- Home

- Investment Guide

- Business Operations

- Taxation

- Types of Taxes

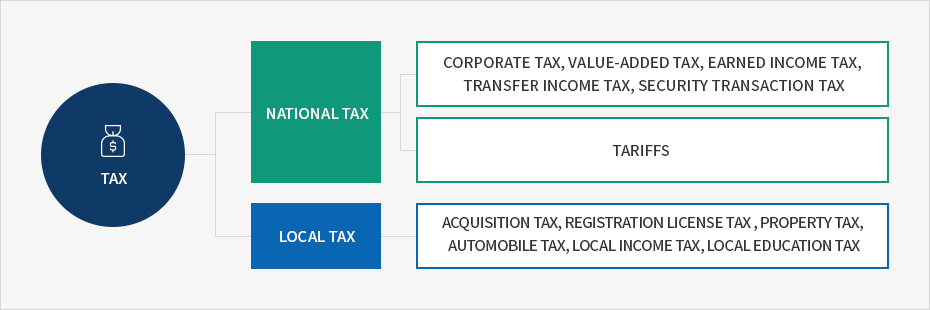

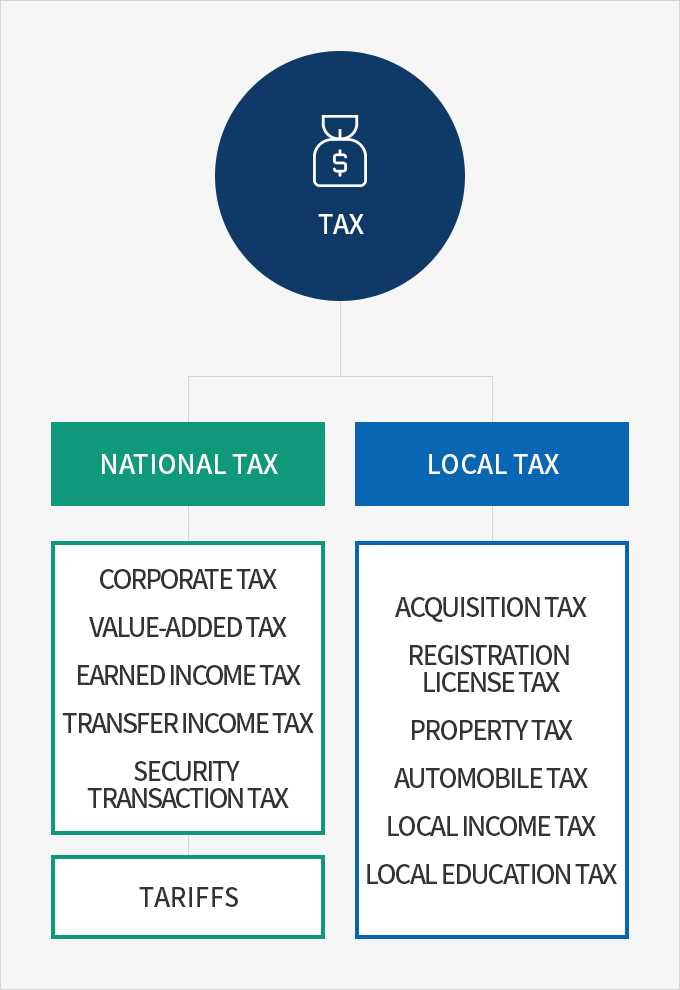

Korea’s tax system is categorized, depending on the authority of taxation, into national taxes and local taxes. National taxes are further divided into internal taxes, including corporate tax and income tax, and tariffs imposed on imported goods. Local taxes, which are imposed by local governments, include acquisition tax, registration license tax, and property tax. Foreign companies must also consider the handling of transfer pricing taxation regarding international transactions with specially related persons such as foreign investors, and the insufficient capital tax system regarding loans.

Key Types of Taxes Related to Foreign Investment

Services

Invest KOREA provides services support your investment journey.

Find Nearby Invest KOREA Offices

Discover nearby offices for Convenient access in your area