Foreign Investment Report

- Home

- Investment Guide

- Investment Procedure

- Foreign Investment Report

Foreign Investment Report

Foreign investors or their agents can notify their investment at Invest Korea (KOTRA) or domestic and overseas Korea Trade Centers of KOTRA, headquarters and branches of domestic foreign exchange banks, or domestic branches of designated foreign banks.

- Notifying person: The very foreign investor or an agent

- Notification receiver: Headquarters and branches of domestic banks, domestic branches of designated

foreign banks, and Invest KOREA(KOTRA) or KOTRA's domestic and overseas Korea Notification receiver: Trade Centers. - Notification processing period: Immediately (the issue of notification certificates)

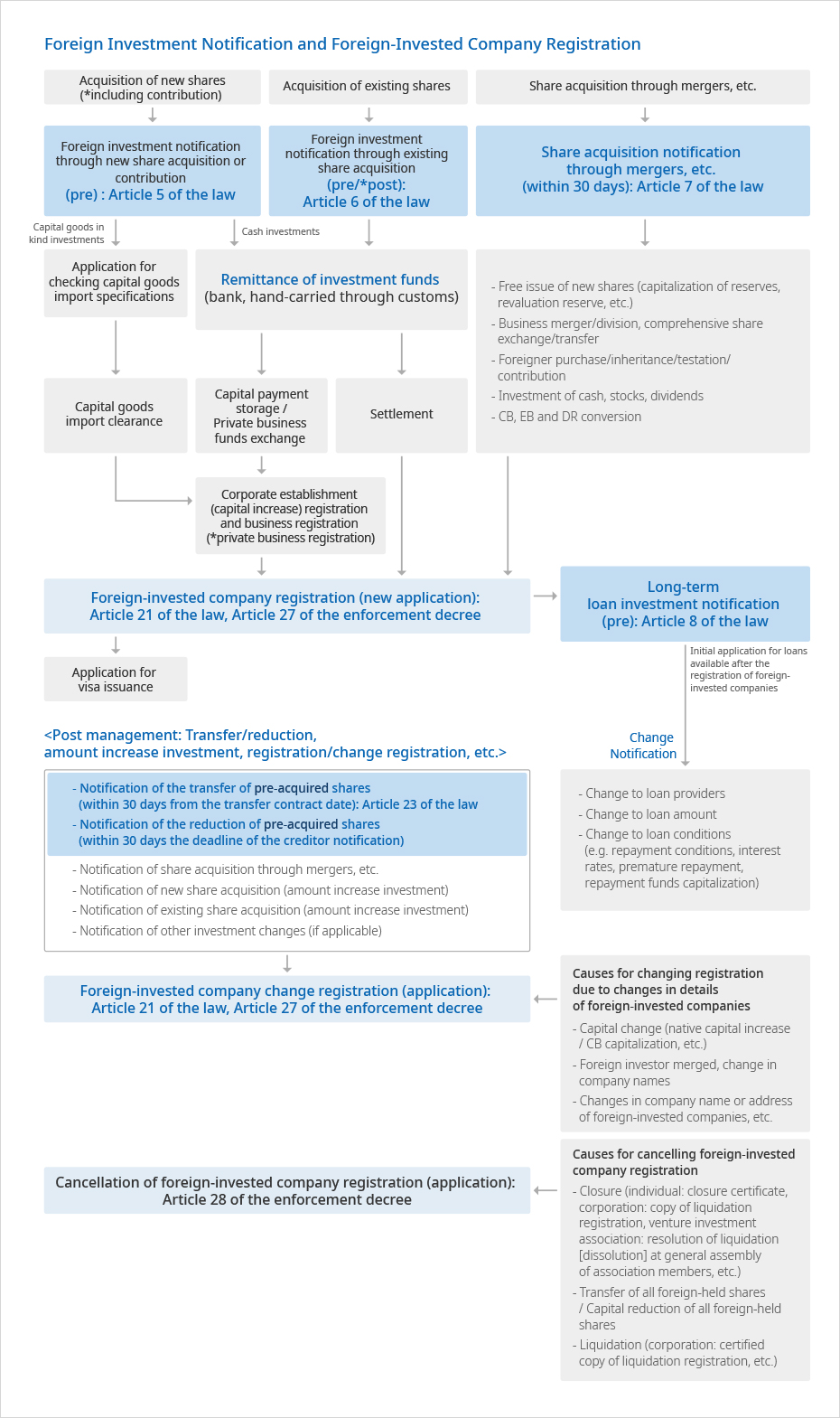

Since November 1998, the principle of simplified notification policy has been applied to foreign investments. The investment notification types are divided into pre-notification prior to the acquisition of shares, equity, etc. and post-notification following the acquisition of shares or the conclusion of a contract. The details are as follows:

Pre- & Post-Notification

| Category | Notified Items | Remarks |

|---|---|---|

| Pre- Notification |

Foreign investment through acquisition of new shares etc. or subscription and changes in investment details | |

| Foreign investment through acquisition of existing shares etc. or changes in investment details | Exceptionally, in case of acquisition of a listed corporate's shares, within 30 days from the date of acquisition | |

| Foreign investment through long-term loan or changes in investment details | ||

| Post- Notification |

Acquisition of shares etc. through mergers etc.

|

Within 30 days from the date of acquisition |

| Transfer of shares etc. | Within 30 days from the date of contract | |

| Decrease in shares etc. | According to Article 439 of the Commercial Law: within 30 days from the date of termination of the creditor's notification period |

|

| Application for registration, change of registration, or registration cancellation of a foreign-invested company | Within 30 days from of occurrence of the case |

Required Documentation

- 2 copies of the foreign investment notification form per investment type

(new shares, existing shares, long-term loans etc.) - Nationality certificate

- For corporations or organizations: copy of register issued by the government of the country or other authorized institutions, or other documents proving the said corporation or organization's existence in the country of origin;

