- Home

- Incentives

- R&D Center

- Professional Research Business

Professional Research Business

※ Related law: Articles 2 and 25 of the Special Act on Support of Science and Engineers for Strengthening National Science and Technology Competitiveness

| Category | Content | Eligible Businesses |

|---|---|---|

| Research and development business | Businesses that conduct some or all R&D activities for companies that are unable to meet their own R&D demands (entrustment), or businesses that independently develop and supply technologies required by the market |

|

| Research and development support business | Businesses that support R&D activities, such as R&D consulting, R&D planning and evaluation, leasing and transactions of research equipment, technology management and strategy, analysis on science and technology information and the securing and suggesting of personnel to do such tasks |

|

Notification

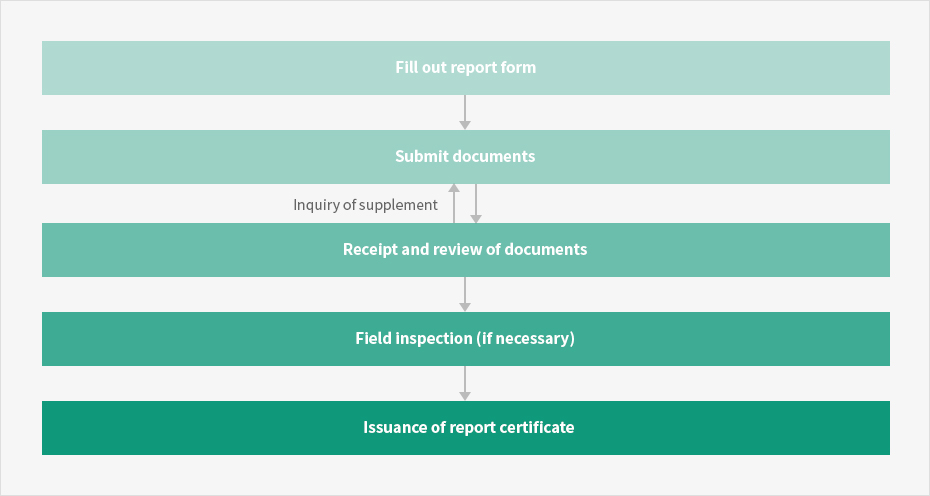

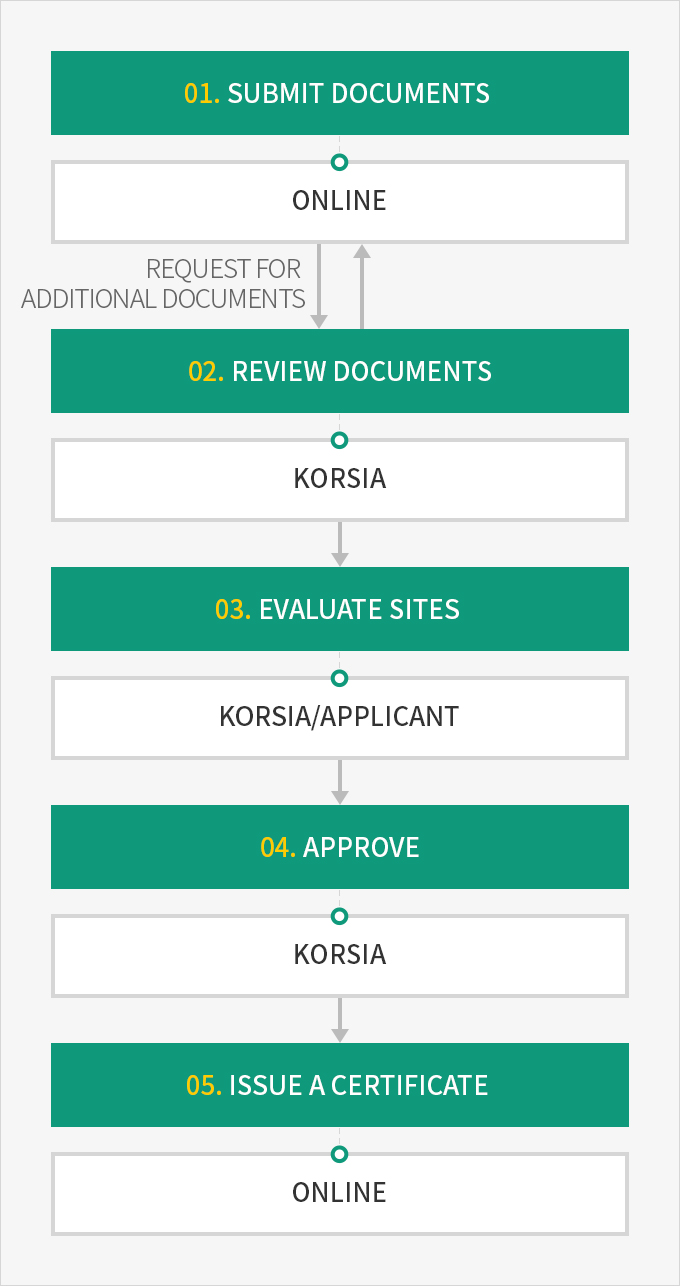

- sumit document - online (request for additional)

- review document - KORSIA

- evaluate sites - KORSIA/APPLICANT

- approve - KORSIA

- issue a certificate - online

- TEL : 02-779-9071

- FAX : 02-779-9070

- E-mail :rndia@rndia.or.kr

- Hompage : https://www.rndia.or.kr

Requirements for Approval

| Category | Research and development service | Research and development support service |

|---|---|---|

| HR requirements | At least 5 researchers who majored in natural sciences or engineering | At least 2 researchers who majored in natural sciences or engineering |

| Physical requirements | Independent research facility | N/A |

| Sales requirements | R&D services account for at least 50% of total sales | - |

Support Provided

HR Support

| Support Provided | Content | Contact | Selection of designated entities for recruiting expert research personnel (special cases for military service) | Articles 36 and 39 of the Military Service Act | KOITA 02-3460-9124 |

|---|

Eligible Businesses

| Ministry of Science and Technology | Ministry of Trade, Industry and Energy | Ministry of SMEs and Startups | Ministry of Land, Infrastructure and Transport | Ministry of Agriculture, Food and Rural Affairs |

|

|

|

