- Home

- Investment Guide

- Business Operations

- Customs Clearance

- Customs Clearance Procedures

Customs Clearance Procedures

Customs Clearance Procedures

Import Clearance

In order to export, import, or return goods, the name, standard, quantity, and price of such goods and other matters prescribed by the relevant regulations must be reported to the head of a customs office. The declaration of imports can only be made after the vessel (aircraft) loaded with the goods has arrived, but the import declaration can be made before arrival when the goods to be imported need to be cleared promptly. Goods that have been declared for import before arrival are deemed to have arrived in Korea.Documents for Import Declaration

Submission of the invoices, bills of landing, packing lists, certificates of origin, and documents confirming other import requirement is required for cargo owners, certified customs brokers, etc. when filing an import declaration. The declaring must summit the documents if requested for the clearance procedure, but if not they may keep the documents by themselves.Import Declaration

Import declaration is undertaken according to the method of screening, document screening, and inspection of goods, etc. When the import declaration is made legally, the report is immediately accepted. If the items listed in the declaration are not sufficient, a supplemental import declaration or customs clearance may be requested.Inspection of Imported Goods

This inspection refers to whether the goods declared for import conform to the import declaration and whether they violate any regulations set by relevant laws and regulations through in-kind inspection. The inspection ratio may be applied differentially in consideration of compliance with regulations of importing companies, records of inspection performance, country of origin, etc., while the inspection method may be extractive inspection, total inspection, or via analysis depending on the inspection objects. The importers bear the costs of inspecting imported goods.Issuance of Certificate of Import Declaration

When the customs officer accepts the import declaration, a declaration certificate electronically stamped by the Customs Special Officer is issued to the declarant.

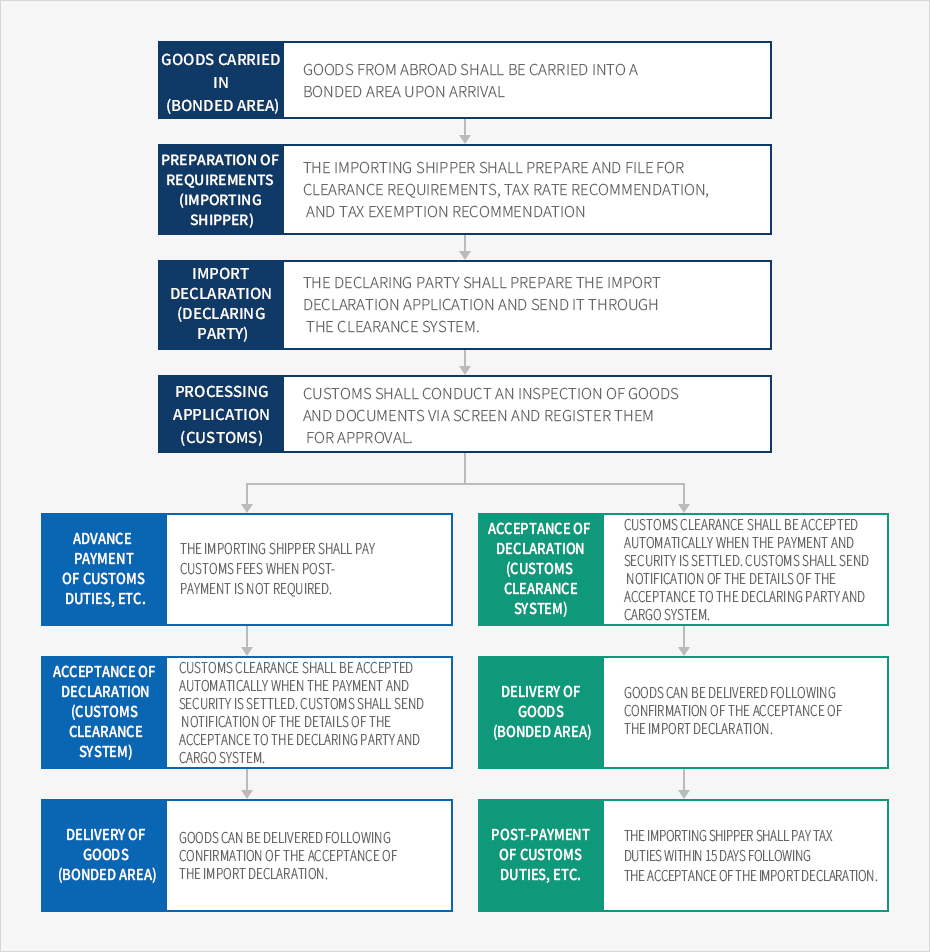

- Goods carried in (Bonded area)

Goods from abroad shall be carried into a bonded area upon arrival.

- Preparation of requirements (Importing shipper)

The importing shipper shall prepare and file for clearance requirements, tax rate recommendation, and tax exemption recommendation

- Import declaration (Declaring party)

The declaring party shall prepare the import declaration application and send it through the clearance system.