- For foreign individuals: National ID card, passport, or other documentation proving his or her nationality, issued by the government of the country of origin, or other authorized institutions;

- In the case the foreign investor holds citizenship of the Republic of Korea, the above documents can be replaced by a certificate of citizenship issued by the Korean Government or other authorized institution, or overseas citizen registration certificates etc. issued by overseas legations of the Republic of Korea;

Additional documents to be attached when necessary:

- Documentary evidence of investment objects;

- Other documentary evidence related to share acquisition;

- Letter of attorney (when the agent of a foreign investors notifies the investment and applies for permits by way of the investor's conferment of an agency).

Foreign Investment Report Procedures by Investment Type

Notification of Foreign Investments through Acquisition of New Shares or Equity or Subscription

- Foreigners wishing to make a foreign investment by acquiring newly issued shares or equity from a company operated by a citizen (corporation) of the Republic of Korea must make a prior investment notification (pre-report).

- 4 Cases Regarding the Acquisition of New Shares:

- Foreigners setting up a new corporation independently, or jointly with a Korean citizen;

- Participating in a paid-in capital increase of a domestic company;

- A foreigner (individual) operating a private business in Korea;

- Giving subscription to an NPO (new share acquisition through subscription)

Required Documents

- 2 copies of the notification form of foreign investment through acquisition of new shares or equity or subscription (letter of attorney to be included for a report made by an agent)

- Nationality certificate of the foreign investor

- Other required documents pertaining to investment objects (only when applicable);

- Valuation certificate for industrial property rights etc.;

- Remaining assets certificate, followed by the disposition of branches or offices, and corporations;

- Certificate of refund for a loan and/or other debts from overseas;

- Certificate of shares of a corporation listed in overseas securities markets;

- Certificate of shares held by a foreigner under the Foreign Investment Promotion Act or the Foreign Exchange Trade Act;

- Capital transaction notification certificate for domestic real estate for investment;

- Documentary evidence of funds originating from the disposition of held shares or real estate under the

Foreign Investment Promotion Act or the Foreign Exchange Trade Act - Documentary evidence of a contribution to an NPO.

