This March, the Federal Open

Market Committee (FOMC)

made a bold turnaround move

by raising the federal funds rate

by 0.25 percent—from 0.50-0.75 percent

to 0.75-1 percent. This rate hike signifies

that the FOMC is departing from the

decade-old tradition of low rates, instead

opting for more “normal” rates. No one

knows what exactly what the normal rates

are, but everybody knows for certain that

the current rate is too low. No matter who

has initiated it, and no matter how successful

it has been in dealing with the

post subprime mortgage crisis, this

decade-long low rate regime should come

to an end and give way to a new world

where normal rates preside.

The normalization policy of returning

to a higher rate is hard to understand for

most people, especially when the economy

has been sluggish for quite some time

and a majority of people are ridden with

heavy debt. Despite the assurances of the

U.S. Federal Reserve about strong

employment and inflation statistics, many

people believe the U.S. economy is still

far from full employment, and a higher

rate is hard to accept. For countries like

Korea, such a rate might be even more

difficult to swallow.

But like always, there is the other side

of the coin. A higher rate could actually

be a blessing, helping the economy come

out of a long economic slump. First, this

rate policy allows higher income to

depositors. Under a high rate regime,

commercial banks naturally have to ask

for higher rates to the borrowers, but at

the same time, they should provide higher

rates to depositors in order to attract new

deposits. Thus, a higher deposit rate

makes it possible for depositors to have a

higher income. In Korea, aggregate deposits of the banking industry amounts

to almost KRW 2.3 quadrillion, and a 1

percent increase

in the deposit rate means

KRW 23 trillion extra interest income to

depositors, which equals about 3 percent

of KRW 770 trillion in private consumption.

Therefore, an increase in the deposit interest rate could work as a strong stimulant

for private consumption.

Second, a higher rate would enable

banks to create more credit to the system

by encouraging more deposits to the

banking system. In other words, a higher

rate could encourage money supply by

the credit creation process. It may seem

odd, but past history has proved that this

is effective. The low rate regime in the

past discouraged bank savings, substantially

reducing the growth of money supply.

One of the critical consequences was

a secular fall of the money multiplier.

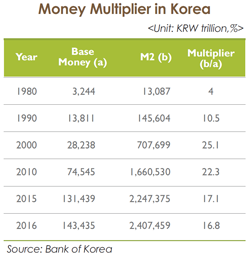

The money multiplier, which is defined

as the ratio of broad money (M2) over

base money, is a barometer of banking

activities—the higher the multiplier, the

more active the banking industry. As the

table below shows, the money multiplier

in Korea has surged from 4 in 1980 to 25

in 2000, but it dropped to 16 in 2016.

Third, it would also encourage financial

industries, such as the banking and

insurance industries, by making the net

interest margin (NIM) a lot higher.

Indeed, low rates from 2008 until recently

have made the profitability of banking

and insurance industries extremely low

because the NIM was chronically dipping.

Now, however, the banking and

insurance industries expect better profitability,

and this could be a driving force

of new economic growth in the financial

industries.

Fourth, a higher rate would make

financial industries more balanced by

channeling funds from stock markets to

other fields such as bonds, direct investments

and various funds. So far under an

extremely low rate

environment, global stock markets have been overheated while other financial industries are suffering relative impasse. The unbalanced development of financial markets with overheating stock markets amid a bleak banking industry and bond markets should arouse serious concern for regulators. All these imbalances were believed to be the outcome of abnormally low rates in the past. Now, the Bank of Korea and the Financial Services Commission have to make a very difficult decision on the interest rate policy. Despite economic uncertainty, it would be more optimal for the government to forgo its policy of leaning against the wind. That is, it can’t let the rate fix stay the way it is for an indefinite amount of time. A better solution would be to lean with the wind and let the markets dictate where the interest rates and exchange rates should go. The government should not excessively intervene in their course. Otherwise, they have to face bigger challenges ahead.