Industry Focus

- Home

- Investment Opportunities

- Latest Information

- Industry Focus

Current Status and Outlook of Korea’s Biotechnology with the Biopharmaceutical Industry at its Heart

The Biotechnology Classification Code set by the Korean Agency for Technology and Standards (KATS)1)estimated the biotech industry’s 2021 production amount at about KRW 21 trillion2). Compared to numbers in 2016, below KRW 10 trillion, there has been an average annual increase of 17.8% over the last 5 years. The biopharmaceutical industry, which accounts for the lion’s share of the biotech industry, showed average annual increase rates in production amount and export value at 11.7% and 14.8%, respectively, during the same period. In particular, Korea’s growth potential in biopharmaceuticals has already been proven by its outstanding performance in public health during the Covid-19 pandemic with the government’s swift response to the pandemic, excellent virus test-kits, and world-class capabilities to manufacture vaccines and therapeutics.3)

| Year | 2001 | 2006 | 2011 | 2016 | 2021 | CAGR(%) | ||||

|---|---|---|---|---|---|---|---|---|---|---|

| '01~11 | '11~16 | '16~21 | '11~21 | |||||||

| Biotech Industy |

Production | 1.40 | 3.16 | 6.40 | 9.26 | 21.00 | 16.4 | 7.7 | 17.8 | 12.6 |

| Import | 0.42 | 0.94 | 1.56 | 1.46 | 4.77 | 14.0 | △1.3 | 26.7 | 11.8 | |

| Export | 0.64 | 1.35 | 2.75 | 4.63 | 11.86 | 15.7 | 11.0 | 20.7 | 15.7 | |

| Biopharmaceutical Industry |

Production | 0.57 | 1.22 | 2.46 | 3.36 | 5.84 | 15.7 | 6.4 | 11.7 | 9.0 |

| Import | 0.16 | 0.74 | 1.23 | 1.24 | 4.07 | 22.6 | 0.2 | 26.8 | 12.7 | |

| Export | 0.26 | 0.25 | 0.95 | 1.76 | 3.51 | 13.8 | 13.1 | 14.8 | 14.0 | |

| CDMO Company | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Lonza | 318 | 324 | 324 | 340 | 460 |

| SAMSUNG BIOLOGICS | 364 | 364 | 424 | 620 | 620 |

| Boehringer Ingelheim | 305 | 490 | 490 | 490 | 490 |

| WuXi Biologics | 54 | 151 | 268 | 332 | 456 |

| FUJIFILM | 132 | 132 | 132 | 261 | 261 |

| Total | 1,173 | 1,461 | 1,638 | 2,043 | 2,287 |

Government Strategy to Foster the Biotech Industry

| Vision | Achieving digital transition in medicine, health, and care to serve the public health Emerging as a global pivotal state in terms of the digital & bio-health market |

|---|---|

| Goal | Creation of new digital markets, Vitalization of bio-health export |

| Key Task | ① Promoting innovation in medical, health, and caring services ② Boosting bio-health export ③ Strengthening R&D in convergence of cutting-edge technology ④ Nurturing talent in the bio-health industry, Expanding support for startups and venture companies ⑤ Establishing related laws, regulations and other infrastructures |

| Vision | To develop a world-class biopharma industry | |

|---|---|---|

| Goal | Develop blockbuster medicines | Foster world-class biopharma companies |

| Double the current export of medicines | Secure the world’s third biggest clinical trial capacity | |

| Create quality jobs in the biopharma industry | ||

| Major Objectives | ▶ Strengthen R&D capabilities – Expanding R&D investment to develop global medicines ▶ Support export – Increasing biopharma investment and support for export of biomedical products ▶ Nurture human resources – Fostering talent in biopharma and technology convergence ▶ Improve regulations and infrastructure – Reforming the regulatory framework to match the global level and expanding supply chain infrastructure |

|

Cases of FDI in Korea

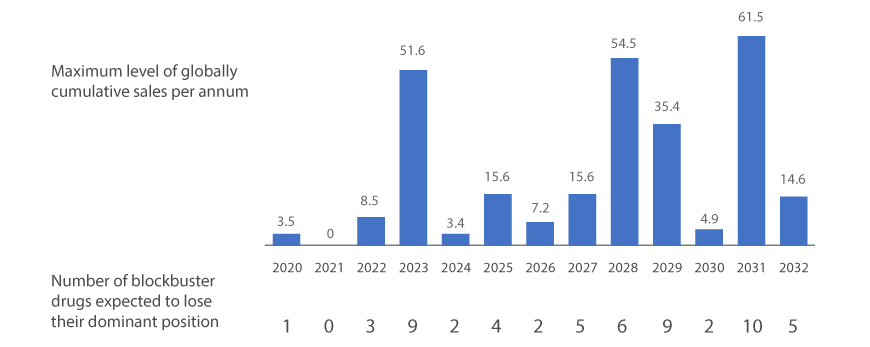

| Yaer | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| The maximum level of globally cumulative sales per annum (billion dollar) |

3.5 | 0 | 8.5 | 51.6 | 3.4 | 15.6 | 7.2 | 15.6 | 54.5 | 35.4 | 4.9 | 61.5 | 14.6 |

| The number of blockbuster drugs expected to lose their dominat position (case) |

1 | 0 | 3 | 9 | 2 | 4 | 2 | 5 | 6 | 9 | 2 | 10 | 5 |

| Company | Cytiva (USA) (’Sep. 2021) |

SARTORIUS (Germany) (’Nov. 2021) |

Thermo Fisher SCIENTIFIC (USA) (’May 2022) |

Merck (Germany) (’May 2023) |

|---|---|---|---|---|

| Details | Building manufacturing facilities to produce raw and subsidiary materials for vaccines (e.g. plastic bags) | Manufacturing raw and subsidiary materials for vaccines (e.g. plastic bags), CMO, research | Manufacturing raw and subsidiary materials for vaccines (e.g. plastic bags), CMO, research | Manufacturing raw and subsidiary materials for vaccines (e.g. plastic bags), CMO, research |

By Ji-Eun Jung( (je.jung@kiet.re.kr))

Korea Institute for Industrial Economics & Trade

2) MOTIE, KoreaBIO (yearly data), 「Report on Survey of Domestic Bioindustry」.

3) Korea’s global CMO capacity in terms of vaccine is the second largest (385,000 ltr) after the US and outperforms Germany (246,000 ltr) and Denmark (144,000 ltr) (BDO USA, 2021)

4) Promoting Competition in the American Economy (Executive Order 14036, Jul. 9, 2021), HMA and EMA issued a joint statement on the interchangeability of biosimilar medicines approved in the EU (Sept. 19, 2022)

<* The opinions expressed in this article are the author’s own and do not reflect the views of KOTRA.>