An application for change must be made when a foreign investor wishes to make a change in a previously reported trade name, title, nationality, foreign investment amount, foreign investment ratio (ratio of shares or equity held by a foreign investor for foreign-invested company's shares etc.), investment method, business to be operated etc.

Investment in Capital Goods

- A foreign investor is required to make an application to verify the capital goods import account prior to

customs clearance after making the foreign investment notification.

Required documents:

- 3 copies of the application verifying the capital goods import account;

- 3 copies of the confirmation of goods sales document or other evidence of price documentation.

- Application for confirmation of investment in capital goods to be made to the Korea Customs Service

dispatch officer at Invest KOREA after the completion of capital goods import.

Notification of and Application for a Permit for Foreign Investment through the Acquisition of Existing Shares

A foreigner wishing to make a foreign investment by acquiring existing shares from a company operated by a citizen (corporation) of the Republic of Korea must make a prior investment notification(pre-report). The acquisition of pre-issued shares etc. from a KOSPI-listed corporation or a KOSDAQ-listed corporation under the Securities Trade Act should be notified within 30 days of acquisition.

※ In the case that a foreigner has already acquired 9% of shares in the securities market under the Securities

Trade Act, and wishes to acquire an additional 3.5% of shares (a case where the total ratio of acquired shares is over 10%), the additional acquisition of 3.5% is recognized as a foreign investment under the Foreign Investment Promotion Act, and a foreign investment notification (or permit application) shall then be made to acquire existing shares. Such cases are considered exceptions to the pre-notification principle, and reports should be made within 30 days of acquisition.

Trade Act, and wishes to acquire an additional 3.5% of shares (a case where the total ratio of acquired shares is over 10%), the additional acquisition of 3.5% is recognized as a foreign investment under the Foreign Investment Promotion Act, and a foreign investment notification (or permit application) shall then be made to acquire existing shares. Such cases are considered exceptions to the pre-notification principle, and reports should be made within 30 days of acquisition.

The following are cases of acquiring existing shares:

- A direct trade between a foreign investor and domestic shareholders for unlisted stocks;

- The acquisition of 10% or more of the shares of a company listed on the KOSPI or KOSDAQ stock index.

Prior permits shall be acquired from the Ministry of Knowledge Economy if a foreign investment is to be made through the acquisition of existing shares of a company in the defense industry (permit application). Should existing shares be acquired in violation of the permit regulation, voting rights attached to the existing shares shall become void, and an order of the transfer of the shares can be issued by the Ministry of Knowledge Economy.

Required Documents

- 2 copies of the foreign investment notification of the acquisition of existing shares (A letter of attorney

must be included for a notification filed by an agent.); - Certificate of nationality of the foreign investor;

- Documentation confirming the relationship between transferees (for multiple transferees);

- Other documents required for the investment object (when applicable);

- Certificate of remaining assets from the disposition of branches, or offices, and corporations;

- Certificate of refund of loans and other debts from overseas;

- Certificate of shares for corporations listed in overseas securities markets;

- Certificate of shares held by a foreigner under the Foreign Investment Promotion Act or the Foreign Exchange Trade Act

- Documentary evidence of funds originating from the disposition of held shares or real estate under the

Foreign Investment Promotion Act, or the Foreign Exchange Trade Act.

An application for change must be made when a foreign investor wishes to make a change in a previously notified trade name, title, nationality, foreign investment amount, foreign investment ratio (ratio of shares or equity held by a foreign investor for foreign-invested company's shares etc.), share transferees etc.

Notification of Foreign Investment by the Acquisition of Shares or Equity via a Merger etc.

The acquisition of shares and equity through a merger is considered different from the acquisition of new or existing shares. The acquisition of shares and equity should be notified within 30 days from the acquisition, and not pre-notified (although post-notification regulations do apply). Most of the notifications of share acquisition through a merger fall under the category of change of registration application by a foreign-invested company.

