of the Enforcement Decree of the Income Tax Act | |

| Customs reductions or exemptions for industrial technology R&D goods | Article 90.1.4 of the Customs Act | |

Financial Support

| Responsible Authority | Content | Information |

|---|---|---|

| Ministry of Science and ICT | Technology development |

|

| Ministry of Trade, Industry and Energy | Core industrial technology development, etc. |

|

| Ministry of SMEs and Startups | New product technology development, etc. |

|

Employment Support

| Support Provided | Content | Contact |

|---|---|---|

| Researcher system | Alternative military service | KOITA 02-3460-9124 |

| Researcher support system for SMEs (employment, dispatch) | Support for labor costs when employing researchers | KOITA 02-3460-9082 |

| Core researcher system for middle market enterprises | Support for labor costs when employing researchers | KIAT 02-6009-35122 |

| Youth Tomorrow Deduction | Support for young adults’ savings | Ministry of SMEs and Startups 1357 |

| ICT academic credit project internship | Support for internship program costs | Federation of Korean Information Industries 02-2132-0726 |

| Capacity-building project for industrial experts | Support for expert development costs | KIAT 02-6009-4375 |

| Invitation project of high-level overseas scientists (Brain Pool) | Support for invitation and research costs | National Research Foundation of Korea 042-869-6377 |

| Letter of employment recommendation system (Gold Card) | Employment recommendation for overseas technical talent | KOTRA 02-3460-7388 |

| Subsidy for additional employment of youth | Support for employment subsidies | Ministry of Employment and Labor 1350 |

| Recruitment center for science and engineering experts | Connect science and engineering experts with work in the field | KOITA 02-3460-9033 |

Technical Support

| Responsible Agency | Content | Information |

|---|---|---|

| Ministry of Trade, Industry and Energy | Reliability voucher program (support for material development) | www.신뢰성바우처.org |

| Ministry of Science and ICT | K-Global project |

k-global@nipa.kr www.nipa.kr |

| Industry-Academic-Research institute cooperative cluster | www.koita.or.kr | |

| Follow-up R&D project of joint research institute of academic-research institute | ||

| Ministry of SMEs and Startups | Consulting service for SMEs | www.smbacon.go.kr |

| Support for acquisition of overseas standard certification | www.exportcenter.go.kr | |

| Korea Intellectual Property Office | Support for IP-R&D strategies | http://biz.kista.re.kr/ippro |

| Support for evaluation of patent technology and commercialization | www.kipa.org |