|

|

|---|

Financial Support

| Support | Content |

|---|---|

| Technology certificate system | Conduct reviews on SME technologies and obtain certification from the Korea Technology Finance Corporation to receive financial support from financial institutions |

| Technology evaluation system | Evaluate technicality, feasibility, and marketability of intangible technologies to display the value, grade, score, and opinion |

| Contact | Korea Technology Finance Corporation : 1544-1220 |

Tax Support

| Support Provided | Content |

|---|---|

| Tax reductions or exemptions for small- and medium-sized startups, etc. | Income tax or corporate tax reduced or exempted for designated SMEs, and research and development service businesses identified as operators at startup incubating centers outside overconcentration control regions |

| Special cases for SMEs | Income tax or corporate tax reduced or exempted for SMES, depending on size and location |

| Tax deductions for R&D costs | A certain percentage of R&D costs incurred by companies deducted from corporate tax or income tax |

| Tax reductions or exemptions related to investment in facilities concerning research and human resource development | A certain percentage of investment in facilities for research and human resource development by Koreans or commercialization of new growth engine industries deducted from corporate tax or income tax |

| Tax deductions for technology transfer and acquisition | If the patent rights, utility model rights, confidential technologies, or technologies are transferred to and acquired by a Korean national, a certain percentage of acquisition costs are deducted from income tax or corporate tax of the year. |

| Special tax reductions or exemptions for SMEs | Income tax or corporate tax reduced or exempted for SMEs |

| Special cases of taxation on R&D related contributions, etc. | The equivalent amount of contributions for R&D excluded from gross income |

| Tax reductions or exemptions for high-tech companies in special R&D zones | Income tax (corporate tax) reduced or exempted for high-tech or small-sized research companies located in special R&D zones that are engaged in projects subject to reductions or exemptions |