Cases regarding the acquisition of shares through a merger are as follows:

- A foreign investor acquiring shares or equity issued by reserves, revaluation reserves and other reserve funds of a foreign-invested company under legal regulations being turned into capital

- A foreign investor acquiring shares or equity of an corporation to continue to exist or be newly created, by way of shares held at the time of merger and comprehensive exchange of shares between the foreign-invested company and another company, or spin-off of the foreign-invested company

- A foreigner acquiring shares or equity of a registered foreign-invested company from a foreign investor through purchase, inheritance, testation, or donation

- A foreigner acquiring shares or equity through an investment with profits from legally acquired shares etc.

- A foreigner transferring, accepting, or interchanging CB, EB, DR and other similar items into shares etc.

Required Documents

- 2 copies of the share or equity acquisition notification

(A letter of attorney must be included for notification made by an agent.) - Certificate of nationality of the foreign investors (for new acquisitions)

- Documentation proving the acquisition of shares (certified copy of corporation registration and the

General Shareholders Meeting Act, the Board of Directors Act etc.)

Notification of Foreign Investment through a Long-term Loan

A prior notification shall be made for a foreign investment in the form of a loan whose maturity is over 5 years to a foreign-invested company by its overseas parent company or a foreign investor, or a company with capital investment relations with the said overseas parent company or foreign investor (pre-notification).

The debtor of a long-term loan is the foreign-invested company. A foreign-invested company being established shall not be the debtor, hence the long-term loan investment notification can only be made after the foreign-invested company has been established. Also, since a loan is not considered an investment object, it is not to be mentioned in the foreign-invested company registration. However, in order for a long-term loan to be recognized as a foreign investment, a loan arrival notification must be made with the foreign currency purchase (deposit) certificate attached.

Required Documents

- 2 copies of the notification of the foreign investment through long-term loan (A letter of attorney must be included for a notification made by an agent.)

- Copy of the loan contract

- Documentary evidence of investment relation, and certificate of nationality of the loan provider

An application for change must be made when a foreign investor wishes to make a change to a previously reported loan amount, loan conditions, (interest rate, maturity, grace period) etc.

Investment Fund Remittance

In principle, investment funds must be remitted through a foreign currency bank under the very foreign investor's name. Funds from domestic sources are not recognized as foreign investments. In the process of paying for stock subscription, the bank issues a stock deposit certificate for subscription payment (required for corporation establishment registration) and a foreign exchange purchase certificate (required for registering a foreign-invested company).Corporate Establishment Registration & Business Registration

Various required documents shall be taken to the district court and tax office to conclude registration of incorporation and business registration.Paid-In Capital Transfer to Corporate Account

When registration of incorporation and business registration procedures are completed, the new company becomes a legally valid corporation. Hence the bank requests the necessary documents and transfers the paid-in capital in custody to the account of the newly established corporation.Foreign-Invested Company Registration

For the following cases, a foreign investor (or their agent) or a foreign-invested company must register the foreign-invested company at the entrustment institution within 30 days of the occurrence of the causes as follows.

- Completion of payment for the investment object (new share acquisition)

- Acquisition of existing shares (existing share acquisition)

- Acquisition of shares through mergers etc. (new acquisition of CB conversion, spin-off etc.)

- Completion of a contribution to an NPO (new acquisition through contribution)

Required Documents

- Foreign-invested company registration application;

- Certified copy of corporate registration (corporations) or business registration (private business) of a foreign-invested company;

- Copy of the foreign exchange purchase certificate or foreign currency deposit certificate;

- Shareholder register (corporate seal, certified copy of the original) or documentary evidence of transfer of funds for shares;

Additional documents to be attached when necessary

- Documentary evidence of investment object;

- Copy of the completion confirmation of investment in kind (for investment in kind of capital goods);

- Copy of the inspection report by an inspector under the commercial law, or the evaluation report by an evaluator (investment of shares or domestic real estate);

- Other documentary evidence related to share acquisition;

- Letter of attorney to be included for notification made by agents;