- Processing application (Customs)

Customs shall conduct an inspection of goods and documents via screen and register them for approval.

- Advance payment of customs duties, etc.

The importing shipper shall pay customs fees when post-payment is not required.

- Acceptance of declaration (Customs clearance system)

Customs clearance shall be accepted automatically when the payment and security is settled. Customs shall send notification of the details of the acceptance to the declaring party and cargo system.

- Delivery of goods (Bonded area)

Goods can be delivered following confirmation of the acceptance of the import declaration.

- Acceptance of declaration (Customs clearance system)

Customs clearance shall be accepted automatically when the payment and security is settled. Customs shall send notification of the details of the acceptance to the declaring party and cargo system.

- Delivery of goods (Bonded area)

Goods can be delivered following confirmation of the acceptance of the import declaration.

- Post-payment of customs duties, etc.

The importing shipper shall pay tax duties within 15 days following the acceptance of the import declaration.

- Advance payment of customs duties, etc.

Internet Portal for Customs Clearance (UNI-PASS)

Services

The primary services of UNI-PASS include electronic declaration, electronic payment, information check, and providing a unique personal customs code.| Service | Contents |

|---|---|

| Electronic Declaration | Reports for import and export declaration or applying for a refund can be done online and checked afterwards. Customs documents can also be printed out. |

| Electronic Payment | Following the import declaration, customs duties can be paid and processing details can be checked. |

| Information Check | Declarants may check customs information, regulatory compliance, HS codes, etc. required for administrative tasks related to customs. |

| Unique Personal Customs Code | A unique customs clearance code used to report imports of personal goods is issued and declarants may check the code. |

Application Procedure

To use the UNI-PASS system, it is necessary to receive the approval of customs. The applicant must apply for and obtain a certificate from an accredited certification body and then join the system via the user registration menu. Then the officer in charge will approve the use of UNI-PASS after the confirmation of the application.How to Use

UNI-PASS provides two types of services regarding the declaration method: application via a website; or application by PC and submitting to UNI-PASS all documents using the software to transmit multiple cases. The latter is useful when processing large amount of data or when there are many applications.

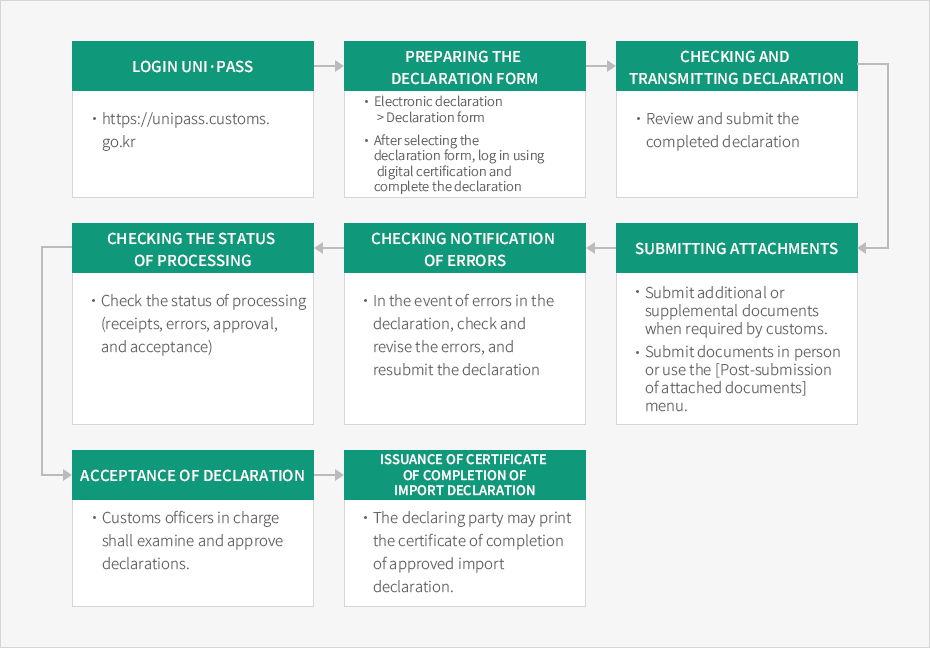

- Login UNI·PASS

- https://unipass.customs.go.kr

- Preparing the Declaration Form

- Electronic declaration > Declaration form

- After selecting the declaration form, log in using digital certification and complete the declaration

- Checking and Transmitting Declaration

- Review and submit the completed declaration

- Checking the Status of Processing

- Check the status of processing (receipts, errors, approval, and acceptance)

- Checking Notification of Errors

- In the event of errors in the declaration, check and revise the errors, and resubmit the declaration

- Submitting Attachments

- Submit additional or supplemental documents when required by customs.

- Submit documents in person or use the [Post-submission of attached documents] menu.

- Acceptance of Declaration

- Customs officers in charge shall examine and approve declarations.

- Issuance of Certificate of Completion of Import Declaration

- The declaring party may print the certificate of completion of approved import declaration.